The holiday season is just around the corner, and for many of us, that means thinking about big life events – and buying a home is certainly one of them. So, what's the deal with mortgage rates over the next month, from November 10th to December 10th, 2025? Based on the most informed guesswork out there, I expect we'll see rates mostly holding steady in the low- to mid-6% range, likely nudging up slightly to around 6.3% to 6.4% by early December. It's not a time for drastic changes, but a few key factors could push things a bit higher or keep them from falling much further.

Mortgage Rate Predictions for the Next 30 Days: Nov 10 to Dec 10, 2025

Right now, as I write this in early November 2025, the average 30-year fixed mortgage rate is sitting at a pretty solid 6.22%, according to Freddie Mac's weekly survey. This is a far cry from the rock-bottom rates we saw during the pandemic, where dipping below 3% was possible. Today's rates mean a significant jump in monthly payments for buyers compared to just a few years ago.

For instance, that $1,300 payment on a $300,000 loan is about 50% more than it was then, making affordability a real concern for many, especially first-time homebuyers. While there isn't a huge controversy or surprise looming, the general feeling among experts is that we're in for a period of relative calm, with just a hint of upward pressure.

A Quick Look Back: How We Got Here

Diving into the numbers would be a lot less useful without understanding the journey. Mortgage rates have been on a rollercoaster for the past few years. After hitting historic lows around 2.65% in 2021, fueled by pandemic-era stimulus and historically low interest rates, they began a steady climb as inflation concerns grew and the Federal Reserve started its rate-hiking campaign. By late 2023, we saw rates peak near 7.8%.

Thankfully, the Federal Reserve started to pivot, implementing two rate cuts in September and October of 2025. This easing has brought average rates down from those scary mid-7% highs to the 6.22% we’re seeing now. It's a significant drop, almost 1.8 percentage points year-to-date. Still, when you look at the historical average of 7.71% since 1971, our current rates, while challenging, aren't completely out of the ordinary in the grand scheme of things. It just feels that way because we got so spoiled with those ultra-low numbers.

Here’s a quick snapshot of how rates have moved:

| Period | Average 30-Year Fixed Rate | Key Event |

|---|---|---|

| 2021 Annual | ~3.0% | Pandemic lows, stimulus boost |

| 2023 Peak | ~7.8% | Fed hikes for inflation |

| October 2025 | ~6.3% | After second Fed rate cut |

| November 6, 2025 | 6.22% | Freddie Mac survey |

This table really shows how much things can change quickly. It sets the stage for why we’re approaching the next few weeks with cautious optimism.

What’s Driving the Numbers for the Next 30 Days?

Mortgage rates are like a thermostat for the housing market, and they’re influenced by a lot of different factors. For the next 30 days, I'm keeping my eye on a few key players:

The Federal Reserve's Next Move

The biggest question mark is the Fed's upcoming meeting on December 9-10. After cutting rates in September and October, markets are pricing in about a 60% chance of another 25-basis-point cut. Fed Chair Jerome Powell has been clear that their decisions are data-dependent, and he’s mentioned there are “differing views” on the committee about how fast to proceed.

If they do cut rates again, it could put a little downward pressure on mortgage rates, potentially keeping them closer to 6.2%. However, if they hold rates steady, especially if inflation worries resurface, we could see yields jump, pushing mortgage rates higher, perhaps even towards 6.5%.

Treasury Yields: The Mortgage Rate's Best Friend (or Foe)

The yield on the 10-year Treasury note is a super important benchmark for mortgage rates. Think of it as the foundation upon which mortgage rates are built. When the 10-year Treasury yield goes up, mortgage rates tend to follow, and vice-versa. It usually sits about 2% to 2.5% above the 10-year yield.

Right now, the 10-year yield is hovering around 4.0%. We’ve seen it tick up recently, partly due to worries about tariffs and their potential impact on inflation. If tariffs do start pushing up the cost of imported goods, that could add a bit of upward pressure on yields, and consequently, on mortgage rates. If the yield stays around 4.0% or dips, rates should stay relatively stable. But if it climbs to, say, 4.2%, we could easily see mortgage rates add another tenth or two of a percent by early December.

Inflation and Jobs: The Economic Pulse

Inflation is still a hot topic. While the overall inflation rate has cooled to about 2.4%, the “core” inflation rate (which excludes volatile food and energy prices) is still a bit stickier, especially with housing costs continuing their upward trend.

Upcoming jobs reports are crucial. If the unemployment rate, currently at 4.1%, continues to tick up, it signals a cooling economy and strengthens the case for more Fed rate cuts. This would be good news for mortgage rates. But if job growth remains strong, it could give the Fed pause and make them less likely to cut rates, keeping mortgage rates elevated. The wild card here is definitely tariffs; economists are warning they could add as much as 0.5% to 1% to inflation in early 2026, which could impact Fed thinking and market sentiment heading into year-end.

The Housing Market's Own Rhythm

The persistently high mortgage rates, even with the recent Fed cuts, have created a “lock-in effect.” This means a huge chunk of homeowners – about 83% – have mortgages with rates well below 6%. They’re naturally hesitant to sell and buy a new home with a much higher rate. This lack of inventory continues to prop up home prices, meaning that even small increases in mortgage rates have a really noticeable impact on monthly payments. A 0.25% rate increase can add around $50 to $60 per month to the payment on a typical-sized loan.

What the Experts Are Saying: A Nod to Stability with a Slight Upswing

When I look across what various housing market experts and organizations are predicting for the next 30 days, a pretty consistent picture emerges. They’re generally forecasting a period of stability, but with a slight leaning towards rates inching up rather than falling significantly.

