One of the things I love most about my work is seeing people move from the left side of the CashFlow Quadrant to the right side of the quadrant.

One of the things I love most about my work is seeing people move from the left side of the CashFlow Quadrant to the right side of the quadrant.

The process of moving from being an employee or self-employed to a business owner or sophisticated investor is a bit like that of a caterpillar turning into a beautiful butterfly. It takes time, and often requires a total transformation in mindset and behavior.

One of these behavior changes is understanding what to do when you have more money suddenly at your disposal. Whether it’s from an inheritance, a raise or bonus, or some other source, the temptation for those on the left side of the quadrant can be to, at best, follow conventional advice about money, or, at worse, to spend it on liabilities like cars or vacations.

Such conventional advice could be to increase your contributions to your 401(k) or to continue to live below your means. I’ve written a lot about both these topics, and it should come as no surprise that I don’t condone either of them.

If you’re facing a windfall in new money, now is the perfect time to put into place the rich dad fundamental: invest in cash-flowing assets.

But in order to do that, you need to understand some basic rules of investing. Here are six of them to master, taught to me by my rich dad.

Basic investing rule #1: Know what kind of income you’re working for

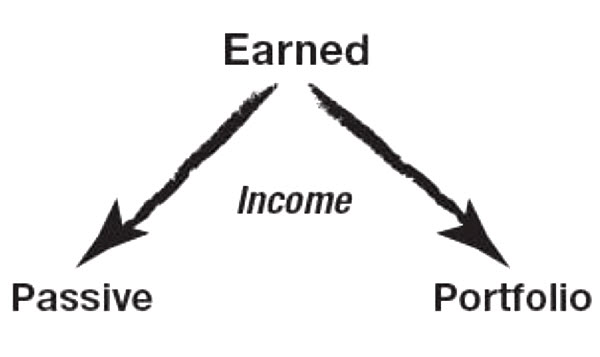

Most people think only of making money. They don’t realize that there are different kinds of money to work for. For years, rich dad drilled into me that there are three kinds of income:

Ordinary earned income: Generally earned from a job via a paycheck. It’s the highest-taxed income, and thus, the hardest to build wealth with due to high taxes and the fact that you’re trading time for money. Your ability to earn is based on how long you can work.

Portfolio income: Generally derived from paper assets such as stocks, bonds, and mutual funds. It is the second-highest taxed income, and is moderately hard to build wealth with due to low returns.

Passive income: Generally derived from real estate, royalties, and distributions. It is the lowest-taxed income, with many tax benefits, and is the easiest income to build wealth with thanks to its combination of low taxes and potentially infinite returns.

Rich dad said, “If you want to be rich, work for passive income.”

Basic investing rule #2: Convert ordinary income into passive income

Most people start their life out by making ordinary earned income as an employee. The path to building wealth then starts with understanding that there are other types of income and then converting your earned income into the other types of income as efficiently as possible.

To illustrate this, rich dad drew a simple diagram:

“That, in a nutshell,” said rich dad, “is all an investor is supposed to do. It’s as basic as it can get.”

This is why when someone gets a raise, I don’t tell them to put it in a 401(k) or to live below their means, which essentially means saving. Rather I tell them to pay themselves first and invest that money in cash-flowing assets. In short, convert your pay raise into passive income.

Basic investing rule #3: The investor is the asset or liability

Many people think investing is risky. The reality, however, is that it’s the investor who is risky. The investor is the asset or liability.

“I have seen investors lose money when everyone else is making it,” said rich dad. “In fact, a good investor loves to follow behind a risky investor because that is where the real investment bargains can be found!”

If you want to move from being a risky investor to a good investor, first invest in your financial education. As part of your education — because nothing beats real-life experience — start small with your investments, learn from your mistakes, and then make bigger and bigger investments.

You can also play games that simulate investing in order to build your financial intelligence.

Basic investing rule #4: Be prepared

Most people try to predict what and when things will happen. But a true investor is prepared for anything to happen. “If you are not prepared with education, experience, or extra cash, a good opportunity will pass you by,” said rich dad.

Rich dad went on to say that it was most important not to predict what will happen but to instead focus on what you want, to keep your eyes open to what is happening, and to respond to opportunity. This is done through continual education and application.

Basic investing rule #5: Good deals attract money

One of my big concerns as a beginning investor was how I would raise money if I found a good deal. Rich dad reminded me that my job was to stay focused on the opportunities in front of me, to be prepared.

“If you are prepared, which means you have education and experience,” said rich dad, “and you find a good deal, the money will find you or you will find the money.”

Rich dad’s point was that getting the money was the easy part. The hard part was finding a great deal that attracted the money — which is why so many people are ready to give money to a good investor. I call this OPM, a.k.a., Other People’s Money, and it’s worth learning more about.

Basic investing rule #6: Learn to evaluate risk and reward

As you become a successful investor, you must learn to evaluate risk and reward. Rich dad used the example of a nephew building a burger stand.

“If you had a nephew with an idea for a burger stand, and he needed $25,000, would that be a good investment?”

“No,” I answered. “There is too much risk for too little reward.”

“Very good,” said rich dad, “but what if I told you that this nephew has been working for a major burger chain for the past 15 years, has been a vice-president of every important aspect in the business, and is ready to go out on his own and build a worldwide burger chain? And what if you could buy 5 percent of the company with a mere $25,000? Would that be of interest to you?”

“Yes,” I said. “Definitely, because there is more reward for the same amount of risk.”

Learning and mastering the rules of investing takes a life-long investment in financial education. But these basics will get you started. Where you go from here is up to you.