The Oklahoma City housing market remains favorable for sellers. The demand for homes and the competitive pricing indicate a seller's market. The average price rose to $282,651, reflecting a positive trend in the market. Based on the current data, there is no indication of an imminent market crash. The stability in total closed transactions, dollar volume, and pricing suggests a resilient housing market in Oklahoma City.

Current Oklahoma City Housing Market Trends

Market Activity in Numbers

According to the recent data provided by MLSOK, Inc., in January 2024, **1321** properties found their new owners, reflecting a **17% decrease** from the previous month's total of **1606**, yet marking a **7% increase** from January 2023's figure of **1225** closed transactions. While the number of closures experienced a slight dip, the total dollar volume paints a resilient picture. The market saw transactions amounting to **$373,382,232** in January 2024, compared to **$463,830,984** in December 2023 and **$345,597,992** in January 2023.

Price Trends: A Closer Look

The average selling price in January 2024 stood at **$282,651**, marginally lower than December 2023's figure of **$288,811**. However, this slight dip does not overshadow the year-on-year growth, with January 2024's average price reflecting a **0.2% increase** from January 2023's **$282,121**. Similarly, the median price, a metric often indicative of market stability, showcased a steady climb. January 2024 saw a median price of **$240,000**, compared to **$243,450** in December 2023 and **$237,000** in January 2023.

Market Dynamics: The Seller's Standpoint

For sellers, the **97%** selling price to list price ratio in January 2024 echoes the competitive spirit of the Oklahoma City housing market. This figure remained consistent both in December 2023 and January 2023, indicating a sustained balance between listed prices and actual selling values. Additionally, the average days on market stood at **48**, showcasing a slight increase from December 2023's **43** days and January 2023's **41** days. While this uptick may hint at a marginally longer wait period for sellers, the market's resilience remains intact.

The Inventory Landscape

As we delve into the inventory metrics, Oklahoma City presents a mixed bag for both buyers and sellers. Currently, the market boasts **5489** active listings, showcasing a modest decrease from December 2023's figure of **5694**. However, this number reflects a substantial **20% increase** from January 2023's inventory of **4582** listings. This uptick in available properties may offer buyers a broader selection, potentially influencing their decision-making process.

Future Outlook: Navigating Market Trends

Looking ahead, the Oklahoma City housing market appears poised for continued growth and stability. With an evolving inventory landscape and resilient price trends, both buyers and sellers can anticipate a dynamic yet balanced market in the months to come. However, as with any market, staying abreast of evolving trends and leveraging expert guidance remains paramount for navigating the nuances of real estate transactions.

Oklahoma City Housing Market Forecast for 2024 and 2025

The Oklahoma City housing market has been a focal point for homeowners and investors alike. Based on the forecast and current trends, there is no immediate risk of a housing market crash in Oklahoma City; however, continual monitoring is essential.

