The housing market continues to be a tale of two cities, with expensive coastal areas experiencing a surge in home values, while more affordable markets see a more balanced approach. This trend is highlighted in the latest Zillow March 2024 Market Report, revealing a clear link between limited inventory and skyrocketing prices.

The report paints a picture of a market heavily influenced by location. Homebuyers in the priciest U.S. metropolitan areas, particularly those on the West Coast, are facing fierce competition and ever-increasing prices. San Jose, the leader of the pack, witnessed a staggering 3.3% monthly appreciation in home values. San Francisco, Seattle, San Diego, and Los Angeles followed closely behind, all boasting a monthly growth rate exceeding 2%.

What's driving this surge in these specific locations? The answer lies in a combination of factors. Firstly, these coastal metros are major tech hubs, where many homeowners benefit from historically low mortgage rates secured before recent interest rate hikes. Secondly, these areas have seen minimal inventory recovery since the pandemic began. Remember, these markets were already quite competitive pre-pandemic, leaving them with a lower baseline of available homes. With demand still outstripping supply, bidding wars are commonplace, further pushing prices upwards.

Meanwhile, a different story unfolds in Southern U.S. metros. Here, a more balanced market is emerging. Existing inventory levels have either grown or nearly recovered to pre-pandemic levels. This growth is partly fueled by a robust influx of new construction, providing much-needed options for move-up buyers. Cities like New Orleans, San Antonio, Tampa, Orlando, and Jacksonville exemplify this trend. These areas boast a significantly slower, yet still healthy, appreciation rate of just over 0.5% per month.

The impact of rising inventory is evident. It has eased the intense competition that plagued these markets earlier and brought price appreciation under control. In fact, New Orleans and San Antonio are the only two major markets where buyers currently have more choices than they did pre-pandemic. Florida metros, while not experiencing a buyer's market, haven't seen significant inventory decline either.

This trend of a divided market extends nationwide. In areas with recovering inventory levels, buyers are gaining some leverage in negotiations. Nationally, the average home sold in March spent only 13 days on the market, significantly faster than the pre-pandemic norm of 21 days. However, this doesn't paint the whole picture. Well-priced and attractive listings in competitive markets can still fly off the shelves within days, especially as buying activity intensifies in the spring and summer months.

On the flip side, the report also reveals listings languishing on the market. The median age of all listings on Zillow currently sits at 43 days. This indicates that some sellers, particularly those in more affordable markets, might be struggling to attract buyers.

Nationally, Home Values Reach New Heights

The median home value in the U.S. has reached a staggering $355,696, reflecting a significant 42.4% increase compared to pre-pandemic levels. This translates to a hefty monthly mortgage payment of $1,851, assuming a 20% down payment. This figure represents a staggering 108% increase since before the pandemic, more than doubling the financial burden for homebuyers.

Market Divergence: Expensive vs. Affordable Areas

The data reveals a clear distinction between expensive coastal metros and more affordable areas in the South. On the one hand, expensive West Coast metros like San Jose, San Francisco, Seattle, San Diego, and Los Angeles continue to witness explosive growth. Monthly appreciation rates in these areas exceeded 2%, with San Jose leading the pack at a staggering 3.3%. This surge is attributed to a combination of factors, including:

- High Demand, Low Inventory: These tech hubs have perennially strong housing demand. However, the pandemic exacerbated the issue by further limiting available inventory. With more buyers vying for a limited number of homes, bidding wars and skyrocketing prices became commonplace.

- Locked-in Mortgage Rates: Many homeowners in these areas secured historically low mortgage rates before recent interest rate hikes. This financial advantage allows them to compete more aggressively in bidding wars.

In contrast, Southern metros are experiencing a more balanced market. Here, a combination of factors is tempering the appreciation rate:

- Inventory Recovery: Existing inventory levels in Southern metros have grown or nearly recovered to pre-pandemic levels. Additionally, a robust influx of new construction has provided more options for move-up buyers, alleviating some of the pressure on existing homes.

- Price Sensitivity: As affordability concerns mount, buyers in these areas are becoming more price-sensitive. This is leading to a more balanced market where negotiations are more commonplace.

New Listings Show Tentative Recovery, But Fall Short

New listings increased in March by 15.5% compared to February, suggesting a potential uptick in seller activity. However, this is tempered by the fact that new listings are still 25.4% lower than pre-pandemic levels. Much of the progress made in February to close the inventory gap seems to have stalled.

There are regional variations in seller activity. Markets like San Jose, Dallas-Fort Worth, and Tampa are witnessing a significant increase in new listings compared to last year. This could be due to a combination of factors, including:

- Seasonal Trend: Spring is typically a busy season for real estate, and this uptick could be a reflection of that seasonal pattern.

- Market Equilibrium: In some areas, particularly those with a more balanced market, sellers may be feeling more confident about listing their homes as competition eases slightly.

Conversely, some major metros like Boston, Pittsburgh, and Washington D.C. haven't seen a significant increase in new listings compared to last year. This could be due to:

- Affordability Concerns: Rising mortgage rates and home values may be discouraging some potential sellers who are concerned about affordability for buyers.

- Inventory Adequacy: In some markets, existing inventory levels may be sufficient to meet current demand, leading some sellers to hold off.

Total Inventory Shows Improvement, But Gap Remains

Total inventory, which refers to the number of active listings at any given time, also saw an increase in March. It rose by 7% compared to February and 12.2% compared to last year. However, despite this growth, total inventory remains a significant 36.4% lower than pre-pandemic levels.

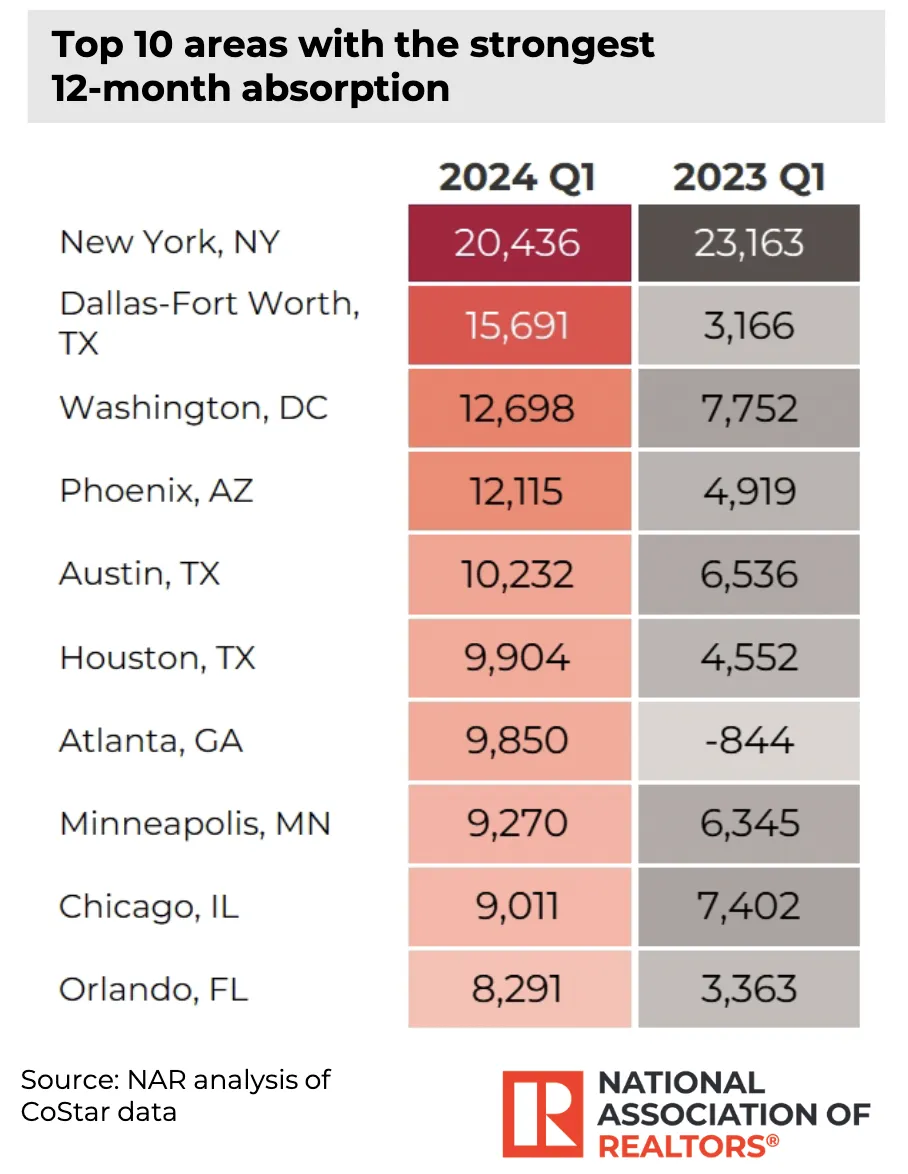

The data reveals a mixed picture across different regions. Markets like Tampa, Dallas, and Orlando have seen the most significant year-over-year growth in total inventory. This could be attributed to factors such as:

- New Construction: A robust new construction industry in these areas may be helping to replenish inventory levels.

- Relocation: In-migration to these areas could be driving up the number of homes available for sale.

On the other hand, some major metros like New York City, Las Vegas, and Buffalo have seen a decline in total inventory compared to last year. This could be due to:

- Strong Demand: In these markets, high buyer demand may be quickly absorbing available listings, leading to lower overall inventory levels.

- Relocation Trends: Out-migration from these areas could be reducing the number of homes available for sale.

Competition Heats Up, But Not For All Listings

The data paints a picture of a two-tiered competition landscape. Well-priced and attractive listings are flying off the shelves, with homes typically selling in just 13 days in March. This is faster than pre-pandemic norms but slightly slower compared to the peak frenzy of 2021 and 2022. This trend is likely to continue in April and May as buyer activity intensifies during the spring selling season.

However, the story is different for listings that are overpriced or lack proper marketing. The median age of all listings on Zillow sits at 43 days, indicating that these homes are languishing on the market. This highlights the importance of sellers strategically pricing and effectively showcasing their properties to attract buyers in a competitive environment.

Price Cuts on the Rise, But Some Areas Still See Bidding Wars

Sellers are increasingly resorting to price cuts, with over 20% of listings experiencing reductions in March. This represents the highest rate for this time of year since 2018 and reflects a shift from the extreme seller's market conditions of the past few years. Price cuts are most prevalent in Phoenix, Jacksonville, San Antonio, Orlando, and Nashville, suggesting a cooling market in some areas.

On the flip side, bidding wars are still a reality in expensive coastal markets like San Jose and San Francisco. Here, a staggering 69.4% and 62.7% of homes, respectively, sold above their asking price in February. This trend extends to other major metros like Hartford, Boston, and Los Angeles, where a significant portion of homes continues to attract offers exceeding the list price.

Newly Pending Sales Show Mixed Signals

Newly pending listings, which represent homes under contract, increased by 17.7% in March compared to February. However, compared to last year, there's only a marginal increase of 0.1%. This suggests a potential slowdown in buyer activity, although seasonal trends could be at play.

Rental Market Continues to See Steady Growth

The rental market shows continued signs of growth, with asking rents rising by 0.6% month-over-month in March. This is slightly above the pre-pandemic average for this time of year. Rents are also up 3.6% compared to last year. While most major metros are experiencing rent increases, some areas like Pittsburgh, Cleveland, Salt Lake City, Charlotte, and Milwaukee are seeing slower growth. On the other hand, cities like Providence, Louisville, Cleveland, Hartford, and Boston are witnessing the most significant annual rent increases.