If you are like most people approaching retirement, you have probably spent years stressing over 401(k) statements and worrying about inflation eroding your hard-earned savings. Real estate investment offers a powerful antidote to that stress, providing tangible income and a hedge against rising costs, but timing and location are everything.

Where Should Retirees Invest in Real Estate?

The best places for retirees to invest in real estate are those that strike the right balance—offering low state taxes (like Florida and Texas), affordable median home prices under $350,000, and strong rental demand from senior populations. These markets provide both a comfortable lifestyle and a dependable income stream.

I’ve spent the last two decades watching markets shift, and what works for a young flipper in a major metro often fails for a retiree needing stable cash flow and low maintenance. Retirement investing isn't about chasing the highest appreciation; it’s about resilience and predictability.

We are looking for places where 10,000 Baby Boomers retiring daily are moving, driving up demand for rentals and maintaining property values without the volatile swings seen in major coastal cities.

In this comprehensive guide, I will take you beyond the raw numbers. We’ll dive into why Pittsburgh is a superior investment to most Sunbelt spots right now, how tax policies can add thousands back into your pocket every year, and what to look out for regarding insurance and climate risks. Let's explore the places where your nest egg can truly start working for you.

Before we jump into specific locations, we need to talk strategy. A retiree has a completely different set of priorities than a younger investor. When I talk to clients nearing or already in retirement, their three main concerns are liquidity, passive income, and minimizing taxes.

Retirees Need Cash Flow Over Capital Gains

For younger investors, it’s all about appreciation—buying a property for $300,000 and hoping it hits $500,000 in five years. But retirees typically need steady cash flow to supplement Social Security and pension income. This means we prioritize markets with low entry costs and strong rental yields, even if annual appreciation is a modest 3% or 4%.

When I look at markets like Boise, Idaho, which boasts an incredible 11.3% appreciation, I see high entry costs ($540,000 median) that require a huge amount of capital upfront. While great for wealth building, it’s not ideal for someone who needs that money liquid or generating immediate passive income. Conversely, a place like Pittsburgh, with a $250,000 median, allows you to potentially buy two properties for the price of one in Boise, doubling your rental income stream right away.

Retirees Should Also Benefit from the Tax Shield Effect

Taxes are perhaps the single biggest factor that separates a good retirement location from a great investment location. States without income tax (like Florida, Texas, and Washington) allow you to keep every penny of your IRA distributions, pensions, and capital gains.

- No State Income Tax: This is a huge win for retirees, as it immediately shields income that other states would chip away at.

- Social Security Exemptions: Many states, like South Carolina and Virginia, exempt Social Security benefits from state tax, even if they have a standard income tax.

- Homestead Exemptions: Look for robust property tax exemptions for seniors, which can substantially lower your carrying costs if you plan to live in the home.

The Healthcare Multiplier

For retirees, the quality and proximity of healthcare are non-negotiable. This isn't just about personal comfort; it is a major investment factor. Top-tier hospitals like UPMC in Pittsburgh or AdventHealth in Palm Coast attract high-quality medical professionals, who in turn need rental housing. This creates a secondary, stable rental market (doctors, nurses, administrative staff) that acts as a strong buffer if the retiree rental demand ever slows down. An area with a Healthcare Rating of 9.0 or higher is nearly always a safer long-term real estate play.

The Current Market Reality: Stabilizing but Still Strong

The real estate frenzy of the last few years has calmed down. As of mid-2025, mortgage rates hovering around 6.5–7% have cooled off bidding wars, leading to increased inventory (up 20–40% nationally). This is excellent news for retirees who prefer to buy with less pressure. The markets we are discussing show modest, sustainable appreciation (averaging 3.5%), signaling stability rather than speculation.

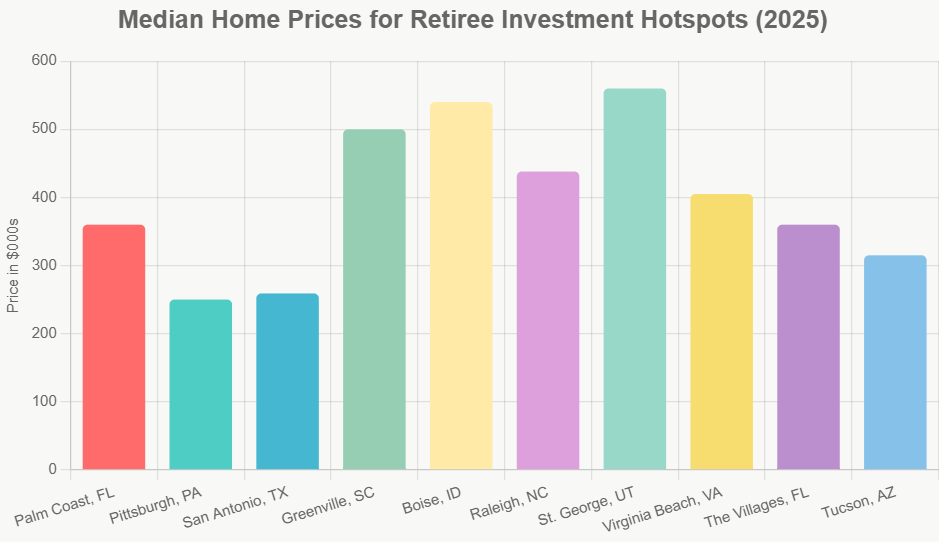

Here is a quick overview of how our top 10 destinations stack up on key metrics for investors:

| City | Median Home Price (2025) | YoY Appreciation | Key Tax Perk | Investment Sweet Spot |

|---|---|---|---|---|

| Palm Coast, FL | $360,000 | +3.0% | No state income tax | Turnkey, low-risk coastal rental. |

| Pittsburgh, PA | $250,000 | +4.8% | Low flat income tax | Highest affordability, medical demand. |

| San Antonio, TX | $259,000 | -2.3% (Stabilizing) | No state income tax | Highest cash flow yields. |

| Greenville, SC | $500,000 | +1.0% | SS income exempt | Premium lifestyle, regional growth. |

| Boise, ID | $540,000 | +11.3% | Flat 5.8% income tax | Highest appreciation potential. |

| Raleigh, NC | $438,000 | +0.6% | Dropping income tax | Education and tech-driven stability. |

| St. George, UT | $560,000 | +6.2% | Flat 4.85% income tax | Active lifestyle, high quality of life. |

| Virginia Beach, VA | $405,000 | +6.6% | SS income exempt | Military/tourism rental demand. |

| The Villages, FL | $360,000 | +5.9% | No state income tax | Niche 55+ guaranteed rental market. |

| Tucson, AZ | $315,000 | -3.1% (Rebounding) | Low flat income tax | Affordable Sunbelt entry point. |

Best Places to Invest in Real Estate for Passive Retirement Income

1. Palm Coast, FL: Coastal Resilience and Tax Benefits

I often recommend Palm Coast because it provides the classic Florida appeal (beaches, golfing, mild weather) without the crushing price tags of Miami or Naples. At a median price of $360,000, it’s accessible. This market is driven almost entirely by retirees, making long-term rentals highly secure.

- The Investment Edge: The vacancy rate here is exceptionally low at 1.4%. When a rental property turns over, it is often leased again almost immediately, minimizing carrying costs. The no state income tax policy means investors living here keep more of their profits, and the 3% appreciation projection shows steady growth without overheating.

- The Lifestyle: It's quiet, secure (1.7% low crime), and focused on the outdoors, appealing perfectly to the active senior demographic you want renting your property.

2. Pittsburgh, PA: The Affordability Champion

If you want immediate cash flow, stop looking at the Sunbelt for a moment and focus on the Steel City. With a stunningly low $250,000 median home price, Pittsburgh provides the greatest entry-level opportunity on this entire list.

- The Investment Edge: The appreciation rate is strong at +4.8%, and the cost of living index is only 92 (meaning it is 8% cheaper than the national average). But the real hidden gem is the medical economy. The massive presence of UPMC attracts a constant influx of medical professionals and supporting staff, guaranteeing high occupancy and a reliable rental yield of around 6.2%.

- Personal Opinion: While the winters are challenging, the low upfront capital requirement and superior healthcare rating (9.0) make this one of the most reliable long-term holds for a cash-flow investor who doesn't mind managing tenants.

3. San Antonio, TX: Maximizing Rental Yields

San Antonio is proof that you can still find value in Texas, despite the massive influx of people to Austin and Dallas. While the median price of $259,000 shows a slight dip (-2.3%) as the market corrects, this is a phenomenal time to buy before the predicted rebound.

- The Investment Edge: This area is characterized by low taxes and a COL index of 89. Crucially, San Antonio’s rental yields are driven by military bases and a high senior population, often leading to yields closer to 6.5%. For an investor who wants quick cash returns on a low initial investment, San Antonio is hard to beat.

- Risk Mitigation: The summer heat is intense, which means you must factor in high AC costs and prioritize property maintenance (especially roof and HVAC systems) when budgeting for ownership.

4. Greenville, SC: Premium Southeast Living

Greenville is a dynamic, high-growth area, and its $500,000 median price reflects that premium status. It might seem expensive compared to Pittsburgh, but for retirees who want a vibrant, walkable downtown and excellent access to nature, this is the spot.

- The Investment Edge: South Carolina exempts Social Security benefits from state income tax. The market is supported by sophisticated infrastructure and a fantastic healthcare scene (8.8 rating). While the 1% appreciation forecast is modest, this market provides high-quality properties that attract high-quality long-term tenants.

- Advanced Insight: The inventory has risen sharply (up 40%), softening prices slightly. This signals an opportunity to negotiate a better deal in a city that still has massive long-term regional potential.

5. Boise, ID: Chasing Growth in the Mountain West

Boise is the outlier on this list. It is expensive ($540,000 median) and has a COL index above the national average (102). However, if your investment goal is maximizing capital appreciation, Boise’s 11.3% YoY growth is nearly unmatched among retiree-friendly areas.

- The Investment Edge: The growth is structural, fueled by the tech industry moving in and the city’s high quality of life (hiking, river access). The vacancy rate is extremely low (0.7% in nearby Meridian), meaning every property is in high demand.

- Who is This For? This market is best suited for the retiree who is selling a high-priced primary home (e.g., in California) and wants to move that capital into a high-growth market using a 1031 exchange to defer capital gains tax.

6. Raleigh, NC: Stability in the Research Triangle

Raleigh offers the best combination of big-city amenities and Southern charm, anchored by the massive Research Triangle Park. Its $438,000 median price is relatively stable, reflecting a highly educated and stable tenant base.

- The Investment Edge: North Carolina’s flat income tax rate is actively dropping, making it increasingly attractive from a tax perspective. The housing market here is tight (2.8 months of supply), supporting rents and low vacancy.

- The Trade-off: With only 0.6% appreciation projected, Raleigh is a stability play. You are buying security—a market unlikely to crash due to the constant churn of students and tech workers—rather than explosive growth.

7. St. George, UT: Desert Oasis for the Ultra-Active

Set near Zion National Park, St. George is perfect for the adventurous retiree. While the $560,000 median is the highest on our list, the lifestyle and extraordinary healthcare rating (9.2) justify the price for many.

- The Investment Edge: The 6.2% appreciation demonstrates sustained demand, largely from people seeking the active lifestyle and the stunning natural beauty. The Intermountain Healthcare system is world-class, making this a magnet for health-conscious seniors.

- The Warning: Water scarcity is a long-term risk that every investor in Southern Utah must consider. While property values are strong now, future infrastructure costs related to water could affect property taxes.

8. Virginia Beach, VA: Reliable Seaside Demand

Virginia Beach provides stability driven by two powerful economic engines: the Atlantic coast tourism industry and the large military presence.

- The Investment Edge: With a solid $405,000 median and 6.6% recent growth, this market is resilient. Virginia exempts Social Security benefits from state taxes. The yields are strong (around 5.8%) because demand is high for both short-term tourist rentals and long-term military/senior housing.

- The Risk Factor: Like all coastal markets, sea-level rise and increasing flood insurance premiums are critical factors that must be budgeted for. Always purchase comprehensive flood insurance, even if not required by your mortgage lender.

9. The Villages, FL: The Niche Investment Dream

The Villages isn’t just a retirement community; it’s a retirement ecosystem. With over 60% of the population being 55+, this area is purpose-built for seniors, leading to an investment opportunity unlike any other.

- The Investment Edge: The Villages offers arguably the most secure rental market in the country for 55+ housing. Demand is massive, yielding around 6%, and the area boasts a spectacular healthcare rating (9.5). The $360,000 median price is identical to Palm Coast, but the appreciation rate is stronger at 5.9%.

- Expert Warning: Because this entire community operates under specific age restrictions, the pool of potential buyers if you decide to sell is limited to those over 55. This can sometimes affect liquidity compared to a general market.

10. Tucson, AZ: Sunbelt Value with Desert Charm

Tucson offers a much more affordable entry point into the Sunbelt than Phoenix or Scottsdale. At a median of $315,000, it’s a bargain for a city with such beautiful natural surroundings (the Saguaro trails).

- The Investment Edge: While it experienced a correction (-3.1%), the market is already rebounding (projected +3% growth). The low flat 2.5% income tax and yields around 6.2% make it attractive for cash flow. Tucson is becoming a favorite among retirees seeking an authentic, less crowded, and more affordable Southwestern experience.

- My Take: If you missed the bus on Phoenix five years ago, Tucson is the next best choice, provided you select properties close to Banner Health facilities to capture both retiree and medical staff rentals.

Investment Strategies for Low-Stress Ownership

A successful real estate investment shouldn't add stress to your retirement. Based on these 10 locations, here are the simplified strategies I recommend for senior investors:

Strategy 1: The Affordable Cash-Flow Play

- Target: Pittsburgh, PA, and San Antonio, TX.

- Goal: Buy two properties for $250,000 each. Put 20% down ($50,000 per property) and leverage the remaining loan.

- Benefit: Even with a 6.5% interest rate, the high rental yields in these markets should cover the mortgage, insurance, and maintenance, leaving you with a small, reliable monthly cash profit and two rapidly appreciating assets.

Strategy 2: The High-Equity Tax Deferral (1031 Exchange)

- Target: Boise, ID, and St. George, UT.

- Goal: Sell a highly appreciated primary residence or rental property and immediately roll the proceeds into a high-growth market like Boise.

- Benefit: You defer the massive capital gains taxes you would normally pay, allowing your entire equity to continue growing at an accelerated rate (like Boise’s 11.3% potential).

Strategy 3: The Turnkey 55+ Niche

- Target: The Villages, FL, and Palm Coast, FL.

- Goal: Purchase properties specifically within or near active senior communities.

- Benefit: These properties are often lower maintenance (HOAs handle exterior work), and the tenant base is inherently stable, resulting in fewer vacancies and maintenance issues—a true definition of passive income.

Final Thoughts: Secure Your Future with Targeted Real Estate

Real estate should be the bedrock of a retiree’s investment portfolio. It provides stability that the stock market often cannot, and it offers tangible income that combats inflation. The markets listed above represent the best balance as of 2025: they offer strong local economies, superior healthcare access (which attracts high-quality tenants), and favorable tax treatment that preserves your retirement savings.

Whether you choose the affordability of Pittsburgh or the high growth of Boise, the key is always to partner with a local expert who understands the unique dynamics of the senior rental market. Don't chase trends; chase security and sustainability.

Download Your FREE Guide to Passive Real Estate Wealth

Real estate investing has created more millionaires than any other path—and this guide shows you how to start or scale with turnkey rental properties.

Inside, you’ll learn how to analyze cash flow and returns, choose the best markets, and secure income-generating deals—perfect for building long-term wealth with minimal hassle.

🔥 FREE DOWNLOAD AVAILABLE NOW! 🔥

Want Stronger Returns? Invest in Growth Markets That Support Your Retirement Goals

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Speak to a Norada Investment Counselor today (No Obligation):

(800) 611-3060

Recommended Read:

- Austin vs. Raleigh: Which Tech Hub Has the Stronger Housing Market for Investors?

- Dallas vs. Houston: Which City Offers Better Returns for Real Estate Investors

- Single-Family vs. Townhome: Which is the Real Cash Flow Winner for Investors?

- 5 Hottest Florida and Texas Markets for Real Estate Investors in 2025

- Best Places to Invest in Real Estate: November 2024 Hotspots

- How to Secure Your Retirement With Cash-Flowing Rental Properties

- Best Places to Invest in Single-Family Rental Properties in 2025

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025