When it comes to the Federal Reserve's upcoming decision on interest rates, it's more like looking at a crowd of people all pointing in the same direction. Today, October 29, 2025, the Federal Open Market Committee (FOMC) concludes its meeting, and the overwhelming consensus is that it will indeed lower the federal funds rate by a quarter point (25 basis points).

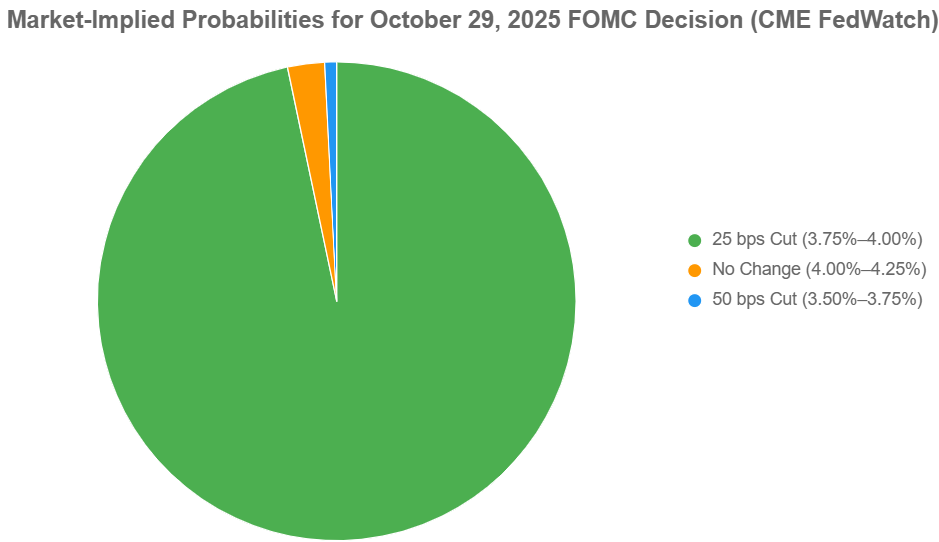

Markets are pricing in over a 95% chance of this move, which would nudge the key interest rate down to a range of 3.75%–4.00%. This would follow a similar cut in September and signals a cautious optimism from the Fed that inflation is cooling without completely stomping out economic growth.

Fed Interest Rate Decision Today: Markets Prepare for Quarter-Point Rate Cut

Now, I'm not one to just parrot what the talking heads on TV say. I've spent a good amount of time digging into the numbers, listening to the whispers from economists, and thinking about what this all means for us everyday folks. The Fed has two big jobs: keeping prices stable (that's controlling inflation) and making sure as many people as possible have jobs. These two goals can sometimes pull in opposite directions, and this meeting is a prime example of that tug-of-war.

Understanding the Fed's Big Decision-Making Day

So, what exactly happens today? The FOMC, a group of 12 smart people who seriously know their economics, is meeting for two days. Their main tool is the “federal funds rate.” This is like the highway toll for banks lending money to each other overnight. When the Fed tinkers with this rate, it sends ripples throughout the entire economy, affecting everything from your mortgage to your credit card bill.

