Are you curious about what the next 5 years hold for the U.S. housing market? The housing market is a complex and ever-changing landscape, making it difficult to predict with certainty what the next five years will hold. However, based on current trends and expert opinions, there are a few key things that we can expect to see in the years to come. The housing market is expected to remain strong in the next five years. However, some key factors could impact the market, such as rising interest rates and a growing supply of homes.

- Home prices will continue to rise in the next five years but at a slower pace. The rapid rise in home prices that we saw in recent years is likely to slow down in the next few years. However, home prices are still expected to rise, albeit at a more moderate pace.

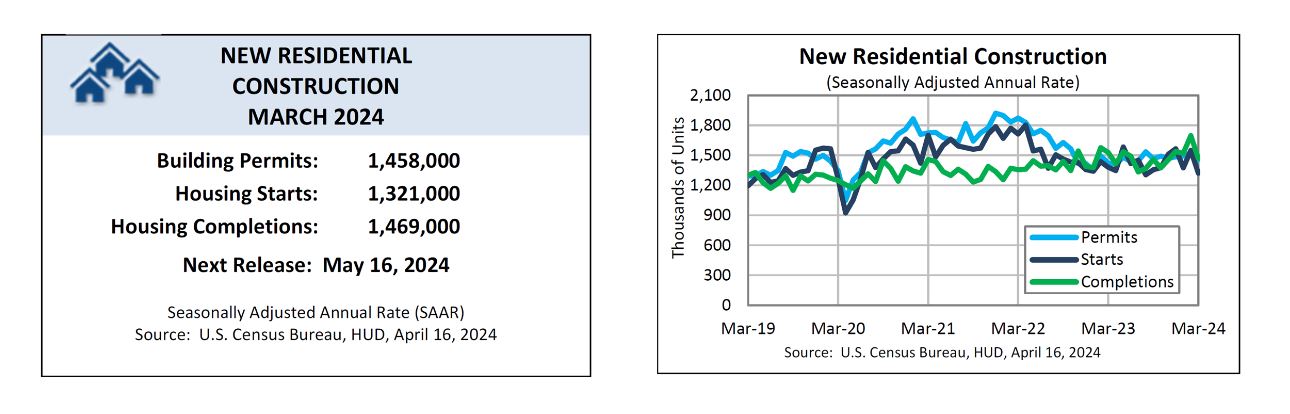

- The supply of homes for sale will increase. The lack of available homes for sale has been a major driver of rising home prices in recent years. However, as more homes are built and come onto the market, we can expect to see some relief from the supply shortage.

- Mortgage rates will rise. The Federal Reserve has been raising interest rates to combat inflation. This has made it more expensive to borrow money, which has led to a decline in demand for homes. However, in the subsequent years, a reversal in this trend is projected, as interest rates are anticipated to gradually recede, potentially culminating in a resurgence of demand in the housing market.

- The housing market will remain competitive in in the next five years. Even with rising interest rates and a growing supply of homes, the housing market is still expected to remain competitive in the next few years. This is due to a number of factors, including strong job growth, population growth, and a limited supply of land.

While these trends offer valuable insights into the future of the housing market, there are additional factors that warrant consideration. Let's get into more detail about these trends and make predictions about how they will affect the housing market. The housing market is a crucial component of the US economy, and predicting its future trends and fluctuations can be difficult, especially as external factors can influence the market.

Rising interest rates will increase the cost of mortgages for new buyers, but prices are unlikely to fall as they did during the 2008 market crash, as lending standards have become more robust. The market was driven higher during the pandemic by record low borrowing rates, encouraging purchases by first-time buyers, and a lack of supply because of underbuilding.

Analysts and economists have different opinions on whether prices will be flat or collapse in the next five years. However, they agree that the housing market will experience a slowdown in the coming years until mortgage rates decline. However, prices are unlikely to fall as they did during the 2008 market crash, as lending standards have become more robust.

ALSO READ: Latest U.S. Housing Market Trends

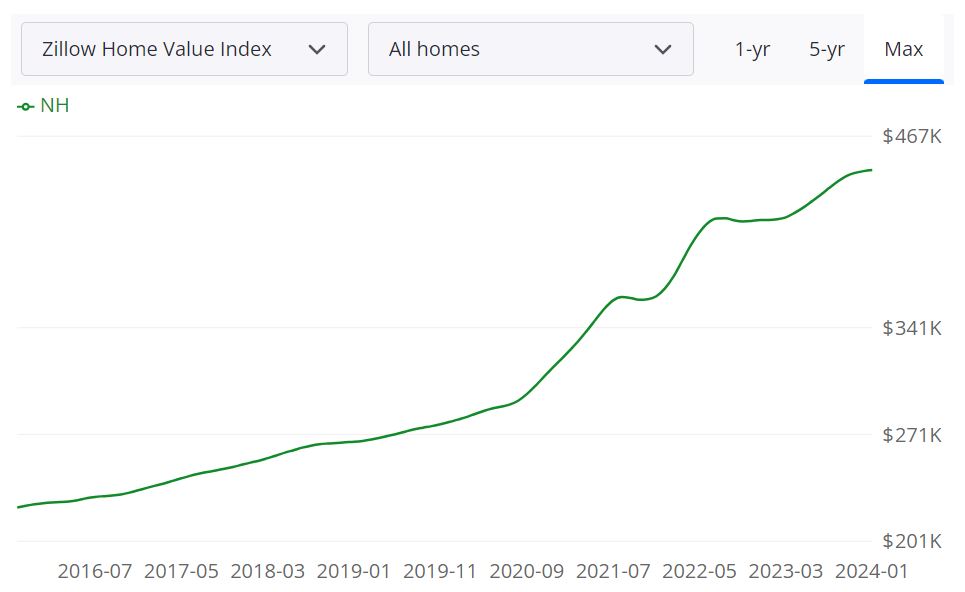

In the next five years, the US housing market is predicted to experience a slowdown, with prices either flat or experiencing a modest decline. According to Zillow's latest forecast, the outlook for 2024 suggests a 0.2% decrease in home values nationally. This projection indicates a trend of stability in the housing market.

Recent inflation data indicates that mortgage rates are expected to remain stable in the upcoming months. After experiencing peak rates unseen in over two decades in the preceding year, prospective buyers in 2024 are anticipated to encounter some relief. The diminishing trend in high inflation, which instigated interest rate hikes in 2023, is aligning with the Federal Reserve's targets.

Should this trend persist as anticipated, it is likely to result in reduced volatility in mortgage rates. Furthermore, the ongoing growth in wages and the projected stability in home values — with an expected minimal decrease of 0.2% — will collectively offer a more favorable environment for buyers grappling with affordability concerns.

Following a period characterized by low inventory, the housing market is witnessing a resurgence in options for prospective buyers. With more sellers anticipated to list their properties for sale, there is an acknowledgement of the prevailing era of higher mortgage rates.

The proliferation of listings is undoubtedly welcome news for individuals in pursuit of a home. This surge not only expands the array of options available to buyers but also has the potential to alleviate market competition, consequently mitigating the propensity for price escalation.

Despite the predicted slowdown, it is important to note that many experts do not expect a crash in the US housing market similar to the one seen in 2008. Lending standards have become more robust, which should help prevent widespread defaults and foreclosures. In addition, the current economic climate is much different than it was in 2008, with a strong labor market and a more stable financial sector.

While the US housing market is expected to see a slowdown in price growth over the next five years, experts do not expect a crash similar to the one seen in 2008. Factors such as rising interest rates, an increase in the supply of homes, and affordability challenges for buyers are expected to contribute to the slowdown, but the overall health of the economy and lending standards should help prevent a catastrophic collapse.

Housing Market Predictions Next 5 Years: Real Estate Forecast

What are the real estate forecasts for 2024, 2025, and so on? Although, it is quite difficult to forecast the housing market for the next five years here is an insight into what most experts predict can happen.

The pandemic has had a significant impact on the real estate and land use sectors. These effects will continue to impact the demand and supply of regional housing markets over the next five years. Emerging technologies, changing demographics, the state of local job markets, and the rise of remote work are some of the trends expected to shape the housing market in the future.

The U.S. News Housing Market Index provides a data-driven overview of the housing market nationwide and serves as one of the authoritative sources for the information presented in this article. While it is possible for median home prices to fall by 5% in 2024, if mortgage rates decline faster than predicted, home prices could remain mostly flat through the end of 2024.

However, if real incomes rise faster than inflation, the combination of extra purchasing power plus lower mortgage rates could boost affordability, home sales, and prices. If real incomes rise from 2025 through 2027, home prices will likely rise again by approximately 1% to 2% above the current inflation rate. However, it will likely take some time to reach the home value heights of mid-2022.

ALSO READ: Will There Be a Drop in Home Prices in 2023?

Housing Market Predictions 2024

The year 2024 is expected to bring more stability to the housing market after a few years of uncertainty. With mortgage rates declining faster than expected, home prices are likely to remain mostly flat throughout 2024. This will be good news for buyers who have been waiting on the sidelines for a good time to enter the market.

According to the U.S. News Housing Market Index, the national housing shortage will continue through the end of the 2020s, making it a seller's market in many regions. The National Association of Home Builders predicts that the national housing shortage will last through the end of the 2020s. Due to the estimated pent-up demand for housing, which ranges from 1.5 million to nearly 3.8 million homes, it will take time for the nation's builders to find suitable land, skilled labor, and materials to create a much-needed supply.

The rising cost and consequences of climate change will also impact the housing market in 2024. Homebuyers and builders will have to factor in the costs of building homes that are resilient to climate change and extreme weather events. The total cost of homeownership will become a key metric, taking into account not only the purchase price and mortgage rates but also property taxes, maintenance costs, insurance premiums, and other expenses.

According to the latest insights from Realtor.com, the shift from climbing to falling mortgage rates is foreseen to enhance housing affordability. However, this change might diminish the sense of urgency among home shoppers. Despite the less frenzied housing demand, the availability of rental home options is expected to keep home sales relatively stable at low levels throughout 2024. Consequently, home prices are projected to adjust slightly lower, even as the inventory of for-sale homes continues to decrease.

Home prices are predicted to ease slightly, with an estimated drop of less than 2% for the year on average. The combined effect of lower mortgage rates and income growth is expected to improve the home purchase mortgage payment share relative to median income, reaching an average of 34.9% in 2024. By the end of the year, this share is anticipated to slip under 30%.

Here are a few key factors that could influence whether the US housing market crashes in 2024:

1. Interest Rates and Inflation

The trajectory of the US housing market is closely tied to interest rates and inflation. Significant increases in mortgage rates or high inflation could result in a substantial reduction in housing affordability, potentially dampening demand. Notably, the Federal Reserve aims to orchestrate a “soft landing” to prevent drastic hikes.

2. Economic Growth

Economic growth plays a pivotal role in determining the health of the housing market. A recession accompanied by significant job losses might trigger defaults and foreclosures, leading to a depreciation in home prices. While some concerns exist, most economists anticipate sluggish growth rather than a severe downturn in 2024.

3. Supply Constraints

Supply constraints continue to be a significant factor, with national inventory levels affected by construction delays. Despite this shortage, the market is bolstered by higher prices, although there are expectations of increased construction activity in the near future.

4. Investor Activity

The involvement of institutional investors in purchasing a substantial share of homes in certain markets introduces an element of uncertainty. A potential pullback in investor activity could impact prices, although the extent of their influence is a subject of ongoing debate.

5. Pandemic-Related Factors

Emerging trends such as remote work and urban flight to suburbs, accelerated by the pandemic, may undergo some reversal post-pandemic. This shift could contribute to a slowdown in markets that experienced heightened activity during the pandemic.

6. Mortgage Credit

The state of mortgage credit and lending standards is crucial in assessing the risk of a housing market crash. Unlike pre-2008 conditions, lending standards are currently tighter, with fewer risky products available. This makes the occurrence of a crash triggered by loose credit less likely.

7. Regional Variations

Regional variations play a significant role, with some markets appearing overpriced while others remain relatively affordable. The likelihood of a correction occurring depends on the specific local conditions in each market.

Overall, while projections point towards sluggish price growth, analysts generally believe that robust demand from millennials and low supply levels should act as a deterrent to a nationwide housing market crash in 2024 unless an unexpected severe economic downturn occurs. However, attention is warranted for potentially vulnerable overheated regional markets.

Housing Market Predictions 2025

In 2025, the housing market is expected to start picking up again, with home prices rising by approximately 1% to 2% above the current inflation rate. This increase will be due to a combination of factors such as the rise in real incomes, lower mortgage rates, and increased affordability. However, it may take some time to reach the home value heights of mid-2022.

More buyers are expected to join with friends and family members to purchase homes, as intergenerational households, grown children “boomeranging” homes, and families created from friendships increasingly pool multiple income sources to purchase homes and avoid the uncertainty of housing costs as renters.

The ways homes are built are also expected to change in 2025. Emerging technologies such as 3D printing, factory-built structural components, and software that minimize the waste of materials are likely to become more common in the construction industry. These methods are expected to improve building quality while speeding up construction timelines.

Here are a few key factors that could influence whether the US housing market crashes in 2025:

1. Interest Rates

By 2025, interest rates are anticipated to have moderated, following a period of increases from 2022 to 2024. The moderation is expected to result in more affordable mortgages, thereby supporting housing demand. However, the impact of higher rates earlier in the period could potentially dampen overall activity.

2. Economic Growth

Current projections indicate sluggish but positive GDP growth in 2025. While this suggests a generally stable economic environment, the possibility of a recession looms. A recession could significantly depress home prices, posing a potential challenge to the housing market.

3. Employment Trends

Job losses typically accompany recessions, leading to lower demand for housing. If a recession occurs, the unemployment rate may experience a considerable rise, further impacting the housing market dynamics.

4. Supply Issues

Underbuilding has contributed to tight inventory in recent years. However, there are expectations that increased new construction by 2025 could alleviate supply constraints, meeting the growing demand for housing.

5. Household Formation

The large millennial generation reaching peak home-buying age is a significant demographic driver. Strong demographics could act as a buoyant force for the market, potentially mitigating the impact of economic headwinds.

6. Investor Activity

A potential decline in institutional investor purchases of homes could moderate house prices in specific markets. The level of investor activity remains a variable that influences market dynamics.

7. Affordability

Price/income ratios are elevated in many areas, and appreciation may slow in less affordable cities, particularly if incomes stagnate. Affordability challenges could impact the overall trajectory of the housing market.

8. Government Policy

Government programs supporting homeownership and the housing sector play a crucial role. While these programs could help avert a major downturn, potential tax changes may introduce an additional layer of uncertainty, impacting prices.

Overall, while there may be a moderation in growth, the potential for a national housing market crash in 2025 seems mitigated by a surge in supply and strong demand from millennials, unless an unexpected severe recession unfolds. However, attention is warranted for potentially vulnerable overvalued regional markets that could experience more substantial price corrections.

Housing Market Predictions 2026

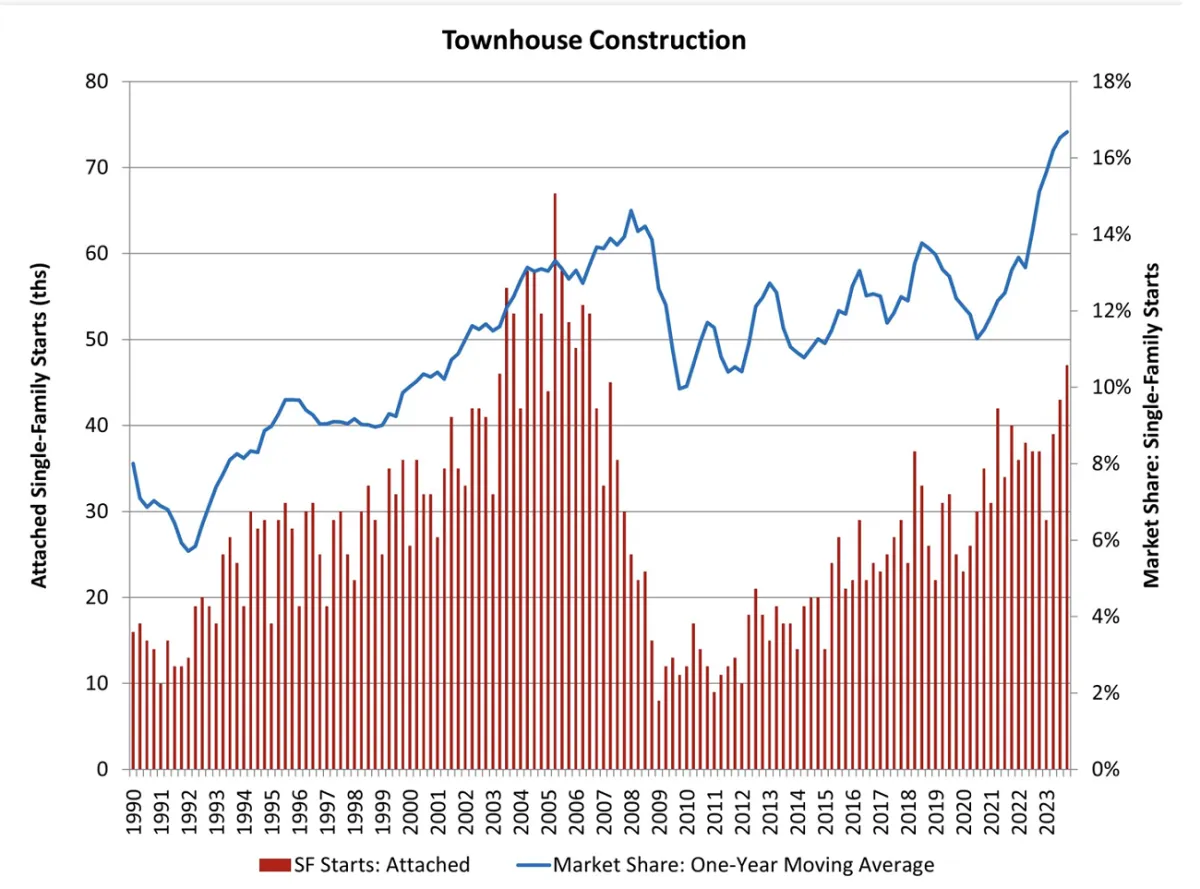

In 2026, the housing market is expected to continue its upward trend, with home prices rising at a moderate pace. The pent-up demand for housing is expected to be supplied between 2025 and 2030, according to the National Association of Home Builders. However, the changing demographics by 2030 will result in lower demand for new housing, which could lead to a slowdown in construction activity.

The trend of more buyers joining with friends and family members to purchase homes is expected to continue in 2026, as the rising cost of housing and the desire for more space and privacy drives people to pool their resources. This trend is likely to result in more multi-generational households and co-living arrangements.

The total cost of homeownership is expected to become an even more important metric in 2026, as buyers and builders factor in the cost of climate change and other external factors. The rising cost of insurance and building materials, along with the need to adapt to a changing climate, will make it essential for homeowners to consider the total cost of homeownership when making purchasing decisions.

Housing Market Predictions 2027

Predicting the housing market for 2027 is a challenging task as it depends on various factors such as economic growth, interest rates, population growth, and government policies. However, based on the current trends and projections, it is possible to make some predictions. One potential trend that could affect the housing market in 2027 is the continued urbanization of populations.

This means that more people are moving from rural areas to urban areas, which will create a higher demand for housing in cities. As a result, there may be more construction of apartment buildings and townhouses to accommodate this growing population. Another factor that could influence the housing market is the continued rise of technology. With advancements in technology, people are becoming more mobile and can work from anywhere in the world.

This could lead to an increase in remote working, which may cause more people to relocate to suburban and rural areas. This, in turn, could lead to an increase in demand for single-family homes in these areas. In addition to these trends, it is also important to consider economic factors such as interest rates, inflation, and job growth.

Interest rates are a crucial factor in the housing market, as they affect the cost of borrowing money for a mortgage. If interest rates remain low, this could encourage more people to buy homes, leading to a rise in demand and prices. However, if interest rates rise too quickly, this could make it more difficult for people to afford a mortgage, leading to a decline in demand and prices.

Finally, government policies could also impact the housing market in 2027. For example, changes to zoning laws or building codes could affect the supply of housing, leading to changes in prices. Similarly, changes to tax laws could also impact the affordability of homes, leading to changes in demand.

In conclusion, the next few years are likely to bring significant changes to the housing market, with a combination of factors such as changing demographics, emerging technologies, and the impact of climate change driving demand and supply. The National Association of Home Builders predicts that the national housing shortage will last through the end of the 2020s, and the cost of ownership will become a key metric for buyers.

Despite the uncertainty caused by the pandemic and other external factors, the housing market is expected to remain strong, with opportunities for both buyers and sellers. It is important for all stakeholders to keep a close eye on the latest trends and developments in the market to make informed decisions.

These predictions and guesses provided are based on current trends and historical data. However, they are still subject to numerous variables and factors that may impact the housing market in unforeseen ways. Therefore, please note that these predictions and guesses are for informational purposes only and should not be considered financial or investment advice. Any decision made based on this information is solely at your own risk.

Will it Become a Buyer's Real Estate Market?

The US housing market has seen skyrocketing home prices for the past two years, with a shortage of inventory, low-interest rates, and high demand fueling the market. However, according to the latest Zillow Home Price Expectations Survey, this trend is expected to shift in the coming years. The report surveyed 107 housing market experts and economists from August 16–27, 2022. In this section, we will explore the predictions for when a buyer's market is expected to arrive and what the housing market will look like in the years to come.

2023: Expect a Shift in Favor of Buyers

According to the survey, the majority of panelists (56%) expect a significant shift in favor of buyers within the next year, making 2023 the year of the buyer. This shift is due to several factors, including sky-high mortgage costs, which are driving down competition among home shoppers. This shift is expected to exert additional pressure on the rental market, as priced-out potential homebuyers turn to rent.

However, the report also found that metros in the South and Midwest are the least likely to see price declines over the next year. In contrast, vacation market areas are most likely to see price declines. The panelists also predicted that rent growth and inflation should outpace stocks and home price appreciation over the next year.

2024: Further Decrease in Home Prices

While 56% of panelists predict a buyer's market in 2023, another 24% predict that the housing market shift would come in 2024. This prediction shows that the trend of a buyer's market will continue to strengthen over the next few years. Inexpensive Midwest markets, such as Columbus, Indianapolis, and Minneapolis, are expected to see the least decline in home prices over the next 12 months. Fast-growing markets in the South, such as Atlanta, Nashville, and Charlotte, are also expected to retain their heat. However, markets that saw some of the largest growth over the course of the pandemic, including Boise, Austin, and Raleigh, are projected to cool the fastest.

2025: Further Consolidation of the Buyer's Market

As per the survey, 13% of the panelists expect the market to favor home buyers in 2025. This further solidifies the buyer's market trend, which has been building up since 2023. Suburban and exurban areas are predicted by the panel to retain their heat over the next 12 months, while vacation areas and urban areas were considered the most likely to see price declines.

Overall, the report suggests that the US housing market will undergo a significant shift in the coming years, with home prices declining and a shift towards a buyer's market. This change is a result of several factors, including rising mortgage rates, a shortage of inventory, and sky-high prices that have pushed many prospective buyers to the sidelines.

Although this shift is expected to benefit buyers, high and rising rents could cut further into their ability to save up for a down payment, making it harder for some to transition from renting to owning. As the housing market continues to evolve, it will be important to monitor these trends to understand the implications for the broader economy.

References

- https://www.zillow.com/research/2024-housing-predictions-33447/

- https://www.zillow.com/research/daily-market-pulse-26666/

- https://www.zillow.com/research/zhpe-q3-2022-buyers-market-31481/

- https://capital.com/housing-market-predictions-for-next-5-years

- https://realestate.usnews.com/real-estate/housing-market-index/articles/housing-market-predictions-for-the-next-5-years

- https://www.nar.realtor/newsroom/nars-lawrence-yun-predicts-us-home-prices-wont-experience-major-decline-could-possibly-rise-slightly#