Considering the data and trends observed, the housing market in New Haven can be classified as a seller's market. With prices on the rise, homes selling above list price, and limited inventory, sellers hold a significant advantage in negotiations. Buyers face stiff competition and may need to act quickly and decisively to secure desirable properties.

However, despite the competitive nature of the market, opportunities exist for both buyers and sellers. Buyers willing to navigate the competitive landscape may find their dream home, while sellers stand to benefit from favorable selling conditions and strong demand.

New Haven Housing Market Trends in 2024

Current State of the Housing Market

The housing market in New Haven, CT has experienced a significant surge in prices over the past year. According to Redfin data, in January 2024, home prices soared by an impressive 37.9% compared to the previous year, with the median price reaching $320,000. Moreover, homes are selling faster, spending an average of 51 days on the market compared to 56 days in the previous year. However, despite the increase in prices, the number of homes sold in January dropped slightly from 53 to 43.

Despite the notable price increase, the median sale price in New Haven remains 13% lower than the national average. The market in New Haven is characterized as somewhat competitive, with homes typically selling in 50 days. Some properties even receive multiple offers, leading to increased competition among buyers.

Market Competitiveness and Trends

New Haven's housing market exhibits signs of competitiveness, with homes selling for about 1% above the list price on average. Particularly sought-after properties, often referred to as “hot homes,” can sell for as much as 7% above the list price and go pending in as little as 14 days. These statistics indicate a market where demand outpaces supply, driving up prices and fostering competition among buyers.

Moreover, key indicators such as the sale-to-list price ratio have seen an increase, reaching 100.2%, indicating that homes are selling slightly above their listed prices. Additionally, the percentage of homes sold above the list price has risen by 9.7 percentage points compared to the previous year, reaching 51.2%. Conversely, the percentage of homes with price drops has seen a marginal increase of 0.7 percentage points year-over-year, reaching 15.3%.

Migration and Relocation Trends

Examining migration and relocation trends provides valuable insights into the dynamics of New Haven's housing market. Between December 2023 and February 2024, 30% of homebuyers in New Haven expressed an interest in moving out of the area, while 70% sought to stay within the metropolitan area.

Interestingly, 3% of homebuyers from across the nation expressed a desire to move into New Haven from outside metropolitan areas. Among these, individuals from San Francisco showed the highest interest in relocating to New Haven, followed by those from Springfield and Lincoln. This influx of potential buyers from other regions suggests a growing appeal and attractiveness of the New Haven housing market.

Future Market Outlook

Looking ahead, the future market outlook for New Haven appears promising yet challenging. While the current market favors sellers due to high demand and limited inventory, there are concerns about affordability and accessibility for buyers. As prices continue to rise, affordability may become a significant barrier for prospective homebuyers.

However, the growing interest from buyers both locally and nationally indicates sustained demand for housing in New Haven. This demand, coupled with ongoing economic development and infrastructure projects, suggests a resilient housing market poised for continued growth.

New Haven Housing Market Predictions 2024 and 2025

New Haven Housing Metrics Overview

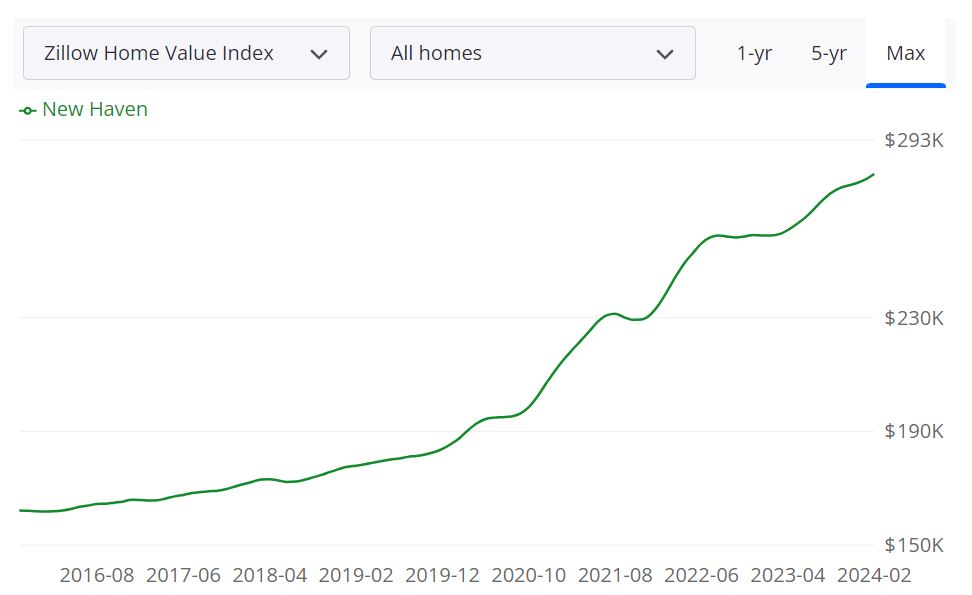

The New Haven housing market has witnessed significant growth in recent times, with the average home value now standing at $281,176, reflecting an increase of 8.3% over the past year. According to Zillow, homes in the area are moving quickly, with the average time to pending sale being approximately 17 days. As of February 29, 2024, there were 107 homes listed for sale, with 26 new listings, and a median list price of $280,167. These metrics provide valuable insights into the current state of the New Haven housing market.

