The Ontario real estate market is expected to remain fairly flat over the next year or two, with some ups and downs along the way, before beginning a slow and steady climb. This isn’t a huge crash, but it’s also not the runaway growth we’ve seen in past years. Looking ahead to the next five years (roughly 2026–2030), the outlook feels more nuanced. It’s a story of a market hitting the pause button, reassessing, and then—hopefully—resuming its upward journey.

Real Estate Forecast for the Next 5 Years in Ontario: 2026-2030

For the first half of 2026, we might see prices dip slightly, especially in pricier areas like the Greater Toronto Area (GTA). Think minor drops, maybe 3-4% in places like Toronto itself. It’s not a full-blown recession for housing, but a noticeable pause. After that, around 2027, I expect a gradual improvement. Sales will likely tick up, and prices will start to recover, though don’t expect them to shoot back to their 2022 highs anytime soon – maybe not until 2029 or even 2030.

This isn't just me guessing. A lot of smart folks at places like the Canada Mortgage and Housing Corporation (CMHC) and various economic analysis firms are looking at the same numbers, and they're painting a similar picture.

What's Driving This Slowdown and Recovery?

There are a few big factors at play that are shaping this real estate forecast for the next 5 years in Ontario.

1. Interest Rates & Mortgage Renewals: The Big “What If?”

This is probably the biggest thing on everyone's mind. The Bank of Canada has been keeping interest rates relatively low, but they're expected to hold steady around 2.25% for much of 2026. After that, they'll likely creep up by about 0.25% each year until around 2030, reaching something like 3.25%.

Now, why does that matter? Well, lots of people locked in those super low interest rates during the pandemic. When their mortgages come up for renewal in 2025 and 2026, they're going to be looking at significantly higher payments. We're talking about monthly increases that could be a real shock to the system for some homeowners, maybe 15-20% more. This “payment shock” could lead to more people deciding to sell, which means more homes on the market.

My Take: This is a delicate balancing act. While it might put downward pressure on prices initially by adding more homes for sale, it also means fewer people will be able to buy if their own finances are strained by rising rates or if they're worried about their neighbour's situation.

2. Population Growth Slowdown: A New Reality

For years, Ontario's real estate market has been fueled by steady immigration. Newcomers arrive, they need housing, and that drives demand. But there's a predicted slowdown in immigration targets for 2025 and 2026. This means less new demand for both buying and renting homes.

My Take: This is a significant shift. We've become so used to immigration being a constant driver of growth that a slowdown will definitely be felt. It might create a bit more breathing room in the rental market, and potentially ease some of the pressure on first-time buyers.

3. Housing Supply: Building Less for the Future

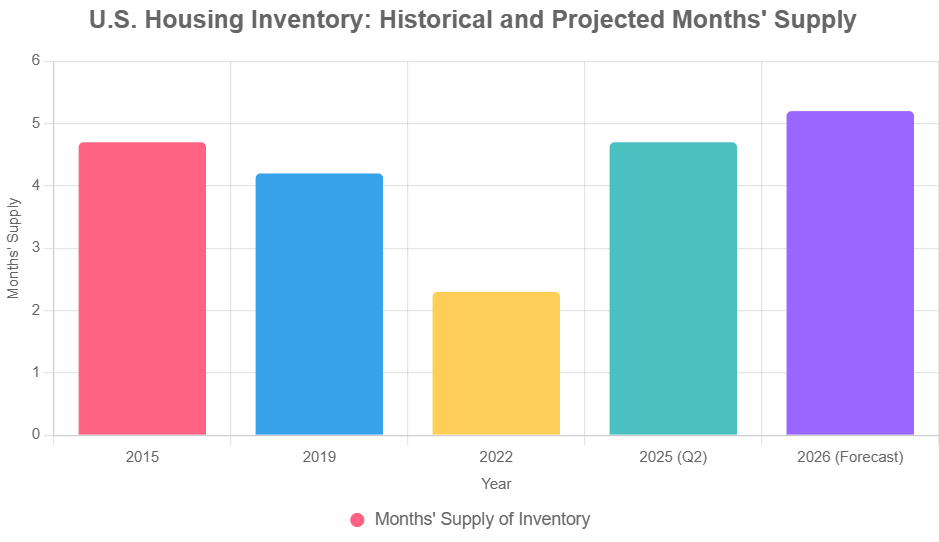

Here’s a bit of a paradox. While demand might soften in the short term, new home construction in Ontario is expected to hit lows we haven't seen in two decades in 2026. The number of housing starts is projected to drop significantly.

My Take: This is a lagged risk. While it might not seem like a big deal right now when demand is a bit softer, it’s a major concern for the future. If demand picks up again in the later years of our five-year forecast (say, 2028-2030) and builders haven't ramped up construction, we could be looking at a supply shortage that drives prices up quickly. It’s a classic supply and demand issue, just with a delayed reaction.

4. Economic Winds and Trade Uncertainty

Ontario's economy is pretty tied to what happens south of the border and globally. Trade uncertainty, especially around agreements like CUSMA (the Canada-United States-Mexico Agreement), is a big question mark. If there are unexpected tariffs or trade disruptions, it could hurt consumer confidence, and that definitely impacts buying decisions. A soft labor market with higher unemployment also plays a role, making people more cautious.

My Take: We can't ignore the fact that Canada, and Ontario in particular, is influenced by global economic health. Any major trade disputes or a global economic downturn would definitely put a damper on the recovery we’re hoping to see.

Regional Highlights: Who's Up and Who's Down?

The real estate market forecast for the next 5 years in Ontario isn't a one-size-fits-all story. Some areas will fare better than others.

- Greater Toronto Area (GTA): This is likely where we'll see the most noticeable price adjustments in 2026. High inventory levels, especially with many pre-construction condo sales struggling, will keep prices under pressure.

- Hamilton & Southwestern Ontario: These areas have generally been more affordable than the GTA, which often makes them more resilient. We might see steadier performance here, as buyers looking for more value might gravitate towards these regions.

- Ottawa: The capital is expected to remain relatively stable. However, any potential cuts to the federal public service could start to impact demand later in 2026.

- Northern Ontario: Places like Sudbury and Thunder Bay, often driven by sectors like mining, are often more affordable and could see consistent growth as they continue to be attractive options for those seeking value.

The Condo Conundrum

The condo market, especially in Toronto, is facing its own unique set of challenges. A lot of new condo units are being completed, and with fewer investors buying and more units becoming available for rent, the market could feel flooded. This could put downward pressure specifically on condo prices.

My Take: This is a sector to watch closely. The sheer number of units coming online could create a short-term oversupply, but if construction slows down and demand eventually returns, these could become attractive opportunities again.

Key Drivers and Risks to Watch

To summarize the Ontario real estate forecast 2026-2030, here are the crucial things I'm keeping an eye on:

- Population Growth: A significant slowdown here is a big change we need to adapt to.

- Mortgage Renewal “Shock”: How well homeowners manage their renewals will be key to market stability.

- Economic & Trade Security: A stable economy means confident buyers.

- Condo Supply: The number of new units coming to market in urban centres is a major factor.

- New Construction Levels: Low building rates today mean potential scarcity tomorrow.

Table: Ontario Housing Market Outlook – Key Projections

| Metric | 2026 | 2027-2030 |

|---|---|---|

| Price Trends | Flat to slight decline (-3-4% in GTA) | Modest recovery, slow climb back |

| Sales Activity | Expected to increase from lows, but below avg. | Gradual increase, approaching long-term avg. |

| Housing Starts | Potentially two-decade lows | Slight rebound beginning 2028 |

| Interest Rates | Bank of Canada rate ~2.25% | Gradual annual hikes to ~3.25% |

What This Means for You

If you're thinking of buying, the next year or so might offer more opportunities to negotiate. Patience could be your best friend. For those looking to sell, timing will be important, and setting realistic price expectations will be crucial.

Overall, I see a market that’s correcting itself after a period of rapid growth. It's not going to be an easy ride for everyone, but for those who understand the dynamics and plan wisely, there will still be opportunities in the Ontario real estate market over the next five years. It’s about adapting to a new normal, and knowing that even a slower market can offer its own rewards.

In 2026, U.S. real estate continues to deliver strong passive income opportunities. Cash‑flowing turnkey rentals in high‑demand markets provide investors with immediate ROI and long‑term appreciation potential.

Norada Real Estate helps investors acquire turnkey properties designed for consistent rental income and wealth building—making U.S. real estate one of the most reliable investment choices today.

Recommended Read:

- Canadian Housing Market Forecast for 2025 and 2026

- Will the Canada Housing Market Crash or Stabilize in 2025?

- Canada Housing Market Forecast for 2025 and 2026 by CREA

- Canadian Housing Market Predictions 2025: Rebound Ahead?

- Bank of Canada Cuts Interest Rates Due to Softening Economic Indicators

- Will the Canada Housing Market Crash?

- Canada Housing Market Outlook: A Shift Toward Healthier Territory

- Canada Real Estate Predictions for Next 5 Years

- Canada Interest Rate Forecast for Next 10 Years