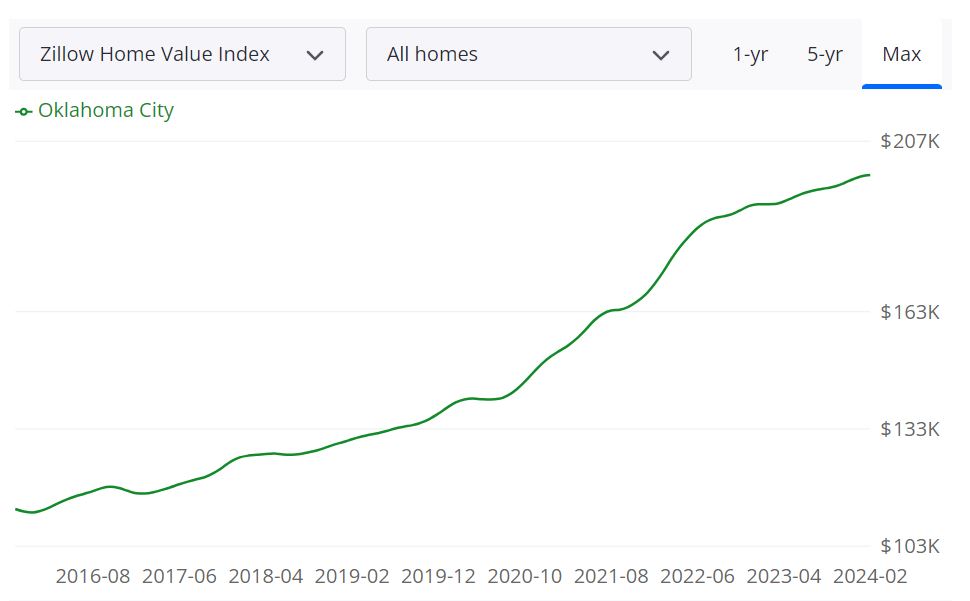

In the Oklahoma City housing market, the average home value stands at $198,826, reflecting a 3.9% increase over the past year. Homes in this area typically go pending within approximately 19 days. According to Zillow, as of February 29, 2024, there are 1,550 homes listed for sale with 472 new listings added.

The median sale to list ratio as of January 31, 2024, is 0.988, indicating homes are selling very close to their list price. The median sale price is $192,667, while the median list price stands at $268,300 as of February 29, 2024. Additionally, 23.4% of sales are recorded above the list price, with 56.2% below the list price, both as of January 31, 2024.

Oklahoma City MSA Housing Market Forecast

The Oklahoma City Metropolitan Statistical Area (MSA) encompasses various counties within the state of Oklahoma. Its housing market is predicted to experience gradual growth in the coming months. According to the forecast data provided for March 31, 2024, the region is expected to see a 0.3% increase, followed by a 0.5% rise by May 31, 2024, and a 0.6% increase by February 28, 2025.

The Oklahoma City MSA includes several counties such as Oklahoma County, Cleveland County, Canadian County, and Logan County. With a diverse mix of urban and suburban areas, this MSA represents a significant portion of the state's housing market. It encompasses various neighborhoods, each offering distinct features and amenities to residents.

Given its size and diversity, the Oklahoma City MSA's housing market plays a crucial role in the state's overall real estate landscape. It serves as a hub for economic activity and residential development, attracting buyers and sellers from both within and outside the region.

Is Oklahoma City a Buyer's or Seller's Housing Market?

Currently, the Oklahoma City housing market leans slightly towards sellers, as indicated by the relatively low inventory of available homes and the high percentage of sales occurring at or above the list price. With fewer homes on the market compared to the demand from buyers, sellers have more negotiating power and may receive multiple offers for their properties.

Are Home Prices Dropping in Oklahoma City?

As of the latest data, there is no indication of home prices dropping in the Oklahoma City housing market. On the contrary, the average home value has increased by 3.9% over the past year, suggesting a trend of appreciation rather than depreciation. However, it's essential to monitor market conditions regularly as fluctuations can occur due to various factors such as economic changes, interest rates, and housing supply.

Will the Oklahoma City Housing Market Crash?

While it's impossible to predict the future with certainty, there are currently no signs pointing to an imminent housing market crash in Oklahoma City. The market has shown resilience and stability, with moderate growth projected in the forecast data. However, it's essential for buyers, sellers, and investors to exercise caution, conduct thorough research, and consult with real estate professionals to make informed decisions.

Is Now a Good Time to Buy a House in Oklahoma City?

For prospective buyers considering purchasing a home in Oklahoma City, now can be a favorable time, given the current market conditions. Although competition may be stiff due to the seller-leaning market, interest rates remain relatively low, making homeownership more affordable for many. Additionally, with the projected growth in home values, buying now could potentially lead to long-term appreciation and investment returns.

Oklahoma City Real Estate Investment Overview

Should you consider Oklahoma City real estate investment? Many real estate investors have asked themselves if buying an Oklahoma investment property is a sound investment decision. Oklahoma City has seen steady growth in both its population and its economy over the years. With a low cost of living and a diverse range of industries, it's a great place to invest in real estate.

