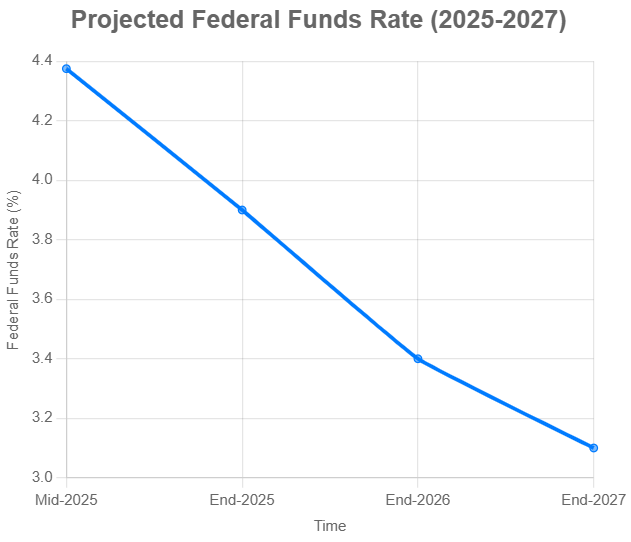

Are you trying to figure out what the future holds for our wallets is always top of mind. And right now, one of the biggest questions that keeps popping up is: what's going to happen with interest rates in 2025, 2026, and 2027? Well, based on what I'm seeing and digging into, it looks like interest rates are likely to gradually decrease over the next three years from the current federal funds rate of 4.25%-4.50% in mid-2025, potentially settling somewhere between 2.25% and 3.1% by mid-2027.

This easing is expected as inflation continues to cool down and the economy navigates various domestic and global factors. Let's dive deeper into what's driving these predictions and what it could mean for you and me.

Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

Where We Stand Now: Mid-2025

Think back to the last couple of years. We saw some pretty significant hikes in interest rates as the Federal Reserve (or the Fed, as it's often called) tried to get a handle on inflation. It definitely made things more expensive for a lot of us, from taking out a mortgage to even using our credit cards.

But fast forward to mid-2025, and the picture is starting to shift. The Fed actually began to ease things up a bit in late 2024, bringing the federal funds rate down by a full percentage point from its peak of 5.25%-5.50%. As of June 2025, inflation, as measured by the Personal Consumption Expenditures (PCE) index, has come down to around 2.7%, which is getting closer to the Fed's target of 2%. However, and this is important, core inflation (which takes out those often-swinging food and energy prices) is still a bit higher at 2.8%. This is why the Fed is probably still being a little cautious.

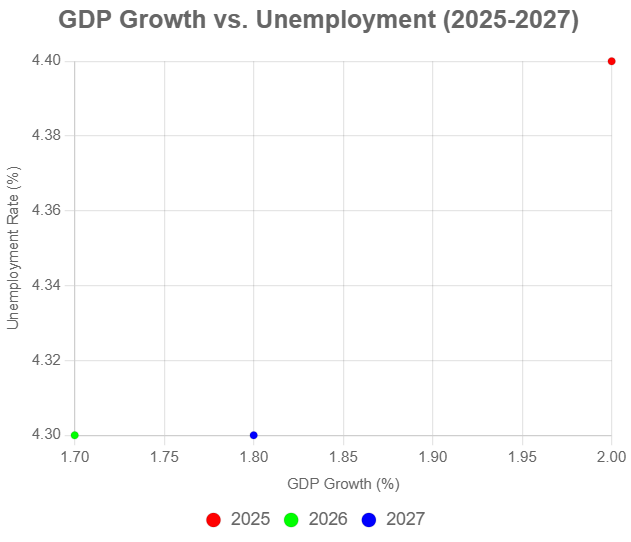

In their third meeting of 2025 back in March, they decided to hold rates steady. According to their Summary of Economic Projections (SEP) from that meeting, the median forecast is for the federal funds rate to be around 3.9% by the end of 2025. That suggests we might see a couple more small rate cuts (around 0.25% each) before the year is out. They're also expecting the economy to grow a bit slower in 2025 (around 2.0%) compared to 2024 (2.8%), and unemployment might tick up slightly to 4.4%. All of this sets the stage for what could be a pretty measured approach to interest rates over the next few years.

What's Going to Shape Interest Rates?

There are a bunch of moving parts that will play a role in where interest rates go from here. It's not just one thing, but a combination of factors that economists like myself keep a close eye on.

