As we look ahead to the Federal Reserve's meeting on September 16-17, 2025, everyone's asking the same question: Will the Fed cut interest rates? Considering the fluctuating economic data, I believe it's likely the Fed will cut rates by 0.25% at the September meeting. However, the final decision will depend on key data points released before the meeting. Let's dive deep into the factors influencing this pivotal decision.

Interest Rates Predictions for September 2025: Will the Fed Cut Rates?

Where We Stand Right Now

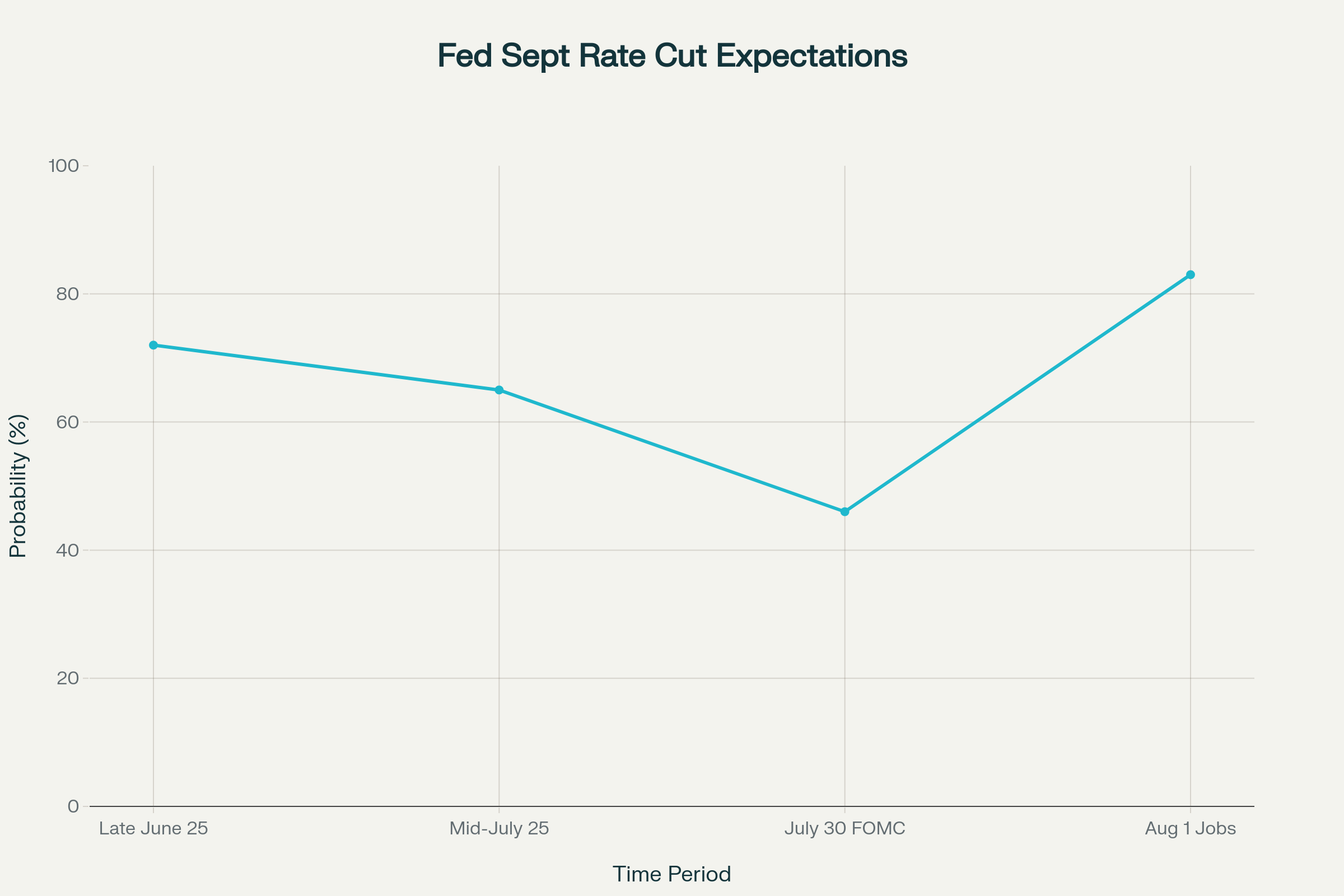

The Federal Reserve has kept the interest rate between 4.25%-4.50% since December 2024. At their July 30, 2025, meeting, they decided to hold steady. At that time, five consecutive meetings had passed without any rate changes. Then, some fresh data came out that made everyone rethink their expectations.

After a disappointing jobs report in July 2025, the chances of a rate cut in September shot up. Before the report, the market predicted only a 37% chance of a cut, but after the report the prediction went up to over 80% according to the CME FedWatch tool. That's a big jump which shows how sensitive the market is to new data.

What's Driving the Fed's Decision?

The economy is sending mixed signals, making the Fed's job much harder. Let's break them down:

- Inflation: Inflation is still above the Fed's target of 2%. In June 2025, it was at 2.7%, up from 2.4% in May. Core inflation, which excludes food and energy, was at 2.9%. The increased tariffs, with average U.S. tariff rates at about 18.4% in July 2025, are contributing to these higher prices.

- Labor Market: The labor market seems to be cooling off. The unemployment rate went up to 4.2% in July, up from 4.1% in June. Also, job growth has slowed. More concerning is that past months' job numbers have been adjusted downwards. May and June job gains were revised down by 258,000 jobs!

Here’s a quick summary:

| Indicator | June 2025 | July 2025 |

|---|---|---|

| Inflation (YoY) | 2.4% | 2.7% |

| Core Inflation | N/A | 2.9% |

| Unemployment Rate | 4.1% | 4.2% |

Tensions Within the Fed

At the Federal Reserve's July 30th meeting, there was some disagreement. Two governors, Michelle Bowman and Christopher Waller, voted for a rate cut of 0.25%. It had been since 1993 that multiple Fed governors have voted againt the majority position, which shows how much pressure there is to start lowering rates.

Jerome Powell, the Fed Chair, played it cool and mentioned that no decision was made about September. He stressed that the Fed wanted to see more data before making any move. He also said the Fed has to balance two things: Cutting rates too soon, which could cause inflation to rise again, versus waiting too long, which could hurt the job market.

The Tariff Situation

It's undeniable that tariffs are causing some serious headaches. Chair Powell admitted that they have made some goods more expensive. The full effect is still unclear. It's a delicate balancing act for the Fed. They see some tariff-related price increases as temporary.

However, the uncertainty around future tariff policy can hurt business confidence and investment decisions. This high level of doubt is one of the factors the Fed is considering.

Economic Growth and Consumer Spending

Even though the job market is shaky, the U.S. economy grew at a 3.0% rate in the second quarter of 2025. However, this growth was mostly due to trade and lower imports, not strong demand in the U.S.

Domestic final sales only grew by 1.2% in the second quarter, which is the slowest since late 2022. This gives a clearer sense of the economy's momentum: things are slowing down.

Consumer spending, which is a significant factor for economic growth, has also slowed, growing by just 1.4% in the second quarter. This is due to higher interest rates and ongoing inflation affecting people's spending power.

What Wall Street Thinks

Financial markets haven't been able to make up their minds. After Powell's cautious comments in July, the dollar became stronger, and Treasury yields increased. People thought the Fed would not be cutting rates soon, but the weak jobs report changed everything. Market participants now expect more aggressive rate cuts.

Big Wall Street firms have changed their forecasts accordingly. Goldman Sachs now predicts three rate cuts in 2025 like what I've indicated, and expects the federal funds rate to be between 3.0%-3.25% by the end of the year. This is pretty substantial.

BlackRock's Rick Rieder even wondered if the Fed might make a big move and cut rates by 0.50% in September if the job market continues to weaken.

The Global View

What the Fed decides greatly influences global markets and other central banks. Many foreign central banks have already started cutting rates. The Fed's actions will likely affect how quickly other central banks make their own changes.

If the Fed starts slashing interest rates, the U.S. dollar, which has been strong, may weaken. This could affect emerging market economies and trade around the world.

Uncertainty Makes Decisions Tough

The Economic Policy Uncertainty Index hit a high of 243.7 in July 2025. This shows how difficult it is for businesses and policymakers to plan for the future.

Fed officials have said that their forecasts are dispersed. The June 2025 Summary of Economic Projections showed that FOMC participants have different ideas about where interest rates should go.

What About Jobs and Inflation?

The job situation is crucial for the Fed's decision, and the Job Openings and Labor Turnover Survey (JOLTS) has shown fewer jobs and lower hiring rates.

Although inflation has come down from its peak, core inflation remains a concern. Models from the Federal Reserve Bank of Cleveland predict that prices will continue to rise in the near future, potentially reaching 2.9% by August 2025.

The Fed needs to figure out whether price increases are temporary due to tariffs or if they are more permanent.

My Interest Rate Predictions for Sept 2025: A Balancing Act

The Federal Reserve is approaching a crossroads. Based on all the evidence, I believe the Fed will likely cut rates in September. Right now, markets estimate around an 80% chance of a 0.25% reduction.

The Fed's next steps will depend on how the economy performs, especially concerning the job market and inflation. I think the challenge will be to figure out recent labor market problems are just a short-term glitch or a sign of something more serious. Though the Fed has some wiggle room to maneuver, the margin for error is small. Given that current unprecedented economic conditions, the September 2025 FOMC meeting could set the tone for monetary policy.

Position Your Portfolio Ahead of the Fed’s Next Move

The Federal Reserve’s next rate decision could shape real estate returns through the rest of 2025. Whether or not a rate cut happens, smart investors are acting now.

Norada Real Estate helps you secure cash-flowing properties in stable markets—shielding your investments from volatility and interest rate swings.

HOT NEW LISTINGS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Recommended Read:

- Fed Holds Interest Rates Steady for the Fifth Time in 2025

- Fed Projects Two Interest Rate Cuts Later in 2025

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Will the Bond Market Panic Keep Interest Rates High in 2025?

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Fed Holds Interest Rates But Lowers Economic Forecast for 2025

- Fed Indicates No Rush to Cut Interest Rates as Policy Shifts Loom in 2025

- Fed Funds Rate Forecast 2025-2026: What to Expect?

- Interest Rate Predictions for 2025 and 2026 by NAR Chief

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet