Are you wondering where interest rates are heading? You're not alone! The Federal Reserve's (the Fed's) interest rate decisions affect everything from your mortgage payments to the growth of your investments. So, what's the scoop for the next two years? Expert predictions suggest a gradual decrease in interest rates.

As of August 2025, the federal funds rate sits at 4.25%-4.50%. Experts at the Federal Reserve and major financial institutions anticipate rates moving downward, although the pace and extent of these cuts remain uncertain, driven by factors like inflation, economic growth, and global events. Let's dive deep into what's influencing these predictions and what they mean for you.

Federal Reserve Interest Rate Predictions for the Next 2 Years

Before we get into the nitty-gritty, let's remember why paying attention to interest rates is so important. Think of them as the price of borrowing money.

- For You: They affect how much you pay for mortgages, car loans, credit cards, and how much you earn on your savings. Lower rates mean cheaper loans but smaller returns on your savings.

- For Businesses: They influence how much it costs companies to borrow money to invest and expand.

- For the Economy: They help control inflation (rising prices) and support economic growth.

Basically, they are a big deal for all.

August 2025: Where Interest Rates Stand Right Now

As I write this in August 2025, the Federal Reserve (the Fed, for short) has kept the federal funds rate steady at a range of 4.25% to 4.50% in its July meeting. The Fed kept the rate unchanged for the fifth time in 2025. This federal funds rate is the benchmark interest rate for the US economy. It's what banks charge each other for overnight lending. It affects things like mortgages, credit cards, and savings accounts. The Fed put a hold on hiking interest rates after raising it many times in the recent past to try to curb inflation.

The Fed’s trying to balance controlling inflation, while making sure the economy keeps growing. It's a tough balancing act! The Fed's aiming for 2% inflation over the long term, and it's watching the data like a hawk before making any more moves.

Decoding the Fed's Crystal Ball: The SEP Projections

To get a sense of where the central bankers think rates are headed, you look at the Fed's Summary of Economic Projections (SEP). This report, updated every few months, gives us clues on what the Fed thinks will happen with interest rates, inflation, the economy, and jobs. I like to think of it as the Fed's way of saying, “Here's what we think will happen if we do what we think we should do.” It’s not a guarantee, but it's the best insight we've got.

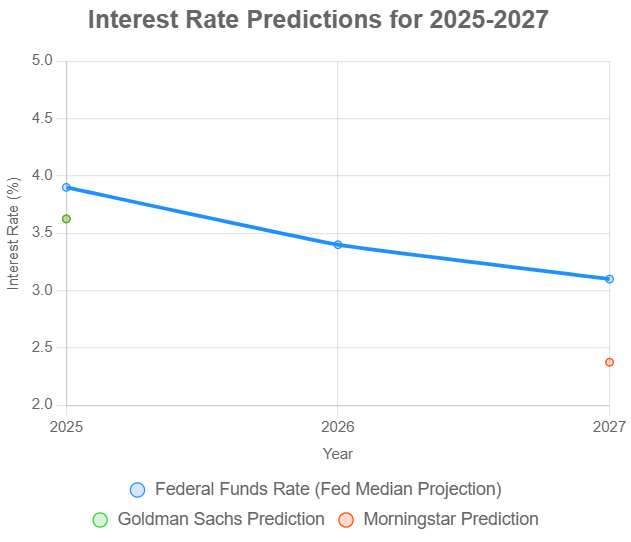

Interest Rate Projections (according to the Summary of Economic Projections):

Here’s what the Fed's Summary of Economic Projections says it expects:

| Year | Median Projection | Central Tendency | Range | Implication |

|---|---|---|---|---|

| 2025 | 3.9% | 3.9%–4.4% | 3.6%–4.4% | Two 0.25% cuts from current levels (4.25%–4.50%) |

| 2026 | 3.4% | 3.1%–3.9% | 2.9%–4.1% | One additional 0.25% cut |

| 2027 | 3.1% | 2.9%–3.6% | 2.6%–3.9% | Another 0.25% cut |

In plain English, the Fed thinks it will be able to cut rates slowly over the next few years as inflation cools down and the economy stays steady.

Inflation Forecasts:

Since controlling inflation is job number one for the Fed, let's look at what they think will happen with prices. The Fed focuses on something called PCE inflation, which is a way of measuring how much prices are changing.

PCE Inflation:

| Year | Median | Central Tendency | Range |

|---|---|---|---|

| 2025 | 2.7% | 2.6%–2.9% | 2.5%–3.4% |

| 2026 | 2.2% | 2.1%–2.3% | 2.0%–3.1% |

| 2027 | 2.0% | 2.0%–2.1% | 1.9%–2.8% |

Core PCE Inflation:

| Year | Median | Central Tendency | Range |

|---|---|---|---|

| 2025 | 2.8% | 2.7%–3.0% | 2.5%–3.5% |

| 2026 | 2.2% | 2.1%–2.4% | 2.1%–3.2% |

| 2027 | 2.0% | 2.0%–2.1% | 2.0%–2.9% |

These forecasts paint a picture of inflation gradually falling back to the Fed's 2% target by 2027. It is predicted they will begin cutting rates as inflationary pressures ease

Economic Growth and Unemployment:

The Fed is looking at these factors:

Real GDP Growth:

| Year | Median | Central Tendency | Range |

|---|---|---|---|

| 2025 | 1.7% | 1.5%–1.9% | 1.0%–2.4% |

| 2026 | 1.8% | 1.6%–1.9% | 0.6%–2.5% |

| 2027 | 1.8% | 1.6%–2.0% | 0.6%–2.5% |

Unemployment Rate:

| Year | Median | Central Tendency | Range |

|---|---|---|---|

| 2025 | 4.4% | 4.3%–4.4% | 4.1%–4.6% |

| 2026 | 4.3% | 4.2%–4.5% | 4.1%–4.7% |

| 2027 | 4.3% | 4.1%–4.4% | 3.9%–4.7% |

It looks pretty stable. The Fed sees the economy growing a bit each year, and they think the job market will stay pretty tight.