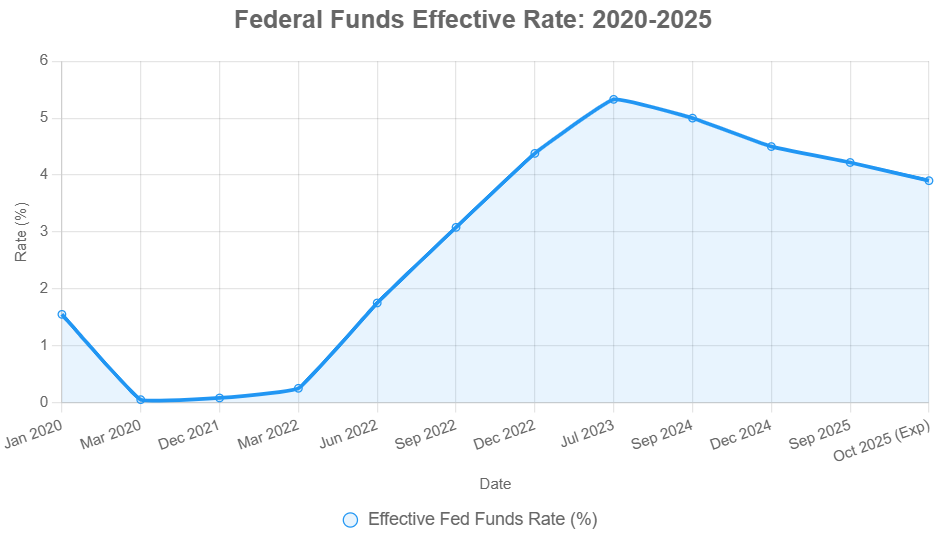

Right now, that target rate is between 4.00% and 4.25%. If they do the expected quarter-point cut, it’ll drop to 3.75%–4.00%. This would be the second time they've eased up on rates in just a couple of months, following a period of aggressive hikes that pushed rates all the way up to 5.25%–5.50% to fight off the inflation that flared up after the pandemic.

Crucially, at 2 p.m. Eastern Time, we'll get the official announcement. Then, at 2:30 p.m., Chair Jerome Powell will hold a press conference. This is where he'll give us his take on the economy and what the Fed might do next. He'll likely share their updated economic forecasts, sometimes called the “dot plot,” which gives us a peek at where they see rates heading in the future.

What's Driving the Chop? The Economic Signals

Why is everyone so sure about a rate cut? Well, the latest economic numbers give us a pretty strong hint.

- Inflation is Cooling: The pace at which prices are rising has slowed down. In September, the Consumer Price Index (CPI), a big measure of inflation, came in at 3% year-over-year. While that's still higher than the Fed's target of 2%, it's a welcome sign of cooling, especially compared to earlier in the year. The Fed wants to see those price increases come down.

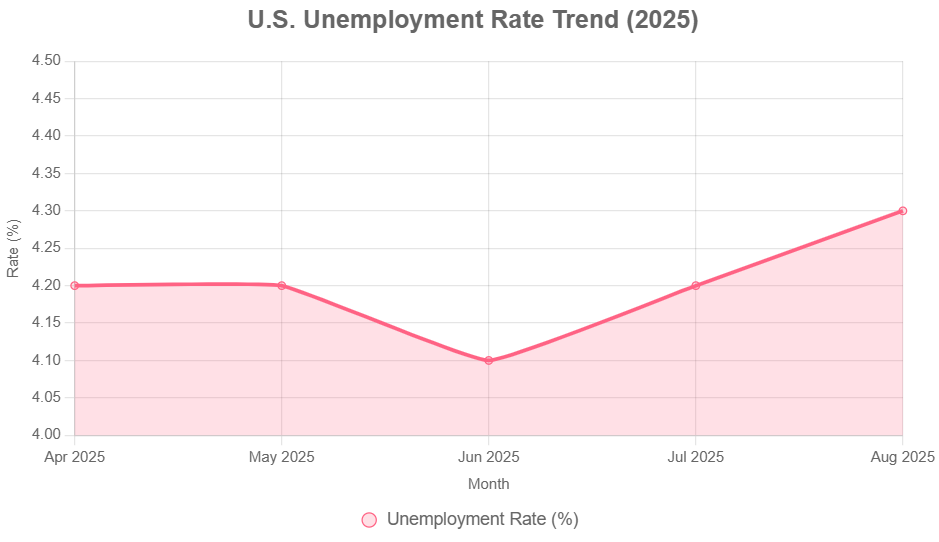

- The Job Market is Softening: This is a bit trickier. On the one hand, job growth has slowed. In August, employers added only 22,000 jobs, which is much lower than in previous months. The unemployment rate also nudged up to 4.3%. This softening in the labor market is exactly the kind of thing the Fed looks for when it considers cutting rates. They want to avoid the economy overheating, but they also don't want to see too many people lose their jobs. It’s a delicate balance.

- Manufacturing Woes: We've also seen manufacturing contract for seven straight months. Tariffs and trade disputes are definitely playing a role here, creating uncertainty and making it harder for businesses in that sector.

The CME FedWatch Tool, which tracks what traders are betting on in the futures markets, is all but screaming a 25 basis point cut. As of yesterday, the odds were at 96.7% for this specific move. It's pretty rare to see such widespread agreement.

Here's a breakdown of what the market is heavily leaning towards:

| Decision | Target Fed Funds Rate Range | Probability (as of Oct 28, 2025) |

|---|---|---|

| 25 bps Cut | 3.75%–4.00% | ~96.7% |

| No Change | 4.00%–4.25% | ~2.5% |

| 50 bps Cut (More Aggressive) | 3.50%–3.75% | ~0.8% |

Here's a graph showing how fed funds rate has evolved:

This historical context is crucial. It shows that the Fed’s actions are part of a process, and the October meeting is another step in that ongoing journey.

What This Means for Your Wallet

Okay, let's get down to what this actual rate cut might mean for you and me.

- Borrowing Gets Cheaper: This is the big one. When the Fed cuts rates, banks often follow suit. This means you might see lower interest rates on things like:

- Mortgages: If you're looking to buy a house or refinance, your mortgage rate could tick down. Just last month, 30-year fixed mortgages were around 6.27%. A Fed cut could push that even lower.

- Car Loans: The interest you pay on a new or used car could decrease.

- Credit Cards: While credit card rates are typically higher and stickier, you could see some relief over time.

- Saving Might Fetch Less: The flip side for savers is that the interest rates on your savings accounts, certificates of deposit (CDs), and money market accounts might also dip. Those high-yield savings accounts that have been paying out nicely might start to offer a bit less.

- The Stock Market Could Get a Boost: Cheaper borrowing costs can make it more attractive for companies to invest and expand. This often leads to a more optimistic stock market. We've already seen the S&P 500 rally this year on the hope of rate cuts.

However, there's a catch. Sometimes, even if the Fed cuts rates, other factors can keep borrowing costs elevated. For example, if the government keeps borrowing a lot of money (which increases the supply of Treasury bonds), those yields might stay high, keeping pressure on other interest rates.

The Skeptics: Is a Cut Really the Right Move?

Now, not everyone agrees that cutting rates is the absolute best move right now. This is where the “hawks” on the Fed (who tend to worry more about inflation) and the “doves” (who tend to prioritize employment and growth) have their debates.

- Inflation Worries: A minority of economists and even some Fed voters are concerned that cutting rates too soon could reignite inflation. They point out that inflation is still above that 2% target. If tariffs or government spending increase unexpectedly, prices could start ticking up again faster than the Fed expects. They don't want to end up having to hike rates all over again, which is a painful process known as a “policy mistake.”

- Data Gaps: We're also dealing with some uncertainty because of the ongoing government shutdown. This can create gaps in important economic data, making it harder for the Fed to get a crystal-clear picture of what's really going on. It's like trying to drive with a foggy windshield – you might be able to see a bit, but your vision is limited.

There are some who argue that the recent progress on inflation is more due to less government spending than anything the Fed has done. They believe the Fed should be cautious.

My Take: A Calculated Step, But Watch Closely

From where I stand, the evidence strongly points towards a quarter-point cut. The Fed's dual mandate gives them reason to ease when inflation is coming down and the labor market shows signs of weakness. The strong market pricing also suggests this is the most anticipated outcome by a mile.

However, I also appreciate the concerns of the hawks. The last few years have been anything but typical. We've had a pandemic, massive government stimulus, and supply chain disruptions, followed by a surprising surge in inflation and now signs of it cooling down while the job market softens. This isn't your grandpa's economic cycle.

I believe the Fed is trying to navigate a “soft landing” – bringing inflation down without causing a recession. A small rate cut is often seen as a way to give the economy a gentle nudge, supporting employment without going overboard and sparking renewed inflation. They’ve signaled this is a data-dependent process, and the data they've seen lately, even with the few bumps, leans towards easing.

The key, as always, will be watching what Chair Powell says today. Does he sound more confident about the inflation fight? Or does he express more concern about jobs? And what will their future projections – that “dot plot” – tell us about their plans for the rest of the year and into next?

It’s a fascinating time to be watching the economy. The Fed's decision today is a crucial step, but it's just one piece of a very complex puzzle.

“Build Wealth Through Turnkey Real Estate”

The Federal Reserve’s decisions on interest rates impact everything—from your mortgage payments to your savings yields. Market analysts now anticipate additional rate cuts over the coming months—potentially lowering the rate to around 3.50%–3.75% by the end of 2025.

This shift could open new opportunities for homebuyers and real estate investors looking to secure better financing terms.

🔥 Lower Rates Mean Smarter Investment Opportunities! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Next Federal Reserve Meeting Just 4 Days Away: What to Expect?

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Federal Reserve Cuts Interest Rate by 0.25%: Two More Cuts Expected in 2025

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet