The year is 2024. A sense of unease hangs in the air, a disharmony between the optimistic hum of real estate agents and the whispered anxieties of economists. The housing market, once a rocket ship fueled by cheap credit and pandemic-induced frenzy, now resembles a sputtering firework—beautiful but potentially dangerous.

We've all heard the whispers, the hushed conversations about bubbles and crashes. But is the US housing market truly teetering on the precipice of disaster, or are we simply experiencing a much-needed correction after years of unsustainable growth?

Housing Market: A House of Cards Built on Shifting Sands

The current state of the housing market is undeniably complex, shaped by a confluence of factors that defy simple analysis.

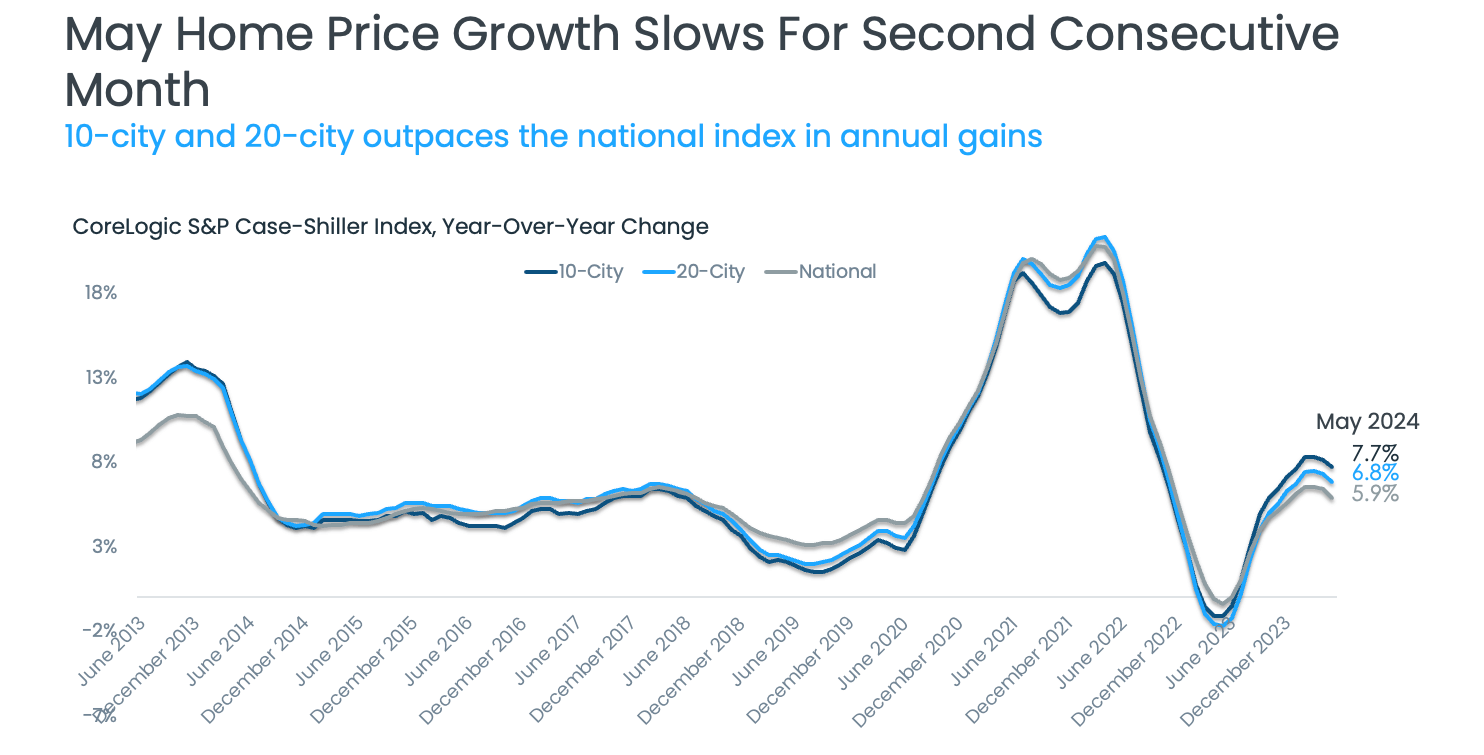

On the surface, the narrative appears relatively stable. The CoreLogic S&P Case-Shiller Index reported a 5.9% year-over-year gain in May 2024, showing an eleventh consecutive month of annual price growth despite cooling demand. This growth rate is down from a high of 6.5% in both February and March of the same year, indicating the market's transition from a frenetic pace to a more tempered rhythm.

Since the mid-20th century, housing prices in the U.S. have experienced substantial increases, with significant jumps occurring in the late 1970s and again in the early 2000s. For instance, from 1997 to 2006, the U.S. housing market saw a meteoric rise in home prices—nearly 124% according to the Case-Shiller index. This unprecedented appreciation led to the infamous housing bubble, which culminated in the crash of 2008. The historical context makes our current environment, with new highs being reached, all the more concerning.

