The Federal Reserve's latest meeting minutes have thrown a spotlight on a significant internal disagreement among policymakers, making a December interest rate cut look increasingly unlikely. Released on November 19, 2025, these minutes reveal a 10-2 vote for a 25 basis point rate cut at the October meeting, but crucially, they highlight that “many” officials felt further easing in December was not warranted. Why?

Because the persistent worries about inflation are starting to outweigh the signs of a cooling job market. This internal clash has sent markets into a frenzy, dramatically shifting expectations for the Fed's year-end moves.

Fed Meeting Minutes Expose Divide: Why December Rate Cut Odds Are Fading Fast

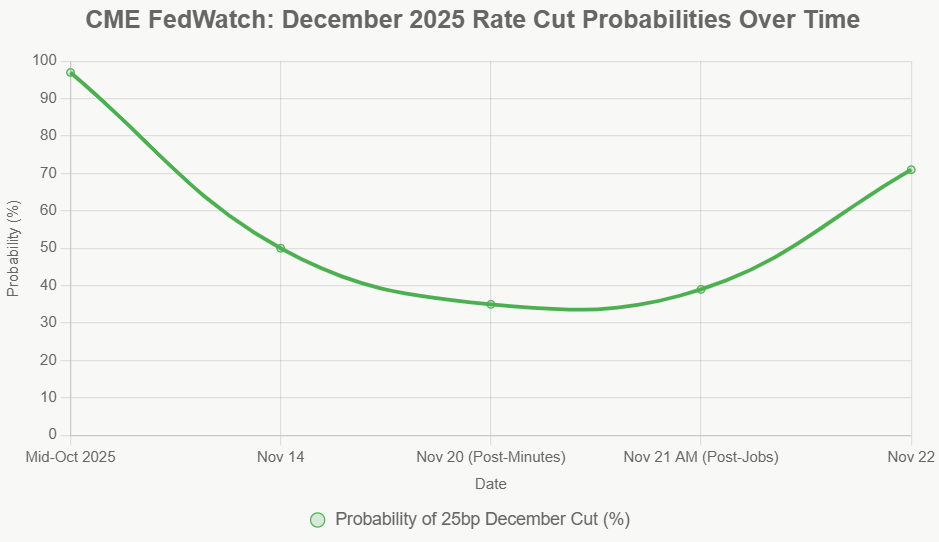

It feels like just yesterday that the market was practically guaranteeing a December rate cut. We were looking at probabilities hovering around 97% in mid-October. But these minutes, well, they've put a serious dent in that certainty. Now, those odds have bounced all over the place, dipping to as low as 35% after the minutes dropped, and even lower briefly following a surprisingly strong jobs report.

While they've clawed their way back up a bit thanks to some dovish comments from Fed officials, the air of inevitability has vanished. I've been following Fed policy for a long time, and what strikes me here is how a single document can so dramatically reshape expectations when there's this much underlying division within the central bank itself.

The Fed's Balancing Act: Inflation vs. Employment

To really get why this is happening, we need to understand the tightrope the Federal Reserve is walking. On one side, there's the job market, which has been showing signs of gradually cooling. We saw nonfarm payrolls add 128,000 jobs in October, which was less than what many expected. The unemployment rate also nudged up to 4.3%. These are the kinds of signals that typically make the Fed consider easing monetary policy – meaning, cutting interest rates – to support employment and keep the economy humming without causing a recession.

But on the other side of the coin is inflation. While it's come down a lot from its peaks, it's still sitting above the Fed's target of 2%. The latest figures show core PCE inflation at 2.8%, and crucially, it ticked up from 2.5% in June. What's adding fuel to the fire are concerns about upside risks to inflation. Think about potential trade tariffs, which could make imported goods more expensive and push prices higher. This is a big consideration. If inflation starts to creep back up, the Fed’s job of bringing it back to 2% – a task they worked so hard to achieve – becomes much harder.

This tension between wanting to support jobs and needing to keep inflation in check is the heart of the Fed's dilemma. It's not a simple “cut” or “don't cut” scenario; it's a complex calculation based on data that’s constantly evolving.

Recent Fed Actions: A Pivot, But Not a Promise

Let's zoom out for a second. The Fed didn't just suddenly decide to consider cuts. They actually did cut interest rates twice in 2025 – by 25 basis points in September and again in October. This brought the target federal funds rate down to a range of 3.75%-4.00%. This pivot from hiking rates to cutting them signaled a shift in their thinking, acknowledging that the economy was slowing and that the risks to employment were growing.

However, these minutes make it clear that the decision to cut wasn't unanimous, and the feeling is that many officials are now hesitant to continue this easing trend in December. The vote of 10-2 in October, while indicating a majority favored a cut, still had two dissenting voices. But the sentiment expressed in the text goes deeper than that single vote. It reveals that even among those who voted for the cut, there isn't overwhelming confidence about further easing.

Inside the FOMC Minutes: A Tale of Two Minds

Reading between the lines of the FOMC minutes is where the real insight lies. The document, dense with economic jargon and careful phrasing, lays bare the “strongly differing views” on the direction of monetary policy.

On one hand, you have the inflation hawks. These officials are clearly worried that inflation isn't falling fast enough and that the recent cuts might be premature. They point to continued strength in core services inflation and, importantly, the potential impact of new tariffs. These tariffs could add a significant chunk to consumer price increases, essentially undoing some of the progress made. For this camp, keeping rates steady signals a strong commitment to price stability and avoids the risk of reigniting inflation.

On the other side are the employment doves. Their focus is on the risks to the labor market. They see the gradual softening—the slower job gains, the modest rise in unemployment, and the dropping number of job openings—as indications that the economy could weaken further. They believe that further rate cuts are necessary to prevent a significant rise in unemployment and ensure a smooth “soft landing.” They might view the current level of interest rates as too restrictive and potentially stifling economic activity more than necessary.

The minutes explicitly state: “Many participants judged that the economic outlook did not warrant a further reduction in the target range at the December meeting.” This is a pivotal sentence. It suggests that the “hold steady” camp might now have the upper hand heading into the December meeting. The “many” here is key – it implies a significant portion of the committee, perhaps even a majority, is leaning towards pausing further rate cuts for now.

There was also a brief mention of financial stability concerns, something the Fed always keeps an eye on. Things like hedge funds holding a lot of Treasuries and banks dealing with unrealized losses on their holdings were noted. To address this, the Fed unanimously agreed to stop reducing its balance sheet runoff by December 1. This is a technical move aimed at ensuring there's enough liquidity in the financial system, but it also signals a cautious approach to monetary policy.

Market Mayhem: The Rollercoaster of Rate Cut Odds

The market's reaction to these minutes has been nothing short of a wild ride. As I mentioned, the probability of a December rate cut, which was once almost a sure thing, has plummeted. When the minutes were released, the CME FedWatch Tool, which tracks market expectations based on futures contracts, showed the odds of a 25 basis point cut dropping from around 60-70% to a mere 35%.

This uncertainty sent ripples through the bond market. We saw yields on Treasury bonds jump. The 10-year Treasury yield, a key benchmark for borrowing costs across the economy, climbed to about 4.2%. This rise in yields, especially with short-term rates still high relative to long-term rates, further inverted the yield curve. An inverted yield curve, as I understand it, has historically been a fairly reliable predictor of recessions, so this movement certainly made investors nervous.

The drama didn’t stop there. Adding to the confusion was a surprisingly strong November jobs report released just two days later. Nonfarm payrolls surged by 215,000, significantly beating expectations. This report could be interpreted in two ways: on one hand, it shows a resilient labor market, which is good. On the other hand, it reduces the urgency for the Fed to cut rates to support employment. Consequently, Fed Funds futures briefly pushed the odds of a December cut even lower, sometimes below 35%. Major financial institutions shifted their forecasts, with J.P. Morgan, for instance, revising its outlook to no December cut.

However, the market's fickle nature soon kicked in. Comments from New York Fed President John Williams on November 21 offered a more dovish tone, suggesting there was “room for cuts” if inflation continued to ease. This sparked a quick rebound in cut probabilities, pushing them back up above 70% again. This constant back-and-forth illustrates just how sensitive markets are to every piece of data and every word from Fed officials. It's a constant recalibration.

