February 2024 portrays a real estate market in Greenville that is in a state of equilibrium, albeit with a slight tilt towards sellers. The surge in new listings and inventory levels signifies a growing market, while the increase in home prices and stable days on market indicate sustained demand.

How is the Greenville housing market doing currently?

Several key trends are shaping the Greenville housing market:

- Rising Home Prices: The median home price in Greenville has experienced steady growth. This trend is driven by a strong local economy, a growing population, and a limited supply of available homes.

- Reduced Inventory: The number of homes available for sale has decreased significantly, creating a seller's market. This low inventory is contributing to the upward pressure on home prices and making it more challenging for buyers to find suitable properties.

- Increased Competition: With fewer homes available and a growing pool of buyers, the competition for properties has intensified. Buyers need to be prepared to act quickly and make strong offers to secure their desired homes.

- Demand for Specific Property Types: There is a high demand for certain types of properties, such as starter homes, move-in ready homes, and homes in desirable neighborhoods. Buyers looking for these types of properties may face more competition and higher prices.

Here’s the latest update on the Greenville real estate market released by the Greater Greenville Association of Realtors (GGAR).

Greenville Market Statistics

The average sales price for homes in Greenville stood at $357,144, marking a 4.6% increase compared to the previous year. Similarly, the median sales price experienced an uptick, rising by 3.1% to $299,900 from February 2023.

There were 1,863 new listings submitted to the MLS last month, representing a substantial 24.3% increase over the previous year. Concurrently, the number of homes sold saw a notable 11.9% uptick, totaling 1,151 units.

Interestingly, despite the surge in inventory, the average days on the market remained unchanged at 57 days, indicating stability in the pace of transactions.

Market Dynamics

With 4,010 active listings available in Greenville last month, there was a significant 35.6% increase compared to the same period a year ago. This expansion in inventory levels, however, may not entirely meet the existing demand.

The surge in the median sales price can be attributed to persistent demand, driving home prices higher. Despite the increased competition among sellers, the stability in the days on market suggests a relative balance between supply and demand.

Moreover, the Months Supply of Inventory rose by 39.1% to 3.2 months, indicating a relatively higher supply against demand. This implies a slight increase in competition among sellers, which could influence future market dynamics.

Greenville Housing Market Forecast 2024 & 2025

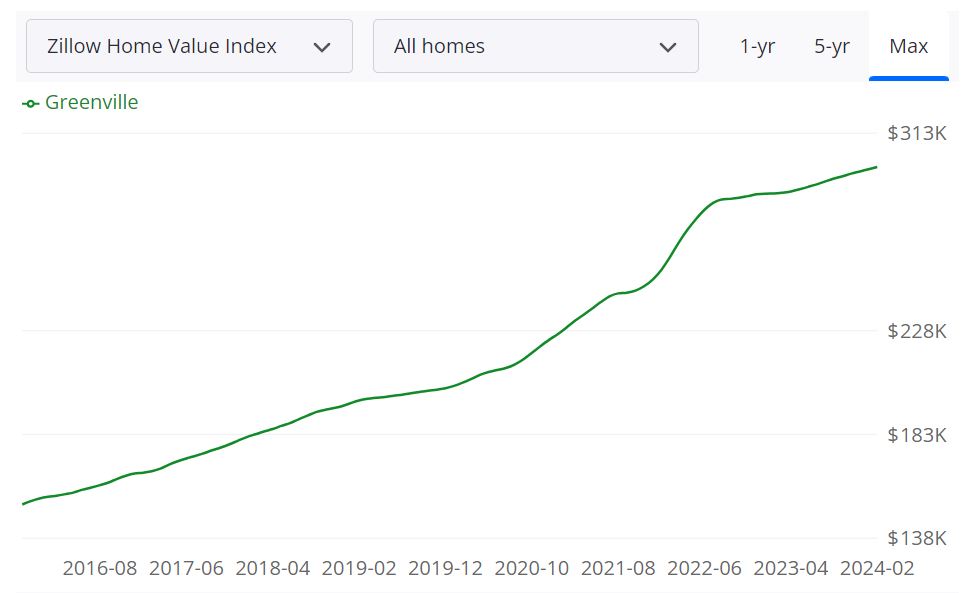

According to Zillow, the average home value in Greenville stands at $299,060, reflecting a 4.0% increase over the past year, with properties typically going pending within 20 days. Delving deeper into the metrics unveils a nuanced perspective:

For Sale Inventory and New Listings

As of February 29, 2024, the market boasts 565 available properties, with 200 new listings added during the same period. This steady influx of listings indicates an active market, providing buyers with diverse options.

