The California housing market ended 2025 on a positive note, with home sales picking up in December compared to both the previous month and the year before. This brings the total sales for the year close to 1% higher than in 2024, suggesting a market finding its footing.

As a real estate enthusiast and someone who's watched this market closely for years, I can tell you that December's numbers, released by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.), offer a promising glimpse into what's next. It wasn't a wild stampede, but a steady stride that signals a potential shift towards a more balanced environment for both buyers and sellers.

California Housing Market Update: A Look at December 2025 and Beyond

Home Sales: Ending on a High Note

Let's talk about the nuts and bolts. In December 2025, we saw a seasonally adjusted annualized rate of 288,200 existing, single-family home sales. What does that really mean? It's basically a way to calculate how many homes would sell in a year if the pace we saw in December continued.

This number showed a slight uptick of 0.3% from November and a more significant 2.0% jump from December 2024. While these might seem like small percentages, in a market as vast as California's, they represent quite a few more transactions.

Looking at the big picture for the entire year of 2025, sales were up 0.9% compared to 2024. This is crucial because it shows a consistent, albeit modest, growth throughout the year, not just a fleeting December surge. This kind of steady momentum can build confidence in the market.

What I'm seeing here is resilience. Despite economic uncertainties that tend to make people pause, buyers are still finding their way to the closing table. This tells me that the desire for homeownership in California remains strong.

Home Prices: A Cooling Trend That's Welcome News

Now, let's address the elephant in the room for many: home prices. In December 2025, the statewide median home price dipped slightly to $850,680. This was a 0.4% decrease from November and a 1.2% decrease from December 2024.

This might sound like bad news if you're a homeowner looking for appreciation, but as an observer of the market, I see this as a positive sign that the intense price escalations of previous years are moderating. For most of 2025, price growth had been easing, and this continued into December.

This cooling isn't a crash, but rather a leveling off. For the full year 2025, the annual median home price did increase by about 1.2% compared to 2024. So, while prices dipped month-over-month and year-over-year in December, the overall annual trend still showed modest growth. This is the kind of stability that can help more people afford to buy and build equity.

Why is this price moderation important? It means that homeownership might be inching back into the realm of possibility for more Californians. When prices go up too fast, it pushes people out. A more stable price environment, even with slight dips, can actually make the market healthier in the long run.

Housing Supply: A Slowing Rise

The availability of homes, or housing supply, is a critical piece of the puzzle. In December, the Unsold Inventory Index stood at 2.7 months. This means if no new homes were listed, it would take about 2.7 months to sell all the homes currently on the market.

This index was down from 3.6 months in November, but it was the same as in December 2024. What's more interesting is that while total active listings increased year-over-year for the 23rd consecutive month, the rate of that increase was the smallest since February 2024. This is the eighth month in a row where the growth in inventory has slowed down.

This might seem a bit contradictory. More homes are available than last year, but the growth is slowing. From my perspective, this suggests that while there's still a healthy amount of supply compared to recent years, the market is starting to absorb some of it. Sellers are still listing homes, but the frenzy of new listings might be easing up as we move into the quieter winter months.

Here's what I think this means: We're not facing a severe shortage like we did a few years ago, but the market isn't flooded with homes either. It's leaning towards a more balanced situation, which is generally good for market stability.

Market Trends: Where Do We Go From Here?

Several trends are shaping the California housing market:

- Mortgage Rates on the Decline: One of the biggest drivers of activity has been the fluctuation of mortgage rates. In December, the average 30-year fixed mortgage rate was 6.19%, down from 6.72% in December 2024. When rates drop, it significantly lowers the monthly cost of a mortgage, making homes more affordable and encouraging buyers to jump in. This is a major positive for the market heading into 2026.

- Regional Variations: It's crucial to remember that California is not a monolith. Different regions experience different market dynamics.

- The Far North and Central Coast saw the biggest year-over-year sales increases, with double-digit gains.

- The Central Valley, San Francisco Bay Area, and Southern California also saw sales improvements, though more modest.

- On the price side, the Far North and Southern California saw slight year-over-year median price increases, while the Central Valley saw a small drop, and the San Francisco Bay Area's median prices remained unchanged.

- Days on Market: Homes are taking a bit longer to sell. The median number of days to sell a single-family home in December was 36 days, up from 31 days in December 2024. This is another indicator that the market is cooling down from its hottest pace and buyers have a little more time to consider their options.

- Sales-to-List Price Ratio: This ratio, which shows how close homes are selling to their asking price, was 97.9% in December 2025, down from 98.7% in December 2024. This means homes are selling slightly below asking price on average, again indicating less intense competition for buyers.

A Look Ahead

As we move into 2026, several factors will continue to influence the California housing market. The C.A.R. report suggests optimism. Key figures like C.A.R. President Tamara Suminski and Chief Economist Jordan Levine point to increased buyer opportunities and a healthier, more balanced market.

The combination of easing price growth and falling mortgage rates is a potent mix for potential buyers. While policy uncertainties are always a factor, the overall outlook suggests modest economic growth and continued progress for the housing market.

For those who have been waiting on the sidelines, this period of stabilization could be a prime opportunity. While we're not likely to see a return to the extreme conditions of the past, the current trends point towards a market that is becoming more accessible and predictable.

It's an exciting time to be watching the California real estate scene. We're moving from a seller's frenzy to a more thoughtful, balanced approach, and that's something I believe most people in the market will welcome.

California Housing Market Forecast: What to Expect in 2026

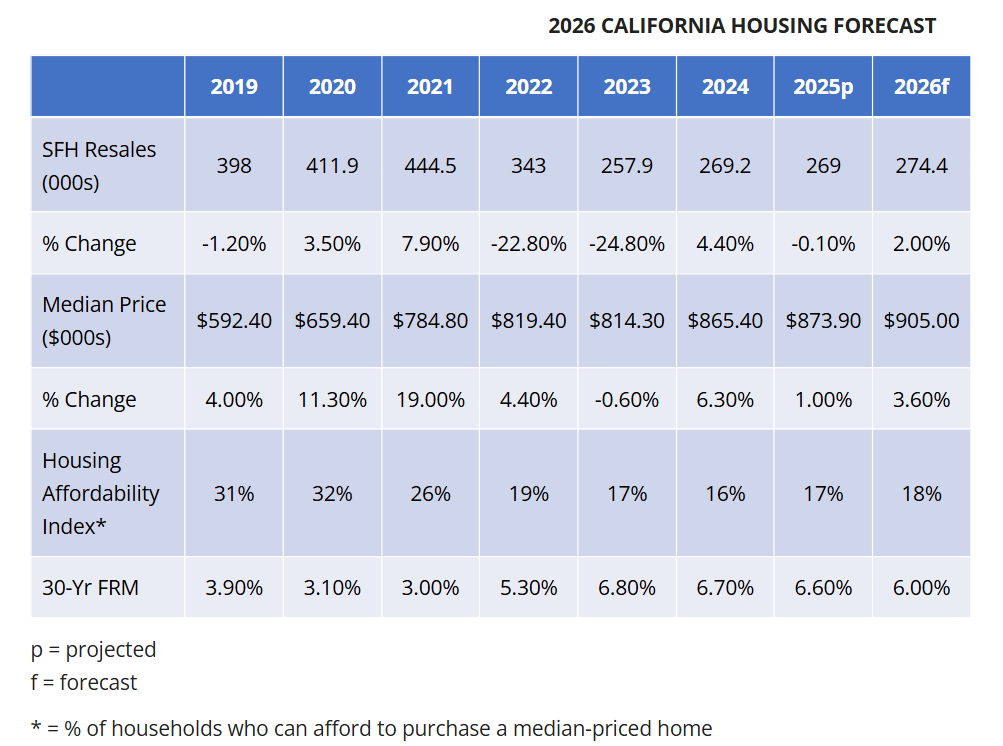

The California housing market is poised for a gentle upturn in 2026, with home sales and the median price expected to inch up slightly. According to the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.), we can anticipate existing single-family home sales to reach around 274,400 units, a 2% increase from 2025. The median home price is projected to hit a new record, climbing 3.6% to $905,000. While this might sound like a straightforward prediction, dig a little deeper, and you'll find a more nuanced picture shaped by economic shifts, interest rates, and a slowly improving affordability situation.

My Take on the 2026 Outlook

As someone who's been following the California real estate scene for a while, I can tell you that “inching up” feels like a pretty accurate description. We've seen some wild swings in the past, and frankly, a period of relative stability is what many buyers and sellers are hoping for. C.A.R.'s forecast suggests that stability is on the horizon, but it's not going to be a free-for-all. Affordability is still a major hurdle, but there are glimmers of hope.

A Look at C.A.R.'s Projections

Let's break down what C.A.R. is predicting for the coming years:

| Year | SFH Resales (000s) | % Change | Median Price ($) | % Change | Housing Affordability Index (%) | 30-Yr FRM (%) |

|---|---|---|---|---|---|---|

| 2024 | 269.2 | 4.40% | $865,400 | 6.30% | 16% | 6.70% |

| 2025p | 269.0 | -0.10% | $873,900 | 1.00% | 17% | 6.60% |

| 2026f | 274.4 | 2.00% | $905,000 | 3.60% | 18% | 6.00% |

p = projected, f = forecast

As you can see, 2025 is looking like a bit of a holding pattern, with sales essentially flat compared to 2024. However, the median price is still expected to tick up slightly. The real movement, according to this forecast, is in 2026, where we see both sales and prices showing more noticeable, albeit still moderate, growth.

