As we look ahead, the commercial real estate forecast for the next 5 years raises important questions for investors, businesses, and stakeholders in the industry. The market is at a pivotal point, influenced by shifting economic factors, technological innovations, and evolving consumer preferences.

With a variety of opinions swirling around, understanding where the market is headed is crucial for strategic decision-making. The commercial real estate (CRE) sector has experienced considerable shifts in recent years, driven by the post-pandemic recovery, remote work adoption, and rising interest rates.

According to a recent report by Deloitte, the outlook for 2024 and beyond appears cautious, emphasizing that the recovery process will not be uniform across all property types.

The Future of Commercial Real Estate: Insights for the Next 5 Years

Remote Work and Office Spaces

The traditional office space has seen a dramatic transformation. With companies opting for flexible work arrangements, the demand for office space is expected to decline. The 2024 Commercial Real Estate Trends report by JPMorgan Chase highlights that office properties in prime locations will likely outperform their peers, but overall demand will remain subdued.

- Reduction in Footprint: Many companies are reducing their office footprint as hybrid working models become the norm. This shift is expected to continue, impacting long-term leases and new office construction.

- Repurposing Spaces: There is an increasing trend towards repurposing excess office space into residential units or mixed-use developments.

Retail Real Estate Adaptations

Retail spaces are undergoing a significant reinvention to accommodate e-commerce growth. Adaptive reuse of existing properties to create mixed-use environments is becoming increasingly common. Retailers are focusing on enhancing customer experiences, driving a reevaluation of physical spaces.

- Experience Over Transactions: Physical retail is pivoting towards providing immersive experiences to attract customers, integrating more entertainment and dining options.

- Omnichannel Strategies: Retailers are focusing on omnichannel strategies, blending online and offline experiences to cater to consumer preferences.

Industrial Growth Continues

As e-commerce continues its upward trajectory, the demand for industrial real estate—particularly warehouses and distribution centers—shows no signs of slowing.

- Expanding Logistics Hubs: Companies are expanding logistics hubs to meet same-day or next-day delivery expectations, increasing the demand for well-located industrial properties.

- Investment in Automation: Investments in automation and advanced warehousing technologies are becoming critical to streamline operations and enhance efficiency.

According to Statista, the United States commercial real estate market is experiencing a surge in demand for flexible office spaces due to the rise of remote work and the need for adaptability.

- Projected US Commercial Real Estate Market Value: US$25.28tn by 2024

- Anticipated CAGR (2024-2029): 2.18%

- Estimated Market Volume by 2029: US$28.16tn

- US Dominance: Expected to be the world's largest Real Estate market by value in 2024

Sustainability Trends

Sustainability is no longer a trend—it's an expectation. Investors are gravitating towards properties that meet environmental standards, shown by a surge in green building certifications. Companies are increasingly recognizing that sustainable practices can lead to cost savings and a positive brand image.

- Green Building Certifications: Certifications like LEED and BREEAM are becoming standard requirements for new developments.

- Energy Efficiency: Implementing energy-efficient systems and sustainable materials reduces long-term operational costs and appeals to environmentally conscious tenants.

Economic Factors and Market Dynamics

One cannot overlook the influence of macroeconomic factors such as interest rates, inflation, and economic growth on the commercial real estate forecast.

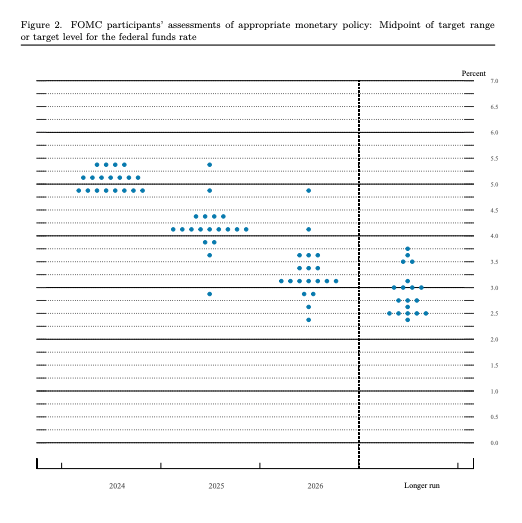

- Interest Rates: With the Federal Reserve's monetary policies aimed at controlling inflation, fluctuations in interest rates will significantly impact CRE financing and investment dynamics.

- Inflation: Rising construction costs and material shortages due to inflationary pressures will affect the feasibility and profitability of new development projects.

- Economic Growth: Economic recovery and growth rates influence demand across CRE sectors. Strong economic indicators are likely to enhance tenant confidence and drive leasing activities.

Technological Innovations

Technological advancements are playing an increasingly vital role in shaping the future of commercial real estate. From property management to tenant experience, technology is influencing every facet of the industry.

- PropTech Integration: The integration of property technology (PropTech) solutions is streamlining operations, from automated leasing processes to enhanced property management systems.

- Smart Buildings: Smart building technologies incorporating IoT (Internet of Things) for energy management, security, and occupant comfort are becoming more prevalent, enhancing property values and tenant satisfaction.

Risks and Challenges

While numerous opportunities lie ahead, the commercial real estate market also faces several risks and challenges.

- Market Volatility: Economic uncertainties and potential recessions can lead to market volatility, impacting property values and investment returns.

- Regulatory Changes: Changes in zoning laws, building codes, and environmental regulations can pose challenges to CRE developments and operations.

- Workforce Dynamics: The evolving workforce preferences, particularly among younger generations prioritizing work-life balance and remote work options, can shape demand patterns across CRE sectors.

Preparing for the Future

The commercial real estate forecast for the next 5 years indicates a transformative phase driven by unprecedented changes in work patterns, consumer behavior, and societal expectations. Investors and businesses must remain agile, ready to pivot their strategies in response to evolving conditions. Keeping an eye on key trends, such as sustainability and technological integration, will be essential for thriving in this new environment.

Forecasted Market Dynamics (2024-2029)

| Year | Office Demand | Retail Demand | Industrial Demand | Market Growth Rate |

|---|---|---|---|---|

| 2024 | Decreasing | Stabilizing | Increasing | Moderate (Approx. 2%) |

| 2025 | Stabilizing | Adaptive Use | High Growth | 2.5% |

| 2026 | Stabilizing | Optimizing | High Growth | 2.8% |

| 2027 | Slight Increase | Adaptation | Continued Growth | 3% |

| 2028 | Increase in Demand | Rebuilding | Peak Growth | 3.2% |

The table above outlines the anticipated shifts across various segments of commercial real estate. As seen, while office demand may stabilize, industrial demand is set to see significant growth. This data underscores the necessity for investors to adapt their strategies to meet market realities.

Conclusion:

As the landscape evolves, those who harness these insights and prepare for change will not only survive but potentially thrive in the new commercial real estate paradigm. Strategic foresight, adaptability, and a keen understanding of emerging trends will be the key differentiators for success.

Commercial real estate is more than just buildings—it’s about people, experiences, and how we interact with our environments. By staying informed and responsive to the changes on the horizon, stakeholders can confidently navigate the complexities of the commercial real estate market over the next five years.

Work with Norada in 2025, Your Trusted Source for

Turnkey Real Estate Investing

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060