The Federal Reserve's upcoming meeting on December 9–10, 2025, is shaping up to be a significant event, and the consensus is leaning strongly towards an interest rate cut. My read of the latest market data suggests there's a very high probability, around 87%, of the Fed lowering its benchmark federal funds rate by 25 basis points (bp). If this happens, the target range will shift to 3.50%–3.75%. This would be the third such reduction in 2025, signalling a deliberate step by the central bank to ease monetary policy as the economy shows signs of cooling.

Interest Rate Predictions This Week Lean Towards a Third Fed Rate Cut

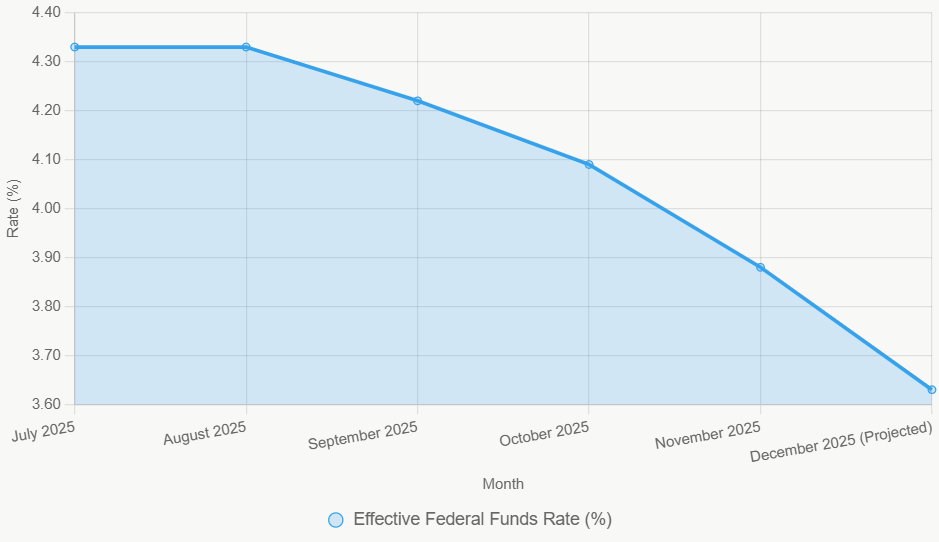

I've been tracking these developments closely. From my perspective, this decision isn't just about one meeting; it's a reflection of the Fed's ongoing effort to achieve its dual mandate of maximum employment and stable prices in a shifting economic environment. The current federal funds rate, sitting at 3.75%–4.00% as of early December 2025, is already a significant comedown from the peaks seen in mid-2024. The question on everyone's mind is what comes next, and the data strongly points towards further easing.

The Economic Tapestry: Weaving Together the Data

To understand why a rate cut is on the table, we need to look at the economic factors the Federal Reserve is carefully considering. The U.S. economy has been navigating a delicate path throughout 2025. We've seen growth moderate, with Gross Domestic Product (GDP) projected to grow between 1.8% and 2.0% for the year. This is a noticeable slowdown from the more robust pace seen previously.

Crucially, the labor market has also shown signs of softening. The unemployment rate has edged up to 4.4%, a figure that, while still historically low, signals some cooling in job creation and hiring. The Fed watches this metric like a hawk, as a strong labor market is a cornerstone of economic health. When it shows signs of weakness, it often prompts policy adjustments.

Inflation, another key piece of the puzzle, has also eased but remains a point of attention. While the overall Personal Consumption Expenditures (PCE) price index is hovering around 2.7%, it's still a bit above the Fed's 2% target. Core PCE, which excludes volatile food and energy prices, is showing a similar trend, sitting around 2.8%–2.9%. This near-target inflation level provides the Fed with the breathing room to consider easing policy without triggering fears of resurgence in price pressures.

Here's a quick breakdown of the key economic indicators influencing the Fed's decision:

| Economic Indicator | Latest Value (Late 2025) | Trend & Fed Relevance |

|---|---|---|

| GDP Growth | 1.8%–2.0% (annualized) | Moderating growth supports rationale for easing to prevent a sharper slowdown. |

| Unemployment Rate | 4.4% | Rising slightly, indicating a cooling labor market, which is a strong signal for potential rate cuts. |

| PCE Inflation (Headline) | ~2.7% | Approaching 2% target, reducing pressure for hawkish policy, but still requires monitoring for stability. |

| Core PCE Inflation | ~2.8%–2.9% | Stable but elevated, closely watched by the Fed to gauge underlying price pressures. |

| Consumer Sentiment | Lowered from previous months | Reflects cautious consumer behavior, potentially impacting future spending and economic momentum. |

These numbers, drawn from credible sources like the Bureau of Economic Analysis and the Bureau of Labor Statistics, paint a picture of an economy that is still growing but at a slower pace, with some softness in the labor market and inflation moving in the right direction. This is precisely the kind of environment where a central bank might decide to nudge rates lower to support continued expansion.

Market Expectations: The FedWatch Snapshot

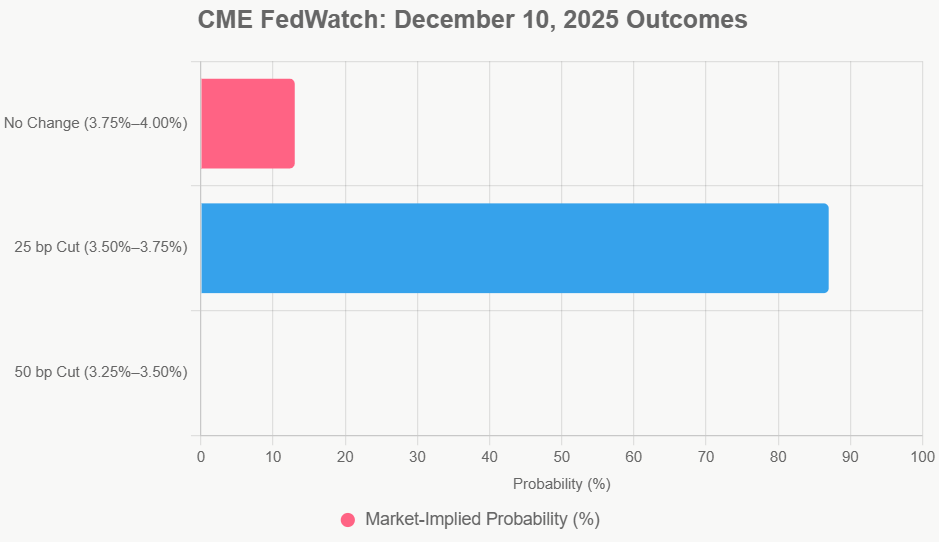

When I look at how financial markets are interpreting the economic data and the Fed's past actions, one tool stands out: the CME Group's FedWatch Tool. This tool, which uses fed funds futures to gauge market sentiment, is currently showing an overwhelming 87.2% probability of a 25 bp rate cut at the December meeting. That's a really high level of conviction from market participants, suggesting that this move is largely priced in.

The Fed's own communication also provides clues. Chair Jerome Powell has been careful to emphasize that no decision is guaranteed and that policy remains data-dependent. However, his remarks often acknowledge the downward trends in inflation and the softening in the labor market. Back at the October FOMC meeting, the Summary of Economic Projections (SEP) indicated a median expectation for three rate cuts in 2025. With the current trajectory, the December cut would fulfill that expectation.

Looking beyond December, economists and market analysts are already forecasting the path for 2026. A widely cited survey by Reuters suggests that most economists anticipate two further rate cuts in 2026, likely occurring in the spring and summer, bringing the target rate down to the 3.00%–3.25% range by mid-year. This suggests a gradual easing cycle rather than an aggressive pivot.

Consider this snapshot of market expectations for the December 10 decision:

- 25 bp Rate Cut to 3.50%–3.75%: Probability of ~87%

- No Change (Rate remains at 3.75%–4.00%): Probability of ~13%

- 50 bp Rate Cut (Rate to 3.25%–3.50%): Probability is negligible.

This strong market consensus means that a rate cut isn't likely to cause a massive market shock. Instead, the focus will quickly shift to any forward guidance the Fed provides about its plans for 2026 and beyond.

Understanding the Fed's Perspective: A Balancing Act

From my experience, the Fed operates like a skilled tightrope walker. On one side is inflation, which they need to keep in check. On the other is economic growth and employment, which they need to support. In 2025, they’ve been carefully lowering rates to achieve a “soft landing”—growing the economy without tipping it into recession, while also bringing inflation back to target.

Several factors are at play:

- Labor Market Signals: The rise in unemployment, though modest, is a clear signal that the economy isn't firing on all cylinders. Companies might be slowing hiring or even implementing some layoffs, a trend that calls for monetary policy support.

