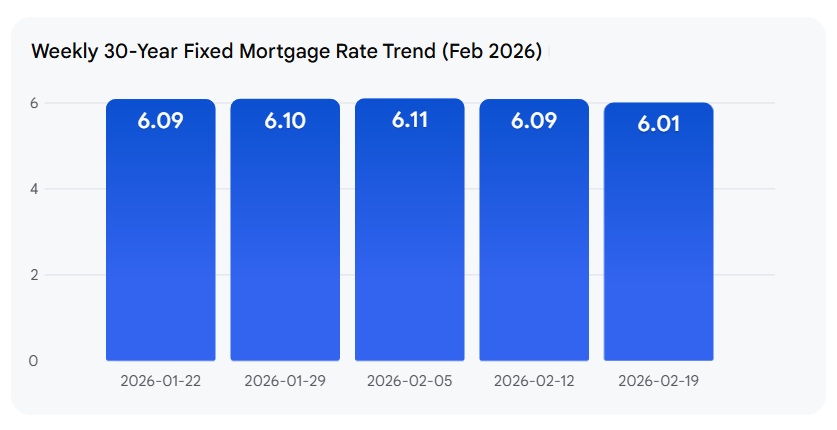

If you've been watching the housing market, you'll be happy to know that as of February 20, 2026, mortgage rates have hit their lowest point in over three years, with the popular 30-year fixed rate dropping to an impressive 6.01%. This is fantastic news for anyone looking to buy a home or even refinance their existing mortgage. It means your monthly payments could be significantly lower than you might have expected, and it's a reflection of some positive economic shifts. This downward trend is a welcomed change, largely fueled by cooling inflation and a drop in longer-term Treasury yields.

Today’s Mortgage Rates, Feb 20: Rates Hit Lowest in Over 3 Years, 30-Year Fixed Falls to 6.01%

What Are Today's Mortgage Rates Saying?

Let's break down what this means for you. According to Freddie Mac, the most common type of mortgage, the 30-year fixed-rate, saw its average fall to 6.01% for the week ending February 19th. That's down from 6.09% the week prior. For those considering a shorter loan term, the 15-year fixed-rate is looking even more attractive, dropping to 5.35% from 5.44% last week.

Comparing this to last year, the difference is pretty striking. This time in 2025, the average for a 30-year fixed was around 6.85%. That means today's rates are nearly a full percentage point lower, saving you a substantial amount of money over the life of your loan.

Now, Zillow Home Loans also provides its own snapshots of national average mortgage rates, and their data for February 20, 2026, echoes this positive trend. It’s always good to compare different sources, and Zillow’s numbers reinforce that rates are trending downwards compared to the same time last year.

Here’s a look at Zillow’s data:

| Loan Type | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed | 5.875% | 6.038% |

| 20-Year Fixed | 6.000% | 6.202% |

| 15-Year Fixed | 5.375% | 5.640% |

| 10-Year Fixed | 5.250% | 5.660% |

| 30-Year Jumbo | 5.875% | 6.054% |

| 7/6 ARM | 5.625% | 6.164% |

Specialty Loan Types also see benefits:

- 30-Year FHA loans are averaging around 5.625% interest (6.306% APR).

- For eligible military members, 30-Year VA loans are also at 5.625% interest (5.905% APR).

And for anyone looking to refinance, national averages for 30-year fixed refinances are holding steady, typically around 5.97%. This is a key takeaway – these lower rates aren't just for new buyers.

Why Is This Happening? The Economic Clues

It’s not magic; it’s economics at play. The primary driver behind this dip is the news on inflation. We’re seeing inflation cool down, which is exactly what the Federal Reserve watches closely. When inflation is in check, it reduces the pressure on the Fed to keep interest rates high.

Another significant factor is the slide in the 10-year Treasury yield. Mortgage rates often move in sync with these longer-term government bond yields. When yields on Treasury bonds fall, it generally signals lower borrowing costs for lenders, which they then pass on to consumers in the form of lower mortgage rates.

Mortgage Activity: A Refinance Rush and Eager Buyers

This change in rates isn't going unnoticed. The data shows a significant surge in refinancing applications. Last week alone, applications jumped by 7%, and the increase compared to a year ago is a staggering 132%. In fact, refinances now make up a hefty 57.4% of all mortgage applications. It’s clear that homeowners are recognizing these multi-year lows and are rushing to take advantage of potentially reducing their monthly payments or shortening their loan terms.

On the flip side, purchase applications have actually seen a slight dip of 3% last week. Now, don't let that discourage you. While lower rates are a huge draw, sometimes other factors can temper immediate buying enthusiasm. The persistent issue of limited housing supply in many areas and ongoing price pressures can still make finding the right home a challenge, even with more affordable financing.

However, there's a lot of optimism for the housing market in 2026. Many experts are predicting a real “thaw” in the housing market. They expect a significant increase in market fluidity, with sales volume potentially jumping by nearly 10% in certain regions. This is partly because the prolonged effect of the extremely low pandemic-era rates is starting to fade for some homeowners, making them more willing to sell and move.

What's Next for Mortgage Rates?

Looking ahead, the Federal Reserve's stance is crucial. They recently paused rate cuts in January after a series of reductions in late 2025. While more cuts are certainly possible later in 2026, many Fed officials are taking a wait-and-see approach, wanting to ensure inflation continues its downward path.

Interestingly, we've also seen some government intervention. Recent announcements about direct government purchases of mortgage-backed securities have helped in suppressing rates. This kind of action directly influences the availability and cost of mortgages.

So, what’s the forecast? Major agencies like Fannie Mae and the Mortgage Bankers Association are predicting that mortgage rates will remain relatively stable throughout much of 2026. They expect them to hover in the 6.0% to 6.3% range. This suggests that while we might not see drastic drops, the current lower levels could be here for a while, offering a consistent window of opportunity.

From my experience, these kinds of stable, lower rates are a sweet spot. They provide predictability for buyers and planners without the wild swings that can make financial decisions stressful. It’s a good time to get pre-approved and start exploring your options if homeownership or refinancing is on your mind.

Key Takeaways for Feb 20, 2026:

- Rates are Low: The 30-year fixed-rate average is at a multi-year low of 6.01% (Freddy data).

- Refi Boom: Homeowners are actively refinancing, with applications up significantly.

- Buying Market Nuance: Purchase demand is a bit slower due to supply and price issues, but future market fluidity is expected.

- Economic Drivers: Cooling inflation and lower Treasury yields are pushing rates down.

- Outlook: Rates are expected to remain relatively stable in the 6.0%-6.3% range for most of 2026.

This is a moment to pay attention and act if it aligns with your financial goals. Whether you're dreaming of a new home or looking to improve your current mortgage, the current rate environment is a powerful ally.

VS

Texas’s A‑rated rental with stability vs Ohio’s affordable property with higher cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to Our Investment Counselor (No Obligation):

(800) 611-3060

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?