So, you're thinking about buying a house, or maybe you're just curious about what's going on in the real estate world? Well, it’s a complicated picture right now, and a big part of that has to do with inflation. The simple answer is that inflation generally pushes both home prices and mortgage rates higher, making it more expensive to buy a home. But the story is more nuanced than that, and I'm going to break it down for you, using my own experience and observations to really make sense of what's happening. Let's get into it.

Inflation's Impact on Home Prices & Mortgages: What to Expect in 2025

Current Economic Climate: What's Going on With Inflation?

It feels like we’ve been talking about inflation forever, right? Well, as of January 2025, the rate is sitting around 3.0% year-over-year. That’s better than the peak we saw back in 2022 when it was a painful 6.8%, but it’s still pretty noticeable in our day-to-day lives. You might have noticed that even though the inflation numbers have come down, the cost of things – groceries, gas, you name it – is still up from where it used to be.

The Federal Reserve has been working hard to bring inflation under control. They've been using their tools, like adjusting interest rates and buying bonds, to try and put the brakes on rising prices. This impacts the entire economy, and one of the biggest effects we’ve seen has been on the housing market.

Mortgage Rate Rollercoaster: High Rates Despite Lower Inflation

Here’s where it gets a little confusing. You'd think that with inflation cooling down, mortgage rates would be falling, right? Well, not quite. In late January 2025, the average 30-year fixed mortgage rate is hovering around 7.04%, down slightly from 7.11% just a few days prior. Now, that’s a significant jump from the rates we saw just a few years ago. We need to consider more than just inflation in understanding mortgage rate dynamics. For instance, investor sentiments, and federal policy changes all affect mortgage rates.

I remember when I bought my first home, and mortgage rates were quite low, around 3.5% or 4%. Looking at today's rates makes me realize how much more difficult it is for first-time homebuyers. It's tough out there. The relationship between inflation and mortgage rates is not as straightforward as one might think. In the table below, you'll see that while inflation came down significantly in 2023 and continues to do so, mortgage rates did not follow the same path.

| Period | Inflation Rate (%) | 30-Year Fixed Mortgage Rate (%) |

|---|---|---|

| 2022 | 6.3 | 5.8 |

| 2023 | 4.9 | 6.5 |

| January 2025 | 3.0 | 7.04 |

Understanding the Dance Between Inflation and Mortgage Rates

So, why aren't mortgage rates coming down as much as inflation is? Well, it's a bit like a dance. Here’s how it works:

- Federal Reserve Moves: The Federal Reserve, as I mentioned, plays a big role. When they raise interest rates to fight inflation, it ripples through the economy, including the mortgage market.

- Investor Confidence: Investors who buy mortgage-backed securities are always watching economic indicators. If they think the economy is going to be volatile, or that inflation might spike again, they tend to demand higher returns, which pushes up mortgage rates.

- Overall Economic Health: Things like job growth, consumer confidence, and even global events can impact investor sentiment. These factors affect the mortgage-backed securities market, which ultimately influences mortgage rates. It is a complex equation with a lot of variables.

Inflation's Impact on Home Prices: Supply and Demand

Now, let's talk about home prices. Inflation has a direct impact here as well. When the cost of construction, labor, and materials go up due to inflation, it translates to higher prices for new homes. This additional cost is often passed on to buyers, which pushes up overall home prices. Here’s what’s happening:

- Price Growth Continues: Even with inflation cooling, home prices have continued to climb in many areas. As of January 2025, home prices are about 5.3% higher than the previous year. That's a solid increase, despite the high mortgage rates. This signals that buyer demand is still robust.

- Low Inventory Woes: The housing supply has remained low for a while now. When there aren't enough homes on the market, this increases competition among buyers and drives prices up. I have personally seen this in my own neighborhood, where it seems every house that goes on the market gets snapped up almost immediately.

Regional Differences: A Market of Many Stories

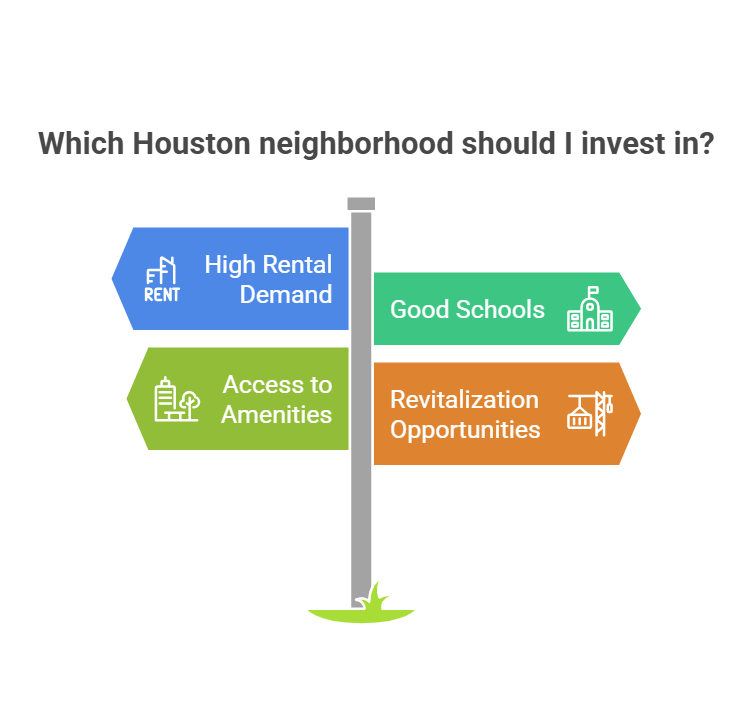

It’s also important to remember that the housing market isn’t the same everywhere. Different areas respond differently to inflation and economic changes:

- West Coast Hot Spots: Places like California have seen really steep increases in home prices over the past few years. However, there are signs that prices in some areas may start to correct if rates remain high. It is hard to buy in these markets now.

- Southern States Boom: On the other hand, states like Florida and Texas are experiencing steady growth, mostly due to growing populations and booming job markets. My friends in Texas have seen their home values increase dramatically in just a couple of years.

It's always a good idea to look at your specific area to really understand what's going on in your local market. It’s not just a national trend.

Buyer Behavior: Are People Hesitating to Buy?

All these factors have led to some shifts in buyer behavior.

- Buyer Caution: Many people are holding off on buying homes because of high mortgage rates. They’re afraid that rates will stay high, making homes unaffordable. It can be scary to make such a large purchase when you don't know what tomorrow will bring.

- Rentals on the Rise: With homeownership becoming harder, demand for rental properties has gone up. This, in turn, pushes rental prices higher and further strains household budgets. It’s a vicious cycle.

Looking Ahead: What Can We Expect in 2025?

So, what might we expect as we move further into 2025? Here's what I’m watching:

- Price Stabilization: If mortgage rates stop climbing, we might see home prices in some markets start to level off or even drop slightly. This could create more opportunities for buyers who have been waiting on the sidelines. I am personally hoping for some stability in the market.

- Rental Market Pressures: The current situation is going to continue to fuel demand for rentals. This means that rent prices are likely to keep rising, making it harder for people to save for a down payment. We may even see an increased demand for multi-family housing solutions.

- Economic Shift Impact: If inflation continues to slow down, the Federal Reserve might change its policies and reduce long-term interest rates. This could have a positive effect on mortgage rates and give the housing market a much-needed boost. This is an area I’m watching closely.

Wrapping it Up: Staying Informed is Key

The relationship between inflation, home prices, and mortgage rates is complicated, but understanding it is crucial for anyone buying, selling, or investing in real estate. In my experience, keeping up with these economic factors helps you make smarter choices.

Whether you’re a first-time homebuyer, a current homeowner, or an investor, knowledge is your best tool. It’s a good time to be cautious and informed. I am personally making sure to not jump into any rash decisions regarding my personal investments, and instead am relying on data and my own intuition.

Remember, the housing market is dynamic. Stay informed, adapt your plans, and take advantage of any opportunities that come your way.

Invest Smarter with Norada in 2025

As inflation affects home prices and mortgages, secure consistent returns with turnkey real estate investments.

Protect your portfolio against inflation by diversifying into high-quality, ready-to-rent properties.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Read More:

- Are We in a Recession or Inflation in 2025?

- Fed Will Not Cut Interest Rates Despite Cooling Inflation Data

- Fed Interest Rate Cut Hope Rises as Inflation Shows Tentative Signs of Cooling

- Housing Market Predictions for Next 5 Years (2025-2029)

- Housing Market Predictions for the Next 2 Years

- Real Estate Forecast Next 5 Years: Top 5 Future Predictions

- Housing Market Predictions for 2027: Experts Differ on Forecast