What the Big Banks Are Saying

The Fed projections are only one piece of the puzzle. It’s always good to check out what other big players in the financial world are thinking. Here's a snapshot of interest rate predictions from some major institutions:

| Institution | 2025 Prediction | 2026 Prediction | 2027 Prediction |

|---|---|---|---|

| Federal Reserve | 3.9% | 3.4% | 3.1% |

| BlackRock | ~4% | – | – |

| Goldman Sachs | 3.5%–3.75% | – | – |

| Morningstar | 3.5%–3.75% | – | 2.25%–2.5% |

| Fannie Mae (30-yr) | 6.3%–6.8% (mortgage) | – | – |

| Mortgage Bankers Association | 6.8% (early) (mortgage) | 6.4% | – |

A few things stand out to me here:

- The Consensus: Most experts agree that interest rates will come down over the next two years, but they have a difference on how fast and how far.

- The Cautious View: BlackRock seems a bit more reserved. They mention things like possible trade wars and other global issues, which could make the Fed think twice about slashing rates too quickly.

- The Optimists: Morningstar is a bit more bullish, thinking rates could fall more dramatically if inflation cools off faster than most people expect.

Mortgage Rate Predictions:

If you're keeping an eye on mortgage rates:

- Fannie Mae sees the 30-year fixed rate starting at 6.8% in early 2025 and then dropping to 6.3% later in the year.

- The Mortgage Bankers Association predicts a drop from 6.8% to 6.4% throughout 2026.

What Could Throw a Wrench in the Works? The Global and Policy Wildcards

Making interest rate predictions is more than just crunching numbers. You need to think about the bigger picture like global events and government policies. Here are a few things that could shake things up:

- Global Economic Conditions: What's happening in Europe, China, and other parts of the world matters too. If other countries are struggling, it could pull down the U.S. economy.

- Trade and Tariffs: If the government starts slapping tariffs on goods from other countries, prices could go up!

- Fiscal Policy: Tax cuts or big government spending could fire up the economy. If the economy grows too quickly, inflation could come roaring back.

- Geopolitical Events: Wars, political instability, or unexpected crises can send shock waves through the economy, making it harder for the Fed to predict what's going to happen.

What It All Means for You: Consumers and Investors

So, how do these interest rate predictions impact your wallet?

For Consumers:

- Borrowing Costs: Lower rates mean you'll pay less for mortgages, car loans, and anything else you borrow money for. This could make it easier to buy a home or a new car.

- Savings Returns: The downside? You'll probably earn less on your savings accounts and CDs.

For Investors:

- Bonds: When rates fall, bond prices tend to rise. So, if you already own bonds, you could see some gains. But remember, new bonds will pay lower interest rates.

- Stocks: Lower rates can be good for stocks because they make it cheaper for companies to borrow money and grow. But if the Fed is cutting rates because the economy is faltering, that could temper the optimism.

- Real Estate: Lower mortgage rates could fire up the housing market, potentially pushing home prices up.

Here’s a quick cheat sheet:

| Financial Decision | Impact of Lower Rates (2025-2027) |

|---|---|

| Buying a Home | Cheaper mortgages, increased affordability |

| Savings Accounts | Lower returns, reduced interest earnings |

| Stock Investments | Potential gains, but risks remain |

| Bond Investments | Higher prices for existing bonds, lower new yields |

The Bottom Line and My Two Cents

The interest rate predictions for 2025-2027 point to a gradual easing, but the road ahead is anything but smooth. The Fed, along with financial institutions, anticipates rates declining from the current 4.25%–4.50% range to around 3.1% by 2027. I believe this path is reasonable because inflation is very hot now. But the Fed might cut more or less.

As I watch this situation of rate cuts unfold, there is a risk of some external factors blowing it all off course.

So, what should you do? Stay informed, be realistic, and remember that nobody has a crystal ball.

Recommended Read:

- Fed Projects Two Interest Rate Cuts Later in 2025

- Federal Reserve Holds Interest Rates Steady in June 2025

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Fed Indicates No Rush to Cut Interest Rates as Policy Shifts Loom in 2025

- Fed's Powell Hints of Slow Interest Rate Cuts Amid Stubborn Inflation

- Fed Funds Rate Forecast 2025-2026: What to Expect?

- Interest Rate Predictions for 2025 and 2026 by NAR Chief

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Interest Rate Predictions for the Next 3 Years

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet

- Interest Rate Predictions for Next 10 Years: Long-Term Outlook

- When is the Next Fed Meeting on Interest Rates?

- Interest Rate Cuts: Citi vs. JP Morgan – Who is Right on Predictions?

- More Predictions Point Towards Higher for Longer Interest Rates