Thinking about buying a home, selling your current place, or making a real estate investment? You're not alone. The big question on everyone's mind is: what will the U.S. housing market look like over the next five years, from 2025 through 2029? My take, based on a lot of research and a keen eye on what's happening, is that we're heading for a period of moderate growth and stabilization. Don't expect the wild swings we've seen recently, but instead a more predictable market where home prices will likely inch up by about 3-5% each year, with a gradual thaw in home sales and a slow but steady increase in available homes.

It's easy to get caught up in the headlines, with some predicting a crash and others forecasting a boom. But having spent time digging into the numbers and the common-sense factors that truly shape our housing situation, I feel confident predicting a more balanced path forward. We'll see higher mortgage rates sticking around for a bit longer than many hoped, but not at the sky-high peaks of sometimes. Affordability will remain a key challenge, especially for first-time buyers, but demand is still strong, fueled by demographic shifts. And while inventory is still tight, it's slowly getting better, meaning fewer bidding wars and more options for everyone.

Housing Market Predictions for Next 5 Years: 2025 to 2029

- Home prices will continue to rise in the next five years but at a slower pace. The rapid rise in home prices that we saw in recent years is likely to slow down in the next few years. However, home prices are still expected to rise, albeit at a more moderate pace.

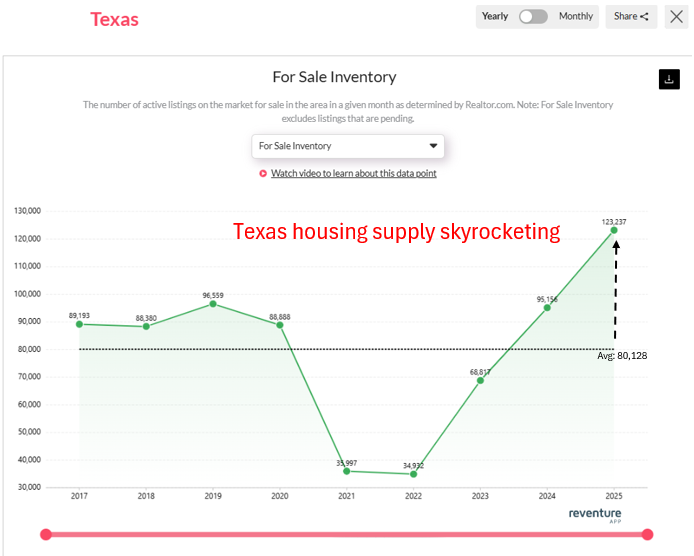

- The supply of homes for sale will increase. The lack of available homes for sale has been a major driver of rising home prices in recent years. However, as more homes are built and come onto the market, we can expect to see some relief from the supply shortage.

- Mortgage rates will rise. The Federal Reserve has been raising interest rates to combat inflation. This has made it more expensive to borrow money, which has led to a decline in demand for homes. However, in the subsequent years, a reversal in this trend is projected, as interest rates are anticipated to gradually recede, potentially culminating in a resurgence of demand in the housing market.

- The housing market will remain competitive in in the next five years. Even with rising interest rates and a growing supply of homes, the housing market is still expected to remain competitive in the next few years. This is due to a number of factors, including strong job growth, population growth, and a limited supply of land.

What Lies Ahead: A Look Year by Year

Let’s break down what we can realistically expect from 2025 to 2029, seeing how things might unfold one year at a time.

| Year | Home Price Growth (Avg. Nationwide) | Existing-Home Sales (Millions) | Inventory (Months' Supply) | 30-Year Mortgage Rates (End of Year) | Rent Growth (Annual Avg.) |

|---|---|---|---|---|---|

| 2025 | 2-3.8% | 4.2-4.25 | 3.5 | 6.4-6.7% | 1-2% (overall); 4% (SFRs) |

| 2026 | 2-3.6% | ~4.5 | 3.8-4.0 | 5.9-6.3% | ~3% |

| 2027 | 3-5% | ~4.6-4.8 | 4.0-4.5 | 6.5-7.5% | ~3% |

| 2028 | 3-5% | ~4.8-5.0 | 4.5-5.0 | 5.5-6% | 2-3% |

| 2029 | 3-5% | ~5.0 | ~5.0 | 5.5-6% | 2-3% |

2025: The Year of Cautious Steps

As we step into 2025, the market will still feel the chill of higher mortgage rates, likely averaging around 6.5-7.5%. This will keep a lid on how fast prices can climb, with modest increases in the 3% range. We might see something like a median home price creeping up to around $410,700. On the flip side, more homeowners who bought when rates were super low will feel more comfortable selling, meaning more homes will hit the market. This could push total sales up a bit, maybe by 7-12%, to around 4.25 million homes. So, while it's still a seller's market with inventory at about 3.5 months, it won't be quite as intense as before. For renters, especially in single-family homes, rents might jump a bit more, perhaps around 4%, while apartment rents stay pretty flat.

