As of January 24, 2026, the national average for a 30-year fixed refinance rate has nudged up by 5 basis points, settling at 6.57%, according to Zillow. While this might seem like a tiny bump, it’s a signal that the mortgage market is still finding its footing, constantly reacting to economic news and what the Federal Reserve might do next. For many of us looking to refinance our homes, even a small change like this is worth paying attention to.

Mortgage Rates Today, Jan 24: 30-Year Refinance Rate Rises by 5 Basis Points

The Latest Numbers: What's Happening Today?

It's always good to have the latest stats at your fingertips. Here's a quick snapshot of where things stand, based on Zillow's data this week:

| Mortgage Type | Current Rate | Change from Last Week | Trend Snapshot |

|---|---|---|---|

| 30-Year Fixed Refi | 6.57% | Up 5 basis points | A slight uptick, but generally stable over the longer term. |

| 15-Year Fixed Refi | 5.59% | Stable | Holding steady, attractive for quicker payoff. |

| 5-Year ARM Refi | 7.03% | Unchanged | Remains higher than fixed rates, involves more risk. |

Decoding the 30-Year Fixed Refinance Rate Increase

The 30-year fixed refinance is still king for a reason: it offers predictable monthly payments that don't change over the life of the loan. This latest move, a rise of 5 basis points from last week's average of 6.52% to 6.57%, is a gentle reminder that rates aren't entirely static.

Think about it this way: when you're refinancing a mortgage, especially a substantial one, even half a percentage point can translate into thousands of dollars over 30 years. While this 5-basis-point increase isn't cause for alarm, it highlights the importance of acting when the timing feels right for your financial situation. In my experience, homeowners who locked in rates significantly higher than this in the past couple of years are definitely feeling the pull to refinance, and these small movements are a big part of their decision-making process.

What About Other Refinance Options?

It's not just the 30-year that matters. Let's look at the other popular choices:

- 15-Year Fixed Refinance: This option is still sitting at a comfortable 5.59% and has been stable. It's a fantastic choice for anyone who wants to pay off their mortgage faster and save a good chunk of money on interest. If you have the financial wiggle room for higher monthly payments, shortening your loan term is a smart move for long-term financial health.

- 5-Year Adjustable-Rate Mortgage (ARM) Refinance: Currently at 7.03%, this rate is unchanged from last week. ARMs can look appealing because they often start with lower interest rates than fixed loans. However, that initial lower rate is for a set period, and then it can go up or down based on market conditions. With rates sitting above 7% for ARMs, the initial savings might not be as compelling when compared to the stability of fixed rates, especially if you're someone who prefers to have their monthly housing cost locked in.

Putting the Numbers into Real-World Terms

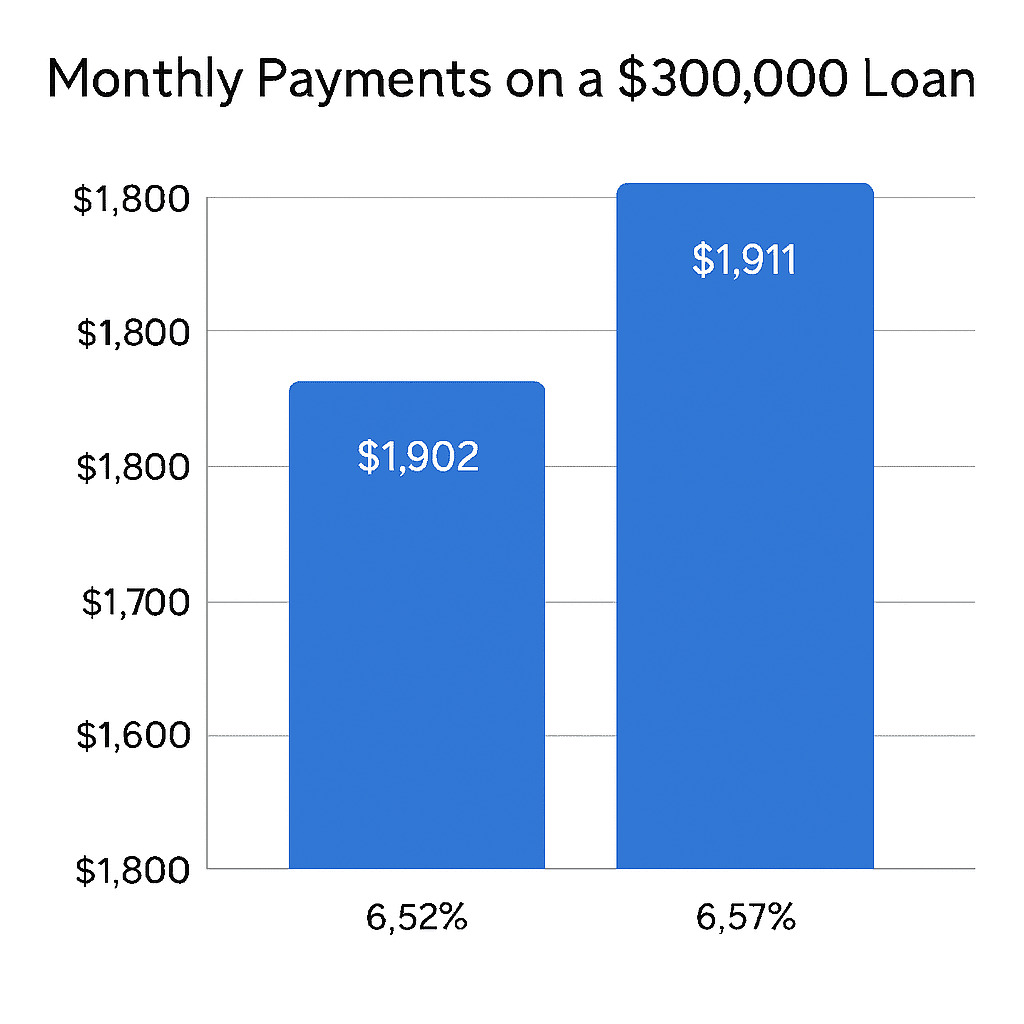

Seeing percentages is one thing, but understanding how they affect your wallet is another. Let's imagine you're looking to refinance a $300,000 loan with a 30-year fixed term.

- If the rate were 6.52%, your principal and interest payment would be approximately $1,902 per month.

- Now, with the rate at 6.57%, that payment climbs a bit to around $1,911.

That’s a difference of about $9 each month, or roughly $108 over the course of a year. Now, $9 doesn't sound like a lot, does it? But remember, this is a 30-year loan. Over the entire life of that loan, that seemingly small monthly increase adds up to over $3,200 more in interest paid. This is why even incremental changes in mortgage rates are worth considering closely.

Why These Seemingly Small Changes Carry Weight

As I’ve seen over my years working with homeowners, even minor shifts in mortgage rates can make a difference, particularly for those with larger loan amounts. When you're refinancing a significant sum, a quarter-point or half-point can translate into substantial savings or added costs. For anyone thinking about refinancing, it’s crucial to run the numbers. Don't just look at the immediate monthly payment change – consider the total interest you'll pay over the entire loan term.

The Big Picture: Refinance Demand is High!

Despite the slight increase in the 30-year rate, the desire to refinance is incredibly strong. The Mortgage Bankers Association (MBA) reported some eye-opening numbers for the week ending January 16, 2026:

- Refinance applications jumped by a whopping 20% compared to the week before.

- Even more dramatically, they were up 183% compared to the same week last year!

What's driving this surge? A lot of it comes down to homeowners who took out mortgages at higher rates, often above 7%, in 2023 and 2024. They are now eager to lower their monthly payments, and these current rates, even with the slight uptick, still offer an opportunity for significant savings for many. We're also seeing the average loan size for refinance applications increase, which tells me that borrowers with larger outstanding mortgages are particularly focused on these rate movements.

What Does This Mean for You?

So, what's the takeaway from all this?

- Refinancing Decisions: If you're considering refinancing, weigh this small increase in the 30-year rate against the potential savings you could get, especially if you're looking at shorter loan terms like the 15-year fixed. Always compare offers from different lenders too!

- Market Stability: Overall, the mortgage market seems to be in a pretty stable place right now. While economic news can always cause ripples, the different mortgage products are holding relatively steady. This means you have a bit more time to weigh your options without feeling pressured by wild rate swings.

- Looking Ahead: Experts are generally predicting that rates will likely stay in a similar range for the near future. Significant changes would probably come only if we see big shifts in inflation or if the Federal Reserve makes a major policy announcement.

My Two Cents: Smart Moves in a Steady Market

While the 30-year fixed refinance rate has seen a modest climb, the overall mortgage environment remains calm. As you think about whether refinancing is the right move for you, consider your personal financial goals. Are you aiming to reduce your monthly bills? Do you want to own your home free and clear sooner? Or are you trying to manage financial risk better? Your answers to these questions will guide you to the best mortgage option, regardless of these small daily fluctuations.

and

Florida’s modern build with strong cash flow vs Missouri’s affordable rental with higher cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Market forecasts suggest steady demand, making turnkey real estate one of the most reliable paths to passive income and wealth creation.

Norada Real Estate helps investors capitalize on these trends with turnkey rental properties designed for appreciation and consistent cash flow—so you can grow wealth securely while others wait for clarity in the market.

Recommended Read:

- 30-Year Fixed Refinance Rate Trends – January 22, 2026

- Best Time to Refinance Your Mortgage: Expert Insights

- Should You Refinance Your Mortgage Now or Wait Until 2026?

- When You Refinance a Mortgage Do the 30 Years Start Over?

- Should You Refinance as Mortgage Rates Reach Lowest Level in Over a Year?

- Half of Recent Home Buyers Got Mortgage Rates Below 5%

- Mortgage Rates Need to Drop by 2% Before Buying Spree Begins

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years