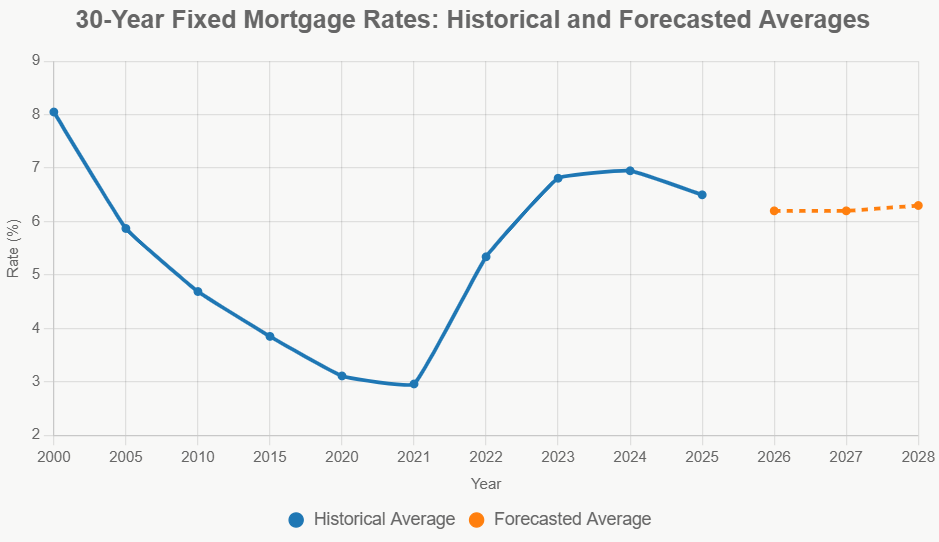

If so, you're probably wondering what's going to happen with mortgage rates. It's the million-dollar question, right? Well, I've been looking closely at the latest forecasts, especially the 30‑year mortgage rate predictions for 2026 by Zillow, Redfin, and Realtor.com. And here's the headline takeaway I'm getting: most experts think the average 30-year fixed mortgage rate will likely settle around 6.3% in 2026. It’s not a huge drop, but it might be just enough to make things a bit easier for buyers.

As we wrap up 2025, the housing market feels like it's finally catching its breath after a few wild years. Remember when rates shot up past 7%? Ouch. Thankfully, the Federal Reserve's moves this year have brought rates down into the mid-6% range. But that dream of getting back to those super-low rates we saw a few years ago? That still seems unlikely for now.

This 6.3% prediction from Zillow, Redfin, and Realtor.com suggests a gradual cooling off, more of a steady adjustment than a sudden boom or bust. I'll be sharing my own thoughts and insights based on what I'm seeing in the market data and hearing from these major real estate players.

30-Year Mortgage Rate Predictions 2026 by Zillow, Redfin, Realtor.com

What the Experts Are Saying About 2026 Mortgage Rates

It’s interesting how closely Zillow, Redfin, and Realtor.com seem to agree on the main point: rates are expected to ease slightly, but probably not dramatically drop below 6% for any extended period in 2026. Think of it as a gentle nudge towards better affordability rather than a wide-open door.

Here’s a quick look at their general outlook:

| Platform | Projected 2026 Average Rate | Key Rate Range/Scenarios | Impact on Payments (Estimated) |

|---|---|---|---|

| Zillow | Around 6.3% (unlikely below 6%) | Lingers in the low- to mid-6% range | Modest improvement |

| Redfin | 6.3% | Mostly low-6% range, brief dips <6% | Slight affordability boost |

| Realtor.com | 6.3% | Stays in the low-6% range | ~1.3% payment reduction |

What strikes me is this consistent forecast. It tells me that the underlying economic forces are pointing in a similar direction for all these groups. They're all looking at factors like inflation, the Federal Reserve's actions, and the overall health of the economy.

Zillow's team, who pay close attention to things like rent prices (a big part of inflation), are really emphasizing that inflation isn't going away completely. This is a major reason they don't see rates diving below 6%. They believe the bond market, which heavily influences mortgage rates, will keep rates somewhat anchored above that psychological threshold.

Redfin talks about a “Great Housing Reset,” and their prediction fits right into that. They see rates averaging 6.3%, maybe dipping slightly below 6% here and there, but not staying there. It suggests a market finding a more stable footing.

Realtor.com's forecast is right on the money at 6.3% too. They highlight that this could mean a noticeable drop in monthly payments—around 1.3% less for the typical homebuyer compared to 2025. That might not sound huge, but trust me, when you're talking about mortgage payments, every little bit helps!

Why Are Rates Predicted to Be Around 6.3%?

It's easy to just throw out a number, but why do these experts think this? Several big economic factors are at play. Based on my reading and experience, here are the main ones shaping the 2026 mortgage rate predictions:

- The Federal Reserve's Balancing Act: The Fed has been raising interest rates to fight inflation. Now, they've started cutting them, which helps lower mortgage rates. But they're being cautious. They've signaled they'll likely cut rates more in 2025, maybe 50 to 75 basis points total. However, they don't want to cut too fast or too deep, especially if inflation starts ticking up again. By late 2025, they might reach a “neutral” rate – not actively trying to slow the economy down, but not stimulating it either. This neutrality means less downward pressure on mortgage rates.

- Inflation Still Lingers: Even with rate cuts, inflation hasn't completely vanished. Costs for things like rent and housing services are still a bit stubborn. Since mortgage rates are closely tied to the yields on government bonds (like the 10-year Treasury), and those yields are sensitive to inflation fears, rates are likely to stay higher than they were a few years ago. Think of it like this: if investors think inflation will eat away at their returns, they'll demand higher interest rates on bonds, and that pushes mortgage rates up.

- The Economy is Okay, But Not Amazing: We're seeing slowing economic growth and unemployment ticking up slightly (maybe around 4.5%). This is actually one reason the Fed can cut rates. But the job market is still pretty solid, with decent job creation each month. This resilience prevents a sharp economic downturn that might force rates much lower. It’s a Goldilocks scenario – not too hot, not too cold – which often leads to moderate rate environments.

- Worries About Debt and Global Stability: The U.S. has a lot of government debt, and that can sometimes put upward pressure on interest rates. Plus, global issues – like trade tensions or conflicts – can create uncertainty. When the world feels shaky, investors often move money to safer assets, which can affect bond yields and, consequently, mortgage rates. These factors act as a brake, preventing rates from falling too drastically.

- What's Happening in Housing Itself: Even though rates are higher, there still aren't enough homes for sale in many areas. This shortage keeps demand relatively strong, which can indirectly support mortgage rates by preventing a steep drop in home prices.

From my perspective, it’s this mix of factors – the Fed trying to be careful, inflation not totally gone, a steady economy, and some lingering global/debt concerns – that creates the consensus for rates hovering in that low-to-mid-6% range.

What Does This Mean for the Housing Market? A “Reset,” Not a “Boom”

So, what’s the practical impact of these 30‑year mortgage rate predictions? The word I keep hearing from these experts is “reset.” It suggests a market that's becoming more balanced, not one that's suddenly going to take off like a rocket.

Here’s what I expect we might see:

- More Homes Selling: With rates slightly lower, some buyers who were priced out or waiting on the sidelines might jump back in. Zillow predicts around 4.26 million existing-home sales, Redfin is looking at about 4.2 million, and Realtor.com forecasts 4.13 million. This is a modest increase, maybe 1-4% higher than in 2025. It’s driven by the fact that buyers could potentially save tens of thousands of dollars over the life of their loan compared to earlier peaks.

- Home Prices Stabilize: Forget huge price jumps. Experts are predicting price growth to slow down to about 1-2.2% nationally. Realtor.com sees prices going up maybe 2.2%, Redfin forecasts just 1%, and Zillow is around 1.2%. This is good news because it means incomes might start keeping pace with, or even slightly outpacing, home price increases for the first time in a while.

- Refinancing Picks Up: Many homeowners refinanced when rates were at historic lows a few years back. Now, with rates expected to be in the mid-6% range, some of those folks might find a reason to refinance again if rates dip into the high 5% or very low 6% range. Redfin, for instance, sees refinancing activity jumping significantly. This could help homeowners lower their monthly payments.

- A Better Balance for Buyers and Sellers: We might see a slight increase in the number of homes available for sale (maybe 15-20% more). This could ease the intense competition buyers have faced. However, I suspect a significant chunk of potential buyers, especially younger ones like millennials, might still struggle with affordability, even with slightly lower rates. Builders might continue offering incentives like mortgage rate buydowns to attract buyers.

I personally feel this gradual adjustment is healthier for the market long-term. It helps prevent another bubble and allows things to stabilize after the craziness of the pandemic and the subsequent rate hikes.

Not All Areas Are the Same: Regional Differences Matter

It’s crucial to remember that these national averages don't tell the whole story. My experience shows that real estate is always local.

- Midwest vs. Sun Belt: You might find better affordability and more stable rates in Midwestern cities, where home prices are generally lower. Places like Indianapolis could see rates around 6.2% with payments dropping. On the flip side, popular Sun Belt areas like Phoenix might continue to see rates slightly higher, maybe closer to 6.5%, and still experience some price growth.

- Value Opportunities: Zillow points out cities like Buffalo, NY, that might see home values increase despite higher rates, maybe by 3.5%. These are often places where prices haven’t skyrocketed as much. Conversely, areas like Austin, TX, might see prices soften slightly (-0.5%).

- Coastal Hubs: Expect sticker shock to remain a challenge in major coastal cities where demand is high and prices are already expensive. Even with a 6.3% rate, monthly payments could easily be $3,000 or more.

Conclusion: A Steady Path Forward

Looking at the 30‑year mortgage rate predictions for 2026, I feel cautiously optimistic. The consensus points towards a gradual cooling, settling around 6.3%. This isn't the super-low rate environment of the past, but it’s a step towards better balance and affordability after a period of intense fluctuation.

This forecast suggests a housing market focused on sustainable growth rather than speculative frenzy. While unexpected economic events can always shake things up, 2026 appears poised to be a year of steady progress for those looking to make a move in real estate. It’s a good time to be informed, do your homework, and make strategic decisions based on the best data available.

From Cash to Cash Flow: Build Hassle‑Free Passive Income

Invest once, collect monthly — a simple way to turn your capital into steady, hassle‑free passive income.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW Properties JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions for 2026: Insights from Leading Forecasters

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?