Thinking about buying or selling a home? You're probably wondering what's going to happen with housing prices. Well, according to a recent report from J.P. Morgan, housing prices are expected to rise by about 3% in 2025. While this isn't the crazy price surge we saw a few years back, it's still something important to consider whether you're looking to make a move or just keeping an eye on your investment. Let's dive deeper into why they're predicting this and what it could mean for folks like you and me.

Housing Market Forecast 2025: J.P. Morgan's Predictions

Why the Continued Rise? Low Supply and Stubborn Interest Rates

Now, a 3% increase might seem modest, especially after the rollercoaster ride the housing market has been on. But to really understand why J.P. Morgan is predicting this, we need to look at a couple of key factors: low housing supply and interest rates that aren't dropping as much as some might hope.

From my perspective, and what the experts at J.P. Morgan are also pointing out, the biggest issue is that not a lot of people are selling their homes right now. Think about it: many homeowners locked in really low mortgage rates a few years ago. With current rates being significantly higher, it doesn't make a lot of financial sense for them to sell their place and then have to buy a new one at a much higher interest rate. This creates a sort of standstill in the market. If people aren't selling, there aren't as many houses available for those who want to buy.

John Sim, the head of securitized products research at J.P. Morgan, hit the nail on the head when he said that the lack of supply is primarily a “lock-in issue.” He pointed out that a large majority of borrowers have mortgage rates that are at least a full percentage point lower than what's currently available. That's a big disincentive to move!

Despite this low supply, demand from buyers has also been somewhat subdued, largely due to those higher interest rates making monthly mortgage payments less affordable. It's a bit of a Catch-22.

The “Wealth Effect” – A Key Reason for Price Stability

So, if both supply and demand are low, why aren't prices just staying flat or even dropping? This is where something called the “wealth effect” comes into play. According to J.P. Morgan, many current homeowners have built up significant equity in their homes, meaning they own a larger portion of their home's value outright. Additionally, growth in the stock market has boosted the wealth of many individuals.

In my opinion, this wealth provides a cushion. Even if affordability is stretched for some potential buyers, those who already own property are generally in a good financial position. This existing wealth, combined with some continued, albeit slower, demand, is expected to keep housing prices on an upward trajectory, even if it's at a “subdued pace,” as J.P. Morgan describes it.

Other Experts Agree: A General Consensus for Rising Prices

It's not just J.P. Morgan predicting a rise in housing prices for 2025. Reports from the National Association of Realtors and Redfin also anticipate an increase in the median existing home sales price, around 3.7%. This general agreement among different experts adds more weight to the expectation of continued price growth.

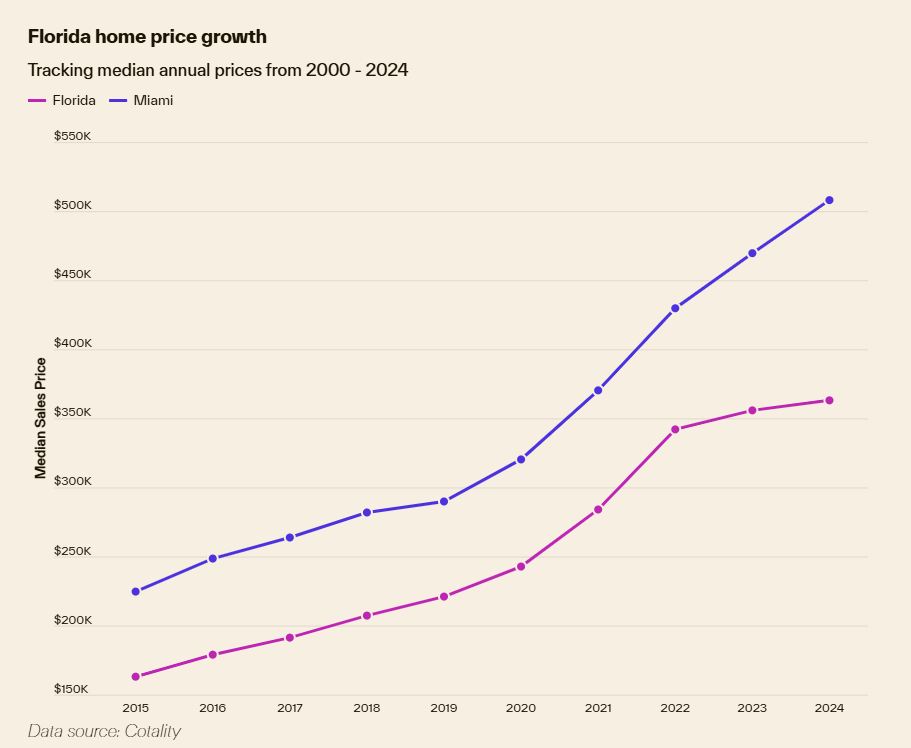

However, it's important to remember that these are national forecasts. Local market conditions can vary quite a bit. What's happening in one city or state might be very different from what's happening in another.

What Does This Mean for Future Homeowners?

If you're hoping to buy a home in 2025, this news might feel a bit discouraging. A 3% price increase, on top of already high prices and interest rates, can make the dream of homeownership even harder to reach.

- For First-Time Buyers: You might need to save even more for a down payment and closing costs. It also reinforces the importance of getting pre-approved for a mortgage to understand what you can realistically afford. Exploring different loan programs and down payment assistance options could also be beneficial.

- For Current Renters: If you're on the fence about buying, the expectation of rising prices might push you to consider making a move sooner rather than later, if your financial situation allows.

It's also worth noting that while mortgage rates are expected to ease slightly to around 6.7% by the end of 2025, according to J.P. Morgan, they aren't predicted to drop dramatically. This means affordability will likely remain a significant challenge for many.

What Does This Mean for Current Homeowners?

If you already own a home, the prediction of a 3% price increase in 2025 is generally positive news. It suggests that your property value is likely to continue appreciating, adding to your wealth.

- For Potential Sellers: While prices are expected to rise, the low supply situation means there might not be a huge rush of buyers. If you're planning to sell, it's still important to price your home competitively and make sure it's in good condition to attract potential buyers. However, you also need to consider where you'll go next and the higher interest rates you might face if you plan to buy another property.

The Wildcard: Potential Impact of a Second Trump Administration

J.P. Morgan also touched on the potential impact of a second Trump administration on the housing market. While specific housing policies haven't been detailed, some potential areas of influence include:

- Zoning Approval Processes: Proposals to streamline these processes could potentially speed up construction timelines and increase housing supply in the long run. However, this often happens at the local level.

- Federal Land Availability: Making more federal land available for building could also help increase the housing stock.

- Immigration Policies: More restrictive immigration policies could lead to labor shortages in the construction industry, potentially hindering new construction and exacerbating the supply issue. On the demand side, reduced immigration could theoretically lessen demand for housing, but the impact isn't straightforward.

John Sim from J.P. Morgan noted that cutting immigration could reduce the labor supply in construction, which might actually make affordable housing even harder to come by. It's a complex issue with potential unintended consequences.

Recommended Read:

Housing Market Predictions 2025 by Dave Ramsey: Will it Crash?

Efforts to Reduce Housing Costs: A Look at California

The high cost of housing, particularly in states like California, is a major concern. Lawmakers are exploring ways to make housing more affordable by addressing the lack of supply. In California, where there's an estimated shortage of 2.5 million homes, bipartisan legislators have proposed over 20 bills aimed at fast-tracking the housing approval process to make building easier and more efficient. These efforts highlight the recognition that increasing supply is a crucial step in tackling housing affordability.

My Final Thoughts: A Slow and Steady Market

Based on the data and expert opinions, including those from J.P. Morgan, it looks like the housing market in 2025 will continue to see price growth, but at a much slower and more “subdued” pace than what we've experienced in recent years. The combination of low existing home inventory due to the interest rate lock-in and a demand side that's being kept in check by affordability concerns is creating a somewhat frozen market.

While a 3% increase might not be dramatic, it's still a factor that potential buyers and sellers need to consider. For buyers, it means the window of opportunity for prices to drop significantly might not be opening anytime soon. For sellers, it suggests continued appreciation, but the lower demand might require a more strategic approach to selling.

Ultimately, the housing market is influenced by a complex interplay of economic factors, and while forecasts provide valuable insights, they aren't guarantees. It's always a good idea to keep a close eye on local market trends and consult with real estate professionals for advice tailored to your specific situation.

“Turnkey Real Estate Investing With Norada”

As housing market trends evolve from 2025 to 2029, smart investors are positioning themselves now. Norada offers access to prime, ready-to-rent properties that are built for long-term success.

Invest in areas poised for growth and secure your financial future with properties tailored for rental income and appreciation!

HOT NEW LISTINGS JUST ADDED!

Speak with our expert investment counselors today (No Obligation):

(800) 611-3060

Recommended Read:

- Housing Market Predictions for the Next 4 Years: 2025-2029

- Top 22 Housing Markets Where Prices Are Predicted to Rise the Most by 2026

- Housing Market Predictions 2026: Will it Crash or Boom?

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- 4 States Facing the Major Housing Market Crash or Correction

- Housing Prices Are Set to Rise by 4.1% by the End of 2025

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Will Real Estate Rebound in 2025: Top Predictions by Experts

- Will the Housing Market Crash Due to Looming Recession in 2025?