Median Sale and List Prices

The median sale price as of January 31, 2024, stands at $293,650, while the median list price recorded on February 29, 2024, is $343,833. This disparity between list and sale prices suggests competitive pricing dynamics, with sellers potentially setting higher expectations than realized in transactions.

Sale-to-List Ratio and Sales Performance

The median sale-to-list ratio is noted at 0.987 as of January 31, 2024. This metric indicates that properties typically sell for slightly under their listed prices. Moreover, 22.8% of sales occur above list price, while 59.5% fall below it, signaling varying negotiation outcomes and market conditions.

Greenville MSA Housing Market Forecast

Looking ahead, the Greenville Metropolitan Statistical Area (MSA) housing market is poised for gradual growth. Defined by Zillow as including Greenville, SC, this MSA encompasses surrounding counties, illustrating the breadth of its influence. With a 0.3% forecasted increase by March 31, 2024, followed by 0.9% by May 31, 2024, and 1.7% by February 28, 2025, the region demonstrates resilience and potential for expansion.

Are Home Prices Dropping in Greenville?

Contrary to expectations, home prices in Greenville are not dropping but rather experiencing a gradual increase. The 4.0% year-over-year rise in average home value reflects sustained demand and limited inventory, contributing to a competitive pricing environment. The current state of the Greenville housing market leans towards being a seller's market. This is evidenced by the relatively low inventory of available properties compared to the demand from buyers. With properties typically spending a short time on the market before going pending, sellers hold an advantageous position, often receiving multiple offers and achieving favorable sale prices.

Will the Greenville Housing Market Crash?

Based on current data and forecasts, there is no indication of an imminent housing market crash in Greenville. While real estate markets are subject to fluctuations influenced by various factors, including economic conditions and regulatory changes, the gradual growth projected in the housing market forecast suggests stability and resilience. However, it's essential to monitor market trends and make informed decisions accordingly.

Is Now a Good Time to Buy a House in Greenville?

For prospective homebuyers in Greenville, the decision to purchase a house depends on individual circumstances and priorities. While the market favors sellers, opportunities still exist for buyers, especially those prepared to act swiftly and strategically. With mortgage rates remaining relatively low and the potential for property appreciation, now could be considered a favorable time to buy for those ready to enter the market.

Should You Invest in the Greenville Real Estate Market?

Greenville, South Carolina, has emerged as a thriving hub for business, culture, and lifestyle, attracting a growing population seeking a vibrant and welcoming community. As a result, the Greenville housing market has experienced a surge in demand, driving up prices and creating a competitive landscape for buyers.

Investing in real estate is a significant decision that requires careful consideration. The Greenville real estate market presents several factors that make it an attractive option for investors. Let's delve into these factors in detail.

Population Growth and Trends

- Greenville has been experiencing consistent population growth over the years. The city's appeal is drawing in new residents seeking a vibrant community with a lower cost of living compared to larger metropolitan areas.

- Population trends indicate that the city's growth is likely to continue, creating a steady demand for housing. This factor is favorable for real estate investors looking for a stable tenant base.

Economy and Jobs

- Greenville boasts a diverse economy with a strong presence of industries such as manufacturing, healthcare, and technology. The region's economy has shown resilience, even in challenging economic climates.

- Job opportunities are abundant in Greenville, attracting a skilled workforce. This economic stability contributes to a robust rental market, making it an ideal place for real estate investments.

Livability and Other Factors

- Greenville is known for its excellent quality of life. The city offers a blend of cultural amenities, outdoor recreation, and a thriving downtown scene, making it a desirable place to live.

- The city's infrastructure and amenities, including schools, healthcare, and entertainment, are well-developed, further enhancing its appeal for residents.

Rental Property Market Size and Growth for Investors

- Greenville's rental property market is sizeable and growing. With an influx of new residents and a thriving job market, the demand for rental properties remains strong.

- The city's diverse economy and educational institutions also attract students and young professionals, contributing to the demand for rental housing. This trend is advantageous for investors seeking consistent rental income.

Other Factors Related to Real Estate Investing

- Tax incentives and favorable regulations for real estate investors in South Carolina make Greenville an attractive location for investment properties.

- The city's real estate market has shown stability and steady appreciation in property values over time, providing potential for long-term capital growth.

- Proximity to major cities like Atlanta and Charlotte enhances Greenville's accessibility and connectivity, making it a strategic location for real estate investments.

Sources:

- https://www.zillow.com/Greenville-sc/home-values

- https://www.realtor.com/realestateandhomes-search/Greenville_SC/overview

- https://www.greatergreenvilleareahomes.com/greenville-real-estate-market-statistics/