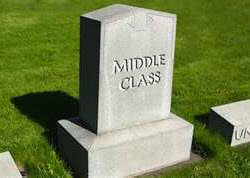

Incomes are dropping. And that’s not good for the real estate industry, nor is it good news for the American Dream of home-ownership. More Americans view themselves as slipping out of the middle class according to a recent survey by the Pew Research Center.

Incomes are dropping. And that’s not good for the real estate industry, nor is it good news for the American Dream of home-ownership. More Americans view themselves as slipping out of the middle class according to a recent survey by the Pew Research Center.

The trend began in the 1970s, Pew claims, but it has accelerated since the Great Recession. In the past five years, the percentage of Americans who consider themselves middle class has fallen sharply, dropping from 44% in the latest survey from 53% in 2008. 40% now identify as either lower-middle or lower class compared with just 25% in February 2008.

One of lasting legacies of the Great Recession is the hollowing out of the middle class. Another report bears this out. In 1970, about 65% of Americans lived in middle class neighborhoods, compared with 42% today, according to a recent study by Cornell University researcher Kendra Bischoff and Sean Reardon of Stanford University. The Census Bureau defines middle class as those families making between $40,000 and $80,000 a year. Incomes vary by state, with Maryland at more than $67,000 and Mississippi at $39,000.

Since the Great Recession began in 2007, median household income has steadily declined the last five consecutive years, according to the U.S. Census.

Median household income in 2012 was $51,017 a year, down from $55,627 in 2007. According to the Census report, the high point of household income in the U.S. was back in 1999, when it was $56,080.

The report also showed 46.5 million Americans are mired in poverty. In any case, individuals and families who feel they’ve slipped from the middle class are likely to spend and borrow less, pulling back from buying big ticket items like new cars and homes.

Historically, homeowners greatly outnumber renters in the U.S. by more than three to one. However, in the wake of the housing bust that brought on the Great Recession, the rate of home ownership has slid steadily — from its peak at 69.2% in the fourth quarter of 2004 (or 77 million owner-occupied housing units) to 65.2% (or 72 million units) in the fourth quarter of 2013, according to U.S. Census data. With incomes withering, and home ownership declining, some researchers argue that deep-seeded structural changes are underway in America’s economy. This has increased the size of the tenant pool and pushed up demand for rental units.

Tyler Cowen, an economist at George Mason University, says that America is increasingly dividing itself into two disparate classes. At the top, there will be 10% to 15% of high achievers who are technologically savvy and earning high salaries. Then, there is everyone else, floundering in “hyper-meritocracy,” where many careers become more demanding as employers measure economic value with a sometimes oppressive precision.

“We will move from a society based on the pretense that everyone is given an okay standard of living to a society in which people are expected to fend for themselves much more than they do now,” writes Cowen, author of Average is Over: Powering America Beyond the Age of the Great Stagnation (Dutton, 2013). “I imagine a world where, say, 10% to 15% of the citizenry is extremely wealthy and has fantastically comfortable and stimulating lives, the equivalent of current-day millionaires, albeit with better health care. Much of the rest of the country will have stagnant or maybe falling wages in dollar terms, but a lot more opportunities for cheap fun and also cheap education.”