Imagine finally being able to afford a home, not in ten years, but maybe next year. That’s the tantalizing promise dangled before millions of Americans struggling to break into the housing market. President Trump's recent push for a 50-year fixed-rate mortgage has sent ripples through the financial world, sparking debates that pit the dream of affordable homeownership against the specter of lifelong debt.

While proponents hail it as a revolutionary “game changer,” critics warn it could become a “debt trap,” a financial quicksand that traps families for generations. My take? It's a high-stakes gamble, offering immediate relief at a steep potential long-term cost, and its success hinges less on the loan term itself and more on a solution to our nation's chronic housing shortage.

Is Trump's 50-Year Mortgage Plan a Game Changer or Debt Trap for Borrowers?

The U.S. housing market right now feels less like a gateway to the American Dream and more like a fortress. Prices have skyrocketed, and even with mortgage rates hovering around 6.25% (as of late 2025), it’s become a near-impossible hurdle for many. For context, the average age of a first-time homebuyer has crept up to a staggering 40 years old.

That spells trouble, not just for individuals but for the economy. We’re well past the generally accepted threshold where housing costs consume no more than 28–30% of a household's income; now, it’s closer to a burdensome 39%.

Compounding this, homeowners with those super-low interest rates from a few years back are essentially locked into their homes, afraid to sell and buy something else because their new monthly payments would be astronomical. This “lock-in effect” has choked off the supply of homes for sale, pushing prices even higher.

The Genesis of the 50-Year Idea: A Nod to the Past, A Push for the Future

This isn't just some wild, out-of-the-blue idea. The Trump administration, through Federal Housing Finance Agency (FHFA) Director Bill Pulte, has been actively exploring this 50-year mortgage option. Pulte himself stated on X (formerly Twitter) in November 2025, “Thanks to President Trump, we are indeed working on The 50 year Mortgage—a complete game changer.”

He's framed it as a direct response to the affordability crisis, aiming to help “young people” secure a home. It's an interesting echo of history. Back in the 1930s, during the Great Depression, President Franklin D. Roosevelt introduced the 30-year mortgage.

This innovation dramatically increased homeownership after decades where shorter loan terms made it incredibly difficult for average Americans to buy property. The idea behind the 50-year mortgage is to achieve a similar democratization of homeownership, but for today's economic realities.

It's also worth noting that this proposal is part of a broader push from the administration. There have been policy initiatives aimed at deregulation and tax credits for builders, trying to encourage more homes to be built. The thinking seems to be that if we can make mortgages more accessible, we also need to address the lack of supply.

The plan is reportedly to leverage government-sponsored enterprises like Fannie Mae and Freddie Mac to offer these longer-term loans. However, there's a wrinkle: the Dodd-Frank Act, a piece of legislation passed after the 2008 financial crisis, put a 30-year cap on what's considered a “qualified mortgage.”

To offer 50-year mortgages with full government backing, congressional action would likely be needed, which could introduce further complexities and potentially affect interest rates.

How a 50-Year Mortgage Works: Spreading the Pain (and the Payments)

At its heart, a 50-year mortgage simply stretches out the repayment period for your loan over an additional 20 years. This means your principal and interest payments are spread over a much longer timeframe. The primary benefit, and the one that gets all the attention, is the lower monthly payment.

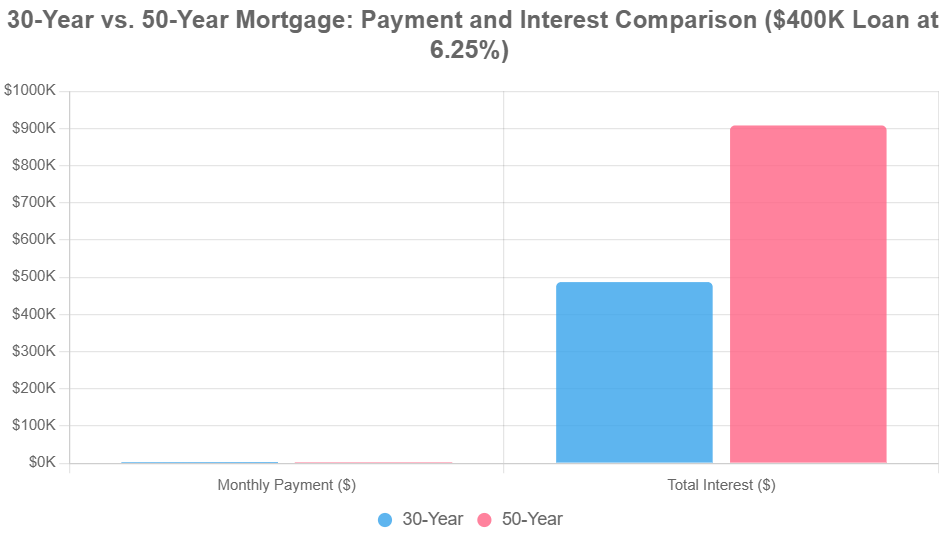

Let's crunch some numbers, as I find that's the best way to really understand the impact. Imagine you're taking out a $400,000 loan, which is pretty common after putting down 20% on a $500,000 home (a realistic scenario in many U.S. markets). If you got a traditional 30-year mortgage at 6.25% interest, your principal and interest payment would be around $2,463 per month.

Now, consider that same $400,000 loan at 6.25% but stretched over 50 years. Your monthly payment drops significantly, to about $2,180. That’s a saving of roughly $283 each month. For a young family trying to make ends meet, that kind of monthly difference could be the deciding factor in whether they can afford to buy a home at all. It could mean the difference between affording basic necessities, childcare, or having a little breathing room in their budget.

However, this monthly relief comes at a steep price over the long run. While your monthly payments are lower, you're paying interest for an extra 20 years. This dramatically increases the total amount of interest you'll pay over the life of the loan.

For our example, the total interest on the 30-year loan is about $487,000. On the 50-year loan, that number balloons to a staggering $908,000! That’s an increase of over $421,000 in interest paid. It essentially doubles the interest cost compared to a 30-year loan.

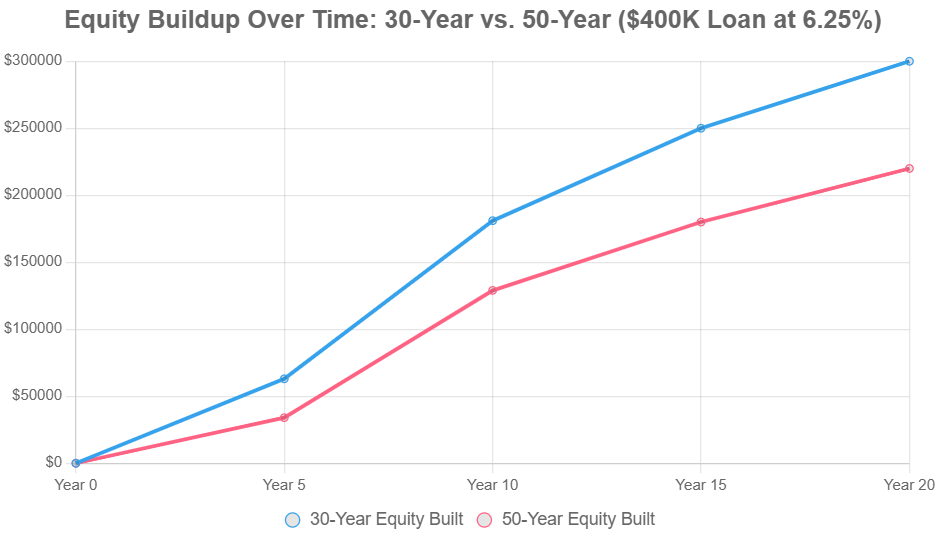

Another crucial aspect is how quickly you build equity. Equity is the portion of your home you actually own. With a 50-year mortgage, a much larger chunk of your early payments goes toward interest, meaning you build equity much more slowly.

In our example, it might take around 28 years to own 50% of your home with a 50-year loan, compared to about 18 years with a 30-year loan. This slower equity buildup can be risky, especially if home prices decline. You could end up owing more than your home is worth, a situation known as negative equity.

Here’s a table to visualize these key differences:

| Metric | 30-Year Mortgage | 50-Year Mortgage | Difference |

|---|---|---|---|

| Monthly P&I Payment | $2,463 | $2,180 | -$283 (12% savings) |

| Total Interest Paid | $487,000 | $908,000 | +$421,000 (86% more) |

| Time to 50% Equity | ~18 years | ~28 years | +10 years |

| Estimated Rate Premium | Baseline | +0.5% to 1.5% | Reflects lender risk |

Please note: These are estimates based on standard amortization formulas and a hypothetical loan of $400,000 at 6.25% interest. Actual figures will vary based on loan terms, rates, and other fees.

The flexibility is often touted as a positive. You could, in theory, make extra payments to pay off the loan faster or sell the home. And if inflation continues to rise, the real cost of that fixed $2,180 payment could decrease over time, making it feel more manageable in future dollars. A home that gains value over time can help offset the extra interest paid, especially if you plan to sell within 10 to 15 years.

However, the risk of being underwater for longer is a serious concern. Studies suggest that longer mortgage terms can increase the risk of default by 150% to 200% if property values drop. And imagine being 80 years old and still making payments on your home – that's a possibility with a 50-year loan.

Additionally, lenders might charge a slightly higher interest rate on these longer loans to compensate for the increased risk they are taking on. Estimates suggest this premium could be between 0.5% and 1.5%, which would eat into those monthly savings and further increase the total interest paid.

To visualize the trade-offs, consider this bar chart comparing key financial outcomes for the $400,000 loan scenario:

This highlights the upfront win versus the long-haul cost. For deeper insight into equity progression, a line chart tracking principal paid over the first 20 years (assuming no prepayments) reveals the 50-year's sluggish start:

Pros and Cons: A Deep Dive into the Agreement's Terms

When I look at this proposal, it’s crucial to weigh the good against the potentially very bad.

