Want to know how to predict real estate prices?

Want to know how to predict real estate prices?

Every investor wants to know how to predict real estate prices and the process is not as mysterious as it may appear.

While I focus on investing for cash flow, loan amortization, and tax benefits, I also appreciate the warm and fuzzy feeling you get as an investor when your real estate values climb! So, what are the things I look for when figuring out how to predict real estate prices?

Prices are a result of supply, demand, AND capacity to pay.

Let’s look at these factors one at a time:

Demand for real estate is driven by population growth which is fueled by job growth. In resort and retirement communities, you might see high demand and price growth even when the local job market is stagnant because the money to fund real estate purchases in resort areas was earned somewhere else and imported.

Real estate supply is restricted by (1) availability of land, (2) geographic boundaries such as water and mountains, (3) political boundaries such as permit fees, restricted density policies, and (4) economic boundaries such as availability of development capital and the ability to build and sell new properties at a profit.

No matter how desirable or limited in supply something is, the price of the thing will be dictated by how many people can afford to buy it. Affluent communities have more expensive restaurants than the poor communities. Although the desire for food and supply of food to both of these neighborhoods might be the same, the prices in these two neighborhoods can be wildly different based on capacity to pay. For example, a can of Coke could be $1 in a poor neighborhood and $3 in an affluent neighborhood. The main thing driving price differences in this illustration is capacity to pay.

Last week, my five year old son and I made blueberry muffins together. When they were done he proudly exclaimed, “Come buy blueberry muffins! Only THIRTY DOLLARS each!!!” I asked him why his muffins were so expensive. Without hesitating he said, “Because people around here have a lot of money!” Even at five years old, he’s paying attention to his dad’s lessons on economics!

As a real estate investor, I am attracted to affordable housing markets because it means the price of housing has the ability to increase in price. Just because something is affordable doesn’t mean it will go up in price, it just means it can go up in price. For prices to rise, the other variables of supply and demand must also be working in your favor. However, if something is unaffordable for the majority of people who want to buy it, that’s a pretty strong indicator that the price could be in a bubble and may soon come down to more affordable levels.

The ratio between median income and median home price is an effective way to gauge the affordability of housing in a particular market:

Median Home Price / Median Income = Affordability Ratio

Using data from Q3 2013, the San Francisco – Oakland MSA had a median home price of $705,000 and a median income of $76,300. That means the median home price is 9.2 times higher than the median income; it would require 9.2 years of median income to buy a median priced house. In terms of a monthly housing payment (Principal, Interest, Taxes, Insurance, and HOA dues), a median home in the San Francisco-Oakland MSA requires ~70% of the median income. That’s not sustainable. Either income must go up or housing prices must come down. I would bet on the latter.

In Rockford, Illinois, the median home price is $88,900 and the median income is $51,500 which means the median home price is 1.7 times higher than the median income. To put it in other terms, residents of Rockford use a mere 13% of their household income for housing. WOW, that’s affordable!

Lenders don’t know how to predict real estate prices, but they know how to predict what borrowers are likely to pay and which are not. Lenders know that when you use a lower percentage of your income for housing, their loans are less likely to go into default. For example, FHA requires its borrowers to use no more than 31% of their gross income for housing and no more than 43% of their income for total debt service including housing and other loans. It seems pretty crazy for someone in California to use 70% of their income for housing!

I’ve traveled to both San Francisco and Rockford and I can tell you without hesitation there is more demand and less supply of housing in San Francisco, CA than Rockford, IL.

If you want to know how to predict real estate prices, there is a great equalizer in this supply and demand equation: CAPACITY TO PAY. Someone earning the median income and living on their parents’ couch in Rockford can save up all their pennies for 1.7 years and pay cash for a median level home in Rockford. Now, I’m not saying run out and buy real estate in Rockford because it’s amazingly affordable. (Remember, if you want to know how to predict real estate prices you also need the combination of supply and demand to create upward price movement.) However, I am saying San Francisco-Oakland prices are back into bubble territory and are poised for a downward price correction. If you’re thinking of buying a home in the San Francisco Bay Area because you think home prices will continue to go up, just ask yourself “Who can afford to pay more than 70% of their gross income to buy this house?” That’s right: NO ONE!

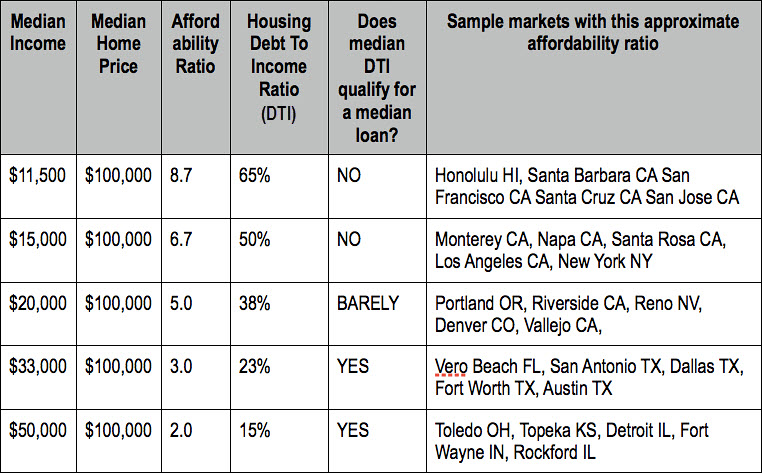

A housing price-to-income ratio less than 3 is very affordable, from 3 to 4 is moderately affordable, 4 to 5 is moderately unaffordable, and over 5 is severely unaffordable. Here’s an example of these ratios based on a $100,000 house whose PITI is $7500/year and using variable median incomes to illustrate my point.

If the median home price is more than five times the median income, those buyers will be required to use too much of their income for housing and will not qualify for mortgages. This affordability ratio can be comfortably higher in resort and second home areas because the income is imported from outside the metro where the property is located. However, if you are looking for rental property in a typical metro, properties with affordability ratios over 5 are overvalued based on the measure of capacity to pay.

One of the things I notice on this list is that the major metros in Texas rank remarkably well in terms of affordability: Austin 3.7, San Antonio 3.3, Houston 3.3, Dallas-Fort Worth 3.1. This healthy price to income affordability ratio is one of the things driving employers to bring jobs and people to Texas. The population of the DFW metro is booming and that is why I am focused on building affordable new homes and owning affordable rental properties there.

If you would like to improve your odds knowing how to predict real estate prices, look for these three indicators of success: increasing demand (jobs), limited supply, and an affordability ratio below 5.