Pittsburgh is a thriving city located in western Pennsylvania with a population of over 300,000 people. The city has a rich history and culture, with a booming economy that attracts people from all over the world. One of the most significant aspects of Pittsburgh's growth is its real estate market.

Pittsburgh sits where the Allegheny and Monongahela Rivers meet and form the Ohio River. That location gave it access to the ocean and the interior, while nearby iron deposits fueled its growth. As of now, the Pittsburgh housing market appears to strike a balance, offering opportunities for both buyers and sellers.

Pittsburgh Housing Market Trends in 2024

How is the Housing Market Doing Currently?

According to Redfin, as of February 2024, Pittsburgh home prices have surged impressively, boasting a remarkable increase of 22.0% compared to the previous year. This surge places the median home price at a modest $250,000. However, despite this notable rise, Pittsburgh's median sale price remains 44% lower than the national average, making it an attractive option for prospective buyers.

On average, homes in Pittsburgh are spending 91 days on the market, slightly longer than the 79 days recorded the previous year. Despite this increase, the market remains active, with 265 homes sold in February, albeit a slight decrease from the 285 sold in the same period last year.

How Competitive is the Pittsburgh Housing Market?

Pittsburgh's housing market is characterized as somewhat competitive, with homes typically selling in approximately 68 days. Interestingly, some properties receive multiple offers, indicating a healthy level of buyer interest.

An intriguing aspect of the market is the sale-to-list price ratio, which stands at 97.2%, representing a 1.4 point increase year-over-year. Additionally, nearly a quarter (24.9%) of homes are sold above the list price, marking a significant 4.9 point increase from the previous year. Conversely, around 21.2% of homes experience price drops, showcasing the market's fluidity and the need for strategic pricing strategies.

Are There Enough Homes for Sale to Meet Buyer Demand?

One crucial aspect of any housing market is the balance between supply and demand. In Pittsburgh, 19% of homebuyers searched to move out of the area between January and March 2024, while 81% sought to remain within the metropolitan area.

Despite this outward migration trend, Pittsburgh remains an attractive destination, with 0.53% of homebuyers from across the nation searching to move into the city from outside metros. Notably, New York homebuyers lead this influx, followed by those from Washington and Los Angeles.

Looking ahead, Pittsburgh's housing market appears robust, with favorable conditions for both buyers and sellers. However, as with any market, fluctuations are expected, and prospective buyers and sellers should stay informed to make informed decisions.

Pittsburgh Housing Market Forecast for 2024 and 2025

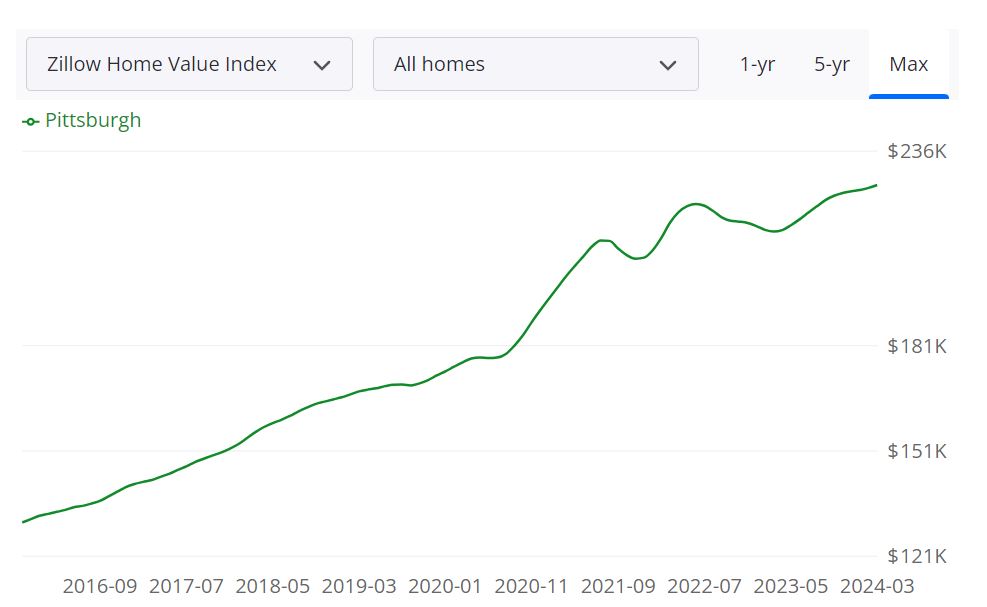

Pittsburgh has been one of the hottest real estate markets in the country for years. It is also one of the hottest real estate markets for investing in rental properties. What are the Pittsburgh real estate market predictions for 2024? Let us look at the price trends recorded by Zillow over the past few years.

According to Zillow, the Pittsburgh housing market is experiencing a notable trend with an average home value of $227,329, marking a decrease of 42.3% over the past year. Homes in Pittsburgh typically go pending in about 19 days, showcasing a brisk pace of transactions. Let's delve into the various metrics shaping the current state of the housing market in Pittsburgh.

Housing Metrics Explained

For Sale Inventory: As of March 31, 2024, there were 1,648 properties listed for sale in Pittsburgh, indicating the availability of a diverse range of housing options for prospective buyers.

New Listings: In March 2024, Pittsburgh witnessed 536 new listings, showcasing a healthy influx of properties entering the market, providing buyers with fresh options to consider.

Median Sale to List Ratio: The median sale to list ratio stood at 0.978 as of February 29, 2024, indicating that on average, homes in Pittsburgh are selling for just under their list price, a factor that could influence negotiation dynamics between buyers and sellers.

Median List Price: As of March 31, 2024, the median list price for homes in Pittsburgh was $256,617, reflecting the prevailing market value of properties in the area.

Percent of Sales Over/Under List Price: In February 2024, approximately 23.7% of sales in Pittsburgh were recorded above the list price, while 61.1% were under the list price, illustrating the diverse range of pricing dynamics within the market.

Pittsburgh MSA Housing Market Forecast

The Pittsburgh Metropolitan Statistical Area (MSA), encompassing several counties in Pennsylvania, presents a nuanced outlook for the housing market. The MSA, including Allegheny, Armstrong, Beaver, Butler, Fayette, Washington, and Westmoreland counties, constitutes a sizable housing market with diverse offerings catering to varying preferences and budgets.

The forecast for the Pittsburgh MSA indicates a projected growth of 0.4% by April 30, 2024, followed by a further increase of 0.5% by June 30, 2024. However, a slight decline of -0.3% is anticipated by March 31, 2025, reflecting the intricacies of market dynamics influenced by factors such as economic conditions, demographic trends, and housing supply and demand.

Is Pittsburgh a Buyer's or Seller's Housing Market?

The current state of the Pittsburgh housing market leans towards being more favorable for buyers. With a decrease in the average home value over the past year and a significant percentage of sales occurring under the list price, buyers have opportunities for negotiation and potentially securing properties at lower prices. Additionally, the relatively high inventory and influx of new listings provide buyers with a diverse range of options to choose from, enhancing their bargaining power in transactions.

Are Home Prices Dropping in Pittsburgh?

Yes, home prices in Pittsburgh have experienced a decline over the past year, with the average home value decreasing by 42.3%. This downward trend suggests a shift in the pricing dynamics of the market, potentially indicating a more favorable environment for buyers seeking affordability and value in their property investments.

Will the Pittsburgh Housing Market Crash?

While the Pittsburgh housing market is currently experiencing a decline in home prices, there is no indication of an imminent crash. Market fluctuations are influenced by various factors such as economic conditions, interest rates, and local supply and demand dynamics. While the forecast predicts a slight decline in the housing market by March 31, 2025, it does not suggest a crash. However, investors and homeowners should monitor market trends and make informed decisions based on their individual circumstances.

Is Now a Good Time to Buy a House in Pittsburgh?

For buyers considering purchasing a home in Pittsburgh, the current market conditions present favorable opportunities. With home prices dropping and a buyer-friendly environment characterized by ample inventory and negotiation potential, now could be a good time to explore homeownership. However, it's essential for buyers to conduct thorough research, assess their financial readiness, and consider long-term factors such as job stability and lifestyle preferences before making a decision. Consulting with a real estate agent can also provide valuable insights and guidance tailored to individual needs and goals.

Pittsburgh Real Estate Investment Overview

Now that you know where Pittsburgh is, you probably want to know why we’re recommending it to real estate investors. Investing in real estate is touted as a great way to become wealthy. Is Pittsburgh a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Pittsburgh is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers.

If you are looking to make a profit, you don’t want to buy the most expensive property on the Pittsburgh real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Pittsburgh that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Let’s take a look at the number of positive things going on in the Pittsburgh real estate market which can help investors who are keen to buy an investment property in this city. Pittsburgh, Pennsylvania is home to around 300,000 people. However, the Pittsburgh real estate market is much larger than this. The entire metro area is home to over two million people. Pittsburgh ranked at the top of Nationwide’s 2015 Health of Housing Market Report. It is home to approximately 90 diverse and eclectic neighborhoods and many of them offer convenient access to downtown and urban amenities.

The overall stability of Pittsburgh’s economic outlook has contributed significantly to the gains seen in the real estate market. This can be seen in two distinct areas, employment rates, and median household income. Several neighborhoods in Pittsburgh are seeing an influx of growth that is spurring new construction and contributing to retail growth. Pittsburgh has also been recognized as one of only four metropolitan areas out of 200 studied by economists at Realtor.com.

What Makes Pittsburgh Real Estate Market Attractive For Investment? |

|

|

|

It Is Landlord Friendly

The Pittsburgh real estate market can be considered landlord-friendly. There are rules regarding security deposits, and depending on the situation, you may have to pay rent on the security deposit. On the upside, there is no limit on late fees and they don’t have to be written into the rental agreement, though this is recommended. You don’t have to give notice before entering. The state, at least, doesn’t require a rental license to become a landlord. Pittsburgh has passed a rental registration regulation, but it is being challenged in the courts.

The Strong Local Economy Attracts Residents

The unemployment rate for Pittsburgh is around 5%. The unemployment rate for Pittsburgh parallels that of the state of Pennsylvania. Employment growth is growing broadly, with seven of the ten major industries seeing job gains. Notably, the unemployment rate for the Pittsburgh real estate market is somewhat better than that in Fayette County and Armstrong County. The Pittsburgh real estate market is seeing a surprising renaissance because it is reinventing itself as a high-tech hub.

The CBRE listed it as the third market in the U.S. for high-tech job growth. That same tech boom is radically altering the commercial real estate market. With many industries adding more jobs every month, which consists of manufacturing, leisure, technology, and health care, Pittsburgh’s economic prosperity will continue to foster a thriving housing market. Google, Apple Inc., Bosch, Facebook, Uber, Nokia, Autodesk, Amazon, Microsoft, and IBM are among 1,600 technology firms generating $20.7 billion in annual Pittsburgh payrolls.

Real Estate Investment In Pittsburgh Is Still Affordable

Real estate investment in Pittsburgh continues to offer an affordable opportunity for potential investors. With a market that boasts a diverse range of neighborhoods, stable pricing trends, and a balanced dynamic between buyers and sellers, Pittsburgh provides an attractive landscape for those seeking to enter the real estate investment arena. The city's relatively lower average home values and the potential for future growth, as indicated by forecasts, make it an appealing destination for investors looking to maximize their returns while entering a market that offers manageable entry points.

The Large Pittsburgh Rental Real Estate Market

Pittsburgh is a centuries-old city, so it is home to many colleges and universities. The area is home to 68 colleges and universities, including research and development leaders Carnegie Mellon University and the University of Pittsburgh. Each is home to several thousand students. Smaller schools like Vet Tech Institute and Dean Institute of Technology abound. The biggest is the University of Pittsburgh with almost 30,000 students, and it is growing. Pittsburgh State University is attracting so many students that the city approved a new mixed-use development near Fourth and Broadway Streets to cater to them.

As of April 2024, the median rent for all bedroom counts and property types in Pittsburgh, PA is $1,470. This is -26% lower than the national average. Rent prices for all bedroom counts and property types in Pittsburgh, PA have remained the same in the last month and have increased by 3% in the last year. The monthly rent for an apartment in Pittsburgh, PA is $1,340. A 1-bedroom apartment in Pittsburgh, PA costs about $1,313 on average, while a 2-bedroom apartment is $1,739. Houses for rent in Pittsburgh, PA are more expensive, with an average monthly cost of $1,599.

Another reason to invest in Pittsburgh over Philadelphia is that the latter has a history of being too aggressive in seizing property under asset forfeiture and then reselling it. While that presented a few deals to potential buyers, no one wants to worry about losing their home or rental property because a kid living there dealt drugs. The expensive deal Philadelphia had to agree to in order to compensate those whose homes were wrongfully taken will only add to the population’s tax bill in the future.

Maybe you have done a bit of real estate investing in Pittsburgh, PA but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Pittsburgh is seeing an incredible renaissance, unlike many other Rust Belt cities. It is attracting new residents, redeveloping its downtown.

And it is an excellent place to invest in real estate while it is still in the early stages of its rebound. A good cash flow from Pittsburgh rental property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Pittsburgh real estate investment opportunity would be key to your success.

Apart from the Pittsburgh real estate market, you can also invest in Columbus, Ohio. The Columbus Ohio real estate market is a bright spot in a declining region. It mixes smart redevelopment, quality of life, and growth to create a stable, slow-growing market that will be thriving well into the foreseeable future. There are many neighborhoods to consider for buying properties in Columbus.

Properties in Worthington and downtown Columbus have higher than average median home prices, and their relatively low crime rates add additional appeal. Places like Victorian Village, where home prices remain higher than many other places in the city, support a strong local market, and they can signify a lower level of risk.

References

- https://www.redfin.com/city/15702/PA/Pittsburgh/housing-market

- https://www.zillow.com/Pittsburgh-pa/home-values

- https://www.realtor.com/realestateandhomes-search/Pittsburgh_PA/overview

- https://www.avail.co/education/laws/pennsylvania-landlord-tenant-law

- https://www.clevelandfed.org/newsroom-and-events/publications/metro-mix/pittsburgh/mm-201805-pittsburgh.aspx

- https://www.cbre.us/about/media-center/pittsburgh-number-3-market-in-north-america-for-hi-tech-job-growth

- https://www.geekwire.com/2018/ready-not-tech-boom-brings-complex-changes-pittsburghs-real-estate-market/