Nestled amidst the turquoise waters and volcanic peaks of Oahu, Honolulu pulsates with a dynamic energy that permeates every aspect of life on the island, including its housing market. This vibrant city offers a unique blend of tropical charm, cultural tapestry, and a booming economy, making it a coveted destination for both residents and investors alike.

Amidst the lush landscapes and azure waters, determining whether Honolulu's market favors buyers or sellers requires a nuanced approach. While the market isn't as fiercely competitive as some urban hubs, it's not a buyer's paradise either. With homes selling close to list price and a modest percentage sold above it, both buyers and sellers find themselves in a balanced environment. However, for those seeking tranquility amidst the Pacific breeze, Honolulu offers more than just a transaction—it's a lifestyle investment.

Current Honolulu Housing Market Trends

How is the Housing Market Doing Currently?

As of February 2024, Honolulu's housing market reflects a steady upward trajectory. According to Redfin, home prices have surged by 4.1% compared to the previous year, with a median price settling at $510,000. While the national average might falter, Honolulu stands tall, boasting a median sale price 24% higher than the national average.

On average, homes linger on the market for 86 days, a slight increase from 74 days recorded last year. Despite this, the market remains relatively swift, with hot homes commanding attention and selling for around list price within a mere 47 days.

How Competitive is the Honolulu Housing Market?

Contrary to bustling metropolises, Honolulu's market exudes a sense of calmness. Multiple offers are a rarity, and homes typically sell with minimal competition. The statistics echo this sentiment, with only 18.9% of homes selling above list price, marking a modest increase from the previous year.

While the market isn't characterized by cutthroat competition, it does maintain a level of stability. Homes sell at 97.9% of the list price, indicating a balanced negotiation landscape where buyers and sellers find common ground.

Are There Enough Homes for Sale to Meet Buyer Demand?

One of the pivotal questions in any real estate market pertains to inventory. In Honolulu, the supply-demand equilibrium seems to be maintained adequately. With 244 homes sold in February alone, there's a healthy flow of properties changing hands.

However, the market isn't without its challenges. 14.7% of homes experience price drops, reflecting a segment where adjustments are deemed necessary to align with buyer expectations.

The Future Outlook for Honolulu

While the numbers paint a clear picture of Honolulu's housing market, it's crucial to consider the intangible factors that contribute to its unique character. Honolulu's residents are drawn to the city's natural beauty, from its pristine beaches and lush rainforests to the breathtaking vistas of Diamond Head Crater. The city's vibrant cultural scene, with its blend of Polynesian, Asian, and American influences, adds another layer of richness to the tapestry of life in Honolulu.

The Honolulu housing market is not without its challenges. The high cost of living, coupled with limited job opportunities in certain sectors, can make homeownership difficult for some residents. Additionally, the issue of vacation rentals and their impact on housing availability is a topic of ongoing debate.

Despite these challenges, Honolulu's housing market remains a beacon for those seeking a slice of island paradise. With its stunning natural beauty, rich cultural heritage, and promising economic prospects, Honolulu's housing market is poised for continued growth and evolution. Whether you're a seasoned investor or a first-time homebuyer, Honolulu offers a unique opportunity to own a piece of paradise, a place where the rhythm of life beats to the gentle sway of palm trees and the endless allure of the Pacific Ocean.