Here’s a breakdown of some common predictions I've been seeing:

| Source | November 2025 Prediction | December 2025 Prediction (End/Q4 Avg) | Key Reason for Outlook |

|---|---|---|---|

| Fannie Mae | ~6.2–6.3% | 6.3% (end-year) | Fed cuts expected, but inflation caps steep drops |

| Mortgage Bankers Assoc. | Low-mid 6% | 6.4% (Q4 avg) | Tariffs and yields keeping rates higher |

| National Assoc. Realtors | Mid-6% range | Mid-6% (through Q4) | Strong labor market balances things |

| LendingTree/Zillow | 6.17% (early Nov) | 6.3–6.5% | Policy uncertainty, lock-in effect |

| NerdWallet/Freddie Mac | 6.22–6.3% | Slight rise to 6.3% | 60% chance of December Fed cut |

As you can see, most forecasts hover within a tight band, suggesting that big swings aren't likely. The MBA's Q4 average prediction sits at the higher end, reflecting concerns about tariffs and yields.

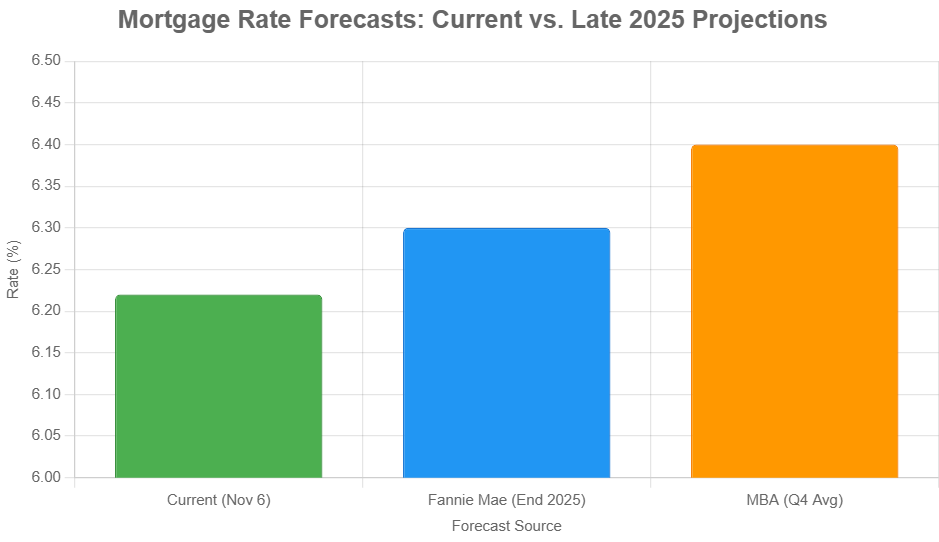

To help visualize this, here's a look at how these forecasts compare:

This chart visually confirms the expectation of a modest upward trend in average rates by the end of the year.

What Does This Mean for You? Smart Moves for the Next Month

So, with all this information, what should you do? My advice is always to be proactive and prepared.

- If You're a Homebuyer:

- Shop Around: Seriously, don't just go with the first lender you talk to. Rates can vary by a significant amount – often 0.25% or more – between lenders for the same borrower. I’ve seen it myself.

- Get Pre-Approved: Know exactly how much you can borrow and what your estimated payments will be.

- Stress-Test Your Budget: Use online affordability calculators that let you plug in slightly higher rates (like 6.5%) to see if you’re still comfortable.

- Consider Different Loan Types: If you qualify, FHA or VA loans often come with lower rates, currently in the 5.9% to 6.1% range.

- If You're Thinking About Refinancing:

- Compare Your Rate: If your current mortgage rate is higher than 6.5%, it might be worth exploring a refinance.

- Calculate Break-Even: Remember to factor in closing costs, which can be anywhere from 2% to 5% of your loan amount. You’ll want to make sure the savings from a lower rate allow you to recoup those costs within a reasonable time, typically 1.5 to 2 years.

- Most Existing Owners are Locked In: Given that so many homeowners have rates below 6%, refinancing opportunities are more limited now. It's really about chasing those significantly lower rates.

- For Everyone: Stay Informed and Be Flexible:

- Watch the News: Keep an eye on weekly Freddie Mac rate surveys and read the minutes from the Federal Reserve meetings. These give you the pulse of the market.

- Consider ARMs (Carefully): For some buyers who plan to move or refinance within a few years, an Adjustable-Rate Mortgage (ARM) might offer a lower initial rate. However, they come with the risk of rates increasing later. In times of uncertainty, a traditional fixed-rate mortgage often provides more peace of mind.

- Look Beyond the Rate: Don't forget about the other costs of homeownership. Property taxes, homeowner's insurance, and even closing costs have seen increases (up to 10% year-over-year). Factor these into your total housing budget.

A Glimpse into 2026

While we’re focused on the next 30 days, it’s helpful to know what the longer-term picture might look like. Most experts, including Fannie Mae, are predicting that rates could head below 6% by mid-2026 as inflation continues to moderate and the Fed completes its easing cycle. However, unexpected global events or changes in U.S. fiscal policy could always throw a wrench in those predictions and keep rates in this mid-6% range for longer.

Wrapping It Up

From November 10th to December 10th, 2025, I don’t anticipate any earth-shattering news in the mortgage rate world. Expect things to be relatively stable, probably hovering between 6.2% and 6.4%. It’s a market that’s still finding its footing after a period of significant change. While it presents challenges, especially for affordability, it’s also a period where informed decisions and careful planning can still lead you to the right homeownership opportunity. Stay vigilant, stay informed, and you’ll be well-positioned for whatever comes next, whether it's finding your dream home this holiday season or setting yourself up for potentially better rates in 2026.

Want Better Cash Flow? Invest in High-Demand Housing Markets

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?