Everyone’s talking about it: whether the Federal Reserve will cut interest rates in December 2025. It's a question that hangs heavy in the air for anyone with a mortgage, a credit card, or a 401(k). Right now, the smart money is betting on a 25 basis point rate cut. But here's the kicker – it's far from a sure thing, with some experts saying there's a roughly 70% chance it happens. This huge decision for our economy is happening on December 9-10, and it’s a real nail-biter.

Fed Interest Rate Predictions 2025: Will December Bring Another Cut?

For months, we've seen the Fed navigate choppy economic waters, trying to steer us toward stable prices and maximum employment without causing a crash. After cutting rates twice this year, first in September and then again in October, the federal funds rate is now sitting between 3.75% and 4%. The big question is: will another cut be on the menu, or will the Fed decide to hold steady and see what happens? This decision is like walking a tightrope, with strong opinions pulling in opposite directions among the people who make these calls at the Fed.

The December Dilemma: Why It’s So Tricky

Think of the Federal Reserve, or the “Fed” as we often call it, as the captain of a massive economic ship. Their job is to keep things running smoothly – not too fast, not too slow. For a long time, the biggest worry was inflation, that sneaky price creep that makes everything cost more. The Fed fought it hard by raising interest rates way up. Now, inflation is cooling down, which is good news, but the economy is showing some mixed signals.

On one hand, the job market, which is super important, has a few cracks. The unemployment rate has been ticking up, reaching 4.4% recently. That's a sign that maybe things are cooling off a bit too much. On the other hand, job growth is still happening, and inflation, while getting better, is still a bit stubborn in certain areas, especially housing.

This creates a real tug-of-war within the Fed’s main policy-making group, called the Federal Open Market Committee (FOMC). Some officials are worried about people losing their jobs and want to lower rates to keep the economy going. Others are still concerned that if they lower rates too soon, we might see inflation start to rise again, which would undo all the hard work they've done. It's this internal debate that makes the December decision so hard to predict.

What the Recent Buzz Means for Rates

This shift in thinking didn't happen overnight. Fed Chair Jerome Powell has always said they look at the data – what the numbers are telling them. But sometimes, what Fed officials say in speeches can really move the markets and change people's expectations.

Just recently, on November 21st, New York Fed President John Williams made some remarks that really got people talking. He suggested that the Fed's current policies are still “modestly restrictive” and that there's “room for further adjustment.” Basically, he was hinting that a rate cut was on the table. After his comments, the odds of a December cut jumped from about 50% to over 70% in just a few hours! It's amazing how much impact a few carefully chosen words can have.

But not everyone is on the same page. Boston Fed President Susan Collins urged people not to “rush” into a decision, pointing out that inflation isn't completely beaten yet. The notes from their last meeting in October also showed this division: 10 officials voted for the rate cut, but two wanted to hold steady, worried about keeping prices in check. This tells me that the debate is real and the decision isn't a slam dunk.

The Economic Picture: What the Numbers Say

To understand where the Fed might go, we have to look at the key economic indicators they use.

- Growth: The U.S. economy has been pretty steady, growing at an annual rate of about 2.5% in the last quarter. This is a decent pace, suggesting the economy can handle maybe a slight easing without overheating.

- Jobs: This is where it gets complicated. Nonfarm payrolls, which count the number of jobs added, came in at 128,000 in October. That's okay, but it was fewer jobs than many expected. And as I mentioned, the unemployment rate has been climbing, reaching 4.4%. This is definitely a point in favor of cutting rates to support job growth.

- Inflation: This is the Fed's main battleground. The good news is that inflation is cooling down. The “core PCE” price index, which is a measure the Fed really watches, slowed to 2.6% year-over-year. That's getting closer to their target of 2%. However, costs for things like housing are still rising by more than 5%, and services are also seeing higher prices. This “stickiness” in certain areas is what gives the inflation hawks pause.

- Wages: Average hourly earnings grew by 0.3% in October. While not a runaway increase, consistent wage growth can contribute to inflation if it outpaces productivity. The Fed wants to see this trend moderably cooling.

So, you can see why there isn't a clear-cut answer. The jobs numbers are giving the Fed a reason to cut, while the inflation numbers are giving them a reason to wait. It's a genuine puzzle.

Market Reactions: What to Expect

The financial markets are always reacting to what the Fed might do. When John Williams made his comments hinting at a cut, the stock market, as measured by the S&P 500, jumped up by about 1%. Mortgage rates also tend to move with Fed policy. If the Fed cuts rates, borrowing costs for things like mortgages usually go down. This could bring mortgage rates closer to 6%, which would be a big help for people looking to buy a home.

