It feels like we’ve been talking about the housing market and its ups and downs for years now. But what does the future hold? If you’re thinking about buying, selling, or just curious about where things are headed, you’re in the right place. I’ve been digging into the latest forecasts, and the buzz is that the housing market predictions for 2026 are looking a lot brighter, with experts pointing towards a potential comeback after a period of slower activity.

To cut straight to the chase, the National Association of REALTORS® (NAR) is forecasting a significant jump in home sales for 2026, potentially seeing a double-digit increase. This is welcome news for many who have felt the squeeze of higher prices and tougher buying conditions. While it’s not a crystal ball, understanding these predictions can help us make smarter decisions.

Housing Market Predictions for 2026: What Experts Are Saying

What’s Driving the Expected Comeback?

So, what’s behind this optimistic outlook for 2026? It boils down to a few key factors that are starting to come together. Think of it like ingredients for a good meal – each one is important, but together they create something substantial.

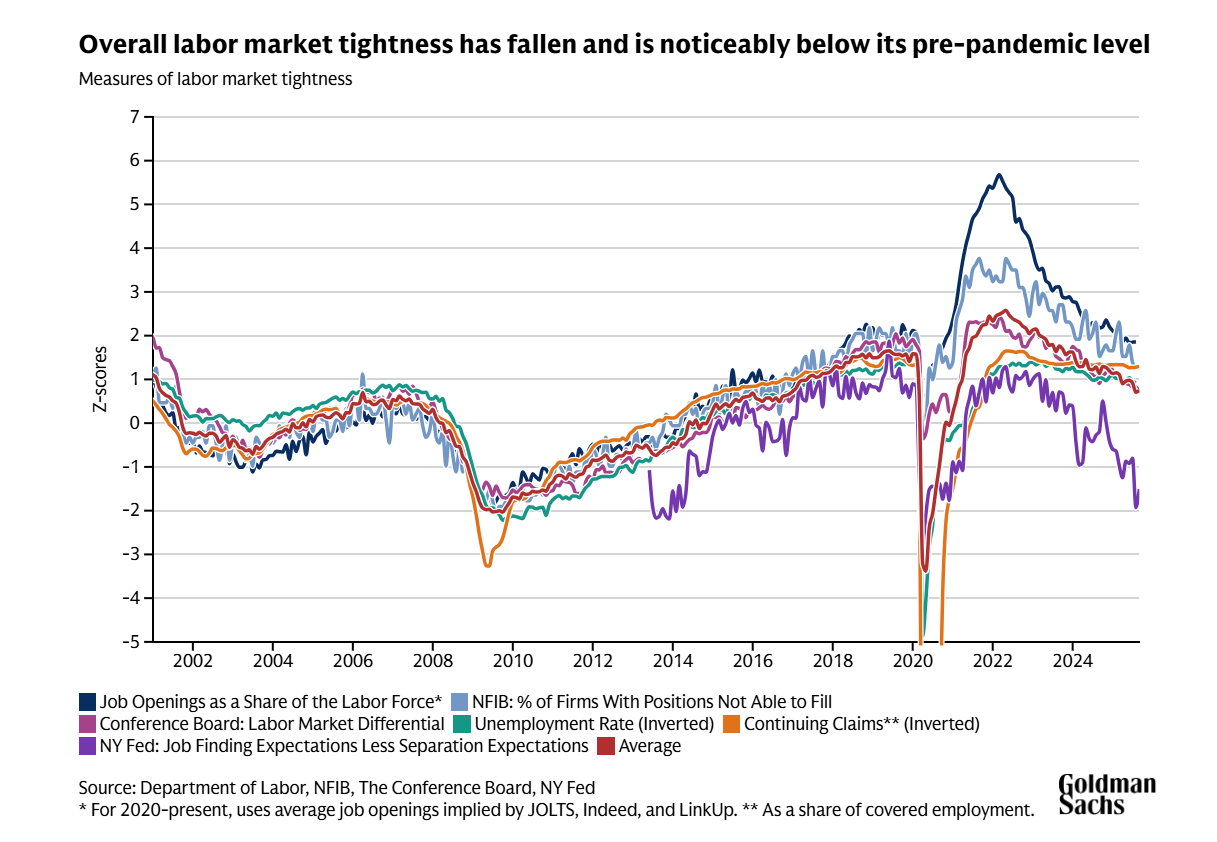

One of the biggest drivers is expected to be steady job growth. When people have stable jobs and feel confident about their future, they’re more likely to make big decisions like buying a home. We’ve seen job gains holding up pretty well, and this is a fundamental strength that supports the housing market.

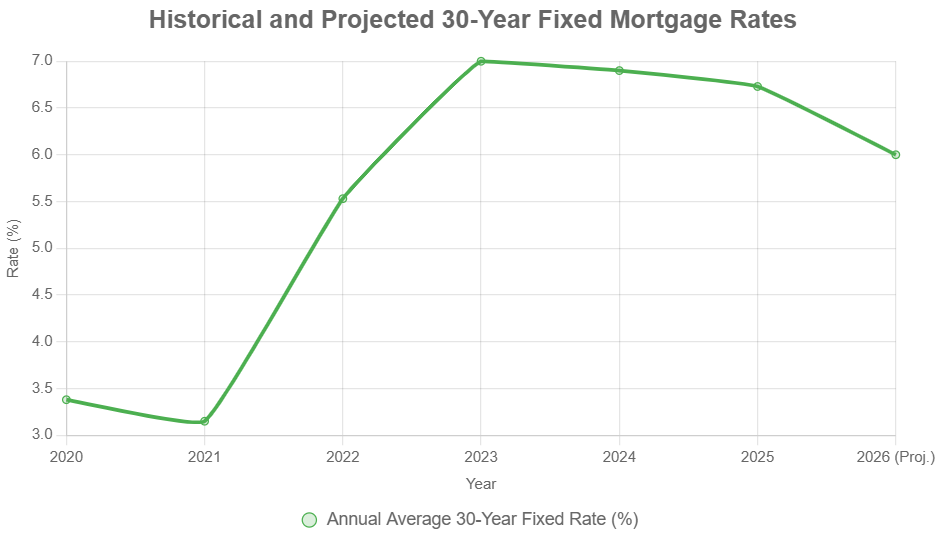

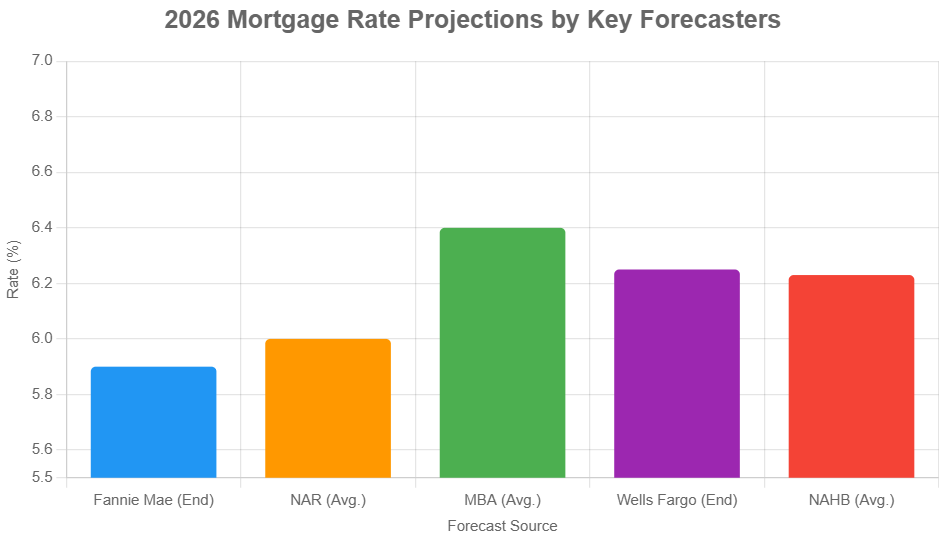

Another crucial piece of the puzzle is mortgage rates. For a while now, higher mortgage rates have been a big hurdle for many potential buyers. They’ve made monthly payments significantly more expensive, pushing some people out of the market altogether. However, experts like Lawrence Yun, the chief economist at NAR, are forecasting a modest decline in mortgage rates for 2026. He expects the average 30-year fixed rate to hover around 6% in 2026, down from an estimated 6.7% this year.

“It’s not going to be a big decline, but it will be a modest decline that will improve affordability,” Yun explained at a recent NAR event. This might not sound like huge news, but even small drops in rates can make a big difference in what people can afford each month.

Furthermore, homebuilder activity is also contributing to the supply side. While we’ve heard a lot about housing shortages, builders are continuing to add new homes to the market. This increase in supply, even if it's slow, helps balance things out.

The Big Numbers: What Sales and Prices Might Look Like

This is where things get really interesting. The NAR forecast suggests that 2026 could be the year we see a noticeable uptick in home sales.

- Overall Home Sales: NAR is predicting a 14% nationwide increase in home sales for 2026. This is a pretty significant jump compared to what we've seen recently.

- New-Home Sales: For those interested in new construction, the prediction is a 5% rise in new-home sales.

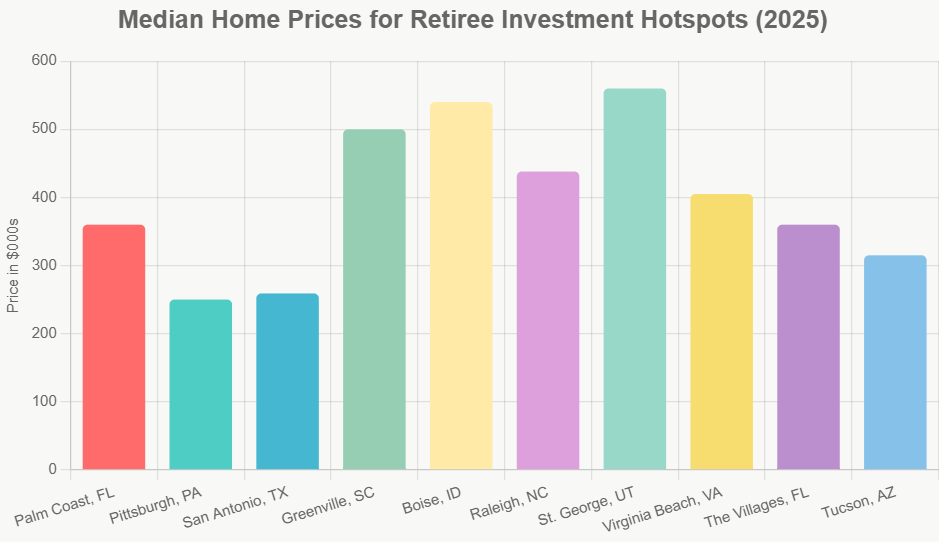

Now, what about prices? A common worry is that a surge in sales could lead to another rapid increase in home prices. However, the outlook for 2026 is different. NAR expects home prices nationwide to climb by about 4%.

This suggests a more balanced market where sales increase, but prices grow at a more sustainable rate. This is a good sign because it means affordability might improve without causing another affordability crisis. It’s important to remember that these are national averages, and local markets will always have their own unique trends.

Understanding the Nuances: A Market of “Haves” and “Have-Nots”

While the overall picture for 2026 looks positive, it’s not a one-size-fits-all story. The housing market today is quite uneven, and this likely will continue to some extent. Jessica Lautz, NAR’s Deputy Chief Economist, highlighted the concept of a market with “haves” and “have-nots.”

The “Haves”:

- These are often individuals who already own homes and have built up significant equity over the years.

- They are frequently repeat buyers, especially baby boomers, who can leverage their existing home equity, sometimes buying with cash.

- The upper end of the market has been doing better, with strong inventory and robust financial markets supporting sales in the $750,000 to $1 million price range.

The “Have-Nots”:

- These are primarily first-time homebuyers who are facing significant challenges.

- The share of first-time buyers has dropped to an all-time low of 21%, far below their historical average of 40%.

- Their average age has also increased, with a median age of 40. This means people are waiting longer to buy.

Why are first-time buyers struggling so much? Lautz pointed to several reasons:

- High rent costs: Rent payments eat into savings that could otherwise go towards a down payment.

- Student loan debt: Many young adults are burdened by student loans, making it harder to qualify for mortgages or save extra money.

- Childcare costs: Raising a family adds significant financial pressure.

To help these aspiring homeowners, Lautz suggests focusing on better financial education about down payment assistance programs and special loan types like FHA loans.

When Homes Sit, Prices Get a Push

We’ve also seen a trend where homes that stay on the market longer than expected often need price adjustments. This isn't necessarily a sign of a collapsing market but rather sellers adapting to buyer demand and market conditions. Yun shared some data on how price reductions tend to increase with how long a home has been listed:

- 0–14 days on market: Typically a 4.9% price cut if needed.

- 15–30 days on market: Might see a 6.1% cut.

- 31–60 days on market: A larger adjustment, around 7.3%.

- 61–90 days on market: Sellers might consider a 9% reduction.

- 91–120 days on market: Further adjustments could be around 10.6%.

- Over 120 days on market: For homes that have been listed for a long time, a 13.8% reduction might be necessary to attract buyers.

These price dips are often temporary or localized when inventory quickly grows. Nationally, the 4% median home-price gain expected for 2026 still points to overall price appreciation.

Looking Ahead: Fundamentals Remain Strong

Despite some of the challenges we’ve discussed, the underlying fundamentals of the housing market remain quite strong, according to Yun.

- Low Mortgage Delinquencies: The number of homeowners falling behind on their mortgage payments or facing foreclosure is at historically low rates. This is a critical indicator of market health.

- Homeowner Equity: Homeowners have built up substantial equity in their homes, providing a financial cushion.

- Steady Job Growth: As mentioned before, consistent job creation is a robust sign for the economy and housing demand.

So, while 2025 might be remembered as a slower year, the pieces for a more active and vibrant housing market in 2026 appear to be falling into place.

My Take on the Forecast

As someone who follows the housing market closely, I find NAR's prediction for 2026 to be cautiously optimistic and realistic. The emphasis on job growth and improving mortgage rates as key drivers makes sense. The forecast for a 14% sales increase is exciting, and the projected 4% price appreciation suggests a market that is growing, but not overheating.

The distinction between the “haves” and “have-nots” is particularly insightful. It reminds us that market conditions can vary wildly depending on your financial situation and where you are in your homeownership journey. For first-time buyers, the path will likely still involve significant planning and resourcefulness, making programs that help with down payments and offer lower interest rates crucial.

For sellers, especially those who might have overshot their pricing or are in a less in-demand area, adapting to market realities with realistic pricing or potential reductions will be key to a successful sale.

Ultimately, the housing market predictions for 2026 from NAR offer a hopeful outlook. It suggests a market that is becoming more accessible as rates ease and demand remains, while also appreciating in value at a more sustainable pace. It’s a forecast that encourages continued interest and readiness for those looking to enter or move within the housing market.

Small Investors Are Winning Big in Today’s Housing Market

Turnkey rental properties in affordable, high-demand metros are helping everyday investors build passive income, equity, and long-term wealth—without the headaches of active management.

Norada Real Estate makes it easy to scale your portfolio in the markets where small investors are outpacing institutional buyers and locking in strong returns.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights:

- Housing Market Predictions for the Next 12 Months by Zillow

- Housing Market Regains Ground as Falling Mortgage Rates Unlock Buyer Savings

- Hidden Costs of Homeownership Now Add Up to Nearly $16,000 a Year

- Small Investors Dominate the Housing Market From Detroit to Vegas

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Housing Market 2025 Splits Between Wealthy Buyers and First-Timers

- Housing Markets at Risk of Double-Digit Price Decline Over the Next 12 Months

- Housing Market Trends: Nearly 1 in 3 Buyers Still Opt for All-Cash Deals in 2025

- Will the Housing Market Shift to a Buyer’s Market in 2026?

- Mid-Atlantic Housing Market Heats Up as Mortgage Rates Go Down

- NAR Chief's Bold Predictions for the 2025 Housing Market

- The $1 Trillion Club: America's Richest Housing Markets Revealed

- 4 States Dominate as the Riskiest Housing Markets in 2025

- Housing Market Predictions 2025 by Norada Real Estate