Why the Gentle Climb?

Several factors are expected to contribute to this gradual ascent:

- Interest Rates Cooling Down: This is a big one. C.A.R. forecasts the average 30-year fixed mortgage rate to drop to 6.0% in 2026. This is a significant improvement from the averages seen in recent years and even the 6.6% projected for 2025. Lower mortgage rates mean more buying power for consumers. Even though it's still higher than pre-pandemic levels, it's a move in the right direction and, importantly, lower than the 50-year historical average of nearly 8%.

- Slightly Better Affordability: With lower interest rates and potentially moderate price gains, housing affordability is predicted to inch up. The index is expected to reach 18% in 2026, meaning 18% of households will be able to afford to buy a median-priced home. This is a small but welcome improvement from 16% in 2024 and 17% in 2025. For many Californians, this slight shift could make the dream of homeownership feel a bit more attainable.

- Increasing Inventory: The forecast indicates that housing supply will continue to improve, with active listings potentially rising by nearly 10% in 2026. When more homes are available, it can ease some of the intense competition we've seen in the market. This could give buyers a bit more breathing room and potentially moderate intense bidding wars.

What About the Economy?

The housing market doesn't exist in a vacuum. The broader economic picture plays a crucial role.

- Slowing GDP Growth: The U.S. gross domestic product (GDP) is expected to grow at a slower pace in 2026, around 1%, after a projected 1.3% in 2025.

- Job Growth and Unemployment: California's nonfarm job growth is also projected to slow down, with a 0.3% increase in 2026 after a 0.4% rise in 2025. Consequently, the unemployment rate is expected to creep up to 5.8% in 2026 from 5.6% in 2025 and 5.3% in 2024. While a slight increase in unemployment can be concerning, these numbers suggest the job market, while cooling, isn't collapsing.

C.A.R. President Heather Ozur points out that as economic uncertainty begins to clear and mortgage rates decline, housing sentiment should improve. This is a key piece of the puzzle – people are more likely to make big financial decisions like buying a home when they feel more secure about their jobs and the economy.

Potential Roadblocks and Challenges

It wouldn't be wise to paint an entirely rosy picture. The forecast also highlights several challenges that could still impact the market:

- Inflation: Inflation is likely to pick up, with the annual average Consumer Price Index (CPI) expected to reach 3.0% in 2026, up from 2.8% in 2025. Higher inflation can erode purchasing power and impact what people can afford.

- Home Insurance Crisis: The ongoing issues with homeowners insurance in California are a significant concern. Rising premiums and reduced availability of coverage can make homeownership more expensive and less attractive, especially in fire-prone areas.

- Trade Tensions: Lingering trade tensions between the U.S. and its trading partners can create economic uncertainty, which can ripple through the housing market.

- Stock Market Volatility: A potential stock market bubble could burst, leading to financial instability and affecting the confidence of high-net-worth individuals who are often significant players in luxury real estate markets.

Senior Vice President and Chief Economist Jordan Levine notes that despite these headwinds, the improving lending environment and clearing economic clouds will be key drivers.

What This Means for You

So, what does all this forecast talk mean for you, whether you're looking to buy, sell, or just keep an eye on your investments?

- For Buyers: The forecast offers a glimmer of hope. Lower interest rates and a slight increase in inventory in 2026 could make it a more favorable year for buyers than the preceding ones. However, affordability remains a challenge, so smart financial planning and patience will still be crucial. Don't expect a crash, but rather a market that might be slightly less of a seller's dominance.

- For Sellers: If you've been holding off, 2026 might present a more opportune time to list your home. With stabilizing prices and rising demand, you could see your property fetch a good price. However, the days of astronomical offers might be behind us, and a more realistic pricing strategy will be important.

- For Homeowners: If you own a home in California, the moderate price appreciation suggests that your home equity is likely to continue growing, albeit at a steadier pace than in boom years.

My personal feeling is that California's housing market, given its fundamental strengths in desirability and economic output, will continue to be resilient. The forecast for 2026 suggests a return to a more sustainable growth pattern. It's not a market for speculators looking for quick flips, but for those looking for long-term value and a place to call home, opportunities will likely emerge.

The key takeaway from C.A.R.'s 2026 California Housing Market Forecast is that we're looking at a period of gradual improvement. Sales and prices are projected to rise modestly, driven by falling interest rates and slightly better affordability, while still navigating economic uncertainties and persistent challenges like insurance costs. It's a market that demands a well-informed approach, but one that holds promise for those looking to enter or move within it.

Turnkey real estate delivers immediate cash flow from day one and builds wealth for decades ahead.

Norada Real Estate helps you secure such properties—so your investment pays today and continues to grow for years to come.

Related Articles:

- California Housing Market Predictions 2025

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash in 2024?

- Will the US Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?