Understanding the New Haven MSA Housing Market Forecast

The New Haven Metropolitan Statistical Area (MSA) encompasses New Haven County in Connecticut. This MSA serves as an essential geographic unit for analyzing economic and housing trends within the region. With a population of over 850,000 residents, the New Haven MSA is a significant contributor to Connecticut's overall economy. Its housing market, characterized by diverse neighborhoods and housing types, plays a crucial role in the state's real estate landscape.

According to the latest forecast data provided by Zillow, the New Haven MSA is projected to experience continued growth in its housing market. As of January 31, 2025, the forecast indicates a 6.6% increase in home values compared to the base date of January 31, 2024. This upward trajectory signifies sustained demand and appreciation within the New Haven MSA.

The forecasted growth reflects the region's resilience and attractiveness to homebuyers and investors alike. Factors such as job opportunities, educational institutions, and quality of life amenities contribute to the appeal of the New Haven MSA as a desirable place to live and invest in real estate.

Are Home Prices Dropping in New Haven?

As of the latest data, home prices in the New Haven area have been steadily rising, indicating a lack of significant price drops. The average home value has increased by 8.3% over the past year, suggesting a trend of appreciation rather than depreciation. However, real estate markets can be subject to fluctuations influenced by various factors such as economic conditions, interest rates, and housing supply. While price drops cannot be entirely ruled out, the current market trend does not indicate a widespread decline in home prices.

The current state of the New Haven housing market leans towards being a seller's market. With limited inventory and strong demand, sellers have the upper hand in negotiations. Low housing inventory coupled with high buyer interest often results in multiple offers and competitive bidding wars. This dynamic favors sellers who can command higher prices and favorable terms for their properties.

Will the New Haven Housing Market Crash?

While no one can predict the future with certainty, there are currently no indications of an imminent housing market crash in the New Haven area. The market fundamentals, including strong demand, limited inventory, and stable economic conditions, do not suggest a scenario conducive to a housing market collapse. However, it's essential to monitor market trends and external factors that could potentially impact the housing market's stability. Vigilance and prudent decision-making are advisable for both buyers and sellers in any real estate market.

Is Now a Good Time to Buy a House in New Haven?

For prospective homebuyers, the decision to purchase a house in the New Haven area depends on various factors, including personal financial circumstances, long-term housing goals, and market conditions. While the current market favors sellers, opportunities may still exist for buyers, especially those who are pre-approved for financing and prepared to act swiftly in competitive situations.

Factors such as low mortgage rates as compared to last year and the potential for future appreciation may make now an attractive time to enter the housing market for buyers who are ready to commit. However, it's essential to conduct thorough research, consult with real estate professionals, and carefully evaluate individual circumstances before making any purchasing decisions.

Is Investing in the New Haven Real Estate Market a Good Decision?

Investing in the New Haven real estate market is a significant decision, and it's essential to consider several factors before making an informed choice.

Population Growth Trends

Population growth is a crucial indicator for the real estate market. Consider the following factors:

Steady Population Growth: If New Haven experiences consistent population growth, it can create increased demand for housing, potentially leading to higher property values.

Demographic Changes: Analyze the demographics of the population to understand the type of housing in demand. For instance, a growing number of young professionals may increase the need for rental properties.

Local Economy and Job Market

The local economy and job market have a significant impact on real estate investment:

Diverse Job Opportunities: A diverse range of job opportunities in various industries can attract new residents and create a strong demand for housing.

Economic Stability: A stable local economy is essential to ensure that residents can afford to rent or buy homes.

Rental Market

For investors interested in rental properties, the rental market plays a crucial role:

Vacancy Rates: Low vacancy rates indicate a healthy rental market, with a consistent demand for rental properties.

Rental Yields: Calculate potential rental yields to ensure that your investment will generate a reasonable return on investment.

Additional Factors to Consider

In addition to the above factors, consider the following:

Local Infrastructure and Development: Assess planned infrastructure projects, as they can impact property values and attractiveness.

Property Management: Determine whether you can efficiently manage the property or if you need a property management service.

Market Trends: Stay informed about current market trends and potential shifts in property values.

Real Estate Regulations: Understand local real estate regulations, taxes, and any restrictions that may affect your investment.

Ultimately, the decision to invest in the New Haven real estate market should be based on thorough research, market analysis, and your individual financial goals. It's advisable to consult with a real estate professional who has local expertise to make an informed investment decision that aligns with your objectives.

References:

https://www.zillow.com/new-haven-ct/home-values/

https://www.redfin.com/city/13410/CT/New-Haven/housing-market

https://www.realtor.com/realestateandhomes-search/New-Haven_CT/overview