Here are some reasons why:

Steady Growth in Oklahoma City & Its Property Values

The city's population has grown by nearly 10% over the past decade, and it's projected to continue growing. This means that demand for housing is likely to remain strong, which should keep property values on the rise. In fact, the average home value in Oklahoma City has increased by 7.7% over the past year, which is a strong indication of the city's economic growth and stability.

Good Rental Market

Oklahoma City's rental market is also very strong, with low vacancy rates and rising rents. This makes it a great place to invest in rental properties, as you're likely to have a steady stream of tenants. The city also has a diverse range of industries, including aerospace, healthcare, and energy, which means there are plenty of job opportunities for renters.

As of January 2024, the median rent for all bedroom counts and property types in Oklahoma City, OK is $1,245. This is -36% lower than the national average. Rent prices for all bedroom counts and property types in Oklahoma City, OK have decreased by 3% in the last month and have increased by 4% in the last year.

It Is Landlord Friendly

Oklahoma City is known for being landlord-friendly, with relatively low taxes and minimal regulations. Landlords have the freedom to set their own rents and can evict tenants more easily than in some other states. This makes it easier for investors to manage their properties and generate a positive cash flow.

Landlords can evict a tenant in Oklahoma City for failure to pay rent, criminal activity, and material breaches of the lease. If the landlord wants to evict them for a breach of lease, a ten-day written notice is required in which the tenant has to solve the issue.

If they don’t, they can be given 15 days to leave. If a landlord wants to evict a tenant for nonpayment of rent, he or she must first give the tenant a 5-day written notice for payment of rent. If the tenant does not pay rent within 5 days, the landlord may proceed with the eviction of the tenant. The only exception is a criminal activity that poses a health or safety threat to tenants and those around them – you can evict someone immediately for that. This includes illegal drug activity in a unit. Eviction can proceed five days after failing to pay the rent.

Conclusion

In conclusion, Oklahoma City offers a great opportunity for real estate investors. With steady growth in its economy and property values, a strong rental market, and landlord-friendly policies, it's a great place to invest in real estate. Whether you're looking for a rental property or a fix-and-flip opportunity, Oklahoma City should definitely be on your radar.

There are pockets where you could tap into a large pool of renters such as around one of the many universities, though other neighborhoods are dominated by families that want more space but cannot afford to buy a home.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Oklahoma City.

Consult with one of the investment counselors who can help build you a custom portfolio of Oklahoma City turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Oklahoma City.

Not just limited to Oklahoma but you can also invest in some of the best real estate markets in the United States. All you have to do is fill out this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Oklahoma City turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

References

Market Data, Reports & Forecasts

https://okcmar.org/

https://okcmar.org/mls-dept-info/mls-statistics/

https://www.zillow.com/oklahoma-city-ok/home-values/

https://www.littlebighomes.com/real-estate-oklahoma-city.html

https://www.redfin.com/city/14237/OK/Oklahoma-City/housing-market

https://www.realtor.com/realestateandhomes-search/oklahoma-city_OK/overview

https://www.neighborhoodscout.com/ok/oklahoma-city/real-estate#description

https://okcfox.com/news/local/oklahoma-forward-riding-the-housing-market-roller-coaster-during-the-pandemic

Rental Trends

https://www.rentcafe.com/average-rent-market-trends/us/ok/oklahoma-city/

https://www.rentjungle.com/average-rent-in-oklahoma-city-rent-trends/

Low volatility

https://smartasset.com/mortgage/best-cities-first-time-homebuyers-2017

https://www.bestplaces.net/compare-cities/tulsa_ok/oklahoma_city_ok/people

Cost of living, including rents

https://www.numbeo.com/cost-of-living/compare_cities.jsp?country1=United+States&city1=Tulsa%2C+OK&country2=United+States&city2=Oklahoma+City%2C+OK

Landlord friendly

https://www.avail.co/education/laws/oklahoma-landlord-tenant-law

Core to Shore downtown redevelopment

https://newsok.com/article/5571657/major-players-in-oklahoma-citys-downtown-development-to-speak-dec.-4

https://www.okc.gov/government/maps-3/projects/downtown-convention-center

Slow multifamily housing permits

https://www.greateroklahomacity.com/subresources/economic-indicators/