Okay, so you're thinking about Florida, sunshine, beaches… maybe a new home? Hold on a sec, because paradise might come with a pinch of reality. We're talking about home prices, and while nationally things are pretty steady, there are pockets, especially in the Sunshine State, where the forecast is looking a bit stormy. If you're wondering about Places in Florida with “Very High” risk of Home price crash, the latest data from CoreLogic has pinpointed them, and yes, you need to know about this if you're buying, selling, or just plain curious about the market.

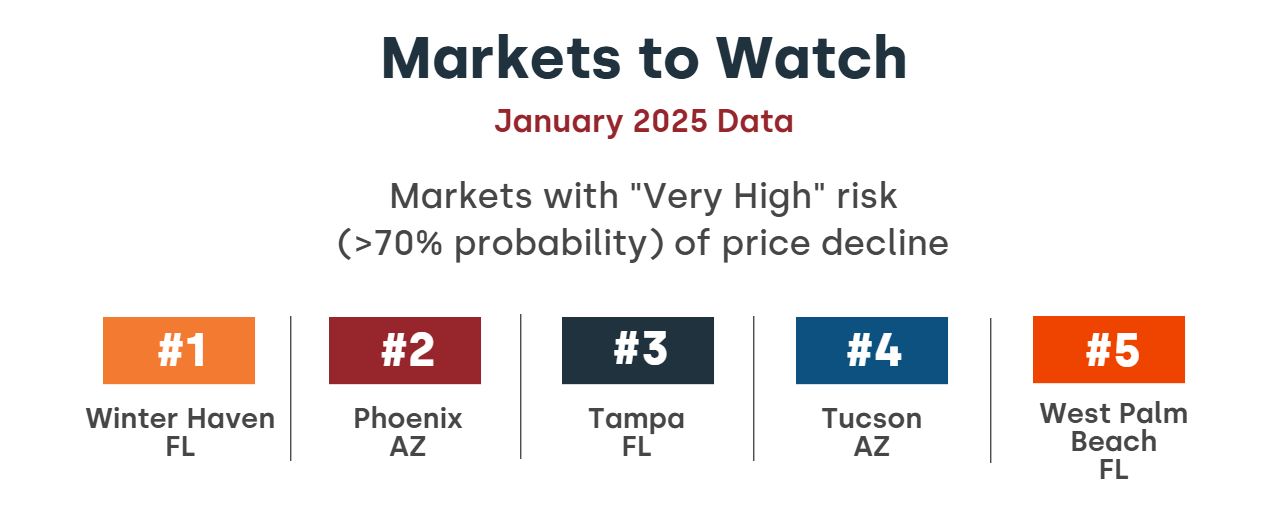

Based on their March 2025 report, the three Florida metro areas flashing red are Tampa, Winter Haven, and West Palm Beach. These aren't just minor wobbles; we're talking about a “very high” risk – over a 70% chance – of home prices actually going down. Let’s dive into why these areas are facing this potential downturn, and what it means for you.

3 Florida Cities at High Risk of a Housing Market Crash

For years, Florida has been the darling of the US real estate market. People flocked here for the weather, the lifestyle, and what seemed like endless growth. But as someone who's been watching the housing market closely for a while now, I can tell you that what goes up must sometimes adjust, and Florida seems to be hitting that point in certain areas.

CoreLogic's latest Home Price Insights report for March 2025 paints a picture of a national market that's pretty much flat month-over-month, with a modest 3.3% year-over-year growth nationwide. That sounds okay, right? Well, dig a little deeper, and you'll see Florida and Arizona standing out – and not in a good way – as places where the risk of price decline is very high.

Why Florida? And specifically, why these three cities: Tampa, Winter Haven, and West Palm Beach? Let's break it down.

Tampa: From Boomtown to…Bust?

Tampa has been on fire for years. Everyone wanted a piece of the Tampa Bay action. Job growth, beautiful waterfront, a lively city – it had it all. And home prices reflected that. But the data is starting to sing a different tune. CoreLogic identifies Tampa as the number one market in Florida with a “very high” risk of price decline. When you look at their numbers, it's not hard to see why. Tampa’s year-over-year home price change is down -0.9%, and even more concerning, the change from October 2024 to January 2025 is a hefty -1.6%. That's a cooling trend, and it’s significant.

But numbers are just numbers, right? What's really going on in Tampa? In my opinion, several factors are converging.

- Overbuilding: Tampa saw a massive construction boom. Condos, apartments, single-family homes – they went up like crazy. Now, there’s a lot of inventory, and when supply outstrips demand, prices tend to soften. Think about it – all those cranes you saw dotting the skyline? They were building for a market that might not be quite as hot anymore.

- Insurance Costs: Florida's insurance crisis is no joke. Homeowners insurance premiums have skyrocketed, making it much more expensive to own a home, especially near the coast. This hits places like Tampa hard and can dampen buyer enthusiasm. Who wants to move to paradise if it costs a fortune just to insure your house?

- Affordability Squeeze: Even before the potential price correction, Tampa was becoming less affordable for many. Interest rates are still elevated compared to the super-low rates of recent years, and combined with those rising insurance costs and property taxes, the dream of homeownership in Tampa may be slipping out of reach for some.

- Shift in Demand? CoreLogic's overview mentions “Florida markets are continuing to fall out of favor.” That's a pretty strong statement. Maybe the pandemic-driven rush to Florida is slowing down. People are re-evaluating, and perhaps Tampa, after its rapid growth, is just experiencing a natural market correction.

Winter Haven: Affordable No More?

Winter Haven, nestled in Central Florida, has long been seen as a more affordable alternative to the coastal cities. Known for its chain of lakes and citrus groves, it offered a quieter, less expensive lifestyle within reach of Orlando’s attractions. But even Winter Haven is flashing warning signs. CoreLogic ranks Winter Haven as the second riskiest market in Florida for a home price crash. Their data shows a -0.9% year-over-year price change and a -1.2% drop from October to January.

Why Winter Haven? It's a different story than Tampa, but still concerning.

- Rapid Price Appreciation: Winter Haven saw huge price jumps during the pandemic boom. Because it was initially more affordable, the percentage increases were often dramatic. This kind of rapid appreciation is often unsustainable and sets the stage for a potential correction. What goes up fast can sometimes come down fast.

- Dependence on Broader Market Trends: Winter Haven's market is somewhat tied to the Orlando and Tampa metro areas. If those markets cool, Winter Haven is likely to feel the chill as well. It's not immune to broader economic and housing market shifts in Central Florida.

- Economic Vulnerabilities: While Winter Haven is growing, its economy might be less diversified than larger metro areas like Tampa. If there’s an economic slowdown, it could impact Winter Haven disproportionately. Less job security can mean less housing demand.

- “Cooling” Effect Spreading: The fact that Winter Haven is on this list suggests that the cooling trend in Florida isn’t just limited to the major coastal cities. It might be spreading inland to previously more affordable areas.

West Palm Beach: Luxury Market Wobbles?

West Palm Beach, the gateway to Palm Beach County, is known for its upscale lifestyle, beautiful beaches, and proximity to the wealthy enclave of Palm Beach. It’s often associated with luxury real estate and high-end living. So, seeing West Palm Beach as the third Florida city with a “very high” crash risk is a bit surprising, and perhaps even more telling.

The data shows West Palm Beach experiencing a -0.5% year-over-year price decrease and a -1.2% dip between October and January. While these numbers are not as dramatic as some other areas, the “very high risk” designation is still there.

What's happening in West Palm Beach?

- Luxury Market Sensitivity: Luxury markets can be more volatile than the broader market. High-end buyers are often more sensitive to economic fluctuations and market sentiment. If there's a perception of risk or economic uncertainty, they might pull back faster than other buyers.

- Over-Development at the High End? Like Tampa, West Palm Beach has seen a lot of new development, including luxury condos and waterfront properties. Is there an oversupply at the higher end of the market? It’s possible. Luxury buyers have a lot of choices.

- Insurance Impact on High-Value Homes: The insurance crisis in Florida can hit high-value homes particularly hard. Premiums for waterfront mansions can be astronomical. This can definitely impact demand in the luxury segment.

- Correction After Extreme Growth: Palm Beach County, including West Palm Beach, experienced some of the most intense price growth in the nation during the pandemic boom. A correction in a market that has risen so rapidly is almost to be expected at some point.

Florida's Broader Real Estate Picture: Beyond These Three Cities

It's crucial to understand that this “very high risk” is specific to these three metro areas according to CoreLogic’s analysis. It doesn’t mean the entire Florida housing market is collapsing. However, it does signal a significant shift and potential challenges for certain areas.

Here are some broader factors impacting Florida's real estate market that contribute to this risk:

- Insurance Crisis: I can't stress this enough – the insurance situation in Florida is a major headwind. Rising premiums, insurers pulling out of the state, and the increasing difficulty of getting coverage are dampening buyer demand and increasing the cost of homeownership across Florida.

- Property Taxes: Property taxes in Florida, while relatively reasonable compared to some states, are also on the rise in many areas, adding to the overall cost of owning a home.

- Climate Change Concerns: While not always explicitly stated, concerns about sea-level rise, hurricanes, and other climate-related risks could be starting to factor into buyers' long-term decisions about investing in coastal Florida properties.

- Economic Slowdown Potential: If the broader US economy slows down, Florida, which is heavily reliant on tourism and retirees, could be particularly vulnerable. Economic uncertainty always impacts the housing market.

- Shift to Other Markets: CoreLogic notes that “western New York is gaining popularity.” This is interesting. Are people looking for more affordable markets, or markets less exposed to climate risks, or simply different lifestyle options? It’s possible there’s a broader shift in where people are choosing to move.

What Does This Mean for You?

If you're a homeowner in Tampa, Winter Haven, or West Palm Beach, this report should be a wake-up call. It doesn't mean your home value is guaranteed to plummet, but it does suggest a higher probability of price decline. If you're thinking of selling in the next year or two, it might be wise to consider your timing and pricing strategy carefully.

If you're a buyer, particularly in these areas, this could present opportunities. It might mean less competition, more negotiating power, and potentially the chance to buy at a more reasonable price than you would have just a year or two ago. However, you also need to be aware of the risks and do your due diligence. Factor in insurance costs, property taxes, and the potential for further price softening.

Key Takeaways:

- Tampa, Winter Haven, and West Palm Beach are identified by CoreLogic as having a “very high” risk (>70% probability) of home price decline.

- This is driven by a combination of factors including overbuilding, the insurance crisis, affordability issues, and potentially a shift in demand away from Florida.

- The broader Florida housing market is facing challenges, but these three cities are currently flagged as particularly vulnerable.

- For homeowners in these areas, it's a time to be cautious and informed.

- For buyers, it could present opportunities, but also requires careful consideration of the risks.

The Florida dream isn't necessarily over, but it's definitely undergoing a reality check in certain areas. Staying informed, understanding local market dynamics, and working with knowledgeable real estate professionals is more important than ever if you're navigating the Florida housing market right now. Keep an eye on these trends, and remember that real estate is local. What’s happening in Tampa isn’t necessarily happening everywhere else, even in Florida.

Work with Norada, Your Trusted Source for

Real Estate Investment in “Florida Markets”

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Read More:

- 4 States Facing the Major Housing Market Crash or Correction

- Florida Housing Market: Record Supply Expected to Favor Buyers in 2025

- Florida Housing Market Forecast for Next 2 Years: 2025-2026

- Florida Real Estate Market Saw a Post-Hurricane Rebound Last Month

- Florida Housing Market: Predictions for Next 5 Years (2025-2030)

- Hottest Florida Housing Markets in 2025: Miami and Orlando

- Florida Real Estate: 9 Housing Markets Predicted to Rise in 2025

- Housing Markets at Risk: California, New Jersey, Illinois, Florida

- 3 Florida Housing Markets Are Again on the Brink of a Crash

- Florida Housing Market Predictions 2025: Insights Across All Cities

- Florida Housing Market Trends: Rent Growth Falls Behind Nation

- When Will the Housing Market Crash in Florida?

- South Florida Housing Market: Will it Crash?

- South Florida Housing Market: A Crossroads for Homebuyers