The Edmond housing market is showing signs of being somewhat competitive in January 2025. While homes are selling faster than they were a year ago, the overall picture suggests a market that's adjusting to changes in interest rates and buyer demand. Read on to find a more comprehensive breakdown of what these trends mean for you if you're looking to buy or sell a home in Edmond, Oklahoma.

It's no secret that navigating the real estate world can feel like trying to solve a complicated puzzle. As someone who keeps a close eye on the local housing market, I'm here to break down the latest Edmond housing market trends and help you understand what's really happening. We'll look at everything from home prices and sales to housing supply and the impact of mortgage rates. Let's dive in!

Current Edmond Housing Market Trends

According to Redfin, here's a summary of the Edmond housing market:

Home Sales

- In December 2024, there were 146 homes sold in Edmond, which is a 28.1% increase compared to the 114 homes sold in December of the previous year. That's quite a jump! It indicates there's still activity in the Edmond market, even with higher interest rates.

Home Prices

- The median sale price of a home in Edmond in December 2024 was $389,220.

- This is a significant 17.5% increase compared to the median sale price last year.

- The median sale price per square foot in Edmond is $168, up 3.1% since last year.

Are Home Prices Dropping?

From the data we see, home prices in Edmond are not currently dropping. In fact, they're up considerably compared to last year. However, it's important to remember that real estate is local. What's happening nationally or even in Oklahoma City may not be exactly what's happening in your desired Edmond neighborhood. It's crucial to work with a local real estate agent who can give you hyper-local insights.

Comparison with Current National Median Price

How does Edmond stack up against the rest of the country?

- The national median home price is $407,500 (December 2024)

- Edmond's median sale price is 10% lower than the national average.

This suggests that Edmond continues to offer a relatively affordable housing option compared to many other parts of the United States. While Edmond's prices are up 17.5% year-over-year, the national median price only saw a 6% rise year-over-year.

Housing Supply

Redfin data doesn't explicitly state the current housing supply in Edmond. However, the fact that homes are selling faster than last year suggests that the inventory is still relatively tight. It's also crucial to consider the type of homes available. Are they mostly new construction, or are there plenty of existing homes on the market? A real estate agent can provide the best insights into the specific types of properties available in Edmond right now.

Is It a Buyer's or Seller's Housing Market?

- Homes in Edmond are receiving 2 offers on average.

- Homes sell in approximately 52 days.

- Homes sell for about 2% below list price.

Based on these factors, I'd say Edmond is leaning towards being a slightly competitive market overall. It's not a screaming seller's market where homes are flying off the shelves for over asking price, but it's also not a buyer's market where buyers have all the negotiating power. It seems like a balanced market where both buyers and sellers need to be strategic.

To further illustrate, consider this breakdown:

| Metric | Edmond, OK (Dec 2024) | Change YoY |

|---|---|---|

| Median Sale Price | $389,220 | +17.5% |

| Number of Homes Sold | 146 | +28.1% |

| Median Days on Market | 52 | +27 days |

| Sale-to-List Price | 98.0% | -0.33 pt |

| Homes Sold Above List Price | 14.4% | -8.4 pt |

| Homes With Price Drops | 16.6% | -2.0 pt |

Market Trends

Several key trends are shaping the Edmond housing market right now:

- Rising Home Prices: As the data clearly shows, home prices in Edmond have been on the rise. This is likely due to a combination of factors, including strong local economy, population growth, and relatively limited housing supply.

- Increased Sales Volume: The number of homes sold is up significantly compared to last year, indicating sustained buyer interest.

- Slightly Longer Time on Market: While homes are still selling, they're taking a bit longer to do so compared to the rapid pace of the past few years. This suggests that the market is cooling down slightly.

- Sellers Negotiating More: The sale-to-list price ratio being below 100% indicates that buyers are having slightly more success negotiating prices down from the original list price.

Impact of High Mortgage Rates

There's no getting around it: mortgage rates play a huge role in the housing market. Currently, with rates hovering around 7%, it's impacting affordability for many potential buyers. Here's how:

- Reduced Buyer Demand: Higher rates mean higher monthly payments, which can price some buyers out of the market or cause them to scale back their budget.

- Slower Price Appreciation: While prices are still rising in Edmond, the pace of growth may be tempered by higher mortgage rates.

- Increased Importance of Negotiation: With less competition, buyers have more room to negotiate on price and terms.

Impact of Migration

Migration also has a significant impact on housing trends.

- 18% of Edmond homebuyers searched to move out of Edmond, while 82% looked to stay within the metropolitan area.

- Across the nation, 0.31% of homebuyers searched to move into Edmond from outside metros.

- Dallas homebuyers searched to move into Edmond more than any other metro followed by Los Angeles and Miami.

- McAlester was the most popular destination among Edmond homebuyers followed by Nashville and Pensacola.

This information indicates that migration out of Edmond is very low, which should translate into continued demand in Edmond.

What This Means for Buyers

If you're a buyer in the Edmond housing market, here's what you should keep in mind:

- Get Pre-Approved: Knowing your budget is more important than ever with rising interest rates. Get pre-approved for a mortgage so you know exactly how much you can afford.

- Be Patient and Strategic: The market is competitive, but not as frantic as it was a year or two ago. Take your time, do your research, and don't feel pressured to overpay.

- Find a Great Real Estate Agent: A local agent who knows Edmond inside and out can be your greatest asset. They can help you find the right property, negotiate effectively, and navigate the complexities of the market.

What This Means for Sellers

If you're thinking of selling your home in Edmond, here's what you need to know:

- Price Strategically: Don't overprice your home based on past market conditions. Work with your agent to determine a competitive list price that will attract buyers in today's market.

- Make Your Home Show Ready: Presentation matters. Make sure your home is clean, well-maintained, and decluttered before listing it.

- Be Prepared to Negotiate: Buyers have more leverage than they did a year ago, so be prepared to negotiate on price and terms.

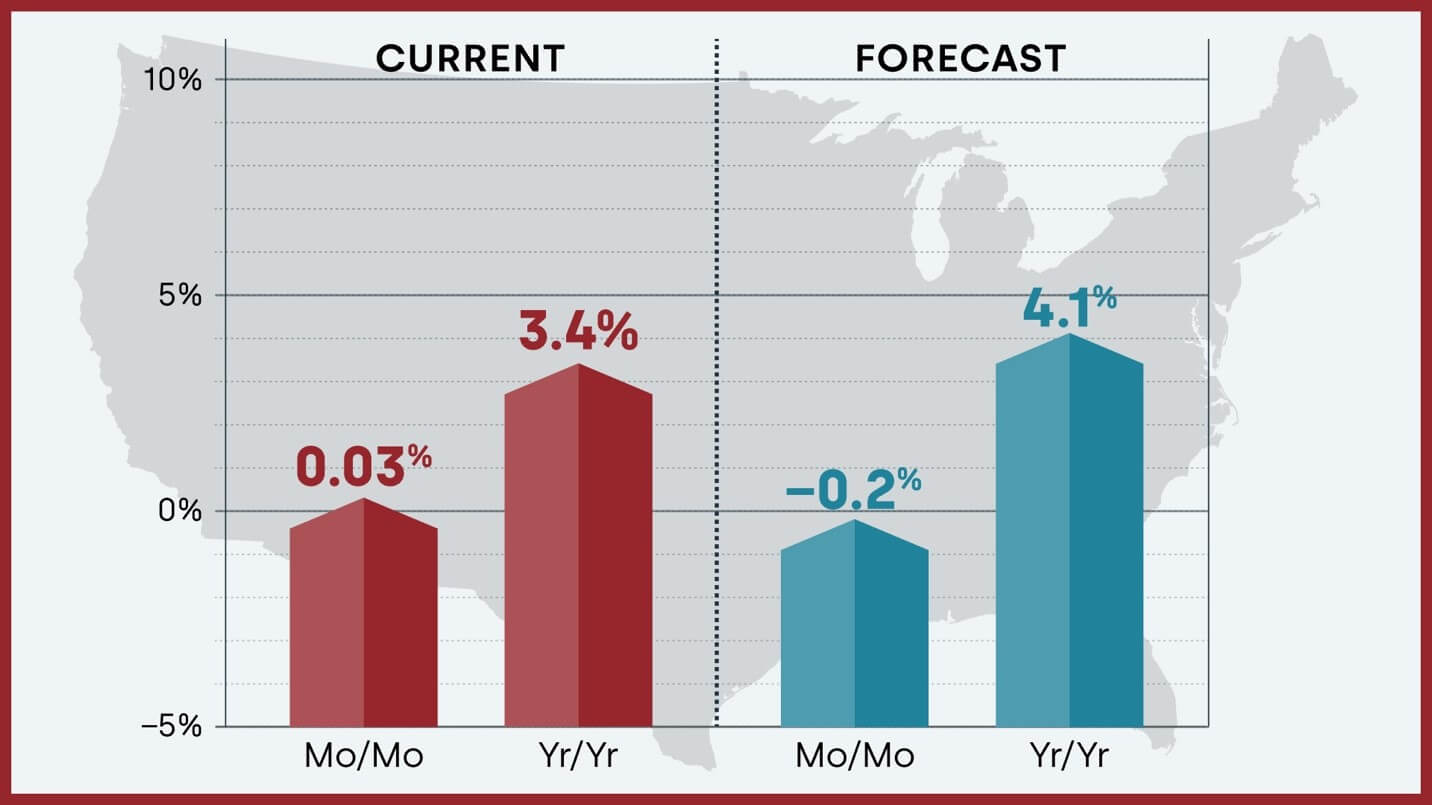

Edmond OK Housing Market Forecast 2025-2026

Predicting the housing market can feel like peering into a crystal ball. For Edmond, OK, several factors and trends can provide insight into whether the market will crash or boom in the coming years.

Will Edmond Housing Market Boom?

- Economic Stability:

- Edmond's economy is relatively stable, driven by sectors like education, health care, and technology. A stable economy can foster confidence and spending in the housing market.

- Population Growth:

- As of recent reports, Edmond continues to witness steady population growth. More people looking to settle in Edmond can drive demand for housing, potentially pushing prices up.

- Low Housing Supply:

- Over the past year, the market has been heavily tilted in favor of sellers due to low inventory levels. If this trend continues, combined with sustained demand, property values may see a rise.

- Quality of Living:

- Edmond is renowned for its high quality of life, excellent schools, safe neighborhoods, and abundant amenities. These factors are continually attracting new residents, fueling housing demand.

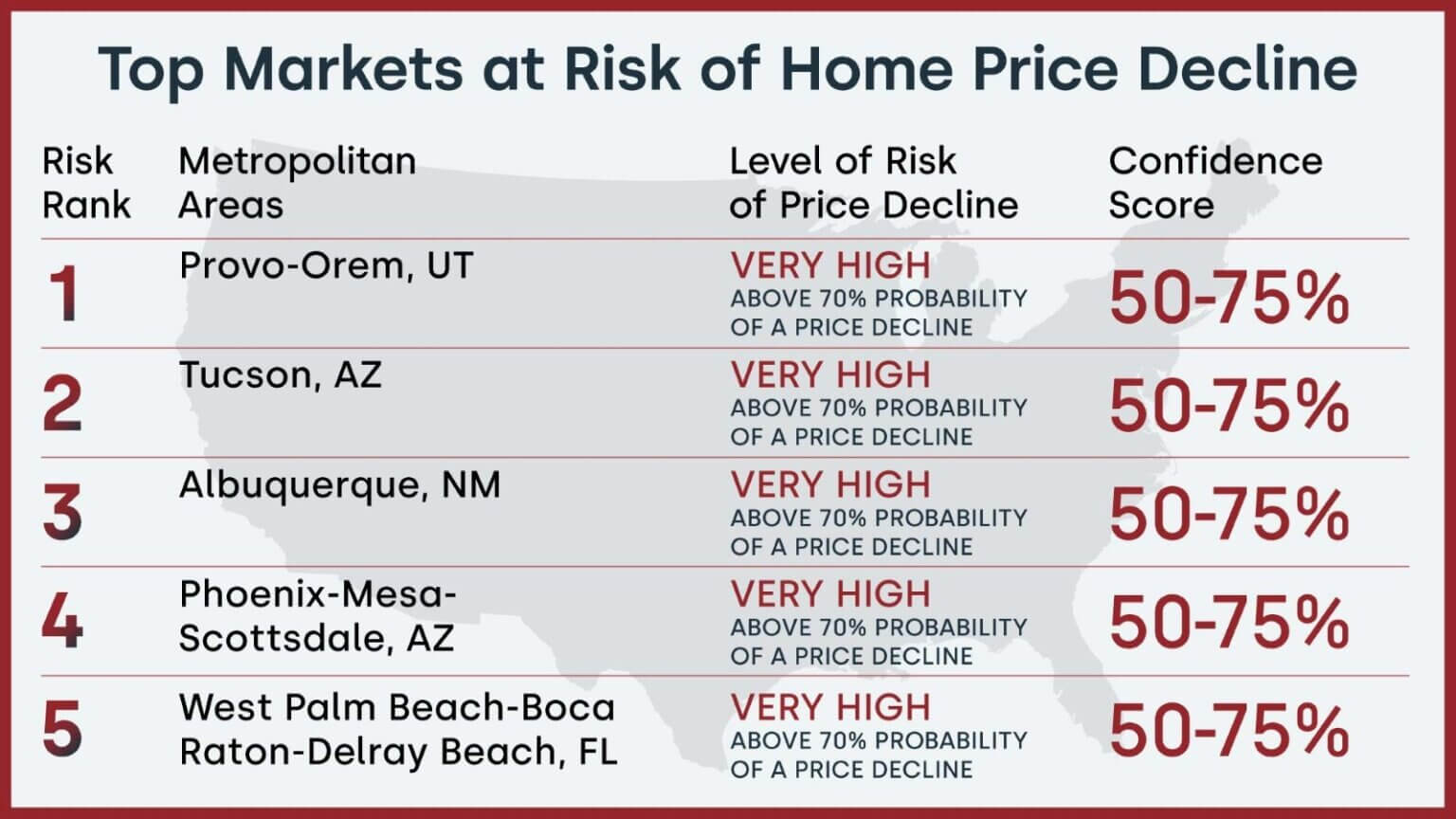

Will The Edmond Housing Market Crash?

- Interest Rates:

- The Federal Reserve's interest rate adjustments can influence mortgage rates. Significant rate hikes could make borrowing more expensive, potentially cooling down the housing market.

- Economic Uncertainty:

- Broader economic challenges, such as inflation or market instability, can reduce consumer confidence and spending power, including in the housing sector. Any economic downturn would likely impact housing demand.

- Increased Housing Supply:

- Should there be a significant increase in housing construction and inventory, the balance could shift from a seller’s to a buyer’s market. This shift might temper ongoing price increases.

- Affordability Issues:

- If home prices continue rising faster than incomes, affordability could become a significant barrier for many potential buyers. This issue could dampen demand and result in a market correction.

In summary, the Edmond, OK housing market is poised for moderate, sustained growth rather than dramatic booms or busts. Several factors, ranging from economic stability and population growth to evolving interest rates, will influence the market's trajectory. While the immediate future may not herald a significant increase in prices, nor is a dramatic downturn likely. Buyers and sellers can expect a relatively balanced market with stable growth prospects.

Investing in the Edmond OK Real Estate Market?

1. Population Growth and Trends

Edmond, OK, has experienced consistent population growth in recent years, contributing to a robust real estate market. The city's appeal has led to an influx of residents, creating a positive environment for real estate investment.

2. Economy and Jobs

- Thriving Economy: Edmond boasts a thriving economy, supported by diverse industries and a strong job market.

- Employment Opportunities: The presence of major employers, including educational institutions and healthcare facilities, provides stability and attracts a steady workforce.

3. Livability and Other Factors

- Livability: Edmond is renowned for its excellent schools, safe neighborhoods, and quality of life, making it an attractive location for residents and investors alike.

- Community Amenities: The city offers a range of amenities, including parks, restaurants, and shopping, enhancing its overall appeal.

4. Rental Property Market Size and Growth

The rental property market in Edmond is substantial, and its growth potential is notable for investors seeking consistent returns. Factors contributing to this include:

- High Demand: The city's growing population and employment opportunities contribute to a high demand for rental properties.

- Rental Yield: Favorable rental yield trends make Edmond an attractive destination for investors seeking income-generating properties.

5. Other Factors Related to Real Estate Investing

- Market Stability: Edmond's stable real estate market, coupled with positive growth indicators, provides a sense of security for investors.

- Future Projections: Ongoing developments and city initiatives point towards a promising future, enhancing the long-term viability of real estate investments.

Considering these factors, investing in the Edmond OK real estate market presents a compelling opportunity for those seeking a thriving and stable investment environment.