As of January 19th, the national average for a 30-year fixed refinance rate has nudged up to 6.68%, marking a 16 basis point increase compared to where we were last week. This means that for anyone eyeing a refinance, the costs have just become a little steeper.

We're seeing these shifts happen across the board, not just with the most popular 30-year loans. The 15-year fixed refinance rate has also seen a bump, climbing by 6 basis points to 5.68%. Even the 5-year adjustable-rate mortgage (ARM), which often starts lower, has climbed 5 basis points to 7.21%. This consistent upward movement tells a story about the current financial climate and what it means for your pocketbook.

Mortgage Rates Today, Jan 19: 30-Year Refinance Rate Rises by 16 Basis Points

What's Driving These Rate Increases?

It’s easy to feel surprised by these daily fluctuations, but they’re usually tied to bigger economic discussions. Think about inflation fears and what the Federal Reserve might do next. When the economy shows signs of heating up, or when there's uncertainty about interest rate policy, mortgage rates tend to rise. Lenders are essentially adjusting their pricing based on their outlook for the future.

From my perspective, this upward climb, especially the 16 basis point jump in the 30-year rate over the week, signals that the window of ultra-low rates might be closing a bit. While rates are still far from the highs we saw a couple of years ago, this trend is a reminder that the market never truly stands still.

A Closer Look at Today's Rates

Let's break down the numbers reported by Zillow for January 19th:

30-Year Fixed Refinance Rate:

- Current Average: 6.68%

- Previous Day: 6.61% (+7 basis points)

- Previous Week: 6.52% (+16 basis points)

This is the one most people watch, and its rise is significant. For someone considering a $300,000 refinance, that 16 basis point increase over a week could mean paying hundreds of dollars more in interest over the life of the loan. It really emphasizes the importance of acting when you see a favorable rate, though timing the market perfectly is a rare feat.

15-Year Fixed Refinance Rate:

- Current Average: 5.68%

- Previous Day: 5.62% (+6 basis points)

- Previous Week: 5.62% (+6 basis points)

The 15-year loan has always been attractive for those who want to pay off their homes faster and save on total interest. However, as this rate creeps up, the gap between it and the 30-year rate narrows. This might make the slightly higher monthly payment of a 15-year loan feel less compelling compared to the longer-term flexibility of a 30-year mortgage.

5-Year ARM Refinance Rate:

- Current Average: 7.21%

- Previous Day: 7.16% (+5 basis points)

- Previous Week: 7.16% (+5 basis points)

Adjustable-rate mortgages, or ARMs, are often sought for their lower initial interest rates. However, the current average of 7.21% for a 5-year ARM means that even the introductory period for these loans is higher than the current 30-year fixed rate. This makes them a riskier bet for many homeowners, as you're always aware that your rate could go up once the fixed period ends.

Comparing Rates: Week-Over-Week

To really see the trend, let’s put it into a table. This gives us a clear picture of how things have changed from last week to today.

| Loan Type | Previous Week Avg. | Current Avg. | Change (Basis Points) |

|---|---|---|---|

| 30-Year Fixed | 6.52% | 6.68% | +16 |

| 15-Year Fixed | 5.62% | 5.68% | +6 |

| 5-Year ARM | 7.16% | 7.21% | +5 |

As you can see, the 30-year fixed rate is the clear leader in terms of week-over-week increases. It tells me that lenders are pricing in more risk or anticipating higher future interest rates, making the longer-term fixed option a bit less attractive than it was just seven days ago.

Day-to-Day Shifts

Here’s a look at how the rates changed just from yesterday to today:

| Loan Type | Prior Day Avg. | Current Avg. | Change (Basis Points) |

|---|---|---|---|

| 30-Year Fixed | 6.61% | 6.68% | +7 |

| 15-Year Fixed | 5.62% | 5.68% | +6 |

| 5-Year ARM | 7.16% | 7.21% | +5 |

Even though the week-over-week change for the 30-year fixed was 16 basis points, showing a sustained upward movement, the daily jump of 7 basis points still contributes to that overall trend. It suggests that market sentiment is holding steady on the idea that rates are likely to stay where they are or potentially climb further in the short term.

Why Are People Refinancing Now (Even with Rising Rates)?

It might sound counterintuitive to refinance when rates are going up, but the data shows a massive surge in demand, pushing refinance applications up by 40% last week alone. This is partly because rates did fall to the lowest levels in over three years at the beginning of 2026, creating a significant “refinance window” for many homeowners.

Think about it: a directive for federal agencies to buy about $200 billion in mortgage bonds pushed rates down earlier this year. Many homeowners who locked in rates above 7% in early 2025 saw this as a golden opportunity to refinance and significantly lower their monthly payments. Zillow's data shows that refinances now make up over 60% of all mortgage applications, a huge jump from previous weeks.

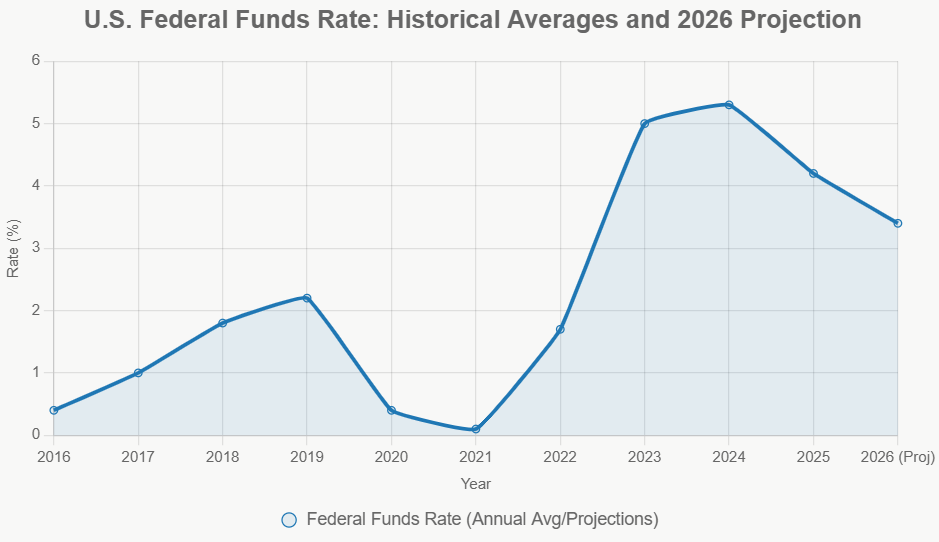

The Federal Reserve's Role

We can't talk about mortgage rates without mentioning the Federal Reserve. They made three interest rate cuts in late 2025, which helped bring down those mortgage rates we saw earlier. While another cut is anticipated later in 2026, most analysts don't expect it at the upcoming meeting this month. This cautious approach from the Fed influences lender confidence and, consequently, mortgage rates.

What's the Forecast for 2026?

Looking ahead, experts are forecasting relatively stable rates for the rest of 2026. The Mortgage Bankers Association (MBA) predicts that 30-year rates will hover around 6.4% for the year. Fannie Mae is a bit more optimistic, suggesting a gradual dip that could bring rates closer to 5.9% by the end of the year.

However, it’s important to manage expectations. We’re not likely to see those 3% rates from a few years back anytime soon unless there’s a major economic shock. This means that while there might be opportunities for some homeowners to still find a good deal, the era of deeply discounted mortgages is likely over for the foreseeable future.

The Bottom Line for You

As of January 19, 2026, the upward trend in refinance rates is clear. The 30-year fixed refinance rate is up 16 basis points week-over-week, making borrowing a bit more expensive.

My advice? If you’ve been considering refinancing to lower your monthly payment, consolidate debt, or tap into your home's equity, now is the time to act decisively. Don't wait too long, because rates can move quickly. It's crucial to shop around for the best loan terms and understand all the costs involved. Staying informed about these shifts is your best tool for making a smart financial move.

and

Florida’s modern build with strong cash flow vs Missouri’s affordable rental with higher cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Market forecasts suggest steady demand, making turnkey real estate one of the most reliable paths to passive income and wealth creation.

Norada Real Estate helps investors capitalize on these trends with turnkey rental properties designed for appreciation and consistent cash flow—so you can grow wealth securely while others wait for clarity in the market.

Recommended Read:

- 30-Year Fixed Refinance Rate Trends – January 18, 2026

- Best Time to Refinance Your Mortgage: Expert Insights

- Should You Refinance Your Mortgage Now or Wait Until 2026?

- When You Refinance a Mortgage Do the 30 Years Start Over?

- Should You Refinance as Mortgage Rates Reach Lowest Level in Over a Year?

- Half of Recent Home Buyers Got Mortgage Rates Below 5%

- Mortgage Rates Need to Drop by 2% Before Buying Spree Begins

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years