Wondering where mortgage rates are headed? You're not alone. After a period of ups and downs, everyone wants to know: What will Mortgage Rates be from August to December 2025? Good news, things are looking brighter! My detailed analysis, drawing from the best sources, suggests that mortgage rates will likely hover in the mid-6% range, gradually decreasing to around 6.3%-6.5% by December 2025.

Mortgage Rates Predictions for the Next 6 Months: August to December 2025

Since the start of the year, high mortgage rates have made buying a home more difficult. But don't lose hope! Let’s get a grasp on the current situation, review the trends, and see what experts are thinking.

The Current State of Mortgage Rates

As of July 10, 2025, here’s where we stand:

- 30-Year Fixed Rate Mortgage (FRM): Averaging 6.72%

- 15-Year FRM: Averaging 5.86%

These numbers, per Freddie Mac, paint a clear picture. While rates are lower than the 52-week high of 7.04%, they're still considerably higher than the ridiculously low rates we saw a few years ago. It’s like when gas prices go up – you remember the cheaper days!

| Metric | 30-Year FRM | 15-Year FRM |

|---|---|---|

| Current Rate | 6.72% | 5.86% |

| 1-Week Change | +0.05 | +0.06 |

| 1-Year Change | -0.17 | -0.31 |

| Monthly Average | 6.74% | 5.88% |

| 52-Week Average | 6.68% | 5.86% |

| 52-Week Range | 6.08%–7.04% | 5.15%–6.27% |

For weeks, the 30-year FRM has stayed below 7%. This shows you that while there are fluctuations, we’ve stepped away from the volatility seen last year.

What’s Coming? Mortgage Rate Predictions for August to December 2025

Let's look at what the big players are saying about where rates are headed. No more stress.

- Long Forecast:

- They're predicting a gradual dip in the coming months.

- August 2025: Average 6.59%

- December 2025: Average 6.29%

- National Association of REALTORS (NAR):

- NAR's Chief Economist, Lawrence Yun, predicts an average of 6.4% for the second half of 2025.

- Yun thinks we're heading for “brighter days” in housing.

- Fannie Mae:

- They're predicting that 30-year mortgage rates will end 2025 at 6.5%, and go down to 6.1% by the end of 2026.

- Mortgage Bankers Association (MBA):

- They anticipate rates near 6.8% through September 2025, then gradually decreasing to 6.7% by year-end.

- Sometime in 2026 they may stabilize to 6.3%.

- Morgan Stanley:

- Strategists believe mortgage rates could fall, which would improve how people can afford homes.

- A slowing economy might bring even lower rates in 2026.

- Freddie Mac:

- They said rates would stay “higher for longer.”

- They do see increased housing activity as buyers get used to the current rates.

- Other Voices:

- Forbes Advisor: Rates might ease slowly due to Federal Reserve caution and economic policies.

- U.S. News: Rates might stay range between 6.5% and 7% through 2025.

- The Mortgage Reports: They say there’s a downward trend in July. They cite NAR’s prediction of 6.4% Q3.

Here’s a Quick Look at the Forecasts:

| Source | Prediction for December 2025 (Approximate) |

|---|---|

| Long Forecast | 6.29% |

| National Association of REALTORS | 6.4% (Average for Second Half) |

| Fannie Mae | 6.5% |

| Mortgage Bankers Association | 6.7% |

The takeaway? Most experts believe rates will stay in the mid-6% range, perhaps drifting down to 6.3%-6.5% by year's end. I wouldn't expect any big drops below 6%.

What's Driving These Predictions?

A bunch of things affect Mortgage Rate Predictions for the Next 6 Months: August to December 2025.

- Federal Reserve and Monetary Policy:

- The Federal Reserve's federal funds rate affects mortgage rates indirectly. Any rate cut that the Fed may make could lower mortgage rates, but potential policy changes could push rates higher.

