The Federal Reserve's next pivotal meeting, scheduled for October 28-29, 2025, is almost certainly going to result in a quarter-point interest rate cut, lowering the federal funds rate target to between 3.75% and 4.00%. After a period of aggressive tightening, the central bank is now signaling a shift towards easing, driven by cooling inflation and a softening job market.

While the market is largely anticipating this move, I'll be watching the Fed's official statement very closely for any nuances that might hint at their future plans or signal concerns about lingering economic uncertainties.

This upcoming October meeting feels particularly significant because the Fed is trying to thread a very fine needle: slowing down an economy that was overheating without pushing it into a recession. It's a delicate dance, and the music they play in their policy statement will be listened to by everyone from Wall Street traders to everyday families planning their finances.

Next Federal Reserve Meeting Just 4 Days Away: What to Expect?

Understanding the FOMC Meeting: What's on the Docket?

For those who don't follow the Fed's every move, the Federal Open Market Committee (FOMC) is the group within the Federal Reserve system that actually decides on interest rates and other monetary policy tools. They get together eight times a year to hash things out. The October meeting is one of the “standard” ones, meaning it won't involve the release of their fancy economic projections (like the “dot plot”) or a press conference with Chair Jerome Powell. Those are usually reserved for the March, June, September, and December meetings.

This means the real substance will be in the policy statement released on October 29th at 2:00 p.m. Eastern Time. This statement is where they’ll lay out their reasoning for any decision and give us clues about what they’re thinking for the future. The minutes from this meeting, which will offer a more detailed look at the discussions, won't come out until November 19th, about three weeks later. So, for immediate takeaways, the statement is our primary source.

The Economic Picture: Why the Fed is Leaning Towards Easing

Several key economic indicators are painting a picture that supports a move to lower interest rates. For starters, inflation, which was a major worry for the Fed in the past couple of years, has been coming down. The latest readings show it hovering around 2.9% year-over-year. While this is still above the Fed's target of 2%, it's a significant improvement from the peaks we saw.

On the employment front, the job market is showing signs of cooling. The unemployment rate has nudged up to 4.3%, and more importantly, the pace of job creation has slowed considerably. In September, we saw only about 22,000 new jobs added, which is well below what was expected. This suggests that the labor market is no longer as red-hot as it was, which is exactly what the Fed wants to see to help control inflation.

However, it’s not all smooth sailing. Gross Domestic Product (GDP), which measures the overall health of the economy, is still showing solid growth. The most recent figures indicated an annualized growth rate of 3.8% in the second quarter. This “soft landing” scenario, where inflation cools without a major economic downturn, is what the Fed aims for, but it's a tough balancing act. Fed officials, including Chair Powell and Governor Waller, have been vocal about the need to carefully weigh the risks. They’re concerned about a potential rebound in inflation due to things like new tariffs or supply chain disruptions, but also about pushing the job market too far.

Here's a quick look at some of the key numbers:

| Indicator | Latest Value (Sept/Oct 2025) | Trend vs. Prior Month | Fed Target/Context |

|---|---|---|---|

| Inflation (YoY) | 2.9% | Down from 2.7% | 2% long-run goal |

| Unemployment Rate | 4.3% | Up from 4.2% | Maximum employment |

| Nonfarm Payrolls | +22K | Significantly Lower | Sustainable growth |

| GDP Growth (Annual) | 2.1% | Steady | Avoid recession |

This dashboard of economic data is what the FOMC members will be poring over. The progression of inflation downwards, coupled with a cooling labor market, provides a strong justification for a measured rate cut.

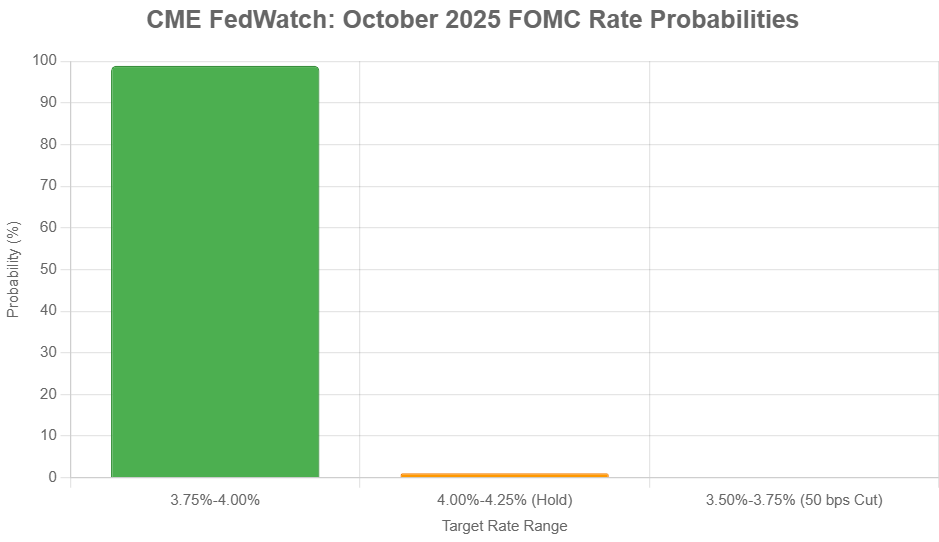

What the Market Thinks: A Near-Certainty

When it comes to what the financial markets expect, there’s very little guesswork. The CME FedWatch Tool, which tracks futures contracts related to the federal funds rate, shows an overwhelming probability – around 98.9% – of a 25 basis point (bps) cut. This means the market is virtually certain that the Fed will lower its target rate from the current 4.00%-4.25% range to 3.75%-4.00%. The odds of no change are barely 1.1%, and a larger 50 bps cut is, for all intents and purposes, off the table.

This high level of certainty reflects the consensus among economists and investors that the Fed is in an easing cycle. This would be the second consecutive quarterly cut, following the reduction made in September. It’s important to remember that markets are forward-looking, so much of this expected move has already been “priced in” to asset values. This means the actual announcement might not cause huge immediate market swings unless the Fed says something unexpected in its statement.

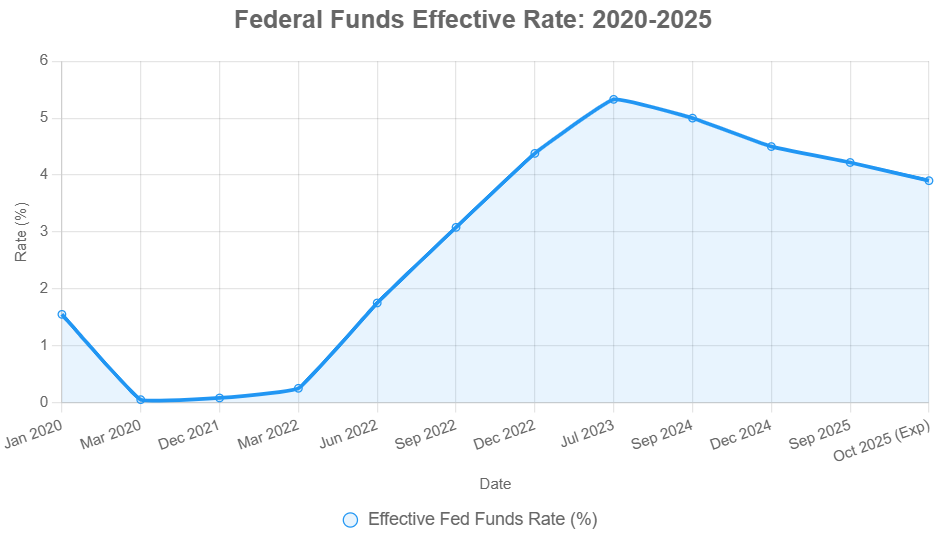

A Look Back: The Fed's Rate Journey

To understand the current situation, it’s helpful to recall the Fed’s recent actions. After keeping rates near zero for a long time, the Fed embarked on an aggressive hiking campaign starting in early 2022 to combat soaring inflation. Rates climbed rapidly, reaching a peak of 5.33% in mid-2023. Since then, we’ve seen a reversal, with the Fed starting to cut rates in 2024 and continuing into 2025.

This trajectory shows how the Fed has been reactive to economic conditions. First, it fought inflation with higher rates, and now, as inflation recedes and the economy shows signs of slowing, it’s shifting to support growth. The proposed cut in October continues this easing trend.

Here's how the effective federal funds rate has evolved:

This historical context is crucial. It shows that the Fed’s actions are part of a process, and the October meeting is another step in that ongoing journey.

