As we stand on the cusp of early 2026, the burning question on many minds, especially those looking to buy a home or refinance an existing mortgage, is: what’s next for mortgage rates? After a period of significant ups and downs, there’s a palpable sense of anticipation. My read on the situation, and on what the data suggests, is that mortgage rates are poised for a period of relative stability or a modest dip over the next 90 days, likely hovering in the low to mid-6% range for a 30-year fixed mortgage. However, it’s crucial to understand that this isn't a guarantee, and a sprinkle of caution is warranted.

Mortgage Rates Forecast for the Next 90 Days: January-April 2026

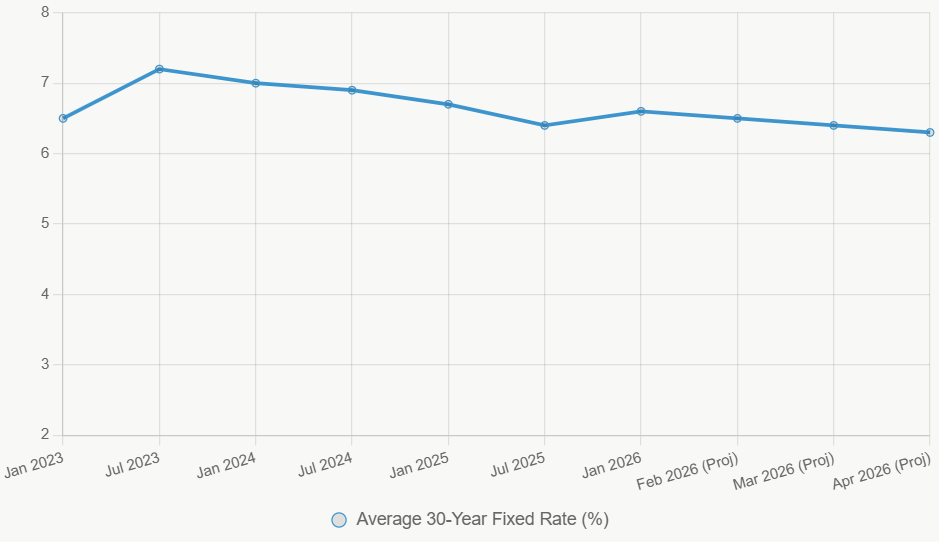

It feels like just yesterday we were talking about rates soaring past 7%, making the dream of homeownership feel impossibly distant for many. Now, as we move through early January 2026, the average 30-year fixed mortgage rate is sitting around 6.5% to 6.8%, with 15-year fixed rates a bit lower, around 5.8% to 6.1%. Adjustable-rate mortgages (ARMs) are still offering lower initial rates, but they come with that built-in risk of future increases.

I’ve spent a lot of time watching the economic signals, digging into reports, and talking to folks in the industry, and my gut feeling is echoed by many experts: we're likely looking at a gradual easing. By April 2026, we might see those 30-year fixed rates nudging down towards the 6.2% to 6.5% mark. This positive outlook is largely driven by the cooling inflation we’ve been witnessing and the Federal Reserve’s recent moves to make borrowing a bit cheaper. But, and here’s the big “but,” economic data can be a fickle thing. If inflation decides to stick around longer than expected, or if the job market continues to roar, rates could surprise us and hold steady or even inch back up.

My goal with this article is to break down what’s influencing these forecasts, what it could mean for you, and how you can best navigate this potentially shifting terrain. I want to give you the real deal, not just a bunch of numbers, but a sense of the forces at play.

Understanding the Basics: What Are Mortgage Rates Anyway?

Before we dive into the future, let’s have a quick refresher on what mortgage rates actually are. Simply put, they’re the price you pay to borrow money for a home. They're usually shown as a percentage, an annual rate. The two main types you’ll hear about are:

- Fixed-Rate Mortgages: These are the predictable ones. Your interest rate stays the same for the entire life of the loan. The 30-year fixed is king for a reason – it offers stable monthly payments, making budgeting much easier. The flip side? They generally come with a slightly higher interest rate compared to shorter terms.

- Adjustable-Rate Mortgages (ARMs): These often start with a lower interest rate for an initial period (say, five or seven years), after which the rate can go up or down based on market conditions. They can be attractive if you plan to sell or refinance before the adjustment period, but they carry more risk.

Mortgage rates are intricately linked to broader economic signals. Think of the 10-year U.S. Treasury yield as a key benchmark; a higher yield on these government bonds usually means higher mortgage rates, and vice versa. Lenders then add their own spread on top of that to cover their costs and make a profit.

Right now, entering 2026, we’re seeing the results of past actions. After a period of aggressive interest rate hikes in 2022 and 2023 to combat soaring inflation, the Federal Reserve started to dial things back with cuts in 2025. This has brought some much-needed breathing room for borrowers. However, the latest whispers from the jobs market and consumer spending data are adding a layer of complexity, making the Fed’s next moves a critical point to watch.

Factors Shaping the Next 90 Days: My Take on the Moving Parts

Predicting mortgage rates feels a bit like trying to catch lightning in a bottle sometimes. So many things can influence them! Here are the key players I'm keeping a close eye on for the next three months (roughly through mid-April 2026):

- The Federal Reserve's Next Steps: This is probably the biggest driver. The Fed has a couple of key meetings coming up in January and March 2026. If inflation continues to play nice and shows it’s heading towards their 2% target, they’re likely to make another interest rate cut, perhaps by 0.25%. This would naturally pull mortgage rates down. But, if inflation proves stubborn – what we call “sticky core inflation” – they might hit the pause button, and that would stabilize or even slightly increase rates. I’m leaning towards them continuing to ease, but I’ve seen surprises before.

- Economic Signals – The Numbers Game: We need to pay close attention to the economic reports that come out. The Consumer Price Index (CPI) report, which tells us about inflation, is a big one. If it’s coming in lower than expected, that’s good news for lower mortgage rates. Similarly, the unemployment rate and job growth numbers are crucial. If the job market is booming, it signals a strong economy that might not need as much help from low interest rates, potentially pushing rates up. I’m looking for a slight moderation in job growth to support continued rate declines.

- The Global Picture: We can’t ignore what’s happening outside our borders. Trade tensions between major countries or spikes in oil prices (often linked to conflicts in the Middle East) can quickly reignite inflation fears. Conversely, a peaceful resolution to global conflicts could take some pressure off. These geopolitical events can be highly unpredictable and have a ripple effect on markets.

- The Housing Market Itself: Even within the housing market, there are tugs and pulls. We still have relatively low inventory of homes for sale in many areas, coupled with steady demand. This can keep prices and, by extension, rates a bit higher than they might otherwise be, as lenders factor in the risk of borrowers struggling if home prices were to fall sharply.

The general consensus among those who analyze these things for a living is that we’ll see some relief, but the uncertainty is real. Some projections suggest a drop of 0.25% to 0.5%, while others believe we’ll see more stability if the economy keeps chugging along stronger than anticipated.

What This Could Mean for You: Buyers and Refinancers

So, how does all this translate to your wallet and your homeownership dreams?

For Homebuyers:

- More Affordable Monthly Payments: A lower interest rate can significantly reduce your monthly mortgage payment. For example, on a $400,000 loan, a 0.5% drop in your interest rate could save you roughly $100 to $200 per month. Over the life of a 30-year loan, that adds up to tens of thousands of dollars.

- Increased Purchasing Power: As rates come down, your budget can stretch further. A rate decrease might allow you to afford a slightly more expensive home or simply make your desired home more financially accessible.

- First-Time Buyers: Programs like FHA loans and VA loans for eligible veterans can sometimes offer even more attractive rates than the standard market averages. It’s always worth exploring these options.

For Refinancers:

- Opportunity to Save: If you have an existing mortgage with a higher interest rate, a dip in rates could make refinancing a smart move. The idea is to lower your monthly payment or reduce the total interest paid over the life of your loan.

- Break-Even Point: It’s crucial to calculate your break-even point. Refinancing involves closing costs (typically 2% to 5% of your loan amount). You need to figure out how long it will take for your monthly savings to offset these costs. If rates drop significantly, this break-even point becomes much more attractive.

Some Important Considerations:

- Rate Locks: If you’re buying a home, you’ll likely need to lock in your rate for a certain period. Be mindful of these lock expiration dates, especially if your closing is delayed.

- Float-Down Options: Some lenders offer a “float-down” option when you lock your rate. This means if your rate drops between locking and closing, you can take advantage of the lower rate. It’s a good way to get some protection against rising rates while hoping for declines.

Deeper Dive: Trends and Projections

To get a more complete picture, I’ve spent time looking at the historical data and where experts are pointing. Mortgage rates are like a barometer of economic health. They reflect how confident investors are, how much inflation is biting, and what central banks are doing. After the crazy stimulus of the pandemic years, which sent rates to historic lows below 3% from 2020-2021, fueling a housing frenzy, we saw inflation climb. That forced the Federal Reserve to hike rates significantly, pushing 30-year fixed mortgages above 7% by 2022-2023.

Thankfully, the tide started to turn in late 2024 with those first Fed rate cuts. By December 2025, rates had eased to roughly 6.6-6.8%. This journey shows just how sensitive rates are to economic cycles.

Here’s a look back to set the stage:

| Period | Average 30-Year Fixed Rate | Key Events Influencing Rates |

|---|---|---|

| 2020-2021 | 2.8-3.1% | Pandemic stimulus, low Treasury yields, low inflation |

| 2022-2023 | 6.5-7.5% | Fed rate hikes to combat high inflation |

| 2024 | 6.8-7.2% | Inflation started cooling, but still persistent pressures |

| 2025 (to Dec) | 6.3-6.8% | Multiple Fed cuts, economic softening, inflation trends lower |

| Jan 2026 | ~6.6% (current) | Stabilizing post-cuts, awaiting new economic data |

Data sourced from Freddie Mac's Primary Mortgage Market Survey and MBA reports.

This table highlights a general downward trend since the peaks of mid-2023, which is why there’s a cautious optimism for early 2026.

The 10-year U.S. Treasury yield, currently around 4.2-4.4% as of January 2026, is the bedrock for mortgage rates. When that yield moves, mortgage rates tend to follow.

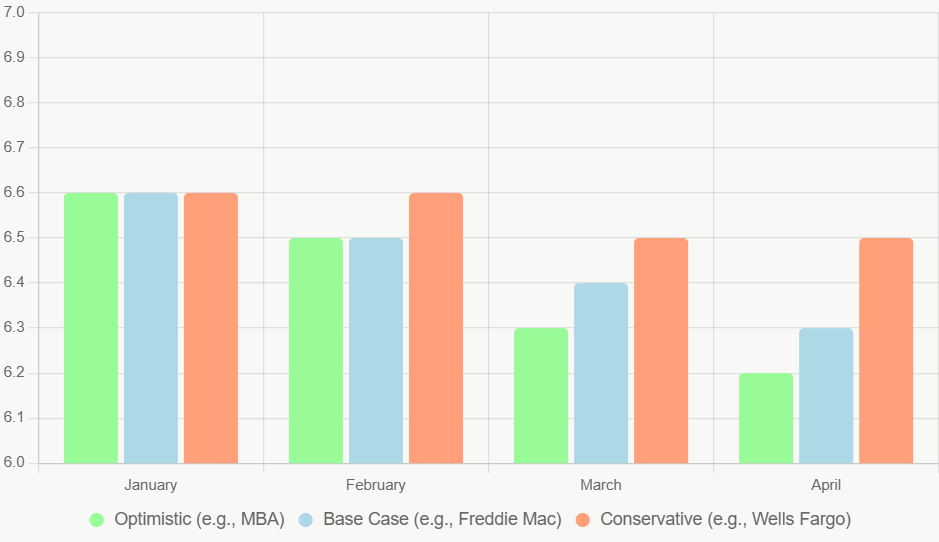

Expert Forecasts: A Look at What the Pros Are Saying

I’ve pulled together some of the general sentiment from reputable sources. Keep in mind these are educated guesses, not crystal balls:

- Freddie Mac: They're anticipating 30-year fixed rates to average around 6.4% in the first quarter of 2026, potentially dipping to 6.2% by the second quarter. They see this driven by expected Fed cuts and a moderating economy.

- Fannie Mae: Their outlook is quite similar, forecasting rates in the 6.3% to 6.5% range through April. Their base scenario involves a couple of Fed rate cuts. They do point out that if GDP growth is stronger than expected, rates could trend higher.

- Mortgage Bankers Association (MBA): The MBA is a bit more bullish on rate drops, predicting rates could fall to 6.2% by the end of March, especially if inflation stays below 3%. Their weekly surveys are a great pulse-check on where things stand.

- Wells Fargo Economics: They see a bit more stability in the short term, with rates in the 6.5% to 6.7% range. However, they suggest a potential drop to 6.3% if unemployment starts to tick up.

- JPMorgan Chase: They are a touch more conservative, projecting an average of 6.4% to 6.6%. They specifically mention that the upcoming election year politics (2026 midterms) could introduce some unexpected volatility.