- Inflation is still a factor:

- Inflation is super important. Slowly cooling inflation rates supports lowering the rates. You may want to keep an eye on policies and how they impact potential pushing of rates.

- The Health of the Economy:

- If the economy is doing well, rates might stay higher. If it slows down, then the Fed might cut rates, which is good for people borrowing money.

- Housing Market Conditions Matter:

- We have a major shortage of houses. This “rate lock-in effect” makes it hard to find houses.

Homeowners don’t want to sell if they have low rates

* If rates go down, more houses might be available. - Global Money Factors:

- Everything from oil prices to political problems can affect the money and the rates.

Related Topics:

Mortgage Rates Predictions for the Next 30 Days: July 3-August 3

Will Mortgage Rates Drop or Increase in July 2025: Key Predictions

Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

How Will These Rates Affect YOU?

These trends have a real impact on homebuyers and the market:

- Affordability: Even a tiny decrease in rates can help a lot in being able to afford a house. Still, even rates in the mid-6% range are still a challenge.

- What About The Housing Market?

- Existing Home Sales: Sales might increase

- New Home Sales: Sales might increase to address supply

- Median Home Prices: Prices may still go up a little bit.

Are THERE Any Refinancing Opportunities?

If rates drop closer to 6.3%-6.5% in December 2025, there are chances that this might cause some refinancing. Keep in mind that last year Freddie Mac reported a 56% increase in refinance applications.

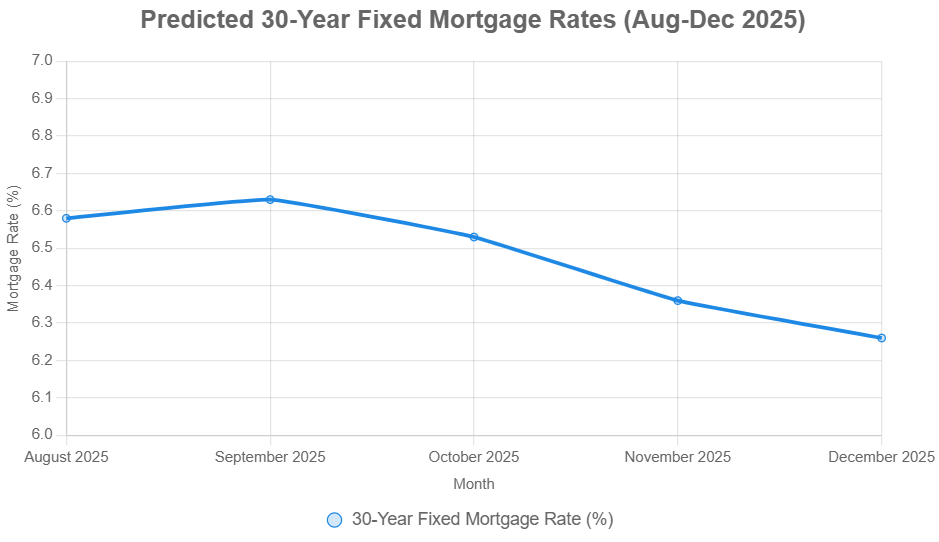

Visualizing the Trends

Check out the trend lines I put together charting the predictions:

A Quick Look Back

It’s good to keep the current predictions in perspective. Here’s the data from Freddie Mac:

- 30-Year FRM: The highest rate it has been is 7.04 since this past year. the average rate to be at 6.68%.

- 15-Year FRM: Rates ranged from 5.15% to 6.27%, averaging 5.86%.

Final Thoughts

Looking ahead, mortgage rates from August to December 2025 are most likely going to be in the mid-6% range. There will probably be some slight decreases. A number of economic factors will affect things such as inflation, Federal Reserve policies, and the housing market.

As someone who's watched these financial currents for awhile, my best advice is to stay informed and be ready. Keep tabs on economic stuff and talk to mortgage experts for advice. I will make sure to post periodic updates.

Good luck! Keep watching the rates!

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?