2026: A Little More Momentum

In 2026, things should start to loosen up a bit more. I'm expecting mortgage rates to ease slightly, maybe settling around 6% by year's end. This should encourage more buyers to jump back in, and also prod more homeowners to sell, bringing the total sales up by another 10-15%. Home prices will likely see slightly more growth, perhaps around 3.5%. We should also see the number of available homes inching closer to a healthier level, maybe 3.8 to 4 months' supply. This is good news for those looking to buy. Apartment rents will likely start to climb a bit more as well, as the initial wave of new construction slows down nationwide.

2027: Holding Steady Amidst Rate Fluctuations

This year could bring a bit of a mixed bag for mortgage rates, potentially ticking back up to the 6.5-7.5% range. This might slow down the pace of sales and price growth a little. However, the fundamental demand for housing, driven by more people entering their prime home-buying years, will keep things from stalling. So, I'm still predicting home prices to grow steadily, around 3-5%, and sales volume to stay strong. On the inventory front, we should see a continued, slow but steady improvement, getting us closer to that 4-4.5 month mark. This year will also see the start of many loans taken out during the lower-rate periods needing to be reset, which could bring some new properties to the market, though I don't see this causing a big flood.

2028: Approaching a Balanced Market

By 2028, I'm hopeful that mortgage rates will start to seriously trend downwards, possibly falling into the 5.5-6% range. This would be a significant boost for affordability and buyer confidence. With more stable and lower rates, together with a healthy, though still not abundant, supply of homes (aiming for 4.5-5 months), I expect sales to pick up solidly, and home price growth to remain in that comfortable 3-5% range. This year feels like the one where the market will feel much more balanced, offering more choices and less pressure for buyers.

2029: A Smoother Sail

Rounding out our five-year look, 2029 should see the market operating in a much more normalized fashion. Rates likely staying in that 5.5-6% window would provide a stable foundation. Home prices should continue their steady appreciation of 3-5%, and sales volume could reach around 5 million units – a healthy number. Inventory should hover around the 5-month mark, which is generally considered a healthy balance between buyers and sellers. This year promises a more predictable environment, where decisions are driven more by long-term planning than by trying to beat the market's next unpredictable move.

The Real Drivers of What Happens Next

Predicting the future isn't crystal ball work; it's about understanding the forces at play. Here are the big ones I'm watching:

- Mortgage Rates and the Fed: What the Federal Reserve does with interest rates is king. If they keep them high to fight inflation, expect higher mortgage rates and slower sales. If they start cutting rates, it will likely spur more activity. A lot of analysts I trust believe rates will stay elevated for a while, perhaps averaging around 6-7% through 2027, before hopefully easing to 5.5-6% by 2028-2029.

- How Many Homes Are Available (Inventory): This is a huge factor. We've been dealing with a shortage of homes for years, and it’s not going away overnight. While new construction is slowly picking up, and more people are willing to sell, it will take time to fill that gap. I don’t see a sudden flood of homes for sale, which is why the market is unlikely to crash.

- Jobs and the Economy: A strong job market usually means people have money to buy homes. If the economy stays healthy with steady job growth, demand for housing will remain robust.

- Who's Buying and Selling (Demographics): Think about the millennials, who are now in their prime home-buying years. There are a lot of them! This means steady demand. On the flip side, Baby Boomers are starting to downsize, which could bring more homes onto the market. These demographic shifts are powerful, long-term trends.

- What’s Happening in Specific Regions: The U.S. is a big place, and real estate is local.

- Midwest markets like Ohio and parts of West Virginia are attractive because they are more affordable. I expect these areas to see stronger price appreciation in the coming years, as people look for better value.

- Sun Belt states, which saw huge growth during the pandemic, might see slower appreciation or even stabilization. Some areas there might have a bit of oversupply, and there's the growing concern about climate risks and rising insurance costs, especially in places like Florida.

- The West Coast will likely continue to see high prices, but affordability will be a major hurdle, limiting significant price jumps.

