Worried about where mortgage rates are headed? You're not alone. Let's cut to the chase: Mortgage rates are expected to remain pretty steady for the next 90 days, between August and October 2025, hovering around the mid-6% range for a 30-year fixed rate. Don't expect any dramatic drops, but also don't panic about a sudden spike. It's looking like a “steady as she goes” kind of situation for the next few months.

Mortgage Rates Predictions for the Next 3 Months: August to October 2025

Current Mortgage Rate Scenario

As of late July 2025, we're looking at:

- 30-year fixed-rate mortgage (FRM): 6.74%

- 15-year FRM: 5.87%

This tells me the market has settled down a bit after the craziness we've seen in recent years. I've been watching this market for a while, and it's reassuring to see some stability, even if those rates still sting a little. They've stayed below 7% for a decent amount of time now (27 weeks according to Freddie Mac), which is a positive sign. I think this plateau is a good base for home buyers to consider entering the market.

What the Experts are Saying: Mortgage Rate Forecasts (August-October 2025)

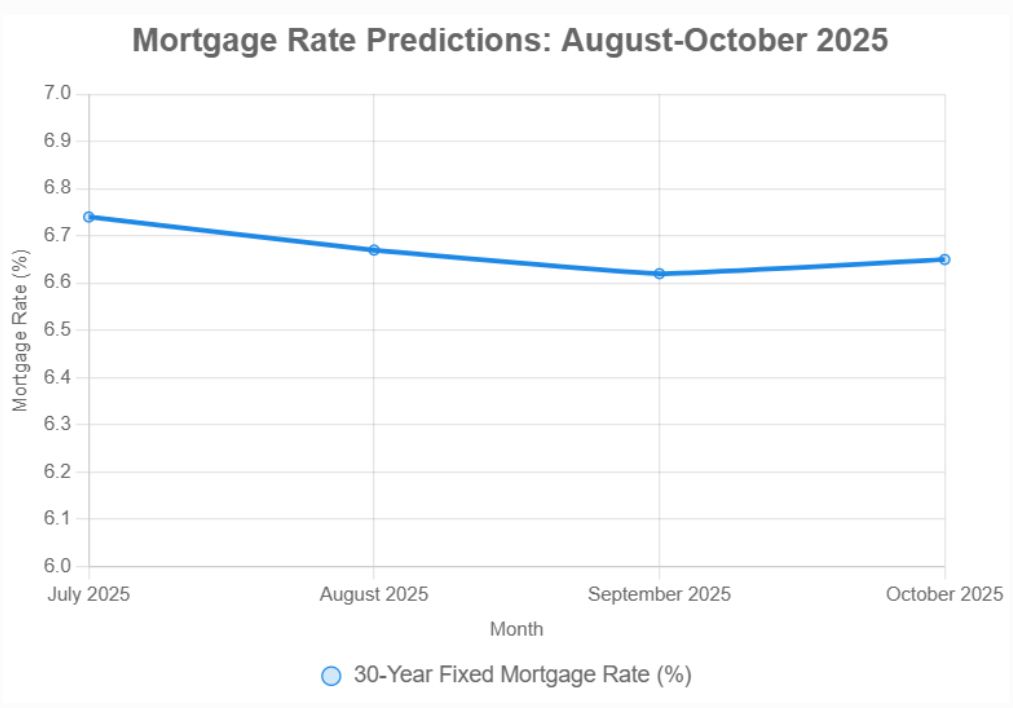

So, what's the crystal ball saying about August, September, and October? Here's a breakdown based on forecasts from several reputable sources:

- Long Forecast: This is probably the most specific forecast I've seen. These guys are predicting slight dips in August and September, and then a tiny bump up in October, all within a pretty tight range.

Month Average Rate (%) Closing Rate (%) Monthly Change (%) Total Change (%) August 2025 6.69 6.67 -0.9 -1.2 September 2025 6.63 6.62 -0.7 -1.9 October 2025 6.64 6.65 +0.5 -1.5 - Bankrate (July 29, 2025): Bankrate reports that 50% of “experts” think rates will stay put. About 33% expect a minor decrease, and 17% are bracing for a small increase. Not all that much to get excited for me. The average 30-year rate was around 6.76% in July as per their data.

- Forbes Advisor: Forbes says rates are stuck in a 6.75%-6.9% band since May, with averages of 6.85% in early June. Nothing extraordinary here!

- U.S. News (July 7, 2025): It's said that rates will likely hang between 6.5% and 7% for the whole year, with minor dips if the economy slows down a bit.

- Realtor.com: Realtor.com believes we'll see a slow easing, with rates averaging around 6.4% by the end of 2025.

- Fannie Mae: Fannie Mae thinks we'll finish 2025 at 6.5% and see rates drop to 6.1% sometime in 2026.

- Mortgage Bankers Association (MBA): MBA’s guess is around 6.8% through September, then ending 2025 at 6.7% and dipping to 6.3% in 2026.

The general consensus I'm seeing from all these sources is that we're not going to see any huge drop-offs in the near future. But it is possible that we'll get some minor gains in affordability as the year goes on.

The Big Players Influencing Mortgage Rates

Okay, so what's actually driving these predictions and mortgage rates in general? A few key factors:

1. The Federal Reserve's Game Plan

The Federal Reserve (or “the Fed”, as it's commonly known) plays a MASSIVE role. They basically control the federal funds rate, which influences all sorts of interest rates, including mortgage rates.

In its July 29-30, 2025, meeting, the Fed decided to keep the federal funds rate as it is. This is because the Fed can't decide between tackling inflation and helping the economy grow. Two members wanted to cut rates! With the economy slowing down, the Jackson Hole Symposium, in which they meet in late August 2025, will be a key event, as it often provides clues about future policy directions.

2. The Inflation Battle

Inflation is still a real concern. If it goes up, the Fed might have to raise rates to try to keep it in check. But if it starts to go down, that could give the Fed room to lower rates, which would be good news for mortgages. The central banks want to maintain inflation at 2%.

3. Economic Growth (or Lack Thereof)

How fast (or slow) the economy is growing matters. Slower growth can lead to lower Treasury yields, which often translate into lower mortgage rates. Projections seem to say we are slowing down but still stable…

4. Treasury Yields: The Unsung Heroes

When it comes to mortgage rates, 10-year Treasury yields are incredibly important. If these yields are stable or slightly declining, as experts are saying, it means that mortgage rates should stay the same too. proposed tariffs increase yields and push rates higher.

How This Affects You: The Housing Market Implications

Let's break down how these stable(ish) mortgage rates impact different people:

a) Home Affordability: Still a Hurdle

Even with rates in the mid-6% territory, buying a home is expensive. Below are some potential savings – while small, they might make a difference:

- A $400,000 loan for 30 years at 6.74% = $2,566/month

- At 6.62%, it drops to $2,558 – a whole $8 saved!

- At 6.5%, it's around $2,525

While the savings are minuscule, every little bit helps, especially for first-time homebuyers. So, you'll still need to manage your expectations and budgets going forward.

b) Home Sales: Will the Market Heat Up?

Experts are saying home sales will increase in the coming years. I'm seeing the “rate lock-in effect” (where people with super low rates don't want to sell) is starting to fade. With that happening, the market might get a bit more inventory, which could lead to more sales!

c) Home Prices: Will They Keep Climbing?

Don't be worried, but Home prices are predicted to keep rising, however, modestly. I'm estimating this more sustainable market compared to recent years. That isn't to say that affordability problems are gone!

d) Refinancing: A Limited Opportunity

Because of the stability in the market, I don't think we'll see tons of people rushing to refinance. However, small dives in rates can allow some refinance activity to happen, as people locked in on higher rates might make that move.

Related Topics:

Mortgage Rates Predictions for Next Year: Will Rates Go Down to 4%?

Mortgage Rates Predictions for the Next 30 Days: July 22-August 22

Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

What Should You Do? (Advice for Buyers, Sellers, and Everyone Else)

Based on everything I'm seeing, here's my advice:

- Homebuyers: Waiting for rates to plummet before you buy? Might be waiting a while. If you find a house you love, lock in a rate. You can always refinance later if rates go down. And shop around for the best deal!

- Sellers: With more sales activity coming, you might find more buyers coming your way!

- Investors and Homeowners: Pay close attention to the economic numbers coming out. And seriously consider fixed-rate mortgages over those adjustable ones (ARMs).

The Bottom Line

So, there you have it: Steady mortgage rates are coming, that is, between 6.62% and 6.67% mostly. So plan accordingly, whether you're buying, selling, or just keeping an eye on the market. Stay informed, shop around, and make smart decisions!

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down to 3% in 2026?

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?