As of May 2024, home prices hit new highs, rising 5% compared to the June 2022 peak. However, the overall market has begun to moderate. The slowdown reflects a market that is taking a breath after extended periods of unsustainable growth, a testament to the cyclical nature of housing trends.

The Specter of Affordability

One of the most pressing issues is the erosion of affordability. Years of stagnant wage growth coupled with skyrocketing home prices have pushed the dream of homeownership out of reach for many Americans. According to the National Association of Realtors, the median home price rose over 40% from 2019 to mid-2024, while wages barely kept pace with inflation.

The situation is particularly dire for first-time buyers, who find themselves priced out of the market and forced to grapple with exorbitant rents. In June, existing home sales activity, which was saddled with high April mortgage rates, slowed to the lowest pace since the Great Financial Crisis of 2008. This data exemplifies the challenges facing many households.

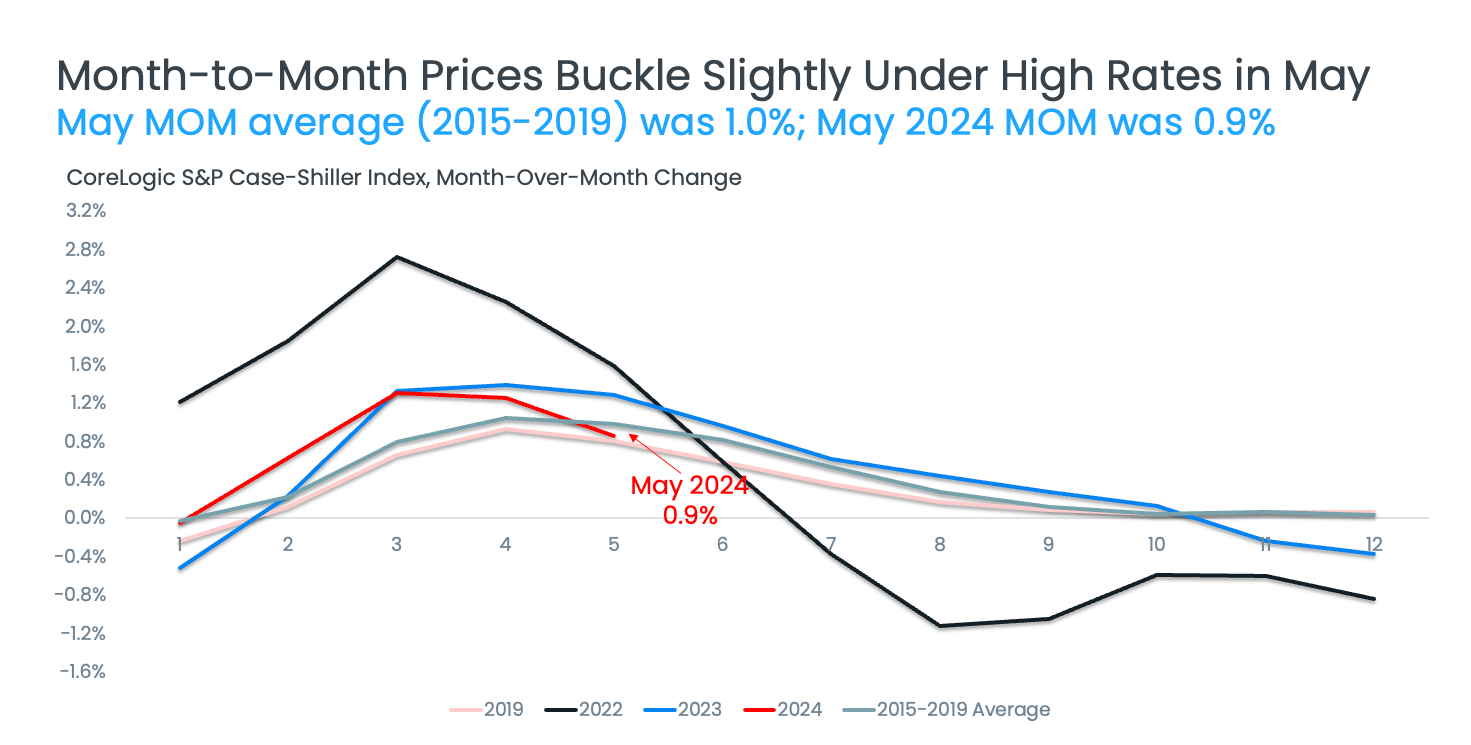

Adding fuel to the fire are soaring mortgage rates, which have pushed past 7%—a level not seen since 2001. The influence of these higher rates on buyer decisions was evident as we moved into the summer, with many opting to wait before committing. Historical data shows that during the early 1980s, mortgage rates peaked at around 18%, leading to a significant downturn in housing demand. While we are not at such extremes today, the psychological impact of climbing rates remains, stifling buyer enthusiasm.

Financialization: Turning Homes into High-Risk Assets

Yet, lurking beneath these immediate concerns is a more insidious threat: financialization. Over the past few decades, the housing market has transformed from a system designed to provide shelter into a playground for investors and a mechanism for wealth generation.

Wall Street, flush with cheap capital, has descended upon the housing market, scooping up properties and converting them into rental units or other financial instruments. This burgeoning trend of institutional investment was not a concern for many until the market dynamics began to change. The involvement of large hedge funds in the market has created an arms race of sorts, leading to inflated prices that further distance regular buyers from homeownership.

Taking a historical perspective, the post-2008 landscape saw new regulations and reforms, including the Dodd-Frank Act, which aimed to enhance the resilience of the housing market against speculative behaviors. However, the current environment raises questions about whether we've learned enough from history.

The echoes of the 2008 crisis still resonate, with concerns over the role of fraud and risky lending practices rising to the fore once more. Reports of occupancy fraud—where investors falsely claim to be owner-occupants to secure favorable loan terms—are deeply troubling. The adaptation of institutional investors to exploit loopholes and legal ambiguities poses significant risks.

A Bubble Ready to Burst?

So, are we on the verge of another catastrophic housing market crash? The answer, as with most things related to economics, is frustratingly nuanced.

A full-blown repeat of 2008 seems improbable due to stricter lending standards implemented after the crisis. However, the convergence of soaring prices, rising interest rates, rampant financialization, and whispers of fraud creates a volatile cocktail that could lead to a significant correction in the market. Historical data shows that following rapid price increases, markets have often faced corrections or downturns as buyers are exhausted by high costs.

For example, after the explosive growth in the housing market leading up to the 2008 crash, a subsequent decline saw home prices plummet by about 30% nationally. Such drastic swings in value leave lingering scars, and today's market dynamics could signify that we are careening towards a comparable moment of reckoning.

Forecasting the Future: A Fool's Errand?

Predicting the future of the housing market is akin to forecasting the weather—educated guesses are the best we can hope for. Some analysts, however, maintain a sense of optimism, pointing to strong labor market conditions and pent-up demand as potential reasons for a more stable recovery. This position echoes sentiments following past downturns when rebounds did occur with newfound vigor.

Others, however, are less sanguine. They warn that the underlying structural issues—such as the affordability crisis, rampant financialization, and potential for fraud—have not been adequately addressed. The recent slowdown in home price growth reflects a budding recognition among buyers that affordability constraints might lead to a painful unwinding of the market.

Navigating the Housing Market Labyrinth

In these uncertain times, prudence and a long-term perspective are paramount. Here are some key takeaways for those looking to navigate the housing market labyrinth:

- Buyers: Carefully assess your financial situation and avoid stretching your budget to the limit. Don't be swayed by FOMO (fear of missing out)—remember, a house is a home first, an investment second. The importance of thorough research and budget discipline cannot be overstated in these volatile times.

- Sellers: Temper your expectations. The days of bidding wars and instant offers may be waning. Be prepared to negotiate and potentially accept a lower price than anticipated, acknowledging the slowing momentum in the market.

- Investors: Exercise caution. While the allure of easy profits is tempting, the market is becoming increasingly risky. Conduct thorough due diligence and be prepared for a potential downturn, reflecting on lessons learned from previous market cycles.

- Policymakers: Urgent action is needed to address the affordability crisis and curb the excesses of financialization. Policies that promote sustainable homeownership, increase housing supply, and rein in predatory lending practices are crucial for ensuring a healthy and equitable housing market for all.

The Road Ahead: Uncertainty and Opportunity

While the possibility of a crash looms large, it's not a foregone conclusion. The choices we make today—whether as individuals, investors, or policymakers—will dictate the trajectory of the market for years to come.

Will we heed the warning signs and take proactive steps to create a more equitable and sustainable housing system? Or will we repeat the mistakes of the past, leading to another painful boom-and-bust cycle? The answers to these questions remain to be seen. One thing is certain: the future of the US housing market hangs in the balance.

The interplay between affordability, financialization, and regulatory measures will determine how resilient the housing market remains in face of economic headwinds. As we chart the course forward, understanding these dynamics becomes even more vital for navigating today's housing market.

ALSO READ:

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- Trump vs Harris: Which Candidate Holds the Key to the Housing Market (Prediction)

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Housing Market Predictions for the Next 2 Years

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions 2024: Will Real Estate Crash?

- Housing Market Predictions: 8 of Next 10 Years Poised for Gains

- Don't Panic Sell: Here's What Current Housing Market Trends Predict

- 2024 Housing Market vs. 2008 Crash: Key Differences

- Economist Predicts Stock Market Crash Worse Than 2008 Crisis

- How Much Did Housing Prices Drop in 2008?