As of April 30, 2025, mortgage rates have seen a notable decrease, with the average 30-year fixed mortgage rate dropping to 6.59%, down 28 basis points from the previous week. This trend is a relief for many potential homebuyers and those considering refinancing. The 15-year fixed rate has also fallen to 5.91%, which marks a significant opportunity for borrowers looking to secure a better deal.

Today's Mortgage Rates – April 30, 2025: Rates Drop for Homebuyers

Key Takeaways

- Mortgage Rates Decrease: The average 30-year fixed mortgage rate is now 6.59%, while 15-year fixed rates are at 5.91%.

- Refinance Rates Fall: The current average refinance rate for 30-year fixed mortgages stands at 6.68%.

- Market Fluctuation: Rates are expected to remain volatile as economic data comes in.

- Watch for Economic Changes: Investors are attentive to signs of slowing inflation rates that may influence future rate adjustments.

Current Mortgage Rates Overview

Today’s mortgage rates reflect a steady decline, significantly benefitting both new home buyers and homeowners looking to refinance. The following table summarizes the prevailing national averages for various mortgage types:

| Mortgage Type | Current Rate (April 30, 2025) |

|---|---|

| 30-Year Fixed | 6.59% |

| 20-Year Fixed | 6.20% |

| 15-Year Fixed | 5.91% |

| 5/1 Adjustable Rate Mortgage (ARM) | 6.75% |

| 7/1 ARM | 6.70% |

| 30-Year VA Loan | 6.14% |

| 15-Year VA Loan | 5.61% |

| 5/1 VA Loan | 6.24% |

(Source: Zillow, April 30, 2025)

Refinance Rates Overview

Homeowners considering refinancing can also take advantage of lower rates. Here’s a breakdown of today’s refinance rates:

| Refinance Mortgage Type | Current Rate (April 30, 2025) |

|---|---|

| 30-Year Fixed | 6.68% |

| 20-Year Fixed | 6.36% |

| 15-Year Fixed | 6.01% |

| 5/1 ARM | 7.24% |

| 7/1 ARM | 7.44% |

| 30-Year VA Refinance | 6.20% |

| 15-Year VA Refinance | 5.86% |

| 5/1 VA Refinance | 6.33% |

(Source: Zillow, April 30, 2025)

Insight into Mortgage Rate Movement

Mortgage interest rates have fluctuated recently, influenced by various economic indicators. In March, job openings decreased, which surprised many analysts and signals potential slowdowns in economic activity. Investors are particularly watchful of these changes, as economic deceleration can lead to lower interest rates following Federal Reserve decisions.

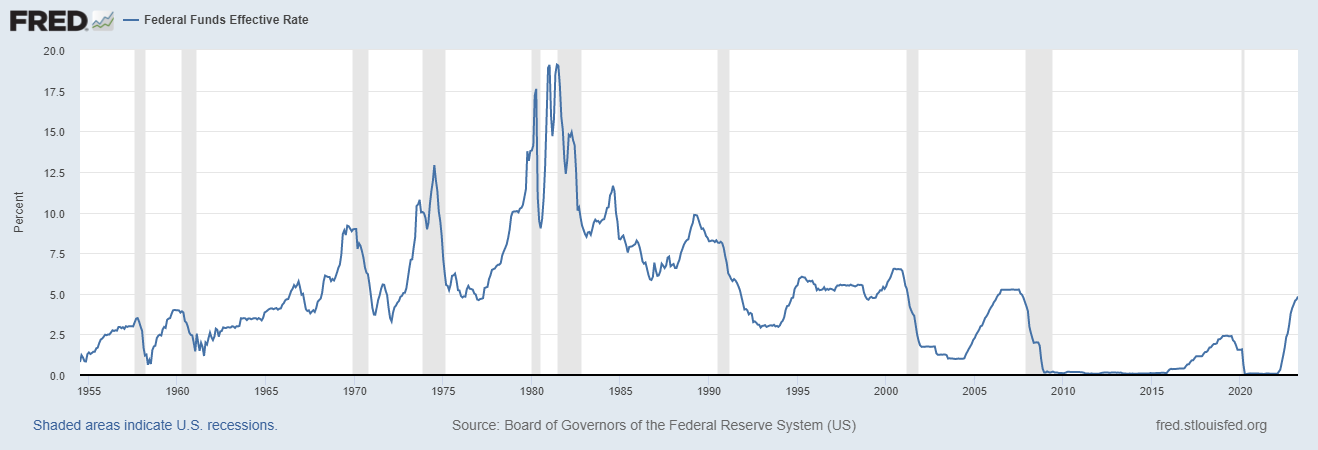

This week, there has been a consistent decrease in rates, which analysts attribute to growing investor concerns about upcoming economic reports that could influence monetary policy. The Federal Reserve's cautious stance on interest rate changes indicates they are pursuing a careful approach, balancing between stimulating economic growth and controlling inflation.

The Fed controls rates by adjusting the federal funds rate, which directly influences mortgage rates. When the economy shows signs of slowing down, as it has with fluctuating job data, the Fed may consider cutting rates to boost spending. However, they are also wary of inflation pressures, particularly due to global trade dynamics and tariffs that could drive up costs.

Types of Mortgages and Their Implications

30-Year Fixed Mortgage Rates

The 30-year fixed mortgage is one of the most popular loan types among homebuyers due to its ability to provide lower monthly payments and predictable loan terms. This type of mortgage is ideal for people who wish to buy a home with a manageable payment plan over an extended period.

By locking in a rate today, buyers can secure their monthly payments against future hikes, allowing them peace of mind in financial planning. However, one downside is that borrowers will typically pay more interest over the lifetime of the loan compared to shorter-term options.

In this current rate environment, purchasing a home with a 30-year fixed mortgage at 6.59% means making calculated monthly payments based on the loan amount. For example, if a buyer takes out a $300,000 mortgage, their monthly payment (excluding taxes and insurance) would be about $1,911.67, which many find manageable compared to higher payments associated with shorter loan lengths.

15-Year Fixed Mortgage Rates

For those able to make higher monthly payments, the 15-year fixed mortgage presents a compelling case. The lower interest rates mean borrowers can save significantly on interest paid over the life of the loan. Moreover, paying off the loan in half the time allows homeowners to build equity more quickly.

At the current rate of 5.91%, a $300,000 mortgage taken over 15 years would incur monthly payments of approximately $2,528.97. Although this requires a stronger financial commitment upfront, the potential to save on total interest – approximately $83,000 over the life of the loan compared to a 30-year fixed loan at the current rate – makes this option very attractive.

Adjustable-Rate Mortgages (ARM)

An adjustable-rate mortgage (ARM) typically offers lower initial rates than fixed-rate mortgages, making them appealing for short-term homebuyers. For example, a 5/1 ARM maintains a fixed rate for five years before adjusting annually based on prevailing market conditions.

While this can lead to significant initial savings, potential buyers must be aware of the risks involved in ARMs. At the end of the introductory period, rates could rise, significantly increasing monthly payments. For instance, if the ARM's rate swings to 7% after five years, the payments could rise considerably, creating a financial burden.

That said, ARMs are ideal for buyers who plan to move or sell their homes before the adjustment period begins. This strategy allows them to benefit from lower initial rates without facing indefinite payment increases.

Read More:

Mortgage Rates Trends as of April 29, 2025

When Will the Soaring Mortgage Rates Finally Go Down in 2025?

Why Are Mortgage Rates Rising Back to 7%: The Key Drivers

The Refinance Landscape

Refinancing is a strategy many homeowners utilize to lower their monthly payments or switch to a loan with more favorable terms. The recent drop in rates has made it a more viable option for many homeowners, especially those whose current mortgage rates are significantly higher than today’s averages.

Consider the situation where a homeowner currently pays 7.00% on their 30-year mortgage. Refinancing today at 6.68% can lead to substantial monthly savings. For example, if they had a mortgage amount of $300,000, their original monthly payment would have been about $1,996.55. By refinancing, they would save approximately $84 each month, accumulating $1,008 in savings per year.

However, refinancing isn’t only about securing lower rates. Homeowners also need to factor in refinancing costs, like closing costs and how long they plan to stay in their homes. If refinancing adds $3,000 in costs, homeowners should calculate how long it will take to recover those costs with their savings.

For the homeowner in this example looking to save $84 a month, it would take around 36 months (or 3 years) to break even on their refinancing costs. This is a crucial metric to consider when weighing whether to refinance.

FHA and VA Loan Rates

For FHA loans, which are particularly attractive to first-time homebuyers, average rates are just below 6%, making them competitive. The Federal Housing Administration insures these loans, allowing lenders to offer better terms to borrowers, especially those with lower credit scores.

FHA loans require only a 3.5% down payment for borrowers with credit scores above 580, making homeownership accessible to a larger audience. For individuals with lower credit scores who can afford a 10% down payment, qualifications can be relaxed further, granting a pathway to homeownership even for those with limited financial flexibility.

Similar to FHA, VA loans, available to eligible veterans and active-duty service members, come with rates around 6.14%. These loans offer substantial savings because they require no down payment and no mortgage insurance, making them a popular choice for military personnel and their families.

In both cases, prospective borrowers should explore whether they qualify for these programs as they can considerably lower the barriers to homeownership.

Future Projections and Economic Indicators

As we look ahead to the remainder of 2025, various economic forecasts suggest that mortgage rates could trend downward, particularly if signs of economic slowdowns persist. Analysts predict rates might flirt with 6.2% by year-end, especially if inflationary pressures remain in check.

However, the potential for a resurgence in inflation due to trade tariffs and other factors could negate these benefits. Recent commentary from Federal Reserve officials highlights their concern regarding inflation and the desire to maintain a balanced approach in monetary policy.

Fannie Mae projects 30-year mortgage rates to settle around 6.2% by the end of 2025, indicative of gradual easing from current rates. Additionally, these projections underscore the importance of caution when planning future home purchases or refinancing strategies.

The Influence of Economic Data

Recent fluctuations in mortgage rates are closely tied to economic data released by organizations like the Bureau of Labor Statistics. For instance, the report showing a decline in job openings sent ripples through financial markets, fueling concerns about the economy's stability. As mortgage rates are sensitive to economic growth, any significant drop in employment opportunities can signal potential adjustments in interest rates.

Moreover, broader statistics, such as inflating consumer prices or shifts in the housing market, play a critical role in shaping mortgage rates. As the economy reacts to various stimuli, borrowers must stay informed and agile, adapting their strategies based on real-time economic insights.

Summary

Today's mortgage rates are reflecting a positive trend for both homebuyers and those looking to refinance. With rates decreasing and expected volatility in the market, borrowers are in a unique position to take advantage of favorable terms. Understanding the different types of mortgages, potential savings through refinancing, and future expectations can equip consumers to navigate these financial waters effectively.

Turnkey Real Estate Investment With Norada

Investing in real estate can help you secure consistent returns with fluctuating mortgage rates.

Despite softer demand, smart investors are locking in properties now while competition is lower and rental returns remain strong.

HOT NEW LISTINGS JUST ADDED!

Speak with an investment counselor (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?