Are you dreaming of buying a home or considering refinancing, but worried about those mortgage rates? You're probably wondering, will mortgage rates go down below 6% in 2025? Based on current trends and expert predictions, the short answer is probably not. While many of us are hoping for a significant drop, the consensus leans towards rates staying in the mid-6% range throughout the year. Let's dive into the reasons why and what it means for you.

Will Mortgage Rates Go Down Below 6% in 2025? An In-Depth Analysis

Understanding Today's Mortgage Rate Reality

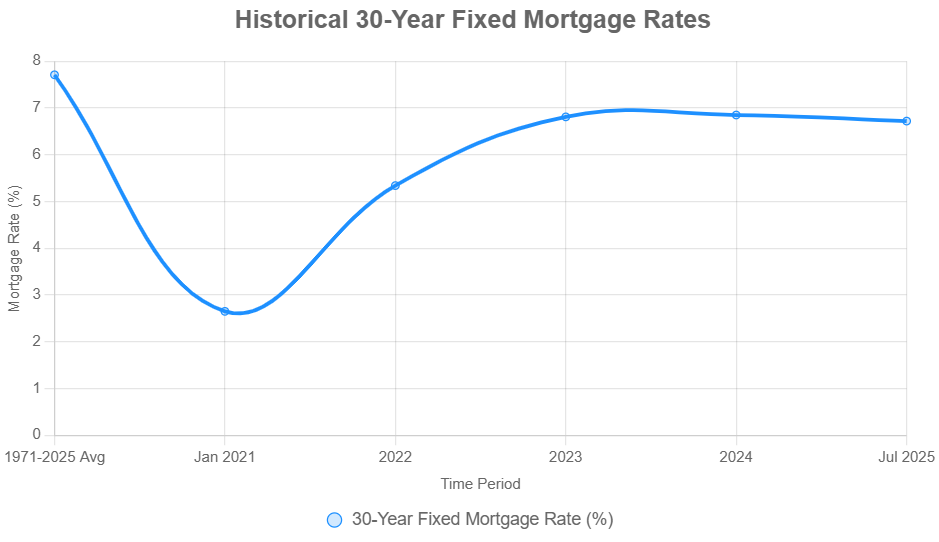

As of August 2025, the average 30-year fixed mortgage rate is hovering around 6.72%. That's according to sources like Bankrate and Freddie Mac. NerdWallet even reported slightly higher figures. Sure, this is way up from the ridiculously low rates we saw in 2021 (remember that 2.65%?), but it's still below the historical average of 7.71% since 1971. So, while it might feel high, it's important to keep things in perspective. Rates have been fluctuating within this 6-7% range all year.

What the Experts Are Saying: Forecasts for 2025 and Beyond

To get a better idea of where things are headed, I decided to check out what the experts are predicting. Here's a snapshot of some key forecasts:

- National Association of Realtors (NAR): They're anticipating an average of 6.4% by the end of 2025 and a further dip to 6.1% in 2026. Their chief economist, Lawrence Yun, doesn't see rates going back to the 4% or 5% range anytime soon due to the national debt.

- Realtor.com: They're also projecting a 6.4% rate by the end of 2025.

- Fannie Mae: Their economic team predicts 6.5% for the end of 2025, with a decrease to 6.1% in 2026.

- Mortgage Bankers Association (MBA): They're a bit more conservative, expecting rates to stay around 6.8% for a while before settling in the 6.4%-6.6% range and ending the year at 6.7%.

- Morgan Stanley: They foresee rates potentially reaching 6.25% by 2026.

As you can see, the experts generally agree that mortgage rates aren't likely to plummet below 6% in 2025. Most forecasts hover in the mid-6% area.

Key Factors Driving Mortgage Rates

So, what's causing these rates to stay where they are? A few major factors are at play:

- Federal Reserve Policy: This is a big one! The Fed's decisions about interest rates have a huge impact on mortgage rates. They raised rates aggressively to combat inflation.

- Inflation: Even though inflation has cooled down a bit, it's still above the Fed's target of 2%. This makes it harder for them to cut rates significantly.

- Economic Growth: A strong economy can actually push rates higher, as investors demand better returns on their investments.

- Treasury Yields: Mortgage rates often follow the 10-year Treasury yield.

- Global and Domestic Policies: Unexpected global events and policies can also create uncertainty and influence rates.

A Look Back: Mortgage Rate History

To really understand where we are, it's helpful to look back at mortgage rate history:

| Time Period | Average Rate |

|---|---|

| 1971–2025 (Average) | 7.71% |

| January 2021 | 2.65% |

| 2022 | 5.34% |

| 2023 | 6.81% |

| 2024 | 6.85% |

| July 2025 | 6.72% |

As you can see, we've had quite a ride! The super-low rates of the early 2020s were an anomaly. The current rates, while higher than recent years, aren't out of line with historical averages.

How Mortgage Rates Affect the Housing Market

Mortgage rates have a huge effect on the overall housing market:

- Affordability: Higher rates mean bigger monthly payments, making it harder for people to afford homes. Even a small difference in rate can add up to hundreds of dollars per month.

- Demand: When rates are high, fewer people are willing to buy.

- Supply: Some homeowners are locked into low rates. They're hesitant to sell and give up those amazing rates.

- Home Prices: Higher rates can put downward pressure on home prices.

Related Topics:

Mortgage Rates Predictions for the Next 3 Months: August to October 2025

Mortgage Rates Predictions for Next Year: Will Rates Go Down to 4%?

Mortgage Rates Predictions for the Next 30 Days: July 22-August 22

Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

My Thoughts and Personal Experiences

I've been following the housing market closely for years, and I've seen firsthand how sensitive it is to changes in mortgage rates. When rates jumped in 2022 and 2023, it definitely cooled things down. I know many people who put their home-buying plans on hold.

In my opinion, the current market is a bit of a mixed bag. While rates are higher than we'd like, there are still opportunities for both buyers and sellers. The key is to be realistic about your budget and expectations. One of my family members had to postpone their plans a few years. But they are finally now able to afford a place after a few promotions and saving more money.

As for the future, I think we're unlikely to see a dramatic decline in rates anytime soon. The Fed is likely to be cautious about cutting rates too quickly. I would keep my expectations realistic.

In Conclusion: Planning for the Road Ahead

So, will mortgage rates go down below 6% in 2025? It's unlikely. The evidence points towards rates staying in the mid-6% range. It never hurts to be prepared and hope for the best. I believe it's more important to get ready for rates to stay elevated.

That being said, the housing market is adapting. There are still opportunities for those who are prepared. Do you homework. Seek professional advice. Make smart financial decisions.

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down to 3% in 2026?

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?