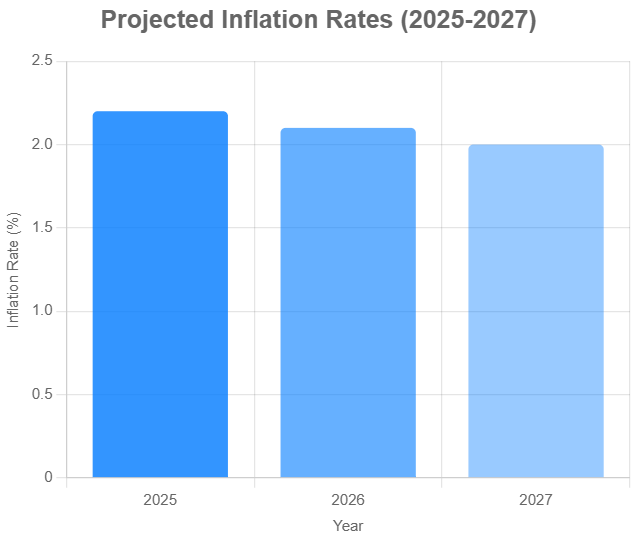

- The Inflation Puzzle: This is probably the biggest piece of the puzzle. The Fed's main job is to keep prices stable, and they aim for that 2% inflation target. Most forecasts I've seen suggest that inflation will continue to come down, maybe to around 2.2% in 2025 and hitting that 2% mark by 2027. But, and there's always a but, things like new tariffs, ongoing global tensions, or disruptions in the supply chain could cause prices to go back up. For example, I remember reading the minutes from the Fed's May 2025 meeting, and they specifically mentioned that tariffs could significantly increase inflation in both 2025 and 2026. That kind of uncertainty is definitely something to watch.

- The Economy and Jobs: The Fed also wants to see as many people employed as possible. Right now, the economy is expected to slow down a bit, with GDP growth maybe around 1.7% in 2026 before picking up again in 2027. Unemployment has been pretty steady, hanging around 4%-4.2% since mid-2024. If the economy slows down too much, the Fed might be more inclined to cut rates to try and boost things. A strong job market, on the other hand, gives them more flexibility.

- Trade and Government Policies: You can't talk about the economy without mentioning what the government is doing. Policies related to trade, especially tariffs being proposed, could really throw a wrench in the works. Tariffs often lead to higher prices for consumers, which makes the Fed's job of controlling inflation even harder. I've also seen some legal challenges to these tariffs, which adds another layer of unpredictability. Then there are fiscal policies – things like tax cuts or increased government spending. These can sometimes stimulate economic growth but might also fuel inflation, which the Fed would then have to respond to with interest rate adjustments.

- What's Happening Around the World: We don't live in a bubble, and what other countries are doing with their monetary policy matters too. It looks like other major central banks, like the European Central Bank and the Bank of England, are also expected to ease their rates. This global trend could put some downward pressure on US rates as well. However, if some countries, like Japan, were to start raising their rates, it could create some volatility in the global financial markets.

- The Market's Take: It's always interesting to see what the financial markets are predicting. What people who are buying and selling bonds and other financial instruments expect can also influence actual rates. I've noticed that some analysts think the peak interest rate we'll see in this cycle might be higher than what others are predicting for the long run. You see a lot of this discussion online, for example, on platforms like X, where some folks are even anticipating rates to fall to around 3.25%-3.50% by the end of 2025.

Looking Ahead: Interest Rate Forecasts (2025-2027)

Now, let's get into some specific numbers. Keep in mind that these are just forecasts, and things can change pretty quickly in the world of economics. But based on a variety of expert opinions and projections, here's a general idea of where interest rates might be headed:

2025: Taking it Slow

- Federal Funds Rate: The Fed itself is projecting around 3.9% by the end of the year, which, as I mentioned, suggests a couple of small cuts. Some analysts, like those at Morningstar, are a bit more optimistic and think we could see rates in the 3.50%-3.75% range, anticipating maybe three cuts due to lower inflation and slower growth. BlackRock seems to think rates will get to around 4% and then might pause to see how the inflation and jobs data look.

- 10-Year Treasury Yield: This is a key benchmark for many other interest rates. Morningstar is predicting an average of around 3.25% by 2027, and they think we'll probably see yields in the 3.5%-4% range in 2025.

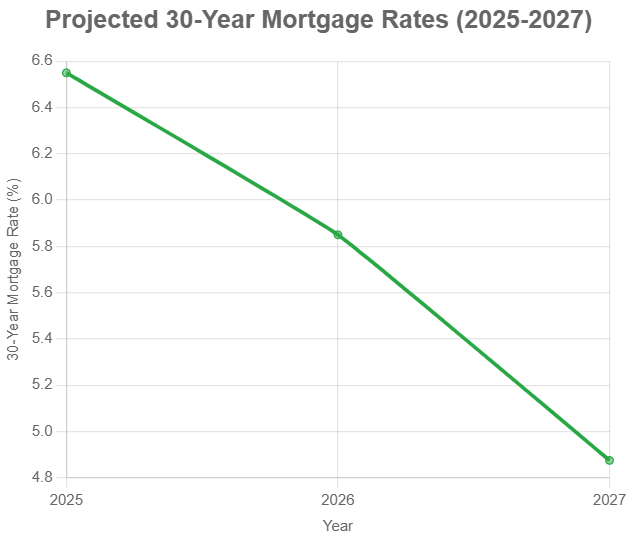

- 30-Year Mortgage Rate: If you're thinking about buying a home, this is a big one. Forecasts for 2025 seem to suggest mortgage rates will stay relatively high, maybe averaging between 6.3% and 6.8%. Fannie Mae is predicting around 6.3% by the end of the year, and Realtor.com is expecting something similar, around 6.2%.

- Key Things to Watch: How quickly inflation cools down, whether the economy slows as expected, and what happens with those potential tariffs will be the main drivers this year.

2026: More Downward Movement

- Federal Funds Rate: By the end of 2026, the Fed's current projection is around 3.4%. Morningstar is again a bit more aggressive, forecasting a range of 2.50%-2.75%, believing that inflation will keep falling and there will be more concerns about the economy. TD Economics is in line with the Fed at 3.4%.

- 10-Year Treasury Yield: Most predictions have this stabilizing somewhere between 3.25% and 3.5%.

- 30-Year Mortgage Rate: There's a wider range of forecasts here, from about 5.5% to 6.2%. Morningstar is on the lower end at around 5.0%, while Wells Fargo anticipates rates might still be above 6.4%.

- Key Things to Watch: Whether inflation gets closer to that 2% target, if GDP growth continues to slow to around 1.7% as expected, and if the unemployment rate stays relatively stable around 4.3%.

2027: Finding a New Normal?

- Federal Funds Rate: Looking further out to the end of 2027, the Fed's median projection is around 3.1%. Morningstar is still anticipating lower rates, in the 2.25%-2.50% range, and S&P Global Ratings is forecasting around 2.9%.

- 10-Year Treasury Yield: Most likely to settle somewhere between 3% and 3.25%.

- 30-Year Mortgage Rate: Predictions here range from Morningstar's forecast of 4.25%-4.5% to others suggesting around 4.75%-5.0%.

- Key Things to Watch: If inflation stays at that 2% level, if GDP growth stabilizes around 1.8%, and if the global trend of easing monetary policy continues.

Here's a quick summary table:

| Metric | End of 2025 Forecasts | End of 2026 Forecasts | End of 2027 Forecasts |

|---|---|---|---|

| Federal Funds Rate | 3.50% – 3.9% | 2.50% – 3.4% | 2.25% – 3.1% |

| 10-Year Treasury Yield | 3.5% – 4% | 3.25% – 3.5% | 3% – 3.25% |

| 30-Year Mortgage Rate | 6.2% – 6.8% | 5.0% – 6.4% | 4.25% – 5.0% |

What This Means for You and Me

These potential shifts in interest rates can have a real impact on our everyday lives:

- For Homebuyers: If mortgage rates do come down to the 6%-6.5% range in 2025 and maybe even to 4.75%-5% by 2027, it could definitely make buying a home more affordable. However, we also need to remember that high home prices and a limited number of houses for sale are still big challenges. While lower rates might help with monthly payments, it's unlikely we'll see a return to the really low rates of the past.

- For Borrowers: If you have a car loan, you might see those rates edge down a bit too, maybe from around 7.53% in 2024 to around 7% in 2025. And credit card interest rates, which can be pretty hefty, might also fall slightly. Lower borrowing costs can provide some financial relief, but again, they're likely to stay above pre-pandemic levels.

- For Savers: If you've been enjoying the higher yields on savings accounts lately (some have been offering 4%-5% in 2025), you might see those rates come down to 2.5%-3% by 2027 as overall interest rates decline.

- For Investors: Lower interest rates can sometimes be good for the stock market because it reduces borrowing costs for companies. However, bond investors might want to think about shorter-term bonds or a strategy called laddering to manage the risk of rates potentially going up unexpectedly.

Things That Could Change the Course

It's important to remember that these are just predictions, and there are several things that could throw these forecasts off:

- Inflation Sticking Around: If those tariffs or other issues cause inflation to stay higher than expected, the Fed might have to hold off on cutting rates or even raise them again.

- A Sharper Economic Downturn: If the economy slows down more than anticipated, the Fed might need to cut rates more aggressively to try and prevent a recession.

- Shifts in Government Policy: Changes in trade or fiscal policy could force the Fed to rethink its strategy.

- Global Events: Unexpected political or economic events around the world can also have a ripple effect on US interest rates.

Final Thoughts

Based on everything I'm seeing, the most likely path for interest rates over the next three years is a gradual decline. The Federal Reserve seems to be aiming for a delicate balance, trying to bring inflation down to its target while also supporting economic growth. For us regular folks, this could mean some relief in borrowing costs down the road, although we probably won't see a return to the very low rates we experienced in the past.

Of course, the economic road ahead is rarely smooth, and there will likely be some bumps along the way. That's why it's so important to stay informed, keep an eye on what the Fed is doing and saying, and maybe even chat with a financial professional to make sure you're making the best decisions for your own situation. As Federal Reserve Chair Jerome Powell himself said back in March 2025, their approach will continue to depend on the data they see coming in. So, while forecasts can give us a general direction, the actual path of the economy is never set in stone.

Recommended Read:

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Interest Rate Predictions for the Next 12 Months

- Interest Rate Forecast for Next 5 Years: Mortgages and Savings

- When is the Next Fed Meeting on Interest Rates?

- Interest Rate Cuts: Citi vs. JP Morgan – Who is Right on Predictions?

- More Predictions Point Towards Higher for Longer Interest Rates