The Upsides Are Clear:

- Puts Homeownership Within Reach: This is the big draw. By slashing those monthly payments, millions more people could qualify for a mortgage and buy a home. It could significantly boost homeownership rates, especially for younger generations who have been severely priced out.

- Flexibility for Life Transitions: A lower payment provides breathing room. It can be ideal for young families who anticipate their income will grow over time. They can make the minimum payment now and then use raises or bonuses to pay down the principal faster, or refinance to a shorter term later on.

- Market Stimulation: By making it easier to buy, it could encourage more people to enter the market, which in turn could help alleviate the “lock-in effect” and bring more homes onto the market for others. It’s a way to inject some life into a sluggish housing sector.

- Historical Parallel: As mentioned, the 30-year mortgage was a radical idea once. This could be another step in evolving how people finance their homes to adapt to economic conditions.

The Downsides Are Significant:

- The Interest Trap: This is my biggest worry. Paying interest for 50 years means that by the time you finally own your home free and clear, you will have paid an astronomical amount more in interest than you would have with a 30-year loan. For some, the home might feel more like a perpetual rental with an enormous interest burden rather than a true asset.

- Slower Equity Growth and Increased Default Risk: As the numbers showed, you build equity much slower. This leaves homeowners more vulnerable to market downturns. If property values fall, you could owe more than your home is worth, making it difficult to sell or refinance, and increasing the likelihood of default. The thought of people being in debt for their homes into their retirement years is concerning.

- Fueling Housing Inflation: If we simply increase the number of people who can afford a mortgage without substantially increasing the number of homes available, basic economics tells us prices will likely go up. This proposal, without a strong supply-side component, could just end up making homes even more expensive for everyone in the long run.

- Benefit to Lenders: Critics argue that banks and financial institutions stand to gain considerably from these longer loans by collecting more interest over time, potentially at taxpayer expense if government-backed entities like Fannie Mae and Freddie Mac end up holding more risky assets.

Who Wins and Who Loses? The Stakeholder Perspective

It's not a simple black-and-white situation; different groups will be impacted differently.

| Stakeholder | Likely Stance | Rationale |

|---|---|---|

| Young Buyers | Supportive (with caveats) | Lower entry barrier; plan to refi/sell. |

| Economists | Skeptical | Ignores supply roots; systemic risks. |

| Banks/Lenders | Enthusiastic | Volume + interest revenue. |

| Conservatives | Divided | Populist appeal vs. “debt slavery” fears. |

| Builders | Positive | Demand surge aids projects. |

Echoes of the Past and Glimpses of the Future

Comparing this to FDR's 30-year mortgage is a powerful analogy, but we must also remember the lessons of 2008. The subprime mortgage crisis, fueled by risky lending practices and complex financial products, taught us that simply extending credit doesn't automatically create widespread prosperity. It can also lead to instability.

Globally, countries like Canada and Australia have different mortgage norms. Canada, for instance, allows longer terms, which aids affordability but is also linked to high household debt levels. This suggests that longer loan terms alone aren't a magic bullet and can be part of a broader picture of household financial health.

What I foresee is that if a 50-year mortgage is implemented, it won't be a simple carbon copy of the 30-year model. It might be tweaked, perhaps capped at 40 years with additional safeguards. Its success will absolutely depend on whether it's paired with robust efforts to increase housing supply. Without that, it risks being a temporary fix that ultimately inflates prices and leaves buyers with more debt.

This proposal, like many bold policy ideas, sits at a crossroads. It could be a tool to unlock opportunities for a generation struggling to achieve a fundamental part of the American Dream. Or, it could be a carefully disguised trap, luring people into decades of debt they may not fully comprehend. It's a provocative idea, sure to keep us talking, debating, and hopefully, searching for the right solutions to our deeply entrenched housing affordability crisis. The real game changer won't just be the length of the mortgage, but whether we can build enough homes for everyone.

Smart Leverage or Long-Term Risk for Rental Investors?

Ultra-long mortgage terms can lower monthly payments and boost cash flow—but they also extend debt horizons and slow equity growth. For turnkey investors, the key is knowing when and how to use them strategically.

Norada Real Estate helps you evaluate financing options and match them to high-performing rental markets—so you can build wealth without overextending your timeline.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- What Are Typical Credit Score Ranges for Mortgage Borrowers?

- FHA Mortgage Rates by Credit Score: 620, 700, 580, 640

- Does Wells Fargo Offer Home Loans with a 500 Credit Score?

- First Time Home Buyer Loans with Bad Credit and Zero Down

- Who Qualifies for Kamala Harris' $25,000 Homebuyer Program?

- Biden Administration's Bold Move for Affordable Housing Plan

- Biden's Student Debt Relief Plan: A Beacon of Hope for Borrowers

- What Credit Score Do You Need to Buy House With No Money Down?

- How Long Does It Take to Get a 700-800 Credit Score?

- How To Improve Your FICO Credit Score: A Guide

- FHA Credit Score Requirements for Homeownership

- 10 Proven Methods to Elevate Your FICO Credit Score

- Mortgages for Low Credit Scores: Your Complete Guide