Here’s a snapshot of how those probabilities have been dancing:

| Date Range | Probability of December Cut (%) | Key Driver |

|---|---|---|

| Mid-October 2025 | ~97% | Strong market consensus, prior Fed signals |

| November 20, 2025 | ~35% | FOMC Minutes release (hawkish lean) |

| Morning, Nov 21, 2025 | ~30-40% | Strong November jobs report, J.P. Morgan revision |

| Late, Nov 21, 2025 | ~71% | Dovish comments from NY Fed President Williams |

This table shows how quickly sentiment can shift. It’s a stark reminder that the Fed’s path isn’t set in stone, and market expectations are constantly being revised.

Economist Forecasts: A Divided Field

It's not just the markets; economists are also deeply divided. Before the jobs report, a Reuters poll indicated that a solid 80% of economists still expected a December rate cut. They were likely factoring in the ongoing slowdown in employment and the committee's previous pivot. Firms like Goldman Sachs were also in this camp, projecting a cut to support the anticipated moderate growth.

But the strong jobs report and the hawkish undertones in the Fed minutes have shaken this consensus. As mentioned, J.P. Morgan changed its tune. Bank of America Global Research, on the other hand, noted the minutes' emphasis on rising inflation risks and revised their forecast to no December cut, predicting fewer total cuts in 2026 than previously thought.

This divergence among economists reflects the fundamental uncertainty about the economic outlook. Some see a resilient economy that doesn't need more rate cuts, while others see growing risks of a slowdown that the Fed needs to address.

What Happens Next? Potential Scenarios for December

So, what does this all mean for the Federal Open Market Committee's (FOMC) meeting on December 16-17? Based on current market pricing, the most likely scenario is a 25 basis point rate cut. This is what the majority are still betting on, implying that they believe the incoming data between now and then will likely confirm the need for further easing, perhaps with softer inflation figures or more pronounced labor market cooling.

However, the minutes have significantly boosted the odds of the Fed choosing to hold rates steady. If inflation proves to be more stubborn than expected, or if other economic indicators show unexpected strength, the hawks might win out. This would signal that the Fed is prioritizing its inflation fight above all else, even at the risk of slowing the economy further.

There are always outlier possibilities too. A 50 basis point cut seems highly unlikely unless there's a dramatic deterioration in the labor market – a sudden surge in unemployment, for example. Conversely, a rate hike is virtually off the table given the current economic trajectory.

Each scenario carries its own set of implications:

- If the Fed Cuts Rates: We could see a positive reaction in equity markets, a further dip in mortgage rates providing a boost to housing, and a generally more optimistic consumer sentiment.

- If the Fed Holds Steady: Financial markets might react with a bit of nervousness. Bond yields could tick higher, potentially putting pressure on stocks, especially growth-oriented tech companies. This would signal the Fed's strong focus on inflation and might lead to a period of further economic caution.

The Bigger Picture: What This Means for You

The internal debates within the Fed aren't just abstract economic discussions; they have real-world consequences. For individuals and businesses, the path of interest rates affects everything from the cost of borrowing for a mortgage or a car loan to the returns on savings accounts and the performance of investments.

If rates stay higher for longer, it means borrowing will remain more expensive. This could slow down big purchases like homes and cars, impacting industries that rely on consumer spending. For savers, it's generally good news, as they earn more interest on their deposits. For investors, higher rates can make bonds look more attractive relative to stocks, potentially leading to more volatility in the stock market.

The “fading fast” narrative around the December rate cut, even with the market's rebound, suggests a period of continued uncertainty. It means that the Fed is going to be extremely vigilant, watching every economic report closely. As we head into the end of 2025, the focus will be squarely on inflation data and employment figures.

The Fed’s decision, whatever it may be, will be heavily data-dependent, and the minutes have made it clear that there's no consensus just yet. It’s a reminder that in the world of monetary policy, certainty is a luxury rarely afforded.

Invest in Real Estate While Rates Are Dropping — Build Wealth

If the Federal Reserve moves forward with another rate cut in December, investors could gain a valuable window to secure more favorable financing terms and scale their portfolios ahead of renewed buyer demand.

Lower borrowing costs would boost cash flow and enhance overall returns, especially for those positioned to act quickly

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Fed Interest Rate Predictions for the December 2025 Policy Meeting

- Fed Signals Growing Reluctance to Interest Rate Cut in December 2025

- Fed Cuts Interest Rate Today for the Second Time in 2025

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet