Finding an affordable place to live can feel like a Herculean task these days. With home prices stubbornly high, especially when viewed in comparison to incomes, the dream of homeownership is becoming increasingly elusive for many. Based on a recent report from Realtor.com, the 5 least affordable housing markets in 2025, where the typical home costs an overwhelming portion of the median household income, are Los Angeles, San Diego, San Jose, New York and Boston.

I felt compelled to dive deeper into this issue, providing you with more insights in a way that's easier to grasp. So, let’s explore why these markets are so expensive and what factors contribute to this growing affordability crisis.

5 Least Affordable Housing Markets for Buyers to Buy a House in 2025

Let's take a detailed look at the five markets where the squeeze is the most intense. The data is based on Realtor.com's May 2025 report, which considered median home prices, mortgage rates (6.82%), a 20% down payment, and estimated taxes and insurance.

1. Los Angeles-Long Beach-Anaheim, CA

- Median List Price: $1,195,000

- Annual Mortgage Payment + Tax & Ins.: $95,496

- 2025 Median Household Income: $91,380

- Share of Income Required: 104.5%

Los Angeles takes the top spot as the least affordable market, with a staggering 104.5% of the median household income needed to cover housing costs. That means the typical homeowner in LA is spending more than they make on their home and the expense is greater than the income! The housing crisis in LA is driven by a severe supply shortage, high demand, and a strong economy that attracts high-income earners.

In fact, owning versus renting is almost parity due to this high expense, with 51% of homes rented and 49% owned.

2. San Diego-Chula Vista-Carlsbad, CA

- Median List Price: $995,000

- Annual Mortgage Payment + Tax & Ins.: $79,513

- 2025 Median Household Income: $103,066

- Share of Income Required: 77.1%

San Diego's idyllic climate and strong job market make it a desirable place to live. As a result, housing costs are astronomical. Nearly 77.1% of the median household income is required to afford a median-priced home. The home prices are almost 10X of the median income.

3. San Jose-Sunnyvale-Santa Clara, CA

- Median List Price: $1,419,500

- Annual Mortgage Payment + Tax & Ins.: $113,436

- 2025 Median Household Income: $156,664

- Share of Income Required: 72.4%

Despite having the highest median household income among the 50 largest U.S. metros, San Jose residents face immense housing affordability challenges. With world-class technology jobs, that drive up the cost of homes, the median list price is nearly $1.5M! Approximately $113k would be the yearly expense to afford the typical home that consumes 72.4% of the median income.

4. New York-Newark-Jersey City, NY-NJ

- Median List Price: $795,000

- Annual Mortgage Payment + Tax & Ins.: $63,531

- 2025 Median Household Income: $94,960

- Share of Income Required: 66.9%

New York City remains a global hub, but its high cost of living (particularly housing) is a major burden for many residents. The market is very competitive! Nearly $64k would be the yearly expense to afford the typical home that consumes 66.9% of the median income. That's almost 4/5 of their income!

5. Boston-Cambridge-Newton, MA-NH

- Median List Price: $879,000

- Annual Mortgage Payment + Tax & Ins.: $70,243

- 2025 Median Household Income: $109,295

- Share of Income Required: 64.3%

Boston is another expensive market due to having robust industry for healthcare and for education. These industries drive high earnings and demand. Nearly $70k would be the yearly expense to afford the typical home that consumes 64.3% of the median income.

Understanding the 30% Affordability Rule (And Why It's Often a Myth)

The traditional benchmark for housing affordability is the 30% rule: the idea that you shouldn't spend more than 30% of your pre-tax income on housing costs (including mortgage payments, property taxes, and insurance). This rule is based on the premise that it leaves enough money for other essential expenses like food, transportation, and healthcare, as well as saving for the future.

However, in many major U.S. cities, sticking to the 30% rule has become virtually impossible for the average household. This affordability crunch doesn't just affect lower-income families; it increasingly squeezes the middle class, delaying homeownership and making it harder to build wealth.

The Dire State of Home Affordability in 2025

As of May 2025, a shocking 47 out of the 50 largest U.S. metros require households to spend more than 30% of their income on housing to afford the median-priced home. This underscores a systemic problem: home prices have risen far faster than wages, creating a significant affordability gap.

Nationally, the typical home priced at $440,000 would require 44.6% of the median household income to afford. This paints a grim picture for prospective homebuyers across the nation.

Why Are These Markets So Expensive?

Several factors contribute to the extreme unaffordability of these markets:

- Limited Housing Supply: Restrictive zoning regulations, geographical constraints (e.g., being surrounded by water or mountains), and lengthy permitting processes can limit the construction of new homes, exacerbating supply shortages.

- High Demand: Strong local economies, desirable lifestyles, and proximity to job centers attract large numbers of people, driving up demand for housing.

- High Land Costs: The scarcity of land in desirable locations pushes up property values, making it more expensive to build and buy homes.

- Rising Construction Costs: The cost of labor, materials, and regulatory compliance can make new construction more expensive, further limiting the supply of affordable options.

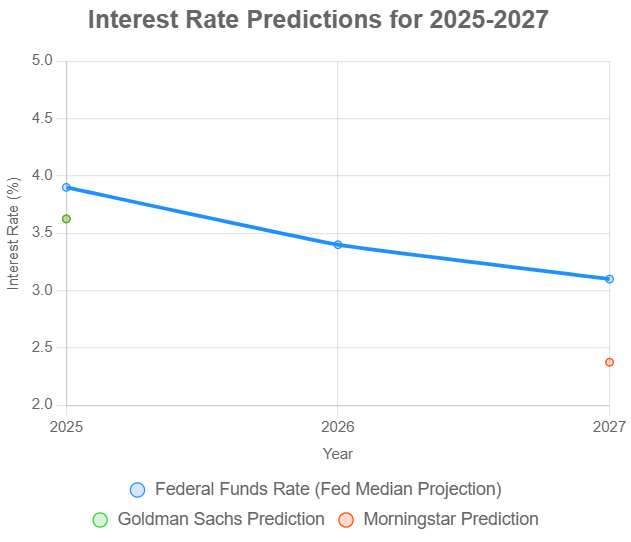

- Mortgage Rates: When mortgages are cheaper, homes get more expensive because they can be afforded by the masses, and vice-versa.

The Ripple Effect of Unaffordable Housing

The unaffordability crisis has far-reaching consequences:

- Delayed Homeownership: Young adults and families are forced to delay buying homes, putting off important life milestones like starting families.

- Increased Renting: More people are stuck renting for longer periods, which can make it harder to save for a down payment on a home.

- Longer Commutes: People may be forced to move further away from job centers to find affordable housing, resulting in longer and more expensive commutes.

- Economic Inequality: The growing gap between home prices and wages exacerbates income inequality, making it harder for lower- and middle-income families to build wealth.

- Brain Drain: Some talented individuals and businesses may choose to relocate to more affordable regions, potentially stifling economic growth in the expensive markets.

What Can Be Done? Potential Solutions

Addressing the housing affordability crisis requires a multi-faceted approach:

- Increase Housing Supply: Streamlining zoning regulations, incentivizing the construction of affordable housing, and encouraging density can help increase the supply of homes.

- Reduce Construction Costs: Streamlining permitting processes, cutting red tape, and exploring innovative building technologies can help lower construction costs.

- Promote Mixed-Income Housing: Encouraging the development of mixed-income communities can help prevent the concentration of poverty and promote economic diversity.

- Increase Wages: Policies that support wage growth, such as raising the minimum wage and strengthening unions, can help make housing more affordable relative to income.

- Offer Financial Assistance: Providing down payment assistance, tax credits, and other forms of financial support can help first-time homebuyers overcome the affordability barrier.

Potential Positive Impact

Fortunately, there are a couple of levers that authorities could move to make home ownership more feasible. This includes rapid wage growth, lowering mortgage rates, increasing supply and new construction. Each of these levers, including increased supply, will make housing prices more reasonable.

Concluding Thoughts

The reality is harsh: housing affordability is a growing crisis in many major U.S. metros. Although home prices stay high and incomes do not rise congruently, the dream of owning a home will sadly become an unachievable aspiration for many families. By understanding the underlying causes and implementing effective solutions, we can work towards a future where housing is more accessible and affordable for everyone.

Invest in Top Real Estate Markets in the U.S.

Looking to tap into the top real estate markets of 2025? Norada connects you with the best investment properties in the most promising cities across the U.S.

Secure high-demand, cash-flowing rental properties in the hottest growth markets before competition heats up even more!

HOT NEW LISTINGS JUST ADDED!

Speak with our expert investment counselors today (No Obligation):

(800) 611-3060

Read More:

- Top 10 Places With Worst Housing Crisis Outlook in 2025

- Top 10 Housing Markets Seeing Incredible Double-Digit Growth in 2025

- Top 10 Housing Markets Attracting Foreign Homebuyers in 2025

- Top 15 Real Estate Markets to Buy Investment Properties in 2025

- 20 Best Places to Buy a House in the US

- Best Places to Invest in Single-Family Rental Properties

- 5 Best Places to Buy and Sell a House in Spring 2025

- 10 Best States to Buy a House in 2025

- Top 10 Least Expensive Places to Buy a House in 2025

- Top 10 Housing Markets Where Gen Zs Are Buying Homes

- Top 20 Hottest Housing Markets Predicted for 2025

- 10 Hottest Housing Markets Predicted for 2025: Sun Belt Boom

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025