On the flip side, if the Fed decides to hold rates steady, it might signal that they are still more worried about inflation than a potential slowdown. This could put some pressure on stocks, and the U.S. dollar might get stronger. A stronger dollar makes U.S. exports more expensive for other countries and can make imported goods cheaper, which can help fight inflation a bit.

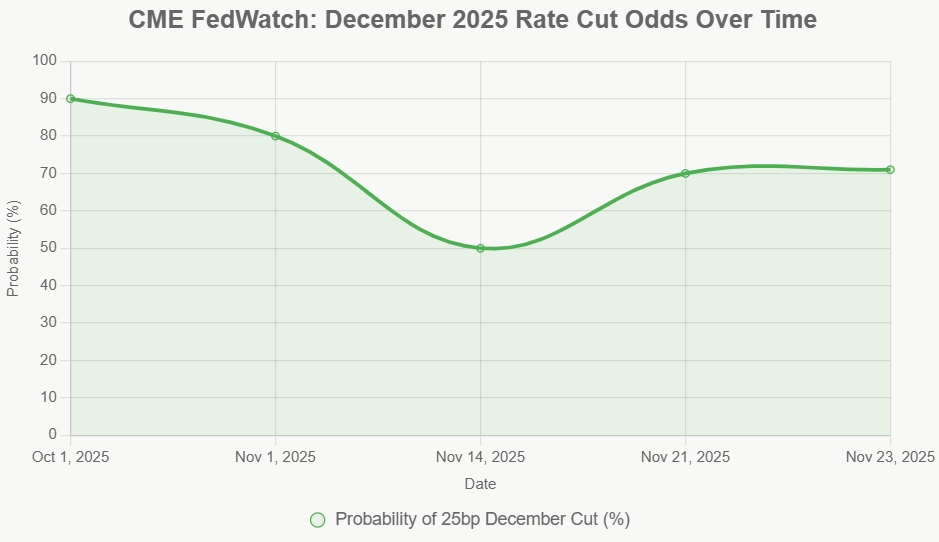

Here’s a look at how market expectations for a December cut have changed recently. It’s like a roller coaster!

| Date | Probability of 25bp December Cut (%) |

|---|---|

| Oct 1, 2025 | 90% |

| Nov 1, 2025 | 80% |

| Nov 14, 2025 | 50% |

| Nov 21, 2025 | 70% |

| Nov 23, 2025 | 71% |

(Data from CME FedWatch Tool, reflecting market expectations)

As you can see, the odds have fluctuated quite a bit based on comments and data.

The Fed's Internal Debate: Hawks vs. Doves

Inside the Fed, there are generally two main schools of thought when it comes to setting interest rates:

- Doves: These officials tend to prioritize economic growth and employment. They worry that keeping rates too high for too long could hurt businesses and lead to job losses. They often advocate for cutting rates sooner rather than later if there are signs of a slowdown. Think of New York Fed President John Williams as leaning this way recently.

- Hawks: These officials tend to prioritize fighting inflation. They are more concerned about prices rising too quickly and might argue for keeping rates higher for longer to ensure inflation is truly defeated. They might point to sticky inflation numbers as a reason to be cautious. Boston Fed President Susan Collins, for example, has expressed a need for patience.

Fed Chair Powell has the tough job of bringing these different viewpoints together. The minutes from their last meeting showed that a significant minority (two out of 12 voting members) disagreed with the rate cut, signaling that this debate is far from settled.

Putting it All Together: What Could Happen?

Based on the current information and market sentiment, here are a few scenarios for the December meeting:

- The Most Likely Scenario: A 25 Basis Point Cut

- Odds: Around 71%

- What Happens: The Fed lowers the federal funds rate to the 3.5%-3.75% range. They'll likely justify it by pointing to the cooling job market and reassuring people that they are managing risks.

- Market Reaction: Stocks would likely see a nice bump, maybe 2-3%. Bond yields could tick down. For homeowners, mortgage rates might ease slightly, perhaps saving a little on monthly payments. Businesses might feel more confident about investing and hiring.

- The Catch: If inflation data comes in hotter than expected in the new year, the Fed might have to backtrack, causing market jitters.

- The Cautious Scenario: Rates Hold Steady

- Odds: Around 29%

- What Happens: The Fed decides not to cut rates. Their message would be one of increased caution, emphasizing that they need more data to be sure inflation is under control and the labor market is stable.

- Market Reaction: This could cause a bit of a dip in the stock market, as investors might worry about a Fed that seems less accommodative. The dollar might strengthen. On the plus side, savers might benefit from slightly higher yields on savings accounts and CDs.

- The Catch: Holding rates steady when the job market is showing weakness could lead to further job losses and potentially slow the economy more than desired.

- The Unexpected Leap: A 50 Basis Point Cut

- Odds: Very low (a tail risk scenario)

- What Happens: This would only likely happen if there's truly shocking news, like a massive drop in job creation or a sudden economic downturn. It would signal a strong shift toward prioritizing growth over inflation concerns.

- Market Reaction: A big cut like this would likely send stocks soaring in the short term but could also raise concerns about future inflation.

Impact on You and Me

These Fed decisions aren't just numbers on a screen; they affect our everyday lives.

- For Borrowers: Lower interest rates mean cheaper loans for cars, credit cards, and mortgages. This frees up more money in people's pockets to spend or save.

- For Savers: Higher interest rates mean better returns on savings accounts, money market funds, and Certificates of Deposit (CDs).

- For Investors: Stock markets tend to react positively to rate cuts because lower borrowing costs can boost company profits and make investing more attractive. However, if cuts signal economic weakness, that can hurt stocks.

- For Businesses: Lower rates make it cheaper for companies to borrow money to expand, buy new equipment, or hire more staff. This can stimulate economic activity.

Looking Beyond December

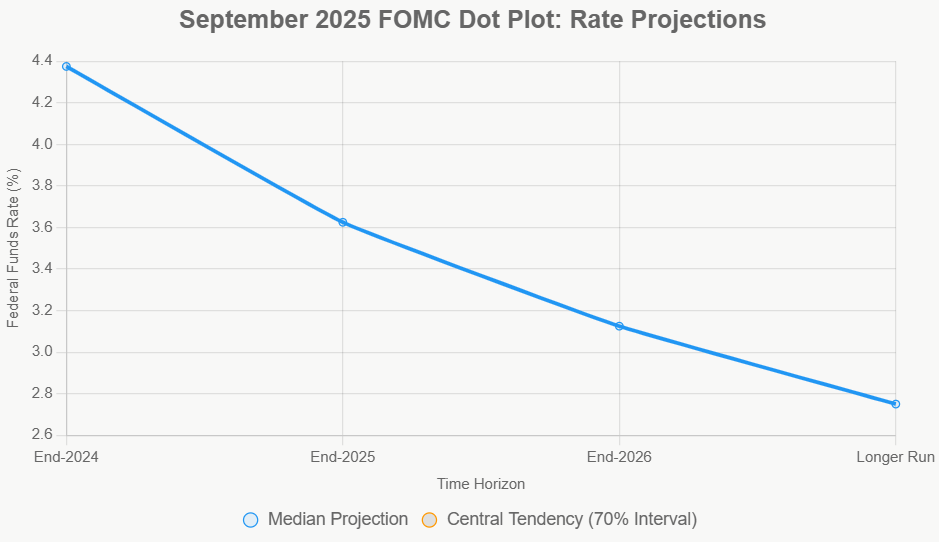

Whatever happens in December, the Fed's job isn't done. Their forecasts, often shown in something called the “dot plot,” suggest they expect to continue lowering rates gradually through 2026. The median projection from September indicated rates could be around 3.125% by the end of next year. However, these are just projections, and they can change based on new economic data.

The Fed has a dual mandate: to keep prices stable and to ensure maximum employment. Right now, they're being pulled in two directions. The December meeting is a crucial test of their ability to navigate these conflicting goals. We’ll all be watching closely to see which way they lean.

Ultimately, the path of Fed interest rates is all about balancing risks. Cut too soon, and inflation could rebound. Wait too long, and the economy could suffer a more painful slowdown. It's a delicate dance, and the performance in December will tell us a lot about the future direction of our economy.

Invest in Real Estate While Rates Are Dropping — Build Wealth

If the Federal Reserve moves forward with another rate cut in December, investors could gain a valuable window to secure more favorable financing terms and scale their portfolios ahead of renewed buyer demand.

Lower borrowing costs would boost cash flow and enhance overall returns, especially for those positioned to act quickly

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Fed Meeting Minutes Expose Divide: Why December Rate Cut Odds Are Fading Fast

- Fed Interest Rate Predictions for the December 2025 Policy Meeting

- Fed Signals Growing Reluctance to Interest Rate Cut in December 2025

- Fed Cuts Interest Rate Today for the Second Time in 2025

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet