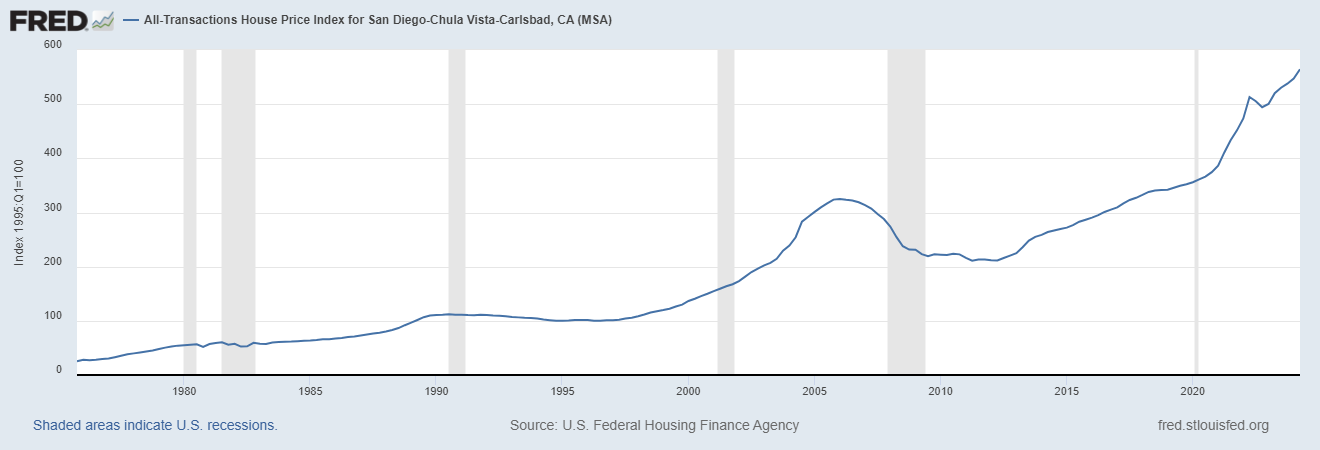

The San Diego housing market graph over the past 50 years tells a captivating tale of booms, busts, and everything in between. As someone who has closely watched this market, I've seen firsthand how it can leave you amazed and bewildered at the same time. Today, we'll break down this rollercoaster ride and try to understand the forces that have shaped San Diego real estate.

San Diego Housing Market Graph: A 50-Year Journey

Here's the graph showing the All-Transactions House Price Index for San Diego MSA.

The Early Decades: Steady Growth and Shifting Sands (1970s-1980s)

Peeking back at the San Diego housing market graph from 1975, we see the House Price Index hovering around 25.29. This period was marked by relatively steady growth, fueled by a developing economy and a growing population.

Key takeaways from this era:

- Interest rates played a major role. The 1970s saw high inflation, leading to fluctuating interest rates that sometimes made it tough for buyers to jump into the market.

- The '80s brought about change. Interest rates started to cool down, making homes more affordable and leading to increased demand. This period saw a significant upward swing in the San Diego housing market graph.

The Boom Years: Riding the Wave (1990s-2000s)

Fast forward to the 1990s, and the San Diego housing market graph takes a dramatic turn upwards. The dot-com boom brought an influx of wealth and jobs to the area, making San Diego a hotbed for real estate investment.

Here's what shaped this period:

- The rise of the tech industry. San Diego, with its pleasant weather and attractive lifestyle, became a magnet for tech professionals, further driving up demand for housing.

- Low interest rates made borrowing cheaper. This fueled the fire, making it easier for people to qualify for larger mortgages, further escalating home prices.

By the early 2000s, the San Diego housing market graph was on an unprecedented upward trajectory, with the House Price Index soaring above 300. The market was hot, with properties often receiving multiple offers and selling for well above asking price.

The Correction and Recovery: Weathering the Storm (2007-2012)

The San Diego housing market graph took a sharp downturn in the late 2000s with the onset of the global financial crisis.

Here's what happened:

- The subprime mortgage crisis. This crisis, triggered by risky lending practices, led to a wave of foreclosures nationwide, including in San Diego.

- The housing bubble burst. Prices that had risen at an unsustainable pace finally corrected, leading to a steep decline in the San Diego housing market graph.

The recovery in San Diego was relatively swift compared to other parts of the country. By the early 2010s, the San Diego housing market graph began to show signs of life.

The Current Chapter: A New Era of Growth? (2013-Present)

The San Diego housing market graph from 2013 onwards has been characterized by consistent, albeit more measured, growth. The House Price Index, while not reaching the dizzying heights of the early 2000s, has been steadily climbing.

Here's what's shaping the market today:

- Limited housing supply. San Diego faces a chronic shortage of housing inventory, with demand consistently outstripping supply. This is a key driver of the upward pressure on prices.

- Strong economic fundamentals. San Diego boasts a diverse and robust economy, with strong job growth in sectors like technology, healthcare, and tourism.

Looking at the Data: A Closer Examination

The data from the U.S. Federal Housing Finance Agency paints a clear picture of the San Diego housing market's journey over the past 50 years.

Let's take a look at some key data points from the All-Transactions House Price Index for San Diego-Chula Vista-Carlsbad, CA (MSA):

| Year | House Price Index | Key Trend |

|---|---|---|

| 1975 | 25.29 | Steady growth |

| 1985 | 66.11 | Significant upward swing |

| 2000 | 150.05 | Unprecedented upward trajectory |

| 2005 | 323.78 | Peak before the correction |

| 2010 | 222.72 | Beginning of recovery |

| 2020 | 374.44 | Consistent, measured growth |

| 2023 | 537.85 | Continued growth despite rising interest rates |

Looking Ahead: What's Next for the San Diego Housing Market?

Predicting the future of any real estate market is like trying to predict the weather – there are a lot of factors at play! However, by studying historical trends, analyzing current market indicators, and considering broader economic factors, we can make some educated guesses.

Here are some key things to watch out for:

- Interest rates: Rising interest rates can impact affordability and potentially slow down price growth.

- Inventory levels: A significant increase in housing supply could help moderate price increases.

- Economic conditions: A strong local economy will likely continue to support demand in the housing market.

Final Thoughts: Navigating Your Path in the San Diego Market

The San Diego housing market has certainly had its share of ups and downs over the past 50 years. But one thing remains constant: San Diego's desirable location, strong economy, and high quality of life continue to make it an attractive place to live. Whether you're a seasoned investor or a first-time homebuyer, understanding the cyclical nature of the market and doing your due diligence is key. Remember, every market cycle presents opportunities, and with careful planning and a long-term perspective, you can navigate the San Diego housing market with confidence.

Related Articles:

- San Diego Housing Market Forecast 2025: What to Expect

- San Diego Housing Market: Prices, Trends, Forecast

- Is San Diego’s Housing Getting Very Expensive: Experts Predict

- San Diego Housing Market Booms With 9.4% Growth: Expert Predictions

- San Diego Housing Market Predictions: Soaring and Expensive!

- San Diego Housing Market Predictions: Prices Skyrocket 11.4%; What's Next?

- Is San Diego Real Estate a Good Investment?