- Inflation Trajectory: While inflation isn't fully tamed, its downward trend has been consistent enough to reduce the immediate urgency for aggressive rate hikes or even holding rates steady at restrictive levels.

- Internal Fed Debates: Even within the Federal Open Market Committee (FOMC), there are differing views. So-called “doves” might be more inclined to cut rates sooner to ensure full employment, while “hawks” might urge more patience to absolutely guarantee inflation is defeated. The current consensus suggests that the arguments for easing are winning out. Fed Chair Powell himself has acknowledged the need to balance progress on inflation with labor market vulnerabilities.

It's this delicate balance that makes my analysis of the Fed's decisions so fascinating. They aren't just reacting to numbers; they are interpreting them within a broader economic context and considering the potential domino effects of their actions.

Beyond the Numbers: Potential Impacts on Your Wallet and Investments

A 25 bp rate cut by the Fed, even if anticipated, will have ripple effects. Let’s break down what this might mean for you and the broader economy:

- Mortgage Rates: When the Fed cuts rates, it doesn't directly set mortgage rates, but it influences them. Lowering the federal funds rate generally pushes down other borrowing costs. Currently, average 30-year mortgage rates are around 6.28%, down from highs of 7% or more earlier in the year. A December cut could push these rates closer to 6% or even slightly below, making home buying a bit more affordable. However, with home prices still at historically high levels (the median home price is around $420,000), this affordability improvement might be tempered. I anticipate a modest increase in housing demand, perhaps 5%-7%, during the spring buying season next year, with lower rates helping to some extent.

- Stock Markets: Markets tend to react positively to rate cuts, as lower borrowing costs can boost corporate profits and consumer spending. Equities have already seen a solid year, with major indexes up considerably. A cut could provide another tailwind, perhaps a 1%-2% lift in the short term. Sectors that are particularly sensitive to interest rates, like technology (which has already outperformed significantly) and real estate investment trusts (REITs), might see continued strength.

- Consumer Spending and Business Investment: Lower interest rates make it cheaper for businesses to borrow money for expansion and for consumers to finance large purchases on credit. While this can be a stimulus, the impact might be somewhat limited by the current levels of consumer debt and ongoing concerns about the cost of living. Still, it's expected to provide a small boost to overall economic activity in 2026.

- Global Markets: A Fed cut can also influence the U.S. dollar's exchange rate. A generally weaker dollar can make U.S. exports cheaper and more competitive abroad, but it can also put pressure on emerging market economies that hold dollar-denominated debt.

It’s important to remember that markets are forward-looking. Much of the expected benefit of this cut is likely already factored into current prices. The real excitement will come from any “forward guidance”—hints about whether this cut is a one-off or the start of a longer easing cycle.

Looking Ahead: What’s Next for Interest Rates?

The December 2025 meeting isn't an endpoint; it's a mile marker. The Fed's communication following the meeting, particularly any updated projections or statements from Chair Powell, will be crucial for understanding the outlook for 2026.

My expectation, shared by many economists, is that the Fed will proceed cautiously with further rate cuts in 2026, contingent on inflation continuing its descent and the labor market remaining stable. The key will be watching:

- The “Dot Plot”: The FOMC's updated projections in early 2026 will reveal individual policymakers' expectations for future rates.

- Inflation Data: Any surprises on the inflation front, perhaps from renewed supply chain issues or geopolitical events affecting energy prices, could derail the easing path.

- Labor Market Trends: Persistent job growth weakness would likely accelerate the pace of cuts, while a rapid re-acceleration could put them on hold.

In my reading of the situation, the Fed is navigating a complex period. The latest predictions for December 2025 point to a measured step toward a more accommodative monetary policy, balancing the need to support growth with the imperative to keep inflation under control. It's a pivotal moment, and the decisions made now will certainly echo throughout the coming year.

Invest in Real Estate While Rates Are Dropping — Build Wealth

If the Federal Reserve moves forward with another rate cut in December, investors could gain a valuable window to secure more favorable financing terms and scale their portfolios ahead of renewed buyer demand.

Lower borrowing costs would boost cash flow and enhance overall returns, especially for those positioned to act quickly

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Fed Interest Rate Predictions Signal 70% Chance of December 2025 Cut

- Fed Meeting Minutes Expose Divide: Why December Rate Cut Odds Are Fading Fast

- Fed Interest Rate Predictions for the December 2025 Policy Meeting

- Fed Signals Growing Reluctance to Interest Rate Cut in December 2025

- Fed Cuts Interest Rate Today for the Second Time in 2025

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet