The Indianapolis housing market is a dynamic and thriving real estate landscape, attracting both homebuyers and investors alike. As the capital city of Indiana and the 16th-most populous city in the U.S. (2020 Census), Indianapolis offers a diverse range of neighborhoods, excellent amenities, and a strong job market, making it a sought-after destination for those looking to settle down or invest in real estate.

Currently, the Indianapolis housing market leans towards being a seller's market. This is evidenced by the low inventory levels and increased competition among buyers for available properties. With fewer homes on the market and heightened demand, sellers have the advantage of dictating terms and often receiving multiple offers on their listings.

Current Indiana Housing Market Trends in 2024

While the median sale price experienced a modest increase in February 2024, there is no indication of a significant drop in home prices. The market remains balanced, with prices fluctuating within expected ranges. Buyers may find stable pricing conditions conducive to making informed purchase decisions.

Inventory

According to the Indiana Association of REALTORS® (IAR), the inventory in February 2024 stood at 10,213 homes, marking a decrease of 9% from the previous month. This drop falls within the expected range based on historical data, reflecting the cyclical nature of the market. Year-over-year, the inventory has decreased by 14%, indicating a potential challenge for buyers due to limited options.

Sales

Despite the decrease in inventory, sales have seen a notable increase. February 2024 witnessed a monthly total of 5,113 closed sales, surpassing expectations with a 21% rise. This surge in sales, albeit surprising, demonstrates the resilience of the Indiana housing market. Year-over-year, sales have grown by 3%, showcasing steady demand.

New Pending Contracts

Another promising indicator is the number of new pending contracts, which saw a monthly increase of 11% in February 2024. This surge in pending contracts, totaling 6,381, suggests a robust pipeline of potential sales in the coming months. Year-over-year, new pending contracts have soared by an impressive 36%, signaling confidence among buyers.

Median Days on Market

The median days on market measure provides insights into the pace of the market. In February 2024, homes spent an average of 26 days from listing to pending, down 7% from the previous month. While this decrease is within the typical range, it indicates a sense of urgency among buyers. Year-over-year, the median days on market have remained stable, suggesting consistency in market dynamics.

Sale Price

The median sale price in February 2024 stood at $237,900, representing a modest monthly increase of 1%. This uptick in prices falls within the expected range, showcasing a balanced market. Year-over-year, sale prices have risen by 3%, highlighting steady appreciation.

Sale Price as Percent of Listing Price

Finally, the sale price as a percent of listing price remained strong at 95.0% in February 2024, reflecting healthy negotiation dynamics between buyers and sellers. This slight increase of 1% from the previous month reaffirms the stability of the market. Year-over-year, this metric has remained unchanged, indicating consistent buyer-seller interactions.

Indianapolis Housing Market Trends

Marion County, located in the heart of Indiana, is home to the state capital, Indianapolis. According to the data released by the Indiana Association of REALTORS®, the Marion County housing market experienced notable changes in key metrics during February 2024.

Inventory and New Listings

In February 2024, the average daily inventory stood at 1,508 homes. This number, although within the expected range based on the previous month's data, reflects a significant year-over-year decrease of 42%. Conversely, the new listings surged, with a 31% increase compared to the previous month and a 16% rise from the same period last year.

Sales and New Pending Contracts

February witnessed a 29% increase in closed sales, totaling 831 transactions. This spike in sales activity is complemented by a remarkable 104% year-over-year increase in new pending contracts, signifying robust market demand.

Market Performance Indicators

The median days on market decreased by 13% compared to the previous month, indicating accelerated sales velocity. Similarly, the median sale price experienced a 2% increase month-over-month, reaching $230,000. Additionally, the sale price as a percent of listing price rose by 1% to 94.2%, demonstrating favorable negotiation power for sellers.

Are Home Prices Dropping in Indianapolis?

Despite the increased demand and limited inventory, home prices in Indianapolis have shown resilience with modest yet steady increases. While there may be slight fluctuations month-over-month, there is no indication of significant price drops in the near future.

Will the Indianapolis Housing Market Crash?

Given the current market conditions characterized by strong demand and limited supply, there are no imminent signs of a housing market crash in Indianapolis. However, it's essential to monitor factors such as interest rates, economic conditions, and government policies that could influence market stability.

Is Now a Good Time to Buy a House in Indianapolis?

For prospective buyers, the decision to purchase a home in Indianapolis depends on various factors, including personal finances, long-term goals, and individual circumstances. While the current market favors sellers, opportunities still exist for buyers, especially those who are pre-approved for financing and prepared to act quickly when suitable properties become available. Consulting with a knowledgeable real estate agent can provide valuable insights into navigating the market and making informed decisions.

Indianapolis Housing Market Forecast for 2024 and 2025

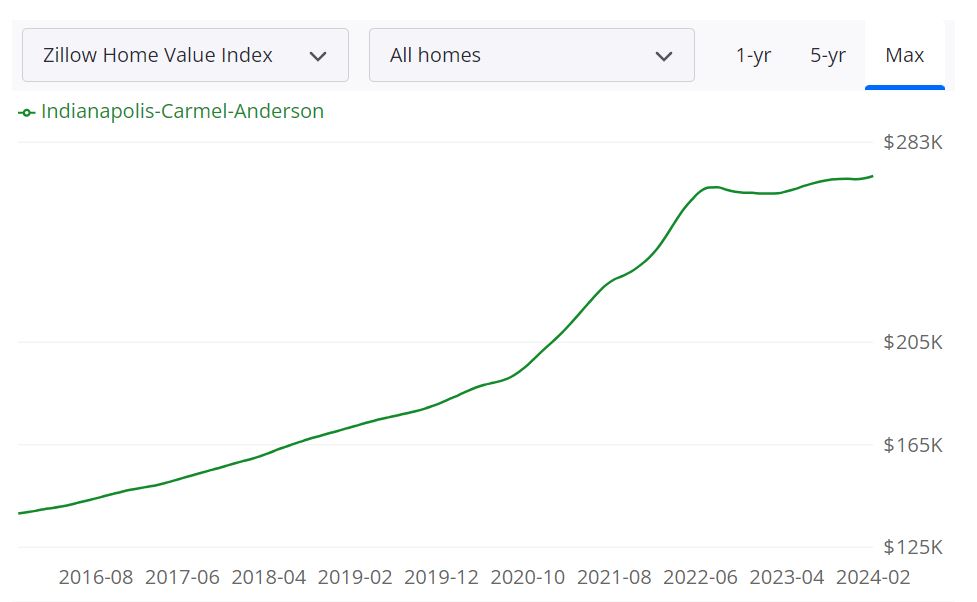

What are the Indianapolis real estate market predictions? According to Zillow, Indianapolis, situated in the Indianapolis-Carmel-Anderson metropolitan statistical area (MSA), boasts a **median sale price** of $251,525 as of January 31, 2024. This figure represents the midpoint of all sale prices, indicating a benchmark value within the market. In comparison, the **median list price** stands at $287,463 as of February 29, 2024, suggesting the typical asking price for properties in the area.

Market Performance

The Indianapolis housing market demonstrates resilience, with an **average home value** of $270,026, reflecting a 2.6% increase over the past year, as reported by Zillow. Additionally, properties typically spend approximately 22 days on the market before entering a pending status. These metrics indicate a market characterized by steady growth and moderate turnover.

Market Forecast

Zillow's **1-year Market Forecast** for the Indianapolis market, as of February 28, 2024, anticipates a 2.0% increase. This projection suggests a continued upward trajectory in property values, aligning with the overall positive trend observed in recent years.

Inventory and Listings

The market boasts a **for sale inventory** of 5,116 properties as of February 29, 2024, indicating the total number of homes available for purchase. Furthermore, 1,647 new listings entered the market during the same period, signaling ongoing activity and potential opportunities for buyers and sellers alike.

Market Dynamics

The **median sale to list ratio**, calculated as 0.985 as of January 31, 2024, provides insight into the relationship between listing prices and actual sale prices. A ratio below 1 suggests properties typically sell for less than their listed price, indicating a buyer's market. Conversely, a ratio above 1 signifies properties selling for more than their list price, indicative of a seller's market.

Sales Performance

Statistics from January 31, 2024, reveal that 17.2% of sales occurred over the list price, demonstrating demand and competition within the market. Conversely, 60.2% of sales transpired under the list price, indicating opportunities for negotiation and potentially favorable conditions for buyers.

Market Size and Significance

The Indianapolis-Carmel-Anderson MSA encompasses several counties and constitutes a significant portion of Indiana's housing market. With its **strong performance**, diverse inventory, and favorable forecasts, the Indianapolis housing market remains an essential economic driver within the region.

Indianapolis Real Estate Investment Overview

Now that you know where Indianapolis is, you probably want to know why we’re recommending it to real estate investors. When it comes down to the Indianapolis real estate market, it is considered to be an excellent destination for cash flow rental properties. There is a strong and steady year-over-year appreciation of Indianapolis investment properties. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers.

Let’s talk a bit about Indianapolis before we discuss what lies ahead for investors and homebuyers. Indianapolis is also known as the crossroads of America with six interstate highways crossing through the town. However, the transport sector isn't the only thing the city is good for. Construction in Indianapolis seems to be a trend ever since 1849 with America's first Union Station. The construction companies have been stretching their profit margins from the ever-growing Indianapolis housing market.

Why should one invest in this hot market in the state of Indiana? Well, to begin with, Indianapolis has a record of being one of the best long-term real estate investments in the U.S. over the past 10 years. Over the last decade, the cumulative appreciation rate has been 92.94 percent, placing it in the top 30% nationally. This equates to an annual average house appreciation rate of 6.79 percent in Indianapolis, according to NeighborhoodScout data.

Why Is Indianapolis A Good Place For Real Estate Investment? |

|

|

|

Let’s look at the state of the Indianapolis real estate market and the factors driving the market in the short and long term.

Indianapolis's Business-Friendly Economy

The circle city may be the 13th largest city in the nation but that doesn't stop it from carefully drawing out its budget to accommodate its locals. It's one of the few cities running on a surplus balanced budget making it favorable for most business investments. This is due to the low tax levied on business premises making it a viable option for the rental real estate business.

Indianapolis has the highest job growth in the midwest. It has seen a surge in the technology sector ushering in a new business climate for the city. In 2016, over 49 companies chose to expand their firms and relocate opening up branches in the area. This led to over 4,500 unemployment cases being eradicated contributing to the overall growth in the local economy. Low cases of unemployment are a great way of attracting new families moving into the area and another reason for real estate investment.

The state capital has been directed towards funding several diversified sectors including tourism. The city hosts major sporting events like the NCAA basketball championships, and the famous Indy Car Race which attracts huge crowds each year. The Indianapolis real estate market can thrive from this especially in the home rental business during such occasions. Other areas of diversification include pharmaceutical as well as retail and healthcare investments.

Indianapolis Has Affordable Cost of Living

Due to the nature of commerce heavily practiced in the area, it's the most affordable place to be. According to CNN Money, it boasts of an affordability score of approximately 96% with low mortgage rates surpassing Dayton Ohio following it closely. The Indianapolis real estate market has been considered to be among the most stable markets out there. This is due to the city's location. The mid-western city's distance from the coast makes its market much more reliable unlike cities like other cities based off the coast. Their markets change just as the seasons come and go.

Increasing Home Prices in Indianapolis

Probably one of the best news to an Indianapolis real estate market investor is to learn of the rise in home prices. Over the recent past, home values have shot up by over 18% percent with the median home value reaching about $217K, according to local real estate agents. Not only will an investor get his money's worth but also stretch out profit margins as time goes by. A wise investment usually quickly returns the capital pumped into it. Indianapolis realtors have confessed to closing the fastest deals of their lifetime. Properties sell quite fast as they are listed on the market. This is advantageous to an investor as worrying about marketing and advertising is completely done away with.

Rise in Population

The population density in Indianapolis is on the rise with a growth rate of 0.33% according to the latest census conducted. Demographics show that the rise saw up to a 3.9% growth rate of African Americans, replacing the non-Hispanic which accounted for a greater percentage of the population. This diversification is a culmination of the accepting nature of the locals towards people of all backgrounds living side by side and in need of new homes.

Indianapolis is One of The Best Downtowns

According to Forbes, Indianapolis is one of the USA's best downtowns. The Circle city is known for its urban design with several construction projects underway with more contracts generated than they are completed. Improved public spaces and conservation-minded avenues are the things for most parts of the town. For those with a keen eye for real estate investment, this could be a major influence over the Indianapolis real estate market. The average rent for a 1-bedroom apartment in Downtown Indianapolis, Indianapolis, IN is currently $1,455. This is a 1% increase compared to the previous year.

Indianapolis Rental Market Has High Demand

Indianapolis is a College Town with university students choosing to reside off-campus. Moreover, graduates tend to move to the immediate area while starting out creating a huge rental market. For Entrepreneurs, opening up shop also adds to the demand. As of February 2024, the median rent for all bedroom counts and property types in Indianapolis, IN is $1,326.

This is -32% lower than the national average. Rent prices for all bedroom counts and property types in Indianapolis, IN have decreased by 4% in the last month and have decreased by 2% in the last year. Some of the best neighborhoods in or around Indianapolis, Indiana are Near Eastside, Far East Side, and South Broad Ripple. Home prices in Indianapolis are well below the national average for all cities and towns in the United States.

Highest Appreciating Indianapolis Neighborhoods Since 2000 (List by Neighborhoodscout)

- Near Northside

- Old Northside / Herron Morton

- Arsenal Heights West

- Ransom Place

- N Beville Ave / E St Clair St

- N Rural St / E 9th St

- Woodruff Place / Arsenal Heights

- Fletcher Place

- Fountain Square

- Fall Creek Place East

Indianapolis Turnkey Properties For Sale

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Indianapolis.

Consult with one of the investment counselors who can help build you a custom portfolio of Indianapolis turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Indianapolis, and have a 3-year appreciation forecast of 10.3%.

All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Indianapolis turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

References

Latest Market Data, Trends, and Statistics

https://www.indianarealtors.com/consumers/housing-data/

https://www.zillow.com/Indianapolis-In/home-values

https://www.neighborhoodscout.com/in/indianapolis/real-estate

https://www.realtor.com/realestateandhomes-search/Indianapolis_IN/overview

https://www.zumper.com/rent-research/indianapolis-in

Why Invest in Indianapolis Rental Market

http://www.cashflowdiaries.com/why-is-indianapolis-such-a-great-city-to-invest-in

https://www.threaltyinc.com/blog/2017/01 /04/why-invest-in-rental-properties-in-indianapolis-in

Best Neighborhoods in Indianapolis

https://www.niche.com/places-to-live/n/allisonville-indianapolis-in