Are you thinking about buying a home in 2025, or maybe you're looking to invest in real estate? If so, you're probably aware that the housing market has been going through a period of change. Some experts believe a housing market crash is looming in certain areas of the country.

This article aims to help you navigate these uncertain times by providing you with information about the 5 riskiest markets that could potentially face a major drop in home prices in 2025. Being prepared and understanding the potential risks associated with the housing market, even in specific areas can help you make sound decisions and protect your financial well-being. So, let's dive in and examine these markets in greater detail.

Housing Market Crash: 5 Riskiest Markets to Avoid in 2025

Understanding the Current Housing Market

As of November 2024, the national housing market has shown signs of slowing down. Home prices increased by 3.4% year-over-year in September 2024. However, month-over-month growth has been rather flat since late summer. In fact, home price growth is projected to decline slightly from September 2024 to October 2024 before seeing a modest year-over-year increase by 2.3% from September 2024 to September 2025. Several factors contribute to this relatively flat market.

- Mortgage Rate Volatility: Mortgage rates have been fluctuating, causing some buyers to hesitate before making a purchase. The potential impact of the upcoming election is adding uncertainty to the overall market.

- Economic Uncertainty: The U.S. economy showed a weak job growth number of just 12,000 jobs in October 2024, the fewest in nearly four years. This kind of news can make people nervous about the economy's future and their ability to afford a home.

- Buyer Hesitation: Many homebuyers have decided to wait and see what happens with mortgage rates and the overall economy before they commit to buying a home. They believe that there might be a better opportunity in the future.

These factors are contributing to a cautious outlook on the housing market. Now, let's see which areas are most vulnerable to a housing market crash in 2025.

CoreLogic's Market Risk Indicator (MRI)

I always like to use the resources that provide the most reliable and up-to-date information on the housing market crash. CoreLogic is a leading provider of property information and analytics. They have a very useful tool called the Market Risk Indicator (MRI). This tool provides insights into the overall health of the housing market across the country and, in my opinion, it is one of the best resources to utilize for assessing potential housing market crash risk in various locations.

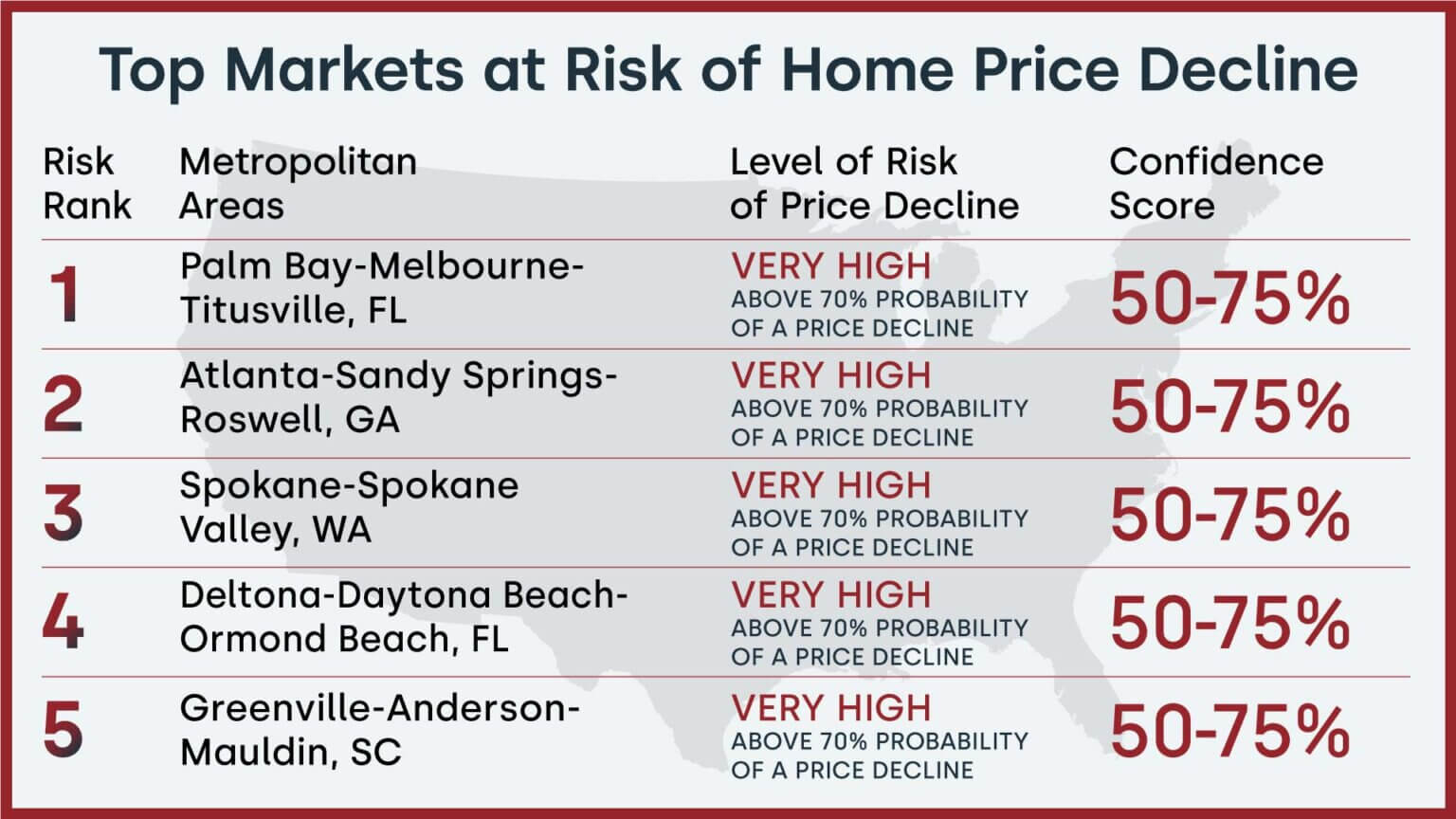

The MRI considers various factors to determine the probability of a home price decline in a particular area. This includes things like job growth, affordability, inventory levels, and the overall state of the local economy. Based on the CoreLogic MRI, five metropolitan areas are at a very high risk of a home price decline over the next 12 months.

5 Riskiest Housing Markets to Avoid in

Now let's dive deeper into the five metropolitan areas that are facing the highest risk of a home price decline based on CoreLogic's MRI. It's important to remember that these are predictions, and actual results may vary.

1. Provo-Orem, UT

- Risk Level: Very High

- Probability of Price Decline: Above 70%

- Confidence Score: 50-75%

Provo-Orem, located in the heart of Utah, experienced explosive growth during the pandemic and it is still a very popular location. This growth fueled a surge in home prices, but now the market appears to be cooling down, potentially leading to a price decline.

My thoughts: I believe that the market in Provo-Orem was simply too hot too fast. The prices were out of sync with fundamentals like local wages, which were not keeping up with price appreciation. Now, with interest rate uncertainty and the cooling economy, this market is becoming vulnerable.

2. Atlanta-Sandy Springs-Roswell, GA

- Risk Level: Very High

- Probability of Price Decline: Above 70%

- Confidence Score: 50-75%

Atlanta, like many other Southern metropolitan areas, has experienced a strong housing market in recent years. However, it has become more vulnerable to a downturn due to rising interest rates, supply chain disruptions, and overall economic uncertainty.

My thoughts: Atlanta has a strong history as a major business hub. While the metro area might experience a pullback, I think a decline in prices would be relatively short-lived. The economy will eventually rebound, and homebuyers will return to the market. But in the short-term, I would be cautious about buying a home in Atlanta.

3. Salt Lake City, UT

- Risk Level: Very High

- Probability of Price Decline: Above 70%

- Confidence Score: 50-75%

Salt Lake City was one of the fastest-growing housing markets in the United States, and during that time the median home price increased by a significant amount. However, like Provo-Orem, a rapid rise in prices and cooling economy could lead to a price correction.

My thoughts: The Salt Lake City metro area has lots of economic drivers and is a beautiful location. The concerns here are very similar to those of Provo-Orem. The market heated up too quickly and might be in for a decline over the next year.

4. Gainesville, FL

- Risk Level: Very High

- Probability of Price Decline: Above 70%

- Confidence Score: 50-75%

Gainesville is a college town with a large student population. This can sometimes make housing markets more volatile. The Gainesville market is at risk due to several factors like affordability concerns and a potential slowdown in student enrollment.

My thoughts: Gainesville has historically been a reliable housing market, and the presence of the University of Florida adds stability. But, the market is still vulnerable to interest rate hikes and economic uncertainty.

5. Palm Bay-Melbourne-Titusville, FL

- Risk Level: Very High

- Probability of Price Decline: Above 70%

- Confidence Score: 50-75%

Palm Bay-Melbourne-Titusville is a region that is reliant on the aerospace and defense industries. While the local economy is strong, it also makes the area subject to changes in federal spending. With a large supply of homes and a cooling economy, the market is vulnerable to price declines.

My thoughts: Palm Bay-Melbourne-Titusville has a strong economy, but the high concentration of employment within a few industries means that it's vulnerable to changes in defense spending and other factors. The risks are certainly present in this area.

Understanding the Risks and Mitigating Them

While these five areas are identified as high-risk, it's crucial to remember that not all homes in these markets will necessarily experience the same level of price decline. Homes that are in excellent condition, well-located, and offer desirable features will likely hold their value better during a downturn.

Here are some tips to consider if you're looking to buy a home in these high-risk markets:

- Do your homework: Research the local market and understand the factors that contribute to the risk of a housing market crash. Look at recent sales data, inventory levels, and economic indicators.

- Don't overpay: Avoid getting caught up in bidding wars or paying top dollar for a home. Try to negotiate the best price possible to protect your investment.

- Get pre-approved for a mortgage: Knowing how much you can afford will help you avoid overspending on a home.

- Consider your personal financial situation: Make sure you can afford your mortgage payments even if home prices decline.

- Be prepared for a possible price drop: If you are in the high-risk areas, have a strategy for how you will deal with a potential decrease in home value.

- Be realistic about your expectations: Don't expect to get rich quick by investing in real estate, especially in a potentially volatile market.

Factors to Consider Beyond the MRI

While the CoreLogic MRI is a valuable tool, it is important to consider other factors that could influence the housing market in these areas. For example:

- Local job market: Strong local job growth can help support home values.

- New construction: An increase in new homes can put downward pressure on prices.

- Interest rates: Rising interest rates will likely reduce affordability and slow down the market.

- Inventory levels: If the number of homes for sale increases, it could lead to a price decline.

The Bottom Line

The housing market is dynamic, and prices can fluctuate based on various economic and local factors. The five markets highlighted above are at a high risk of experiencing home price declines in the next 12 months, according to CoreLogic's MRI.

It is my belief that you should proceed with caution in these markets. If you are considering buying a home, it is essential to do your research, understand the risks, and make informed decisions.

I hope this article has helped you better understand the potential risks and provided valuable information to help you make informed decisions about your real estate goals in 2025.

Recommended Read:

- 3 BIG Cities Facing High Housing BUBBLE Risk: Crash Alert?

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- Will Fed's Policy Lead to a Crash in the Housing Market?

- San Francisco Housing Market Crash 2025: Will it Happen?

- 3 Florida Housing Markets Are Again on the Brink of a Crash

- Will Housing Be Cheaper if the Market Crashes in 2025?

- UK Housing Market Forecast 2025: Crash or Correction?

- When Will the Housing Market Crash Again in California?

- AZ Housing Market Forecast 2025-2026: Will it Crash?