Currently, the Boston housing market leans slightly towards sellers, given the competitiveness in pricing and the limited inventory. However, the increasing number of new listings and the growing buyer interest suggest a more balanced market in the near future.

Buyers have more purchasing power now, thanks to lower mortgage rates, but they still face challenges due to limited inventory. Meanwhile, sellers can take advantage of the current demand but should be cautious about pricing their properties appropriately to attract the right buyers.

Current Trends in the Boston Housing Market

The Boston housing market, after experiencing a period of slower sales and softening prices, is showing signs of revival in the early months of this year. With lower mortgage rates as compared to last year and an increase in inventory, buyers are returning to the market, boosting home sales in the Boston area.

How is the Housing Market Doing Currently?

According to a report from the Greater Boston Association of Realtors®, sales of single-family homes in January saw a year-over-year increase for the first time in 20 months. This uptick in sales, coupled with rising median prices, indicates a promising start to the year for the housing market.

In January, sales of single-family homes improved by 1.4 percent compared to the same period last year, while the median sales price also rose both annually and monthly. However, sales of condominiums saw a decline, dropping by 27.3 percent year-over-year, marking the slowest January for condo sales in 15 years.

How Competitive is the Boston Housing Market?

Buyer interest has been steadily increasing, especially since mid-November when mortgage rates began to decrease. Despite the limited inventory, which has constrained overall sales volume, the rise in listings by about 20 percent since the beginning of the year has provided buyers with more options and negotiating power.

Properties are selling close to their asking prices, with typical single-family homes selling for 98.3 percent of their original list price, and condominiums fetching 98 percent of their initial sales price. This competitiveness in pricing reflects the confidence and purchasing power of buyers in the current market.

Are There Enough Homes for Sale in Boston to Meet Buyer Demand?

While buyer interest is high, inventory levels are still lagging behind what is typical for a balanced market. However, there has been a notable increase in new listings since the end of last year, with active listings for single-family homes rising by 21 percent and condominium listings improving by 20 percent in January alone.

The influx of listings, combined with the steady increase in foot traffic at open houses since the beginning of the year, suggests that the market is gearing up for a robust spring season.

What is the Future Market Outlook for Boston?

The future outlook for the Boston housing market appears positive, with the strong buyer interest and increasing foot traffic indicating a healthy demand. As new listings continue to increase, it is expected that inventory levels will improve steadily, providing buyers with more options and opportunities for negotiation.

However, homeowners are advised against pricing their properties too aggressively, as overpricing can deter potential buyers and prolong the selling process. Pricing competitively and aligning with similar properties on the market is crucial for a successful sale.

ALSO READ: Massachusetts Housing Market Forecast

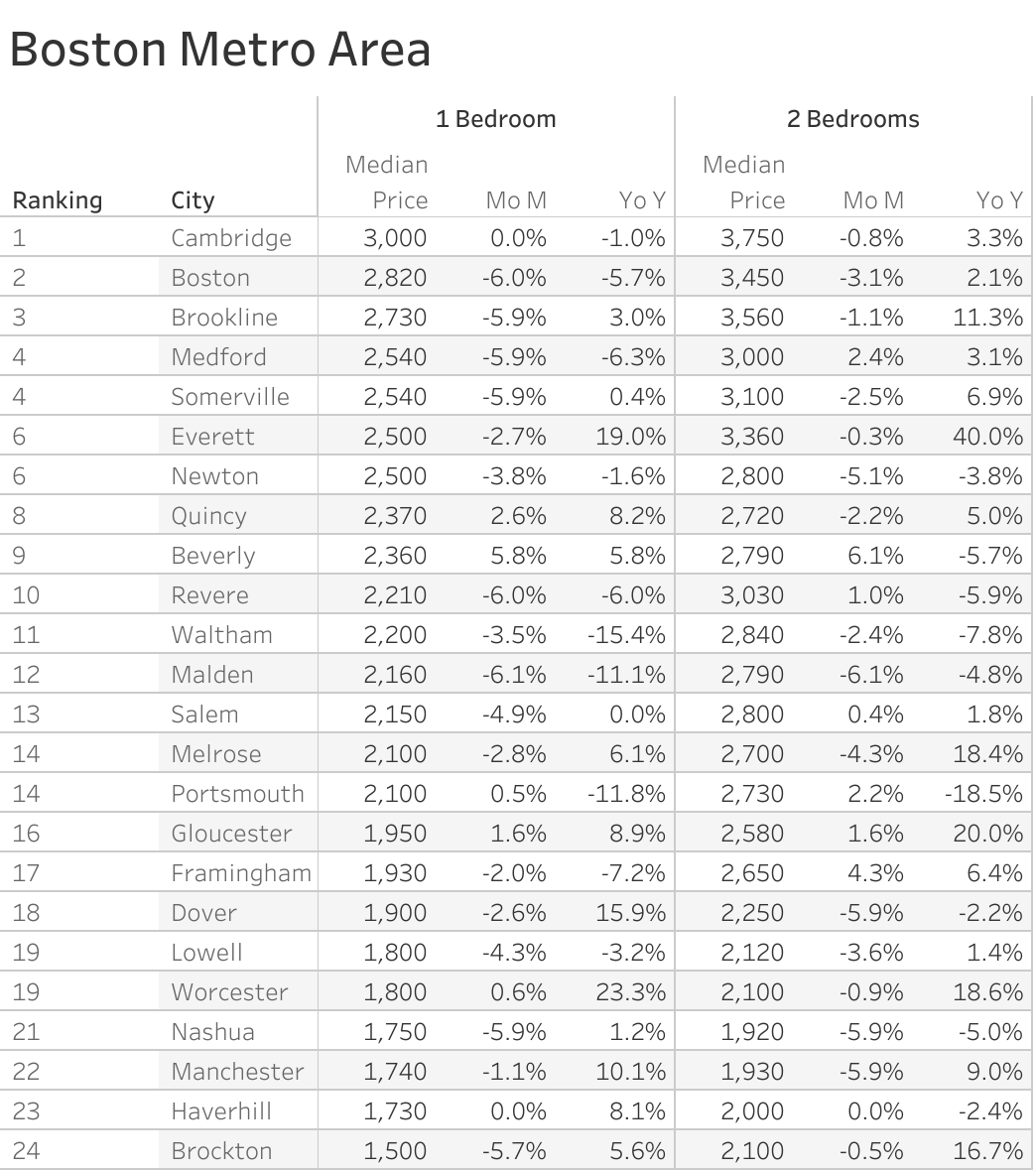

Boston Rental Market Trends

The Zumper Boston Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Massachusetts one bedroom median rent was $2,190 last month. Cambridge ranked as the most expensive city with one-bedroom rent priced at $3,000. Brockton was the most affordable city with one-bedrooms priced at $1,500.

The Fastest Growing Cities For Rents in Boston Metro Area (Y/Y%)

- Worcester had the fastest growing rent, up 23.3% since this time last year.

- Everett saw rent climb 19%, making it second.

- Dover was third with rent increasing 15.9%.

The Fastest Growing Cities For Rents in Boston Metro Area (M/M%)

- Beverly rent had the largest monthly growth rate, up 5.8%.

- Quincy rent increased 2.6% last month, making it second.

- Gloucester had the third largest rent price growth rate, climbing 1.6%.

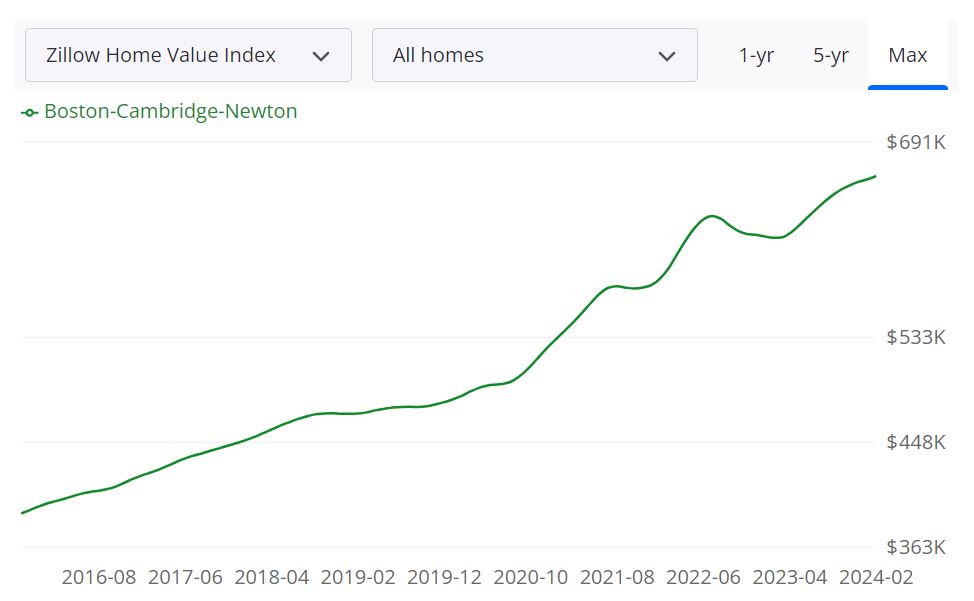

Boston Housing Market Forecast 2024 and 2025

What are the Boston real estate market predictions? The Boston-Cambridge-Newton housing market has remained robust, with significant increases in home values over the past year. According to Zillow, the average home value in this area stands at $664,491, reflecting an 8.1% increase compared to the previous year's data. Homes in this region are also in high demand, typically going pending in approximately 11 days.

Market Forecast

Zillow's 1-year Market Forecast for the Boston-Cambridge-Newton area, as of February 28, 2024, indicates a modest 0.6% increase, suggesting continued stability and growth in the housing market.

Housing Metrics Explained

For Sale Inventory

As of February 29, 2024, the Boston housing market had 5,497 properties available for sale. This figure provides insight into the current supply of homes on the market.

New Listings

During the same period, there were 2,278 new listings added to the market. New listings signify the influx of properties available for purchase, contributing to market activity and options for potential buyers.

Median Sale to List Ratio

The median sale to list ratio, calculated as of January 31, 2024, was 1.000. This ratio indicates the relationship between the final sale price of a home and its initial list price. A ratio of 1.000 suggests that, on average, homes are selling for their listed price.

Median Sale Price

As of January 31, 2024, the median sale price for homes in the Boston area was $615,000. This figure represents the middle point of all sale prices, providing a benchmark for understanding the affordability of homes in the market.

Median List Price

The median list price as of February 29, 2024, stood at $747,133. This metric represents the midpoint of all listed prices, indicating the pricing trend in the market.

Percent of Sales Over and Under List Price

Data from January 31, 2024, reveals that 49.3% of home sales in the Boston area were over the list price, while 40.3% were under the list price. These percentages offer insights into market competitiveness and negotiation dynamics between buyers and sellers.

Market Size and Significance

The Boston-Cambridge-Newton metropolitan statistical area (MSA) encompasses several counties, including Suffolk, Middlesex, and Norfolk. With its diverse economy, world-renowned universities, and cultural attractions, the Boston housing market is significant both regionally and nationally. Its housing market serves as a barometer for real estate trends and economic indicators, making it a focal point for investors, homebuyers, and industry analysts alike.

Is Boston a Buyer's or Seller's Housing Market?

With the current data indicating a median sale to list ratio of 1.000 and a substantial 49.3% of sales occurring over the list price, the Boston housing market appears to lean heavily towards sellers. Low inventory levels, coupled with high demand and competitive bidding, create favorable conditions for sellers to command higher prices and negotiate advantageous terms. Consequently, buyers may face challenges such as limited options and potential bidding wars, suggesting that it is currently a seller's market in Boston.

Are Home Prices Dropping in Boston?

Despite fluctuations in the real estate market, recent data does not indicate a significant drop in home prices in the Boston-Cambridge-Newton area. On the contrary, the average home value of $664,491 reflects an 8.1% increase over the past year. While individual neighborhoods or property types may experience variations, the overall trend suggests continued appreciation rather than a widespread decline in home prices.

Will the Boston Housing Market Crash?

Predicting a housing market crash involves considering numerous factors, including economic indicators, housing supply and demand dynamics, and regulatory policies. While the Boston housing market has shown resilience and sustained growth, there are no guarantees against unforeseen events or market corrections. However, based on current data and market conditions, there are no imminent signs of a housing market crash in the Boston area. Prudent monitoring of economic trends and real estate indicators is advisable to mitigate potential risks.

Is Now a Good Time to Buy a House in Boston?

Whether it's a favorable time to buy a house depends on various factors, including personal financial circumstances, long-term goals, and market conditions. Despite the challenges posed by a seller's market, opportunities may still exist for buyers, especially those who are well-prepared and flexible in their approach. While timing the market perfectly is difficult, low mortgage rates as compared to last year and the potential for future appreciation may make now an attractive time for some buyers to enter the Boston housing market.

Boston Real Estate Investment: Should You Invest in Boston?

Successfully investing in real estate — whether you are in Boston or anywhere else in the world — is all about correctly timing the market. Knowing when to enter the real estate market can often be a bit of a challenge. Should you invest in Boston real estate? Is Boston a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Boston is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers.

Boston is a fairly walkable city in Suffolk County with a population of approximately 700,000 people, making the Boston housing market rather large on its own. It is a thriving city, which makes it the best location to buy an investment property at any point in time including the present. Since it contains around 80% of all residents of Massachusetts, it is certainly the first place that people choose to research, when they want to invest in the state.

The broader Boston Metropolitan Area or Greater Boston is home to more than four million people. Boston real estate has been one of the best long-term real estate investments in the nation. The Boston real estate market is dominated by rental properties and Airbnb is a great pick for starters. The city is a wonderful place to call home. People want to live in the city, yet the number of new homes being built is relatively low.

Boston's real estate market is vibrant, and plenty of buyers are offering more than the asking price when they love a property. Throughout the Greater area of Boston, numerous investment properties are waiting to be revitalized by a wise investor. But for most people, Boston is a high-priced real estate market, though it isn’t as expensive as Washington DC, San Francisco, or New York City.

Greater Boston is still an expensive place to buy a house, but the years of relentless price increases may be nearing an end. It’s too soon to know if this trend is a blip or if the Boston housing market heading toward some stability. However, new investors should always consider cheaper markets for investment. Because of the large number of students, and college and university faculty, it is a no-brainer for savvy investors to invest in a rental property in Boston.

Rental property in Boston is guaranteed to get a lot of demand from tenants – whether an apartment or a condo or a single-family home. Any investment property is likely to get rented out fast. Airbnb rentals are one of the best options for real estate investment in Boston. Let’s find out more about it.

Boston has been one of the hottest real estate markets in the country for many years. It is not just an expensive real estate market on the East Coast. It is one of the few in the region not expected to see significant declines. And there are areas we can expect to see significant appreciation due to the sheer demand for affordable housing with easy access to major arteries or public transit.

Boston is an old, East Coast city. We’ve already mentioned the height law and the challenges faced by getting anything approved even with the mayor behind it. Unfortunately, Boston’s entrenched bureaucracy limits the redevelopment of large garages and other major projects that could bring thousands of units to the Boston real estate market.

If it takes ten years (or more) for the Boston Harbor Garage to be redeveloped, and it is far from the only project on hold, then you can be certain to see high returns on any redevelopment project that creates more housing units within existing buildings. Whether this is converting warehouses into lofts or single-family homes into multi-family housing, if you don’t face major roadblocks, you’ll see a great return on the investment.

If you are looking to make a profit, you don’t want to buy the most expensive property on the Boston real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Boston that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Investing in Boston real estate will fetch you good returns in the long term as the home prices in Boston have been trending up year-over-year. Let’s take a look at the number of positive things going on in the Boston real estate market which can help investors who are keen to buy an investment property in this city.

Boston is Attractive to Millennials

Millennials are a market real estate agents want to cater to since they’re buying homes in mass. And Boston is considered one of the cities Millennials love. The challenge for Millennials is affording a market where the median home costs around $740,000. Yet the demand from young and old alike means there’s very little inventory, much less housing stock considered affordable.

Boston isn’t just attracting young people from across the country – it is also attracting immigration from around the world. The city has seen population growth every year since 2004 in part because of the influx of immigrants attracted to healthcare, biotech, and educational jobs here.

Millennials and older adults alike are choosing to spend more on an apartment, condo, or house to avoid spending hours each week commuting. It is seen as an investment in their quality of life. This explains why downtown Boston is seeing price increases far higher than the rest of the Boston metro area.

Downtown enclaves sell for much more per square foot than properties at the edge of town or in the suburbs; the price hit a thousand dollars a square foot recently. That’s expensive for the U.S. but half the price you’d pay for a comparable apartment in New York City. Ironically, the high price of real estate in NYC explains why many financial firms are expanding in the relatively cheaper city of Boston, home of the mutual fund.

Boston's Job Market Will Keep People Coming

Boston was ranked the best city in the U.S. for startups. A large number of world-class universities provide a large number of skilled workers, many of whom work in medicine, finance, and biotech. The constant creation of new jobs will continue to attract residents and help the city retain the ones it already has. The economy is dominated by services, which usually pay high wages and attract more and more job seekers. All these factors have created a hot housing market in Boston, dictated by both home buyers and tenants.

Guaranteed Real Estate Appreciation

Strong demand plus limited inventory and limited space to grow will guarantee appreciation of any property you buy in the Boston real estate market. Prices are going to appreciate in 2021 by 6-8%. This is only a continuation of the steady property increases seen since the 2008 property crash. This is partly because the market is so built-up already that land prices are high.

Then there’s the fact it can take a long time to get approval to build up. Boston’s mayor is facing flak for wanting to waive the building height rule just once. Ironically, the Boston shadow law that limits the height of buildings in the Boston housing market has the greatest impact on the downtown areas where people most want to see the tall apartment and condo towers built.

The increase in mortgage interest rates is putting pressure on home buyers, limiting what they can afford. This in turn is leading home builders to cut prices on new properties. According to the Washington Post, Boston home builders are cutting the price of properties on the market by 6%. If you have financing or the cash to invest in the Boston real estate market, you can’t pass up a deal like this.

Boston's Rental Market

The Boston real estate market and its environs include a whopping hundred universities, colleges, and trade schools. There are more than 150,000 college students in Boston and Cambridge alone. You could buy properties across the Boston real estate market and cater to students, and your market is so diverse that you’ll always see demand. Boston is landlord-friendly compared to markets like NYC. There is no limit on late fees.

You don’t have to provide notice before entering the apartment. The state doesn’t require rental licenses to become a landlord. There aren’t laws regarding re-keying or pets. A written rental agreement is only mandatory if your tenant is staying for more than 12 months. Evictions are allowed if they are not paying the rent, violating the lease, or breaking the law. You can start evictions two weeks after the non-payment of rent. Since evictions can take weeks, screen tenants well for any property in the Boston housing market.

Rents in the inner Boston Core hit 2800 a month. All those grad students, young single professionals, and highly paid power couples are bidding up the limited housing stock available. If you can find a reasonably affordable property in the Boston real estate market and convert it into multiple units or a more upscale clientele, you’ll enjoy significant cash flow from the property. Any future real estate investor in Boston should also have in mind that the expected rental income for both traditional rentals and Airbnb rentals is high.

The combined effect of high property prices and high rental income leads to a decent return on investment for Boston rental properties. The taxes here are high compared to the U.S. average but lower than in several other states in the area. The income tax rate is much lower than in New York, and property taxes are far lower than in New Jersey. Therefore, you’ll clear more here than in some of the other large Northeast markets.

Luckily for real estate investors in Boston who are interested in Airbnb rentals, they are fully legal in the Boston real estate market and are not even taxed at the moment. Recent discussions among Massachusetts lawmakers failed to result in an agreement on taxes to be charged on short-term rentals.

Latest Rental Market Statistics: According to RENTCafe, 51% of the households in Boston are renter-occupied, which is a significant population. More than 95% of the apartments fall in the range of $2,000 or more, which shows how high are the rents in Boston. As a rental property investor, it should be on your list of due diligence. Do the math and find out the best neighborhood & property that suits your investment goals.

The average size for a Boston, MA apartment is 812 square feet with studio apartments being the smallest and most affordable. 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage.

As of March 2024, the median rent for all bedroom counts and property types in Boston, MA is $3,318. This is +70% higher than the national average. Rent prices for all bedroom counts and property types in Boston, MA have increased by 6% in the last month and have increased by 11% in the last year.

The monthly rent for an apartment in Boston, MA is $3,295. A 1-bedroom apartment in Boston, MA costs about $2,958 on average, while a 2-bedroom apartment is $3,609. Houses for rent in Boston, MA are more expensive, with an average monthly cost of $4,000.

Here are the ten neighborhoods in Boston having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Roxbury Northeast

- Washington Park

- Central Square

- Central Maverick Square Paris Street

- East Boston

- Harbor View Orient Heights East

- Jeffries Point

- Roxbury Northwest

- Harbor View Orient Heights West

- Roxbury East

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Boston.

References

Market Data, Reports & Forecasts

https://www.gbreb.com/

https://www.gbreb.com/GBAR/Housing-Market-Data/

https://www.zillow.com/boston-ma/home-values

https://www.realtor.com/realestateandhomes-search/Boston_MA/overview

https://boston.curbed.com/boston-market-reports

https://www.bostonmagazine.com/property/2018/01/24/boston-zillow-housing-crisis

Pre-COVID stats

https://www.bostonmagazine.com/property/2019/01/31/expensive-housing-market/

https://www.bostonmagazine.com/property/2020/03/16/boston-home-prices-doubled/

https://www.redfin.com/city/1826/MA/Boston/housing-market

Landlord friendly & Rental Statistics

https://www.avail.co/education/laws/massachusetts-landlord-tenant-law

https://www.rentcafe.com/blog/renting/states-best-worst-laws-renters

https://www.rentjungle.com/average-rent-in-boston-rent-trends/

https://www.rentcafe.com/average-rent-market-trends/us/ma/boston/

Reasons to Invest

https://nextcity.org/daily/entry/boston-mayor-waive-building-height-rule-park

https://www.fool.com/taxes/2017/10/09/7-states-with-the-highest-income-tax.aspx

https://www.bostonmagazine.com/property/2018/05/30/boston-renting-crisis

http://charlesgaterealty.com/2018/11/29/boston-strong-the-fast-growing-boston-housing-market

https://www.forbes.com/sites/ellenparis/2018/01/29/2018s-housing-market-looks-good-unless-youre-a-first-time-millennial-buyer/#78138a011885

Bureaucracy

https://boston.curbed.com/boston-development/2018/2/22/17037854/boston-building-height-limit

The Best Neighborhoods for Boston Real Estate Investment

https://www.bostonmagazine.com/property/2020/03/16/boston-home-prices-doubled/

https://boston.curbed.com/boston-development/2020/1/7/21051943/boston-neighborhoods-to-watch

https://www.boston.com/news/local-news-2/2020/07/09/boston-ranked-third-most-gentrified-city

https://www.bostonglobe.com/2020/07/27/business/plans-major-project-along-fort-point-channel-are-moving-ahead/