Beyond the Big Picture: Deeper Trends

- Renting Might Be More Attractive for Some: With higher mortgage rates and high home prices, renting will continue to be a strong option for many, particularly for single-family homes. Builders of build-to-rent communities are expecting good returns.

- Green and Smart Homes: People are increasingly interested in energy-efficient homes and smart technology. This trend will likely grow, and homes that offer these features might command a premium.

- Rising Construction Costs and Labor: Things like tariffs on building materials and shortages of skilled construction workers could make it more expensive and slower to build new homes, which can only add to the existing inventory problem.

- Climate Change's Impact: We can't ignore the real effects of climate change. Higher insurance costs in flood-prone or fire-prone areas could make owning homes there more expensive and less desirable, potentially impacting home values in those specific regions.

Will it Become a Buyer's Real Estate Market in the Next 5 Years?

It's at the heart of what many people want to know when we talk about. Based on my analysis, I don't see a full-blown, traditional buyer's market emerging in the next five years. Here's why I say that:

- Persistent Inventory Shortage: The core issue is that we still have a significant shortage of homes. Even with a slow increase in inventory, it's unlikely to reach a level where homes sit on the market for extended periods or where buyers can make very lowball offers and have them accepted. We're talking about a gap of millions of homes nationwide; that doesn't disappear in just five years. This persistent undersupply is a powerful force keeping the market from tilting heavily in favor of buyers.

- Strong Underlying Demand: Demographics are a huge factor. Millennials are in their peak home-buying years, and there’s a significant number of them. This sustained demand is a constant pressure that will prevent a full buyer's market scenario.

- Affordability Hurdles: Ironically, while affordability challenges limit buyer activity, they also prevent a market flooded with buyers who can dictate terms. When buying is tough, fewer people are actively in the market, which can seem like a buyer's advantage, but it's often more about demand being suppressed rather than supply being overwhelming.

- Moderate Price Growth: We're predicting moderate home price appreciation (3-5% annually). This isn't the kind of environment where prices are dropping significantly. While growth will be slower than in recent years, the overall trend is still upwards, which is characteristic of a more balanced or slightly seller-favored market, not a buyer's one.

What We Will See is a More Balanced Market

Instead of a buyer's market, I anticipate a more balanced market emerging, especially by 2028-2029. Here's what that looks like:

- More Options: Inventory will improve enough that buyers will start to have more choices. You might not have to rush into an offer the second a house lists.

- Negotiation Power Returns (Slightly): Buyers will likely regain some negotiation power. This means being able to negotiate on price, repairs, or closing costs might become more common than in the intense seller's markets of the recent past.

- Less Intense Bidding Wars: While multiple-offer situations won't disappear entirely, they'll likely become less frenzied and less frequent.

- Regional Differences: As I mentioned, some areas, particularly affordable Midwest markets, might lean more towards a buyer's advantage simply because they are more accessible. Conversely, high-demand or supply-constrained areas might remain more challenging for buyers.

In short: It’s unlikely to be a true “buyer's market” where sellers are desperate. However, it will improve significantly for buyers compared to the recent extreme seller's market, leading to a more comfortable and balanced experience for many over the next five years, especially towards the latter half of that period.

Summary:

In conclusion, while the US real estate market is expected to see a moderation in price growth and increased inventory over the next 5 years, it is unlikely to become a full buyer's market nationwide. Regional variations will play a significant role, with some areas like Florida and certain Western cities potentially favoring buyers, but the national market will likely remain balanced or slightly seller-favorable due to persistent housing shortages and strong demand. Economic policies and consumer spending trends will be critical, but experts do not anticipate a crash, with lending standards and a strong labor market providing stability.

Invest in Real Estate to Build Cash Flow Portfolios

The next 5 years could bring shifting rates, tighter supply, and strong rental demand — smart investors will build cash flow portfolios now while others wait.

Norada helps you buy turnkey rental properties that generate income from day one — no stress, no guesswork, just predictable returns and long-term growth.

🔥 Invest Smart for the Next 5 Years 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- 5 Cities Where Home Prices Are Predicted To Crash in 2025

- Fannie Mae Lowers Housing Market Forecast and Projections for 2025

- Housing Market Forecast 2025 by JP Morgan Research

- Housing Predictions 2025 by Warren Buffett's Berkshire Hathaway

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Housing Market Forecast 2025: Affordability Crisis Will Continue

- Lower Mortgage Rates Will Reignite the Housing Demand in 2025

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for the Next 4 Years: 2025 to 2028

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?