The Charleston real estate market is known for its historic homes, stunning waterfront properties, and vibrant neighborhoods. With a range of options from condos to single-family homes, there's something for everyone in this dynamic market. The Charleston housing market has been experiencing significant growth and competitiveness in recent years.

With rising median sale prices and decreased days on the market, it's an attractive area for both buyers and sellers. In this blog post, we'll delve into the latest housing trends, explore the competitive nature of the market, examine migration and relocation patterns, learn about the local schools, and understand the impact of natural hazards on homes in Charleston.

Charleston Housing Market Trends in 2024

Examining the current state of affairs, Charleston, SC emerges as a buyer's market in February 2024. This designation suggests that the supply of homes surpasses the demand, offering buyers a favorable landscape for exploration and negotiation.

Median Listing and Sold Prices

According to Realtor.com, as of February 2024, the median listing home price in Charleston, SC stands at $689.9K, reflecting a significant 15.1% year-over-year increase. This surge in listing prices indicates sustained demand and competitiveness within the market. Additionally, the median sold price for homes in Charleston is reported at $905K, underlining the city's allure for both buyers and sellers alike.

Sale-to-List Price Ratio and Market Dynamics

One key metric shedding light on market dynamics is the sale-to-list price ratio, which currently sits at 98.53%. This figure indicates that, on average, homes in Charleston, SC are selling for 1.47% below their asking price. Despite this slight variance, the city maintains a balanced environment, with both buyers and sellers finding opportunities within the market.

Days on Market

An essential factor influencing buyer and seller behavior is the median days on market. In Charleston, SC, homes typically spend 31 days on the market before being sold. This statistic signifies a relatively swift turnover rate, indicative of the city's appeal and active real estate transactions.

Furthermore, analyzing the trend over time reveals a promising trajectory. The median days on market have exhibited a downward trend, indicating increased efficiency and agility within the housing market. Comparing data from previous months and years, Charleston's real estate landscape demonstrates resilience and adaptability to evolving market conditions.

In summary, the Charleston, SC 2024 housing market showcases resilience, growth, and opportunity. With escalating listing prices, a balanced market dynamic, and a declining median days on market, the city maintains its status as a sought-after destination for homebuyers and investors alike.

Charleston Housing Market Forecast 2024 and 2025

As the interest rates have risen since last year, many home buyers and investors have questions regarding the future of the Charleston real estate market. One positive trend that will affect real estate in the Charleston market is continued job growth. This ongoing job growth means that there will be a continued demand for housing. The increase in Charleston home prices is easily explained by the theory of supply & demand. Whenever there is a limited supply of an item that is in high demand, prices increase.

Current State of the Market

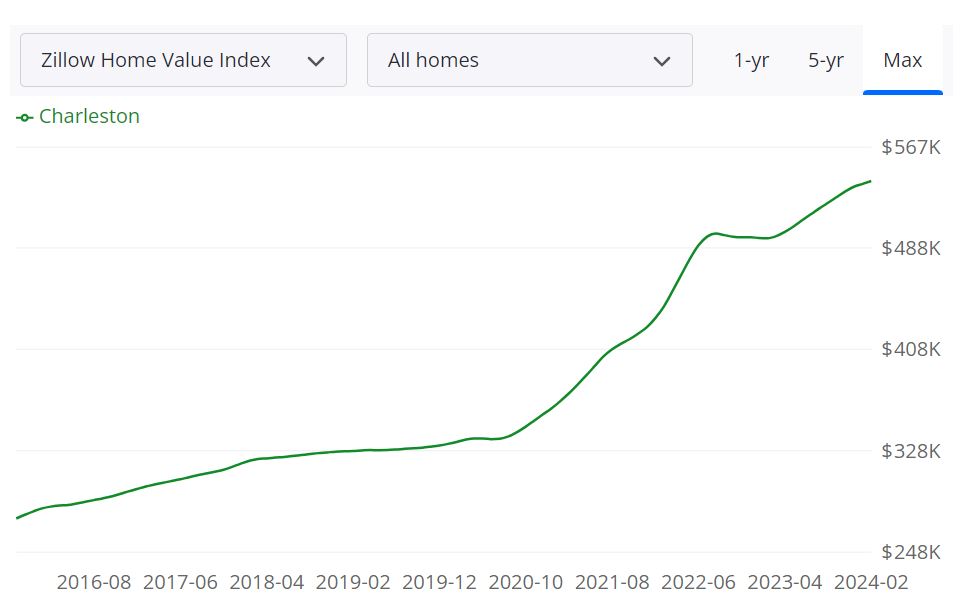

According to Zillow, the Charleston housing market has exhibited robust growth, with the average home value soaring to $541,040, marking a substantial 9.1% increase over the past year. Notably, properties are swiftly going to pending status in around 17 days, indicating a high demand. To delve deeper into the intricacies of the market, let's dissect key housing metrics.

Understanding Housing Metrics

1. For Sale Inventory: As of February 29, 2024, there were 751 properties listed for sale in Charleston, offering ample choices for prospective buyers.

2. New Listings: On the same date, 244 new properties were listed, reflecting ongoing activity and potential growth in inventory.

3. Median Sale to List Ratio: As of January 31, 2024, the median sale to list ratio stood at 0.985, indicating that properties are typically selling close to their listing prices.

4. Median Sale Price: The median sale price for homes in Charleston, recorded on January 31, 2024, was $526,933, providing insight into the prevailing market value.

5. Median List Price: As of February 29, 2024, the median list price surged to $668,300, reflecting seller confidence and potentially higher expectations.

6. Percent of Sales Over/Under List Price: In January 31, 2024, 16.3% of sales were recorded above list price, while 64.0% were below list price, showcasing diverse negotiation dynamics within the market.

Charleston MSA Housing Market Forecast

The Charleston Metropolitan Statistical Area (MSA), encompassing various counties, serves as a pivotal region in the South Carolina housing landscape. Defined by the U.S. Census Bureau, an MSA typically includes a core urban area and adjacent communities with strong economic ties.

In the case of Charleston, this MSA comprises Charleston, Berkeley, and Dorchester counties, collectively forming a vibrant housing market. With a forecasted growth rate of 0.5% by March 31, 2024, followed by 1.3% by May 31, 2024, and an anticipated 2.4% by February 28, 2025, the Charleston MSA demonstrates resilience and potential for continued expansion.

Charleston's MSA stands as a significant player in the state's real estate landscape, catering to a diverse range of homebuyers and investors. With its strategic location, historical significance, and burgeoning economy, the Charleston MSA attracts individuals seeking a desirable lifestyle amidst a thriving community. As the housing market evolves, monitoring these forecasts and understanding the underlying trends is paramount for informed decision-making.

Are Home Prices Dropping in Charleston?

Despite occasional fluctuations, Charleston's housing market has shown consistent growth in home prices over the past year. The average home value has risen by 9.1% annually, reflecting sustained demand and a robust real estate market. While short-term variations may occur, there are no significant indications of a widespread decline in home prices in the foreseeable future.

Will the Charleston Housing Market Crash?

Speculating about a housing market crash involves considering numerous economic, regulatory, and market-specific factors. As of now, Charleston's housing market exhibits resilience and stability, supported by strong demand, limited inventory, and consistent price appreciation. While unforeseen events or economic downturns can impact the market, there are no imminent signs of a crash. Vigilance, prudent investment strategies, and monitoring market trends remain essential for mitigating risks.

Is Now a Good Time to Buy a House in Charleston?

Deciding whether it's an opportune time to buy a house in Charleston depends on individual circumstances, financial readiness, and long-term goals. While the current market favors sellers, buyers can still capitalize on historically low mortgage rates and potential opportunities for negotiation. Additionally, investing in real estate often offers long-term benefits, including equity accumulation and asset appreciation. However, prospective buyers should conduct thorough research, assess their financial situation, and consider consulting with real estate professionals to make informed decisions tailored to their needs.

Potential Factors Influencing the Forecast

The Charleston housing market forecast is influenced by a variety of factors that shape the real estate landscape. Some of the potential factors influencing this forecast may include:

- Economic Conditions: Economic stability and growth in the Charleston area can impact housing demand and pricing.

- Population Trends: Changes in population, including migration patterns, can affect the demand for homes.

- Interest Rates: Fluctuations in mortgage interest rates can influence the affordability of homes for buyers.

- Local Development: New construction and development projects can impact housing supply and demand.

- National Trends: Broader national economic and housing market trends can have ripple effects on Charleston's market.

Both buyers and sellers need to keep an eye on these factors and stay informed about the evolving Charleston housing market to make informed decisions.

Charleston Real Estate Investment Overview

The Charleston SC real estate market is often overlooked for “hotter” markets like cities in Florida and Texas. Yet there are a number of factors that make the Charleston housing market an excellent place for investors to look at buying properties. Charleston, South Carolina, is a coastal city with a rich history, vibrant culture, and thriving economy. The city's real estate market has seen steady growth in recent years, making it an attractive option for real estate investors. Here are some key factors to consider when deciding whether to invest in Charleston real estate.

Population & Demographics

Charleston's population has grown by more than 14% in the past decade, and it is projected to continue to increase in the coming years. The city's demographics are also attractive for real estate investment, with a relatively young and highly educated population. This demographic shift has led to an increased demand for housing, making the Charleston real estate market an excellent investment opportunity.

CHARLESTON SC MSA COUNTY POPULATION ESTIMATE, 2021 (Source: U.S. Census Bureau, 2022)

- Berkeley County: 236,701

- Charleston County: 413,024

- Dorchester County: 163,327

- Charleston Metro Area: 813,052

Charleston Has a Massive Military & Student Market

Any military base provides a large, mobile population that overwhelmingly rents. Joint Base Charleston combined the Air Force and Naval bases located in Charleston. The joint base is home to a number of military training programs like the nuclear power school and Coast Guard maritime law enforcement academy, as well. There is more than twenty thousand personnel in all, and nearly all of the rent.

Charleston, South Carolina was founded around 1670. The College of Charleston serves around 11,000 students. Charleston Southern University is a private university located in the city. The Medical University of South Carolina is the only medical school in the area, attracting students from across the region.

Trident Technical College is the local community college. On top of that are the military educational programs. This creates a disproportionately large student market for a city this size. Yet the Charleston housing market is better than that of the average college town since the value of rental real estate here isn’t dependent on the appeal of a particular college.

The Tourist Market Is Big in Charleston

Charleston, once best known for its rich history dating back to the mid-seventeenth century, is quickly gaining recognition as a destination resort that caters to discerning travelers. The city sits on the Atlantic coast, the ocean breezes mediating the warm summer climate and keeping winter’s chill at bay. The mild weather and surf help to explain why around eight million visitors a year pass through the city. If you have a condo or beach house, you can rent it out to tourists at a decent rate. Note that Charleston County’s rules on short-term rentals through sites like AirBnB are more relaxed than that of Charleston proper.

The Booming Job Market in Charleston, SC

Charleston's economy has seen tremendous growth in recent years, with the city's job market booming in particular. The city is home to a diverse range of industries, including healthcare, aerospace, tourism, and manufacturing. Major employers include Boeing, the Medical University of South Carolina, and the College of Charleston. The city's strong economy and job market make it a great place to invest in real estate.

This Is a Low Tax State

South Carolina is a low-tax state, which is a significant advantage for real estate investors. The state has one of the lowest property tax rates in the country, which can help investors maximize their returns. Additionally, the state has no inheritance or estate tax, making it an attractive option for long-term investment.

South Carolina is Landlord Friendly

South Carolina is known for being landlord-friendly, with laws that protect landlords and their property rights. The state has a relatively low tenant protection index, which means landlords have more control over their properties. This can make investing in Charleston real estate less risky than in other markets.

Conclusion

The Charleston housing market is certainly benefiting from a local economy that has gained worldwide attention. The Charleston real estate market contains multiple, sizable renting populations aside from a growing workforce that cannot afford to buy local single-family homes. The strong job market and relatively limited space are driving up rents and home values.

Apart from the Charleston market, you can invest in Raleigh, NC. The Raleigh NC real estate market is landlord friendly, contains several large populations of renters, and has an economic future that ensures long-term growth in housing demand and rents. Owning a piece of Raleigh real estate is a great achievement for many people.

Homeowners in Raleigh continue to see their homes appreciate in value because they are in such high demand. From Millennials moving to the area to retirees living here, Raleigh continues to be a great place for people from all walks of life. Whether you are a Baby Boomer or a Millennial, you will find living in Raleigh is a unique experience. From being a leader in the job market to being a hub for entertainment, it’s pretty clear why many people love to call Raleigh home.

Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you can fill up the form given here. One of our investment specialists will get in touch with you. Norada Real Estate Investments helps take the guesswork out of real estate investing. We can help you succeed by minimizing risk and maximizing the profitability of your real estate investments.

References

- https://www.zillow.com/Charleston-sc/home-values

- https://www.neighborhoodscout.com/sc/charleston/real-estate

- https://www.redfin.com/city/3478/SC/Charleston/housing-market

- https://www.realtor.com/local/Charleston_SC/housing-market

- https://en.wikipedia.org/wiki/Charleston,_South_Carolina_metropolitan_area

- https://www.deptofnumbers.com/unemployment/south-carolina/charleston/

- https://www.thestate.com/news/politics-government/article101629497.html

- https://www.avail.co/education/laws/south-carolina-landlord-tenant-law

- https://www.bestplaces.net/economy/city/south_carolina/charleston

- http://www.live5news.com/story/31247521/charleston-rental-prices-rise-as-millennials-move-in/

- https://www.accreditedschoolsonline.org/south-carolina/charleston-sc/