As you can see, the experts generally agree on a downward bias, but they all add caveats about unexpected events.

Here’s a quick comparison of these projections:

| Source | 30-Year Fixed Forecast (Jan-Apr 2026) | Key Assumptions |

|---|---|---|

| Freddie Mac | 6.4% average, down to 6.3% | Two Fed cuts, inflation ~2.5% |

| Fannie Mae | 6.3-6.5% | GDP growth ~1.8%, mild recession risk |

| Mortgage Bankers Assoc. | 6.2-6.4% | Strong refinancing activity if rates dip below 6.5% |

| Wells Fargo | 6.5-6.7%, potential drop to 6.3% | Continued strong jobs data holds rates steady |

| JPMorgan Chase | 6.4-6.6% | Geopolitical stability assumed |

Scenarios for the Next 90 Days

To really get a grip on the possibilities, thinking in terms of scenarios is helpful:

- Best Case (Rates Fall Sharply): Imagine inflation dropping below 2.5% and the Fed deciding to make more aggressive cuts, say a total of 0.50% in the next couple of meetings. This could push 30-year fixed rates down to the 6.0% to 6.2% range. This would be fantastic news for affordability, likely spurring a noticeable increase in home sales.

- Base Case (Modest Decline): This aligns with most of the expert forecasts. We see moderate economic growth (around 2% GDP), inflation continuing its downward trend, and no major economic shocks. Rates ease slightly, settling in the 6.3% to 6.5% range. This is the “steady as she goes” scenario.

- Worst Case (Rates Rise or Hold Steady): If inflation proves more persistent than expected (say, it stays above 3.5%), or if the job market remains exceptionally strong, the Fed might pause its rate cuts. This could lead to rates holding steady above 6.7% or even drifting back up towards 6.8% to 7.0%. This would undoubtedly cool down the housing market.

Strategies for Navigating the Next 90 Days

Given this mix of potential outcomes, what’s the best way to approach things?

- Stay Informed and Watch Key Dates: Mark your calendar for the Federal Reserve’s policy meetings (January 31 and March 20 for 2026) and the release dates for major economic reports like CPI (mid-February, mid-March, mid-April for January, February, and March data, respectively) and employment figures.

- Shop Around Like Crazy: This is non-negotiable. Mortgage lenders can offer different rates and fees. Using online tools from sites like Bankrate or NerdWallet can give you a starting point, but always get personalized quotes. Differences of 0.25% or more are not uncommon and can save you thousands.

- Understand Rate Locks vs. Floating:

- Locking: If you’re confident you want to buy and are worried about rates going up, a rate lock provides peace of mind. You’re guaranteed that rate for a specific period.

- Floating: If you think rates will go down and you have some time before you need to close, you might choose to “float” your rate. This means you’re taking the risk that the rate could go up. Some lenders offer float-down options, which is a nice compromise.

- Boost Your Credit Score: If you have a bit of time before seriously shopping for a mortgage, focus on improving your credit score. A score of 760 or higher typically gets you the best rates from lenders. Even a small improvement can make a difference.

- Explore All Your Options: Don’t just think about the 30-year fixed. If you plan to move in five to seven years, a 7/1 ARM starting around 5.8% could offer initial savings. Always discuss your personal financial situation and goals with a mortgage professional.

- Seek Professional Advice: A good mortgage broker or financial advisor can be an invaluable resource. They can help you understand the nuances of different loan products and guide you based on your unique circumstances. The Consumer Financial Protection Bureau (CFPB) also offers helpful tools to compare rates.

The Bigger Picture: Beyond the Next 90 Days

Looking further out, if the trend of moderating inflation and economic growth continues, some forecasts suggest that the average 30-year fixed rate could settle between 5.8% and 6.2% for 2026. However, longer-term predictions are even harder to make accurately. Factors like climate change impacting insurance costs in certain areas, demographic shifts (like millennials aging into prime home-buying years), and global financial stability all play a role.

Right now, U.S. mortgage rates remain significantly higher than in some European countries (where rates might be around 3-4%), which can influence international investment in U.S. real estate.

In conclusion, the next 90 days offer a promising outlook for those looking to enter or re-enter the mortgage market. While stability or modest declines seem likely, the economic chessboard is constantly shifting. Staying informed, comparing your options diligently, and having a strategy are your best defenses against uncertainty. This forecast is based on the best available information right now, but remember that markets are dynamic and always evolving.

VS

Tennessee’s balanced rental vs Texas’s larger home with lower cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?