What to Watch For in the Statement

Since there won't be a press conference or new projections, the policy statement issued on October 29th will be the main guide. I'll be looking for several things:

- The specific language used to describe inflation and employment: Does it suggest they are truly comfortable with current trends, or are there lingering concerns about upside inflation risks or deeper labor market weakening?

- Forward-looking guidance: Even without the dot plot, the statement might offer clues about the pace and extent of future rate cuts. Phrases like “gradual” or “measured” will be important to note.

- Any mentions of specific risks: Will they highlight potential issues like geopolitical events, trade policy changes, or financial stability concerns? These could provide insight into potential future actions.

- The balance between the dual mandate: How are they weighing the need to keep prices stable against ensuring maximum employment?

The difference between a hawkish statement (suggesting a more cautious, slowing approach to cuts) and a dovish statement (indicating a quicker pace of easing) can significantly influence market sentiment.

Potential Impacts: Who Benefits and Who Worries?

A 25 bps rate cut could have several effects:

- Stock Markets: Historically, rate cuts, especially when initiated during a period of economic expansion, can be positive for stocks. The thinking is that lower borrowing costs can boost corporate profits and consumer spending. However, the reaction can depend on the reason for the cut. If it's seen as purely precautionary to stave off a recession, it might be met with more caution.

- Borrowing Costs: Consumers and businesses could see slightly lower interest rates on things like mortgages, car loans, and business loans. This can stimulate demand and investment. However, the impact on mortgages might be muted if rates have already fallen in anticipation.

- Cryptocurrency Markets: These markets tend to be sensitive to liquidity and the cost of capital. A dovish Fed generally supports higher prices for assets like Bitcoin, as investors seek higher returns and liquidity increases. Analysts suggest that a cut could see Bitcoin testing new highs.

- Businesses: For companies with significant debt, lower interest rates mean lower borrowing costs, which is a positive for their bottom line. However, they'll also be watching consumer demand, which is influenced by the overall health of the economy.

- Households: Those with variable-rate debt will see their payments decrease. However, if inflation begins to tick back up, the benefit from lower rates could be eroded.

It’s a mixed bag, and the actual outcome depends on how the Fed's actions are interpreted and how the economic data continues to unfold in the coming weeks and months.

Expert Opinions and The Road Ahead

Economists and analysts I follow are largely in agreement with the market’s expectation of a rate cut. However, many also echo the Fed’s caution. The uncertainty surrounding government data releases due to potential disruptions adds a layer of complexity. This means the Fed might be relying on older data points or alternative indicators, which could lead to surprises.

The discussions among Fed officials themselves highlight this balancing act. Governor Waller has indicated support for a 25 bps cut due to job market concerns, but has also flagged potential inflationary pressures from tariffs. Chair Powell’s recent remarks have emphasized a “no risk-free path,” underscoring the difficult choices the Fed faces.

Looking beyond October, the big question is: what’s next? Will this be the start of a steady path of rate cuts, or a pause before potentially more aggressive action? The economic forecast for 2026 by institutions like the IMF suggests continued growth, but with potential headwinds. How the Fed navigates these challenges in the coming months will shape not just the economy but also influence broader trends like trade policies and even the upcoming elections.

Ultimately, this October FOMC meeting is about the Fed’s assessment of whether its aggressive fight against inflation has succeeded enough to begin supporting growth without reigniting price pressures. It’s a critical juncture, and while the rate cut itself might be largely predictable, the nuances within the Fed’s statement will be key to understanding the path forward.

“Build Wealth Through Turnkey Real Estate”

The Federal Reserve’s decisions on interest rates impact everything—from your mortgage payments to your savings yields. As of October 2025, the Fed’s target range stands at 4.00%–4.25% following a recent 25 basis point cut, with the effective rate hovering near 4.09%.

Market analysts now anticipate additional rate cuts over the coming months—potentially lowering the rate to around 3.50%–3.75% by the end of 2025. This shift could open new opportunities for homebuyers and real estate investors looking to secure better financing terms.

🔥 Lower Rates Mean Smarter Investment Opportunities! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Federal Reserve Cuts Interest Rate by 0.25%: Two More Cuts Expected in 2025

- Fed Projects Two Interest Rate Cuts Later in 2025

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Fed Funds Rate Forecast 2025-2026: What to Expect?

- Interest Rate Predictions for 2025 and 2026 by NAR Chief

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet