It wasn't that long ago that the Texas housing market felt unstoppable. Homes were selling in bidding wars, often in days, and prices seemed to climb forever. For anyone trying to buy, it was a frustrating, expensive time. But times change, and the latest data points suggest a significant shift is underway. Indeed, the Texas housing market enters a major correction phase as prices drop across the state, driven by a dramatic increase in the number of homes for sale.

I've been watching real estate markets for years, and what we're seeing in Texas right now is a clear signal that the wild boom times are over, at least for now. Let's dive into what the numbers are telling us and what it means if you're a buyer, a seller, or just curious about the Lone Star State's real estate future.

Will the Texas Housing Market Crash as Prices Drop Across the State?

The Unmistakable Sign: Skyrocketing Inventory

The first and perhaps most obvious sign of a changing market is the sheer number of homes sitting on the market. Think of it like this: when there are way more items on the store shelves than people wanting to buy them, the store eventually has to lower prices to move the goods. The same principle applies to housing.

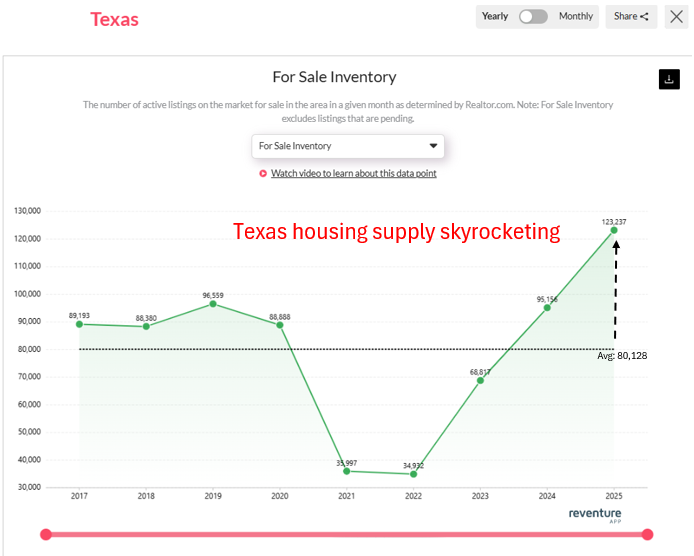

According to data highlighted by real estate analyst Nick Gerli, the CEO of Reventure App, the number of active listings for sale across Texas has shot up dramatically. Looking at the historical data, the state's inventory levels were relatively stable before the pandemic madness.

- In 2017, active listings were around 89,193.

- They hovered in the 88,000s and 90,000s through 2018, 2019, and 2020.

- The average during this pre-pandemic period was roughly 80,128 listings.

Then came the pandemic boom. Fueled by low interest rates, remote work, and a rush of migration, demand exploded while supply tightened. Builders couldn't keep up, and homeowners with incredibly low mortgage rates weren't selling. This caused inventory to absolutely plummet to historic lows.

- In 2021, listings dropped to a stunning low of around 35,997.

- 2022 wasn't much better, staying incredibly tight at about 34,932.

These incredibly low numbers are a huge reason prices jumped so much. There just weren't enough houses for everyone who wanted one.

But the tide has turned. As interest rates climbed and the initial rush of pandemic buyers slowed, more homes started coming onto the market, and fewer buyers were able to jump in.

- Inventory started climbing in 2023 to around 68,817.

- It continued its ascent in 2024, hitting about 95,156.

- And now, the data point that really catches my eye: in April 2025, active listings hit a whopping 123,237.

Let that sink in. 123,237 active listings. Compared to the roughly 80,128 average from 2017-2020, that's about a 53% increase in the number of homes available for sale. Compared to the pandemic lows of 2021-2022, it's literally more than triple the inventory.

From my perspective as someone who follows these markets, such a rapid and significant rise in inventory is a screaming signal. It tells me that the intense competition among buyers has faded. Sellers are finding their homes are sitting on the market longer, and they're facing much more competition from other homes for sale. This shifts the power dynamic firmly towards buyers.

Prices Are Following Suit: It's Not Just Inventory

High inventory is important because it's a leading indicator, but the real impact people feel is on prices. And Nick Gerli's analysis confirms what we'd expect: prices are now dropping across the state.

This isn't just a prediction based on inventory; it's a report on what's actually happening. We're seeing more price cuts, longer days on market before a home sells (if it sells), and ultimately, sale prices coming down from their peaks.

Why is this happening now? It's a mix of factors all coming together:

- The Inventory Surge: As discussed, more choices mean buyers don't have to overpay or waive contingencies like they did before.

- Higher Interest Rates: This is a massive factor. Even if a house price is slightly lower, the monthly payment on a mortgage is significantly higher now than it was a couple of years ago because interest rates have risen. This directly impacts how much house people can afford, reducing the pool of eligible buyers.

- Slowing Migration: The influx of new residents, particularly from more expensive states like California, was a major driver of demand and price growth in Texas during the boom. Nick Gerli notes that domestic migration into Texas slowed significantly in 2024, down 62%. While Texas is still growing, the pace of migration that fueled the recent frantic buying has cooled considerably. Fewer people arriving with potentially higher budgets means less competition for local buyers.

When you combine a flood of supply with cooling demand (due to affordability issues and slower migration), the result is predictable: prices have to come down to find the market clearing level.

How Much Could Prices Drop in Texas? Looking Ahead

This is the question on everyone's mind: just how far could this correction go? Predicting the exact bottom is impossible, but the data gives us some strong hints and potential scenarios.

One way to look at it is comparing current prices to long-term historical norms relative to incomes or rents. Nick Gerli's analysis suggests that Texas home values are still about 17.7% overvalued today compared to that historical relationship. This means, even with some recent small drops, prices haven't yet fully adjusted back to where they “should” be based on underlying economic fundamentals over the long run. He notes this overvaluation has improved a bit recently (meaning prices got even more overvalued at the peak), but it's still significant.

Based on current supply/demand conditions like the skyrocketing inventory, increased price cuts, and longer days on market, Reventure's short-term forecast (over the next 12 months) is for home prices in Texas to drop by -4.0% statewide. This seems like a reasonable near-term prediction given the clear shift in market dynamics we're witnessing.

However, Nick Gerli also talks about the potential for a larger correction, perhaps in the range of 15-20%. This more significant drop is a possibility, especially if certain economic conditions worsen. A key risk factor he points out is the oil industry. Texas's economy, while diverse, still has significant ties to energy. He mentions oil prices around $57/barrel as being problematic, potentially causing local operators to shut down production. A recession in the oil sector could lead to job losses and reduced economic activity in parts of Texas, further weakening housing demand and potentially accelerating price declines.

My own thoughts align with this analysis. Markets rarely correct in a perfectly smooth line. The 4% drop over the next year might be the initial phase, especially if economic conditions remain stable. But if there's an external shock, like a downturn in a key industry or a broader recession, the correction could easily deepen into that 15-20% range. The underlying overvaluation suggests there's still room for prices to fall before they hit historical norms.

The Silver Lining: A Step Towards Affordability

While headlines about price drops can sound alarming, it's important to remember why this correction is happening. The previous run-up in prices made Texas, a state long known for its relative affordability, increasingly out of reach for many of its residents. This was particularly true for first-time buyers or those earning local wages who weren't benefiting from the high salaries of coastal transplants.

Prices declining is actually a necessary step towards restoring some balance and improving affordability. As prices come down, more local Texans will be able to consider buying a home again. This can bring buyers back into the market, which in turn helps stabilize things eventually.

Even after a potential 4% drop, Nick Gerli's analysis suggests the market might still be about 10-12% overvalued. This indicates that the path to full affordability, based on historical metrics, might require further price adjustments down the line.

Understanding Reventure's Forecast Score

Reventure App uses a forecast score (0 to 100) to predict 12-month price movements based on supply and demand fundamentals. Texas currently has a score of 37/100. Scores closer to 0 indicate a market where prices are expected to decline, while scores closer to 100 suggest prices are likely to rise. A score of 37 is on the lower end, reinforcing the expectation of falling prices in the near future compared to other markets in the U.S. It signals weak fundamentals for price appreciation right now.

My Take on What This Means

Based on the data, the trends, and my understanding of how markets work, here's my personal view:

- For Sellers: The party is over. Listing your home now means entering a market with much more competition. You'll likely need to price competitively, be prepared for negotiation, and accept that your home might take longer to sell than it would have a year or two ago. Overpricing is the quickest way to have your listing sit and eventually require larger price cuts.

- For Buyers: This is potentially good news. You have more options, less pressure to make rushed decisions, and more leverage to negotiate on price and terms. However, higher interest rates still make the monthly cost of buying high, even if the price comes down. Don't just look at the list price; look at the full monthly payment with the current rates. Do your homework on local market conditions – while the state average is dropping, some specific neighborhoods might hold up better than others initially.

- For Texas: A housing market correction, while painful for those who bought at the peak, is ultimately healthy if it improves affordability. Making it easier for residents who work in the state to afford homes is crucial for long-term economic stability and quality of life.

The dramatic increase in inventory, coupled with clear signs of prices dropping and underlying overvaluation, strongly indicates that the Texas housing market is undergoing a significant correction. It's a necessary adjustment after a period of unsustainable growth. While the exact magnitude and duration of the downturn remain to be seen and could be influenced by broader economic factors like the energy sector, the direction is clear: the Texas housing market is cooling down, and prices are finding a new level.

Work With Norada in Texas's Shifting Market

As Texas enters a housing correction phase, savvy investors are capitalizing on price adjustments and increased inventory across key markets.

Norada offers a curated selection of turnkey rental properties in resilient Texas cities, providing consistent income and long-term appreciation potential.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- Average Down Payment on a House in Texas in 2025

- Texas Housing Market Predictions for Next 2 Years: 2025-2026

- 10 Texas Cities Where Home Prices Are Predicted to Drop in 2025

- This Texas Housing Market is the Best in the U.S. [2024 Rankings]

- Texas Housing Market: Prices, Trends, Predictions

- Are Texas Home Sales Dropping ?

- How Much Do Real Estate Agents Make in Texas?

- 10 Cheapest Places to Live in Texas

- Is Texas a Good Place to Live: Explore the Cost, Jobs and Lifestyle