This is the million-dollar question many homeowners are asking themselves right now. As of November 9, 2025, with mortgage rates hovering around 6.22%, the decision to refinance your home seems tempting, but should you act today or hold out for potentially better deals in 2026? My take, after looking at all the angles, is that if you stand to save a significant amount and have a solid plan to stay in your home, refinancing now can be a smart move, but waiting offers a gamble for even greater savings if forecasts pan out.

Should You Refinance Your Mortgage Now or Wait Until 2026?

Buying a home is often the biggest financial decision of our lives, and for many, the equity built up is their largest asset. That’s why deciding whether to refinance your mortgage carries so much weight. Homeowners can potentially save thousands each year, but getting it wrong can end up costing you. The economic signs are pointing towards potential rate drops, but there’s a lot of uncertainty. Let’s dive into what’s happening with rates, what experts are predicting, and how you can figure out the best path for your situation.

Understanding Today's Mortgage Rate Environment

Mortgage rates aren't just numbers pulled out of thin air; they're closely tied to what's happening in the broader economy. The 30-year fixed mortgage, the most popular choice for its predictable payments, is currently averaging 6.22%. This is a welcome drop from the higher rates we saw for much of 2025, thanks to the Federal Reserve’s efforts to lower borrowing costs.

Several big factors influence these rates:

- The Federal Reserve's Moves: The Fed has been cutting its key interest rate, making it cheaper for banks to borrow money. This generally means lower mortgage rates. As of November 2025, their target rate is between 4.5% and 4.75%. However, mortgage rates are more directly influenced by the yields on the 10-year Treasury note. This yield, which reflects what investors expect for inflation and economic growth, is currently around 4.09%. It’s come down from last year, but it can jump up quickly if there’s a lot of positive economic news or concerns about inflation.

- Inflation: Inflation is still a bit higher than the Fed’s target of 2%. Right now, it’s sitting around 2.6% year-over-year. If inflation continues to cool down, mortgage rates are likely to follow. Many economists predict inflation will get closer to 2.3% by mid-2026, which would be good news for borrowers.

- Economic Signals: The economy is showing signs of strength, with solid job growth and a decent pace of expansion. However, there are still whispers of a possible slowdown, and global events can always throw a wrench into the works. All these things can make mortgage rates a bit jumpy.

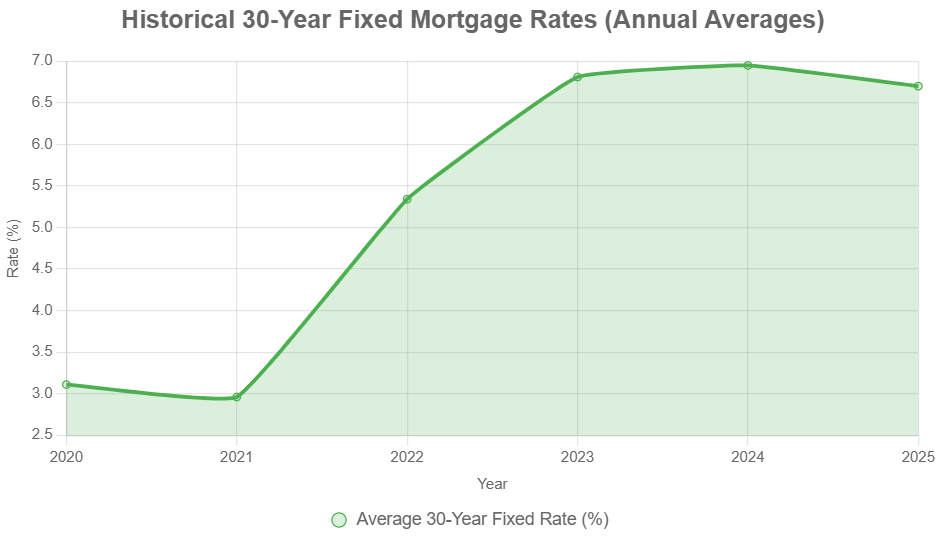

To give you a sense of where we’ve been, look at this chart showing average annual mortgage rates. You can see that the super-low rates of 2020 and 2021 were an exception, largely due to pandemic recovery efforts. Rates then climbed significantly in 2022 as inflation surged. The 2025 figure reflects rates seen so far this year, with recent dips suggesting we might be past the peak.

What Do the 2026 Forecasts Say?