Honolulu Housing Market Forecast for 2024 & 2025

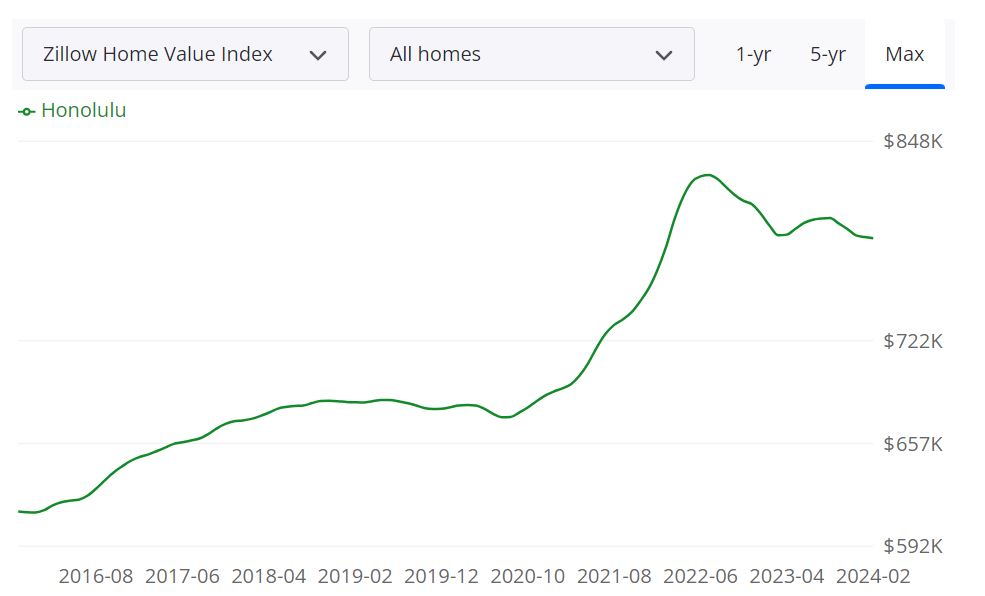

According to Zillow, the average home value in Honolulu stands at $787,369, depicting a 1.0% decrease over the past year. This figure offers a glimpse into the current state of the market, providing valuable insights for prospective buyers, sellers, and investors alike.

Delving deeper into the nuances of the market, it's essential to dissect various housing metrics to gain a comprehensive understanding. With 1,676 homes currently available for sale as of February 29, 2024, and 369 new listings added within the same timeframe, Honolulu presents a diverse array of options for potential buyers.

The median sale price stands at $615,833, while the median list price is $676,667, indicating a notable differential in pricing strategies. Moreover, with 14.6% of sales occurring over the list price and 65.4% under the list price, there exists a dynamic interplay between buyer demand and seller expectations in the Honolulu market.

Honolulu MSA Housing Market Forecast

Zooming out to consider the broader Honolulu Metropolitan Statistical Area (MSA) housing market forecast, Zillow's projections offer valuable insights into future trends and trajectories. Specifically, focusing on Urban Honolulu, HI, as a pivotal region within the MSA, Zillow forecasts a marginal 0.1% increase in housing prices by March 31, 2024, followed by a 0.2% uptick by May 31, 2024. However, a slight -2% decline is anticipated by February 28, 2025, indicative of potential fluctuations in the market landscape.

The Honolulu Metropolitan Statistical Area (MSA) encompasses Honolulu County in the state of Hawaii, serving as a vital economic and cultural hub within the region. Comprising various municipalities, including the bustling city of Honolulu, this MSA boasts a diverse housing market catering to a wide array of residents and investors. With its strategic location and vibrant lifestyle offerings, the Honolulu MSA attracts attention not only from local residents but also from individuals seeking to invest in the thriving real estate landscape.

Is Honolulu a Buyer's or Seller's Housing Market?

Assessing whether the current Honolulu housing market favors buyers or sellers requires a nuanced analysis of various factors. With a 1.0% decrease in the average home value over the past year, coupled with a median sale price of $615,833 and a median list price of $676,667, it's evident that buyers may find opportunities in the market.

Additionally, the percentage of sales occurring under the list price further indicates potential negotiation leverage for buyers. However, with 14.6% of sales happening over the list price, sellers also wield influence in certain segments of the market. Therefore, while the market may lean slightly towards buyers, it remains dynamic and warrants careful consideration based on individual circumstances.

Are Home Prices Dropping in Honolulu?

The 1.0% decrease in the average home value in Honolulu over the past year suggests a slight downward trend in prices. However, it's essential to contextualize this decline within the broader market dynamics and fluctuations. Factors such as inventory levels, economic conditions, and buyer demand can influence price movements in the housing market. While the decrease may signal opportunities for buyers, it's crucial to monitor market trends closely and consider long-term implications before drawing definitive conclusions about the trajectory of home prices.

Will the Honolulu Housing Market Crash?

The notion of a housing market crash evokes concern and speculation among homeowners, buyers, and investors alike. While past trends and historical data provide insights into potential risks, predicting a market crash with certainty is inherently challenging. In the case of Honolulu, while there may be fluctuations and adjustments in prices, the market's resilience and underlying demand for housing suggest a degree of stability.

However, external factors such as economic downturns or unforeseen events can impact market dynamics unpredictably. Therefore, while vigilance and prudent decision-making are advisable, labeling the current Honolulu housing market as destined for a crash would be premature and speculative.

Is Now a Good Time to Buy a House in Honolulu?

For individuals contemplating entering the Honolulu housing market, the question of timing is pivotal. With a slight decrease in home values and a market that appears to offer opportunities for both buyers and sellers, assessing whether now is a good time to buy a house necessitates careful consideration of personal circumstances and financial readiness.

Factors such as long-term goals, affordability, and market conditions should guide this decision. While the current market landscape may present favorable conditions for certain buyers, it's essential to conduct thorough research, consult with real estate professionals, and weigh the pros and cons before making a significant investment in a home.

Should You Invest In Honolulu Real Estate Market?

Investing in real estate is a significant financial decision that requires careful consideration of various factors. Honolulu, Hawaii, with its stunning natural beauty and unique culture, may seem like an attractive location for real estate investment. However, before making such a decision, it's crucial to examine the potential benefits and drawbacks. In this section, we'll delve into the top reasons to invest in Honolulu real estate, as well as some potential drawbacks to be aware of.

Top Reasons to Invest

1. Strong Demand: Honolulu is a popular tourist destination and a major economic hub in the Pacific. The city's robust economy, coupled with its unique charm, attracts a consistent stream of visitors, professionals, and retirees looking for housing options. This strong demand for rental properties and homes can provide a steady income stream for investors.

2. Limited Supply: Honolulu's geography limits the availability of land for new developments. This scarcity of land contributes to limited housing supply, which can drive up property values over time. Investing in a market with constrained supply can potentially lead to appreciation in property values.

3. Tourism Industry: Honolulu's thriving tourism industry can provide lucrative opportunities for short-term rentals, such as vacation homes and Airbnb properties. The demand for accommodations from tourists can lead to higher rental income during peak seasons.

4. Potential for Appreciation: While past performance is not a guarantee of future results, Honolulu has historically shown appreciation in property values over the long term. Investing in a market with a track record of appreciation can offer potential capital gains.

5. Diversification: Investing in Honolulu real estate can serve as a diversification strategy for your investment portfolio. Real estate often behaves differently from other asset classes, such as stocks and bonds, providing a level of portfolio diversification.

6. The Large Military Market: A Factor in Honolulu Real Estate Investment: The substantial military presence significantly shapes Honolulu's real estate landscape, presenting both opportunities and challenges for investors. With major military installations like Joint Base Pearl Harbor-Hickam and Marine Corps Base Hawaii, the city hosts a sizable military population comprising active-duty service members, civilian employees, and retirees.

This demographic contributes to a steady demand for rental properties, given the transient nature of military assignments, offering stability for investors through consistent rental income. Additionally, the potential for short-term rentals to accommodate transitions further enhances investment prospects.

However, increased competition, market volatility influenced by government decisions, higher tenant turnover rates, and regulatory considerations are challenges that investors must navigate in this unique market. Recognizing the impact of the military community is pivotal for those seeking success in Honolulu's real estate investment arena.

Potential Drawbacks

1. High Costs: The cost of real estate in Honolulu can be significantly higher compared to other markets. Property acquisition costs, ongoing maintenance expenses, and property taxes can strain an investor's budget.

2. Market Volatility: While Honolulu has shown appreciation in property values historically, real estate markets can be cyclical and subject to economic downturns. A sudden economic downturn can lead to a decrease in property values and rental demand.

3. Regulation and Zoning: Honolulu has strict regulations and zoning laws that can impact real estate investment. These regulations may affect property use, short-term rentals, and property modifications. Investors need to be well-versed in local regulations to avoid legal complications.

4. Property Management Challenges: Managing properties remotely or as an absentee owner can be challenging, especially if you are investing in short-term rentals. Finding reliable property management and maintenance services is essential.

5. Natural Disasters: Hawaii is prone to natural disasters such as hurricanes, earthquakes, and tsunamis. While Honolulu has measures in place to mitigate risks, these events can still impact property values and disrupt the rental market.

Conclusion

Investing in Honolulu real estate offers both promising opportunities and potential challenges. It's essential to thoroughly research the market, understand local regulations, and assess your risk tolerance before making an investment decision. While the strong demand, limited supply, and potential for appreciation are enticing, the high costs, market volatility, and regulatory complexities should also be considered.

As with any investment, careful planning, due diligence, and a long-term perspective are crucial to success in the Honolulu real estate market. Buying an investment property is different from buying an owner-occupied home. Whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success as a Real Estate Investor in Honolulu, HI is your ability to find great real estate investments in that area.

We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you may fill up the form given here.

Sources:

- https://www.zillow.com/Honolulu-hi/home-values

- https://www.redfin.com/city/34945/HI/Honolulu/housing-market

- https://www.realtor.com/realestateandhomes-search/Honolulu_HI/overview