If you're dreaming of buying a home or refinancing your current mortgage, the big question on your mind is likely: what will mortgage rates look like in the years to come? Based on what I'm seeing and hearing from experts, the outlook for mortgage rates beyond 2026 suggests we're settling into a new normal, likely in the 6.0% to 6.5% range, a far cry from the ultra-low rates of the past decade, and significant drops below 5% are highly improbable.

What's the Outlook for Mortgage Rates Beyond 2026?

It feels like just yesterday we were talking about 3% mortgage rates. For many of us who bought homes during that period, it was a golden opportunity. But as we look past 2026, those days seem to be firmly in the rearview mirror. The experts are largely in agreement that while rates might not be zooming upwards uncontrollably, they definitely aren't expected to plummet back to the historic lows we witnessed.

A Look Ahead: What the Experts Are Saying

When you're trying to predict the future, especially something as sensitive as interest rates, you turn to the folks who spend their days analyzing economic trends. And from what I gather, there's a general consensus brewing among the big players in the housing and finance world.

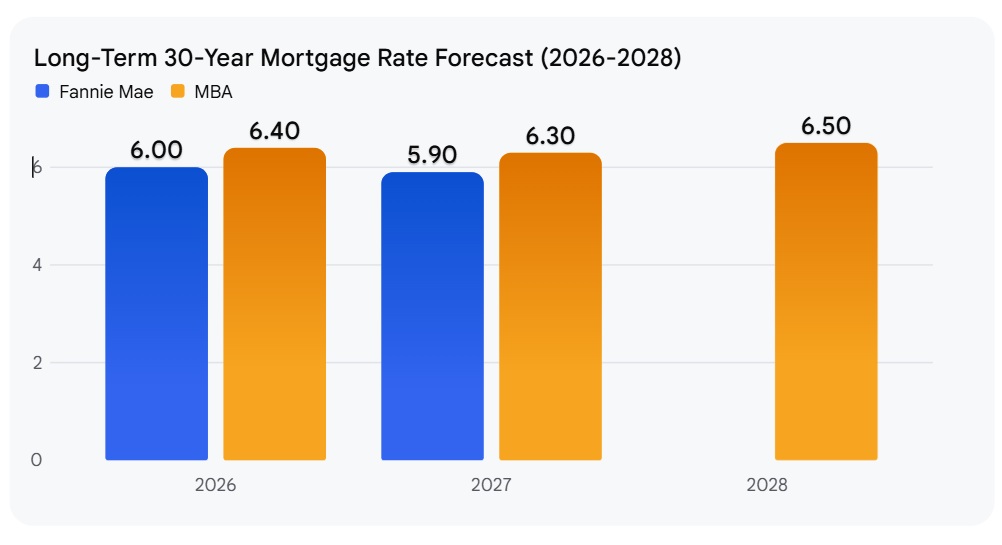

Here's a peek at what some leading institutions are forecasting for 2027 and 2028:

| Source | 2027 Projection | 2028 Projection | My Takeaway |

|---|---|---|---|

| Fannie Mae | ~5.9% – 6.0% | N/A | These guys see rates hanging around 6%, figuring that people will still really want homes, keeping demand steady. |

| Mortgage Bankers Assoc. (MBA) | 6.3% | 6.5% | The MBA is leaning towards a slight increase, pointing to ongoing government spending (fiscal deficits) as a factor that will keep borrowing costs higher, even if short-term rates ease. |

| Morningstar | ~5.25% | 5.00% | They're a bit more optimistic, believing the Federal Reserve might eventually cut rates more aggressively, pulling mortgage rates down more than others predict. |

| NAHB | 6.01% | N/A | The National Association of Home Builders anticipates a slow slide down towards 6% as inflation finally calms down completely. |

As you can see, there are some differing opinions, but the overall picture isn't one of super-cheap borrowing. The idea of seeing sub-5% rates again in the next few years? Unless something pretty dramatic happens in the economy, it's looking like a long shot.

Why Are Rates Expected to Stay Elevated?

It's not just a hunch; there are some pretty solid economic reasons behind this outlook. Think of it like this: several big forces are at play, and they're all pushing mortgage rates in a similar direction.

- The Government's Bill: This is a big one. You might hear about the Federal Reserve “cutting rates,” which sounds good for borrowers. But the U.S. government has a lot of debt, and plans to keep borrowing. When governments borrow a lot, it tends to push up the cost of borrowing for everyone, including those getting mortgages. The Mortgage Bankers Association specifically flags this, warning that persistent fiscal deficits will keep long-term borrowing costs higher.

- The 10-Year Treasury Yield: This is your financial benchmark for mortgages. The 10-year Treasury note's yield is like the pace car for mortgage rates. Some economists are predicting that this key rate will stay above 4.1% for the foreseeable future, even through 2030. If that benchmark stays high, it's tough for mortgage rates to do anything but follow suit.

- A “New Normal” for Interest Rates: For a long time, we got used to what seemed like incredibly low interest rates. But a lot of smart people in finance are now saying that the era of 3% or 4% mortgages was a bit of an anomaly, a historical blip. The economy is evolving, and the “natural” or “neutral” rate of interest seems to be shifting higher. What was low for us might have been abnormally low for the economy as a whole.

- Housing Supply and Demand: This one is interesting. Right now, many homeowners are hesitant to sell because they have a low mortgage rate and don't want to buy a new home with a higher one. This is called the “lock-in effect.” As mortgage rates begin to stabilize, even if they're in that 6% range, it might encourage some of these homeowners to finally list their properties. This could mean more homes on the market, which would be great for buyers. However, the expectation is that this increased supply will help keep home prices steady rather than driving mortgage rates down significantly.

My Perspective on the Long Term

From where I stand, having watched the housing market for a while, this “new normal” for rates feels more like a recalibration than a catastrophe. The ultra-low rates of the past decade were fueled by unique circumstances, including major efforts to stimulate the economy after the 2008 financial crisis and then again during the pandemic.

Now, the Federal Reserve is working to tame inflation, and that inherently means keeping borrowing costs higher. We're also seeing a global economy grappling with different challenges, from government debt to geopolitical events, all of which can influence these rates.

So, what does this mean for you?

- Don't Hold Your Breath for 3% Mortgages: If you're waiting for rates to drop back to the historic lows of the early 2020s, you might be waiting a very long time, possibly indefinitely.

- Focus on Affordability: Instead of chasing the lowest possible rate today, focus on what you can comfortably afford for your monthly payment. This involves looking at your income, debts, and savings, and finding a home that fits your budget, even with rates in the 6% range.

- Homeownership is Still Achievable: While the borrowing costs are higher than they were a few years ago, owning a home is still within reach for many. The increased availability of homes might even level the playing field for buyers looking for their piece of the American dream.

- Consider Adjustable-Rate Mortgages (ARMs) Wisely: For some buyers, an ARM might be an option. They often come with a lower introductory rate than a fixed-rate mortgage. However, you need to be prepared for the possibility that your rate could go up when the introductory period ends. This is a more advanced strategy that requires careful consideration of your financial future and risk tolerance.

Ultimately, the mortgage rate outlook beyond 2026 points to a more stable, albeit higher, interest rate environment. For borrowers, this means adjusting expectations and focusing on long-term financial planning rather than hoping for a return to an era that is likely gone for good.

And

Alabama’s newer A- rental vs Tennessee’s larger property with higher NOI. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to a Norada Investment Counselor (No Obligation):

(800) 611-3060

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

Also Read:

- What Leading Housing Experts Predict for Mortgage Rates in 2026

- Mortgage Rate Predictions for 2026: What Leading Forecasters Expect

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?