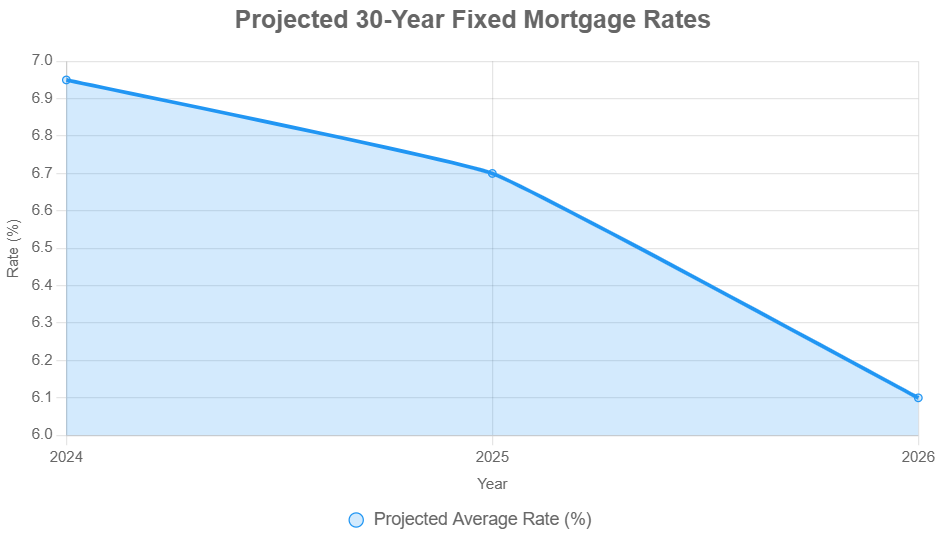

Most experts are predicting that mortgage rates will continue to drop, but not necessarily back to the ultra-low levels we saw a few years ago. Fannie Mae, for example, expects rates to be around 5.9% by the end of 2026, assuming inflation stays in check and the Fed makes further rate cuts. Other groups, like the Mortgage Bankers Association, are a bit more cautious, projecting rates closer to 6.4%.

These predictions rely on a few key things:

- The Fed's Plan: If the Fed continues to cut rates as expected, this should help push mortgage rates down.

- Housing Market Balance: While home inventories have increased, demand is still a factor that can influence how much further rates can fall.

- Global Stability: Major world events, elections, and economic shifts can impact investor confidence and, consequently, bond yields and mortgage rates.

This chart shows a projected trend, with a moderate decline anticipated over the next year:

(Note: The 2026 projection is an average of various expert forecasts, highlighting the range of possibilities.)

It's interesting to see discussions online about a potential “refinance boom” in 2026 as rates move closer to lower figures. Many people are debating whether to lock in savings now or wait and hope for even better rates.

The Nitty-Gritty of Refinancing: Costs, Savings, and When You Break Even

When you refinance, you're essentially replacing your current mortgage with a new one. The most common reasons are to get a lower interest rate, shorten your loan term, or tap into your home equity.

The Price Tag of Refinancing:

Keep in mind that refinancing isn't free. You'll encounter closing costs, similar to when you bought your home. For a typical loan, these costs can range from $3,000 to $7,000, or about 1-2% of the loan amount. Some lenders may even let you roll these costs into the new loan.

Here’s a general idea of what these costs include:

| Cost Category | Estimated Amount | What It Covers |

|---|---|---|

| Application/Origination Fees | $500 – $1,500 | Lender’s administrative costs |

| Appraisal Fee | $300 – $500 | Professional estimate of your home's value |

| Title Search & Insurance | $800 – $2,000 | Ensures clear ownership and protects lender |

| Credit Report/Underwriting | $200 – $500 | Checks your credit history and loan approval |

| Total Estimated Costs | $3,000 – $7,000 |

Let’s crunch some numbers. If you have a $300,000 loan and can refinance from 7% down to 6.22%, your monthly payment could decrease by about $147. That’s $1,764 saved each year. To figure out your break-even point – when your savings cover the closing costs – you’d divide the total closing costs by your monthly savings. Using our example, $5,000 in closing costs divided by $147 in monthly savings is about 34 months, or roughly 2.8 years.

Key Personal Factors to Consider:

- How Long Will You Stay? If you plan to stay in your home for at least 5-7 years, refinancing is often worthwhile because you’ll be in the home long enough to truly benefit from the savings. If you think you might move sooner, the closing costs might eat up your savings.

- Your Credit Score and Equity: You’ll generally need a credit score of 620 or higher and at least 20% equity in your home to get the best rates and avoid paying for private mortgage insurance (PMI) again.

- Taxes: The interest you pay on your mortgage is usually tax-deductible, and refinancing can impact this. It's always a good idea to chat with a tax advisor about your specific situation, especially with any changes in tax laws.

Refinancing Now vs. Waiting: The Pros and Cons

Refinancing Now:

- Pros:

- Immediate Savings: You start saving money on your monthly payments right away.

- Security: You lock in a lower rate and protect yourself if rates unexpectedly rise again.

- Simplicity: Some refinance options, like streamline refinances for FHA or VA loans, are designed to be quick and easy.

- Catching Rate Drops: If your current rate is significantly higher than today’s, say above 6.75%, refinancing now can provide substantial savings that quickly add up.

- Cons:

- Upfront Costs: You have to pay closing costs, which means it takes time to see net savings.

- Missed Lower Rates: If rates drop significantly in 2026 (e.g., by 0.5% or more), you might regret not waiting and could end up paying refinancing fees twice.

Waiting Until 2026:

- Pros:

- Potentially Bigger Savings: If rates fall to 5.9% or lower, your monthly savings could be even larger, leading to greater long-term financial benefits. You avoid paying closing costs now.

- Potentially Lower Fees: Sometimes fees can fluctuate, and waiting might mean you avoid seasonal price increases for services.

- Cons:

- Delayed Savings: You continue paying your current, possibly higher, interest rate until you refinance.

- Uncertainty: Rate forecasts aren't guarantees. Economic shifts or unexpected events could cause rates to level off or even increase.

- Life Changes: If you unexpectedly need to move or face other major life changes, your plans to refinance might get complicated.

A Special Case: If you currently have an adjustable-rate mortgage (ARM) and your rate is scheduled to reset higher soon, refinancing now is often a no-brainer to avoid that upcoming payment increase.

Recommended Read:

Are There Other Options Besides a Full Refinance?

You don't always have to do a complete mortgage refinance to achieve your financial goals. Here are some alternatives:

- Home Equity Line of Credit (HELOC) or Home Equity Loan: These allow you to borrow against the equity you've built in your home. HELOCs typically have variable rates, while home equity loans have fixed rates. They can be useful for debt consolidation or home improvements without changing your primary mortgage. Current rates for these might start around 8-9%, or perhaps 7.99% for those with excellent credit.

- Mortgage Recasting: This is a simpler process where you make a large lump-sum payment towards your principal, and the lender then re-calculates your monthly payments based on the new, lower balance. There are usually minimal fees ($250 is common) and no credit check involved.

- Reverse Mortgage: If you're 62 or older, a reverse mortgage allows you to convert a portion of your home equity into cash without having to make monthly mortgage payments. However, it does reduce the inheritance you leave to your heirs.

- Personal Loans or Balance Transfers: For smaller debts, these can be options, but their interest rates are often much higher than mortgage rates.

My Advice: What to Do Next

Based on my experience and what I’m seeing in the market, here’s how I’d approach this decision:

- Run the Numbers Personally: Don't just rely on general advice. Use online calculators from reputable sites like Bankrate or NerdWallet to get a precise idea of your potential savings and break-even point.

- Consider Your Current Rate: If your current mortgage rate is above 6.75% and your break-even point is less than 3 years, refinancing now is likely a good idea. It's especially compelling if you can get tax benefits by refinancing before year-end.

- If Your Rate is Lower: If your rate is closer to today's average (say, below 6.5%), it might be worth waiting. Keep an eye on weekly mortgage rate trends from sources like Freddie Mac. A drop of 0.25% or more could make waiting more attractive.

- Talk to a Lender: Get a no-obligation quote from a mortgage lender. Many are happy to provide this, and they can also explain rate lock options, which can secure a rate for you for 60-90 days while you finalize your decision.

- Think About Your Life: Are you planning any major life changes in the next few years? Does the thought of a potentially lower payment bring significant peace of mind? These personal factors are just as important as the numbers.

The mortgage market is dynamic. Rates can change based on Fed announcements, economic reports, or even global events. Staying informed and understanding your personal financial picture will help you make the best decision for your home and your future.

Refinance Now or Wait? Turnkey Investors Are Locking in Strategic Gains

Refinancing your mortgage in late 2025 could mean lower monthly payments, stronger cash flow, and better positioning for future rate hikes—especially for turnkey rental owners.

Norada Real Estate helps investors evaluate refinance timing, optimize loan structures, and scale portfolios with properties that deliver consistent income and long-term equity.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Recommended Read:

- When You Refinance a Mortgage Do the 30 Years Start Over?

- Should You Refinance as Mortgage Rates Reach Lowest Level in Over a Year?

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Mortgage Rates Predictions for 2025: Expert Forecast

- Half of Recent Home Buyers Got Mortgage Rates Below 5%

- Mortgage Rates Need to Drop by 2% Before Buying Spree Begins

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for 2025: Expert Forecast