The land trust is one of the most talked about, but least understood, entity utilized by real estate investors. The reason for this is simple, most attorneys or CPAs have never come across the entity in their professional practice. How can this be?

The land trust is one of the most talked about, but least understood, entity utilized by real estate investors. The reason for this is simple, most attorneys or CPAs have never come across the entity in their professional practice. How can this be?

You might be asking yourself: if the land trust is a legitimate entity used by real estate investors all over the country shouldn’t my local attorney know something about it. Unfortunately the answer is no, they most likely wouldn’t have a clue and this is because only a handful of states actually recognize a land trust via statute.

Unless you are speaking to an attorney in Hawaii, Illinois, Indiana, Florida, Georgia, Montana, South Dakota, or Virginia, where there is a statue on the books recognizing this form of trust, it is probably an area of law your local attorney has never been exposed to, unless of course he is also an informed real estate investor.

Due to a gap in knowledge on the part of many professionals, beginning and seasoned investors alike are either oblivious to this important tool or set it up incorrectly. In either case, this knowledge deficit will not make itself evident until much later. Consider a real estate attorney friend who helped his clients in Washington State protect their rental property in Florida:

Tim, a beginning real estate investor, asked Scott, his real estate attorney, if he could protect a recent property he acquired in Florida. Experienced in the use of LLCs for real estate investments, Scott created a Florida LLC to hold Tim’s rental property. After the LLC was established, Scott prepared and recorded a deed transferring Tim’s property into his newly formed LLC. Both Tim and Scott were happy with the structure until the following year when Tim received a tax bill for over $2,000 from the county recorder office in Florida. Tim’s transfer of his rental into the LLC triggered a transfer tax because his property was encumbered by a mortgage.

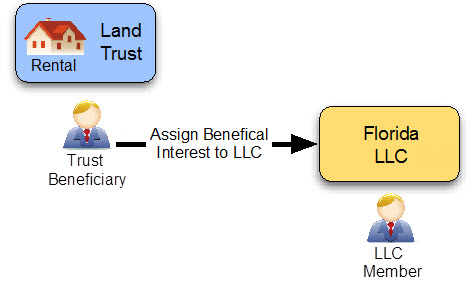

Scott’s mistake was not being familiar with the use of land trusts and the nuances of Florida. These two mistakes cost his client several thousand dollars. In Florida if you transfer encumbered property (this is property with a mortgage) into a business entity (i.e., a LLC) the county taxes the transfer. An attorney familiar with Florida law and the use of land trusts could have easily avoided this tax by creating a land trust to hold title to the property then assigning the beneficial interest to a LLC for asset protection. Had Scott called me before proceeding with transferring the property I could have instructed him accordingly and saved his client $2,000.

Transfer taxes are not the only concern for investors who transfer property directly into a LLC; lenders can create problems as well. Recently a client, Sandy, contacted me over a letter she received from her lender informing her of the lender’s intention to call her note due and payable in 30 days. Sandy was told to come up with $432,000 or the lender would initiate a foreclosure action. Sandy’s lender was accelerating her note. Why? It is quite simple, her lender discovered, as did I, that Sandy transferred her mortgaged rental property into an LLC without obtaining approval from her lender. The lender was not happy with Sandy’s actions.

Sandy had set up her own LLC and attempted to play attorney not fully understanding all of the legal ramifications of transferring encumbered property into a LLC. Because her property was encumbered by a mortgage, the lender reserved the right to accelerate the note if Sandy transferred title to the property. This is commonly referred to as a violation of the “due on sale clause” which is included in most mortgages. Unfortunately for Sandy, the market is operating under a new set of rules and Sandy thought she could continue to operate the way she did in the mid-2000s. Direct transfers of mortgaged property into LLCs are now scrutinized and prior strategies must be re-evaluated.

With the implosion of the housing market the use of land trusts have risen dramatically. Prior to 2009, many investors held little fear of transferring their mortgaged real estate directly into a LLC. If you recall, between 2003 and 2008, banks gave out loans like your local ice cream parlor hands out samples, all you have to do is ask. How you held title after the loan closed was of no consequence to the lender or the subsequent purchaser of your mortgage. To the lenders, the game was about loaning money then securitizing to fully monetize the investment. After an investor acquired a house he could turn around and sell it subject to the existing loan the very next day with relative confidence the original lender, or even a subsequent purchaser of the mortgage, would never check title.

The same can be said for investors seeking asset protection. Set up your LLC and deed your mortgaged property to the LLC for asset protection and move on to your next deal.

When the wheels fell off in 2009 many cavalier investors eventually received calls from their lender or note holder inquiring about ownership. More than a few of these inquiries were precipitated by mortgage insurers who were trying to evaluate their overall risk on a pool of mortgages. During the insurer’s inspection of random mortgages they would often find that the borrower did not match the title holder. The property was held by a LLC or had been transferred to another individual. The mortgage insurers placed pressure upon the lenders to get their loans in order and the lenders jumped on the borrowers.

So what did the savvy investor learn from this mess? If your property is encumbered you’d better find a way to move your mortgaged property under the protection of a LLC without alerting the lender to the transfer. The solution is to construct a land trust.

Please read Part 2 of this series here: Why Investors Use Land Trusts.